Move to Earn: Reasons for StepN's Success. Is StepN Sustainable? What's the direction?

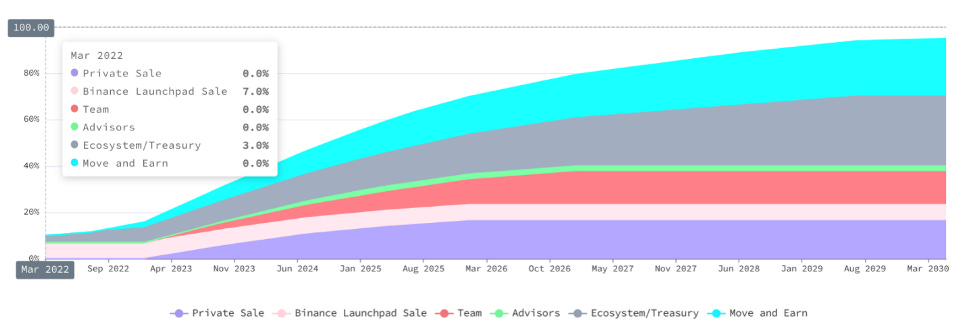

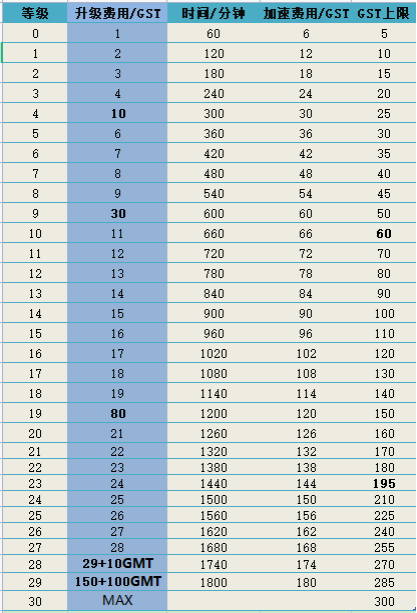

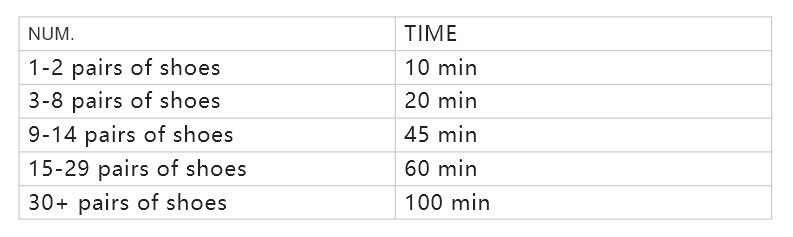

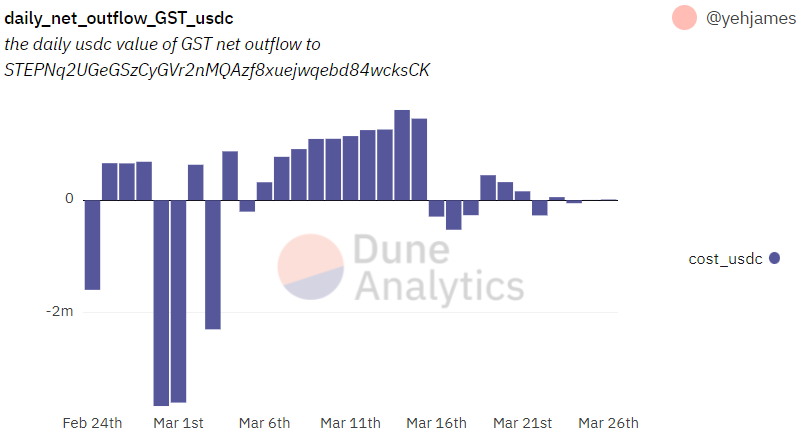

Editor’s Note: StepN has not only become a global sensation, but also sparked extensive thinking in the industry. Its success is due to the choice of niche industry, the satisfaction of user needs, the rapid development and implementation of the team, the thinking of the model and gameplay, the “tap water” of many industry leaders, and the support of Binance. More importantly, the team has not fully unlocked the project’s potential for the time being, and it is worth watching the future development after completing 0 to 1. But on the other hand, both GameFi and move-to-earn have their own cycles, which may be relatively short. Will it become a “flash in the pan” as the fever decreases, old players get bored, and a lot of imitations appear? This is a question worth thinking about. (At the time of writing and publishing this article, WuBlockchain has no commercial partnership with the project party and does not represent any financial advice) 1. The reason for StepN becoming a global sensation.StepN is an app that combines elements of GameFi and SocialFi and attracts many users outside the crypto world through the move-to-earn model. StepN’s explosion of popularity can be attributed to two things: first-mover advantage and skyrocketing prices. From Axie in play-to-earn, to Monaco in write-to-earn, to StepN in move-to-earn, a new type of game always attracts a lot of attention in a short period of time. In terms of game setup and token model, StepN is not fundamentally different from Axie (at least as of this moment), but its gameplay experience feels “out of the web3” and provides a long-overdue hotspot in a slow first quarter. Of course there are many doubts that it is somewhat similar to the ponzi game QuBu. But to be honest, there is no similar product in the crypto world. StepN, which has received investment from Sequoia India, Solana, Binance, etc. and focuses on high net worth people, has not opened up the app store for download in mainland China, nor has it operated and promoted in mainland China. Mainland users need to create overseas accounts to participate, and there is a high threshold. There is still a relatively big difference with QuBu. In addition, in the crypto world, “surge” is the best publicity, and the surge of StepN’s governance token GMT is definitely the booster of StepN’s popularity. Since its launch, the price has risen from a low of $0.01 to a high of $1.87, thanks to the GMT unlocking cycle and the game’s upgrade system. It is also due to Binance’s boost. Source:Official Website The only GMTs that have been unlocked so far are Launchpad and the airdrop, which started on March 14. In other words, from the launch on March 9 until the airdrop date, the only selling pressure on GMT is Launchpad, which costs almost nothing (shorting BNB is a hedge against coin price fluctuations), so most investors will choose to sell a small portion and keep most of it for a higher return. The game upgrade system is shown in the table below. Source: Users who wanted to upgrade their shoes to the highest level had to purchase GMT, so GMT was a huge buy in the early period. Not only that, the upgrade process takes a lot of time. According to the table, it takes a total of 465 hours or nearly 20 days to upgrade a pair of shoes from level 0 to level 30 (although users could theoretically upgrade their shoes to level 27 before GMT was launched, in reality, there were almost no shoes above level 10 on the market before March 9. (Even if you start from level 10, it will take 17 days to upgrade). Users can only earn GMT by upgrading to level 30 (which is not yet start). This means that there is only a small portion of GMT sold in Launchpad for the first 5 days, with airdrops starting on day 6, and the real selling (i.e. “digging and selling”) does not increase until around day 17. 2. Is the balance model sustainable?Consumers vs. investorsThe traditional balance model of the game is essentially the same as insurance. The revenue of insurance comes from the majority of people who pay premiums without settlement of claim, while expenses go to the minority of people who make claims. If the premiums collected are not enough to cover the claims paid, then the insurance cannot rely on the internal cycle to continue operating. Similarly, if a game has more users making money than spending money, then it is ultimately a Ponzi game, and the money made by users must be the money spent by the later. That’s why we’ve always emphasized that GameFi is about Game, not Fi. If a game can make users spend money willingly without expecting a monetary return, then the game must be sustainable. StepN follows Axie’s dual token model, which effectively prevents the game from being affected by the fluctuation of the governance token. From the perspective of game sustainability, the game token GST is more important than the governance token GMT. If we compare GST to an insurance product, then the upgrade, repair, and reproduction of shoes are equivalent to collecting premiums, while running rewards are paying claims. In other words, whether the supply and demand of GST can be balanced determines whether the game can be operated sustainably. There are only two ways to regulate the supply and demand: firstly, to increase income, that is, to increase the premium; secondly, to reduce expenditure, that is, to reduce the claims. In the area of reduce expenditure, the team has made a clever design. The first is to set a cap on the number of running hours per day. The second is diminishing marginal returns: as you can also see from the table, the higher the number of shoes, the shorter the average time and the longer the payback period. In terms of increase income, StepN has also designed many ways to burn GST, such as the aforementioned shoe repair, upgrade, and reproduction. But for users, the ultimate goal of all this is still to get more GST, and if the earned GST is not as much as the consumed, then no one wants to continue to play. Therefore, the real increase income should be that users willingly play on even if they lose money. Just like people buying accident insurance, most people don’t expect this insurance to actually come in handy when they buy it. In other words, a good balance model should have a larger number of consumer users than investment users. StepN’s consumers are mainly from the social sector.How can a regular GameFi program attract consumer users? That is to improve the entertainment of the game. Suppose GTA5 is changed to GameFi mode, then even if the token price goes to zero, it will not drive away the loyal players. StepN, on the other hand, is a product that, I’m afraid, is difficult to improve entertainment from the perspective of the game. After all, no matter how much fun you add to play, you still have to implement the “Move”, which is always boring. Many people expressed the view that “even if the price of StepN’s shoes is zero, at least it also allows me to exercise my body.” But this kind of statement is typical of self-congratulation after being trapped. You go running with the intention of making money, and once you lose money, you tell yourself “I’m exercising”. The truth is that running is just boring, and without the drive of profit, most people have a hard time sticking with it. So why can you see a lot of people running in real life? In addition to a few people who really love sports, most of them are just for the spiritual benefit of “having a good body to improve the image” or “showing the number of kilometers in social media to show their rich life”. These are, in essence, social attributes. Therefore, StepN’s consumer users will mainly come from SocialFi rather than GameFi in the future. How many consumers are currently on StepN?Unfortunately, although the StepN team claims the product is GameFi + SocialFi, we haven’t seen much of the Social element so far. I’d rather see Adidas VP Scott Dunlap give StepN verbal praise on social media than announce a digital version of the adidas D Rose 1.5 with StepN, preferably with a clip of the NBA Top Shot of Rose. highlight reel. That’s the kind of sports blockchain product I’d most like to see. Of course, you can have your own preferences, but there’s no denying that the future of this direction is very ambitious. So I think StepN’s potential is huge, but must admit I’m only buying their shoes to make money right now because there’s really nothing to play or show. So is there a large percentage of investment-oriented users like me? To answer this question we need to analyze the net traffic of GST. The following chart shows the net GST outflows as shown by the data on the chain. Source:https://dune.xyz/yehjames/STEPN The above address is the official wallet, i.e. Spending Account. Users need to transfer GST from their personal wallet to Spending Account before they can repair or upgrade their shoes, and they also need to transfer GST from Spending Account after they get it to sell it. On March 1, Binance announced the launch of its 28th Launchpad project, STEPN (GMT). On the same day, GST changed from a net outflow (earned by running) to a net inflow (burned by repairing, upgrading or breeding shoes), and the token price shot up from $2.6 to a high of $4.0. After the good news, GST went into a net outflow again, and the price gradually fell back to around $3.4. The price of GST directly determines the price of shoes, so the floor price of shoes has been maintained at $800-$900 for the last half month, which shows that the balance of supply and demand of GST depends on the number of new players. With the opening of the rental market in the future, more and more “get the best deal” users will come in. How to stabilize the GST price is especially important: a sharp rise will discourage new users from joining (soaring shoe prices), and a sharp fall will not retain old users (significantly lower revenue). If the on-chain data of Spending Account reflects the real supply and demand of GST, then it means that there are more investment-oriented users like me. If the real data is not available from the chain, that’s a different problem. SummaryFor a game to be sustainable, consumer users must be bigger than investment users. Although StepN is positioned as GameFi + SocialFi, running is less entertaining, so the product should cultivate more consumer users from the social element. But up to now, StepN has not shown much social element. From the current on-chain data, GST is in a net outflow state without new users. Therefore, we have reason to worry whether GST will be able to withstand the selling pressure once the investment-oriented users come in with the opening of the rental market. Appendix: additions to the team’s interviewQ: The current number of users and regions? A: The daily activity is about 100,000 people and the monthly activity is about 500,000 people. We have not liberalized the registration and need to be invited. Due to the restriction of local laws and regulations, it is not open to download in regions such as mainland China. The ranking of user sources are Japan, USA, France, Russia, UK, Taiwan, etc. Japan has a lot of Move to Earn game tradition, so it is accepted quickly. About 30% of the users are outside of the crypto world. We don’t want any Game studio to enter and destroy the ecology of the game, so we have not opened up the rental market, nor have we abolished the invitation system and opened up free registration. Q: Cross-chain? Future development direction? A: We will cross-chain to BSC soon, cross-chain to ETH may be a little later. Our future development direction is to become an NFT exchange, or even the largest trading platform in the NFT field. Users can buy not only shoes but also other NFT products from us. We are developing NFT exchanges on BSC and Solana, about to merge platform wallets and local wallets, and our internal AI team is working on how to make AI assist users in making smarter decisions. Follow us If you liked this post from Wu Blockchain, why not share it? |

Older messages

Ronin Bridge Hack: Will it be as lucky as PolyNetwork?

Thursday, March 31, 2022

On March 29, Axie Infinity's Ronin Network suffers $610M exploit, making it the largest crypto theft case in history in terms of amount at the time of occurrence (the previous largest amount,

Global Crypto Mining News (Mar 21 to Mar 27)

Monday, March 28, 2022

1. Bloomberg:Exxon Mobil Corp. is running a pilot program using excess natural gas that would otherwise be burned off from North Dakota oil wells to power cryptocurrency-mining operations and is

Investigation report:Is There “Insider Trading” in BINANCE and COINBASE's New Listing

Tuesday, March 22, 2022

This report calculates the price movements of Binance and Coinbase in the week leading up to the listing of the new cryptocurrencies between November 2017 and February 2022, to determine whether the

Global Crypto Mining News (Mar 14 to Mar 20)

Monday, March 21, 2022

1. At its March 12 conference in Chengdu, Bitmainland highlighted the ANTSPACE water-cooled container, which integrates hydronic cooling technology into mining operations and can accommodate up to 210

Global Crypto Mining News (Mar 7 to Mar 13)

Monday, March 14, 2022

1. HIVE announced a supply agreement with Intel Corporation (Nasdaq:INTC) (“Intel”) to purchase new high performing ASIC chips that will be incorporated into state-of-the-art mining equipment that will

You Might Also Like

Texas doubles down on crypto with new $250 million Bitcoin reserve bill

Tuesday, March 11, 2025

Texas' second crypto bill seeks to enhance state and local government participation in digital asset investments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How-ey Can Get Out of Here

Tuesday, March 11, 2025

How On-Chain Data Can Clarify the Regulation of Cryptoassets ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

February CEX Data Report: Significant Decline in Trading Volume Across Major CEXs - Spot Down 21%, Derivatives Dow…

Tuesday, March 11, 2025

In February 2025, the spot trading volume of major CEXs decreased by 21% compared to January. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

El Salvador defies IMF, continues Bitcoin purchases amid market downtrend

Monday, March 10, 2025

El Salvador's Bitcoin holdings grow to $504 million, challenging IMF directives amid sharp price declines. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🖊️ Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO …

Monday, March 10, 2025

Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO for a Cronos Strategic Reserve; Texas's Senate passed bitcoin reserve bill SB-21 ͏ ͏ ͏

Vitalik TAKO AMA: ETH Positioning, Sequencer Centralization, L1 vs L2, Governance, and Success Metrics

Monday, March 10, 2025

On the evening of February 19th at 12 PM UTC and lasting until 12 PM UTC on February 20th, Vitalik Buterin, the founder of Ethereum, was invited to participate in a flash text interview on Tako (a

Donald Trump Creates U.S. Bitcoin Reserve

Monday, March 10, 2025

March 10th, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Donald Trump Creates US Bitcoin Reserve Diddy Shows 'Kindness' To Sam Bankman-Fried Robinhood Conducts $1M Crypto Trivia

Bitcoin’s realized volatility surges in as traders face extreme price swings

Sunday, March 9, 2025

Volatility clustering in Bitcoin reveals the impact of turbulent rallies and sharp pullbacks. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Mar 3 to Mar 9)

Sunday, March 9, 2025

Ms. Sun Xueling, Minister of State, Ministry of Home Affairs of Singapore, said that cryptocurrency fraud cases accounted for a quarter of the total loss amount involved in fraud last year. ͏ ͏ ͏ ͏ ͏ ͏

Trump declares end to ‘war on crypto,’ vows to propel America to Bitcoin supremacy

Saturday, March 8, 2025

Trump brands the Biden era as a crypto setback, .President Trump vows to make America the Bitcoin leader, ending Operation Chokepoint 2.0 and bolstering crypto strategies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏