The Daily StockTips Newsletter 04.01.2022

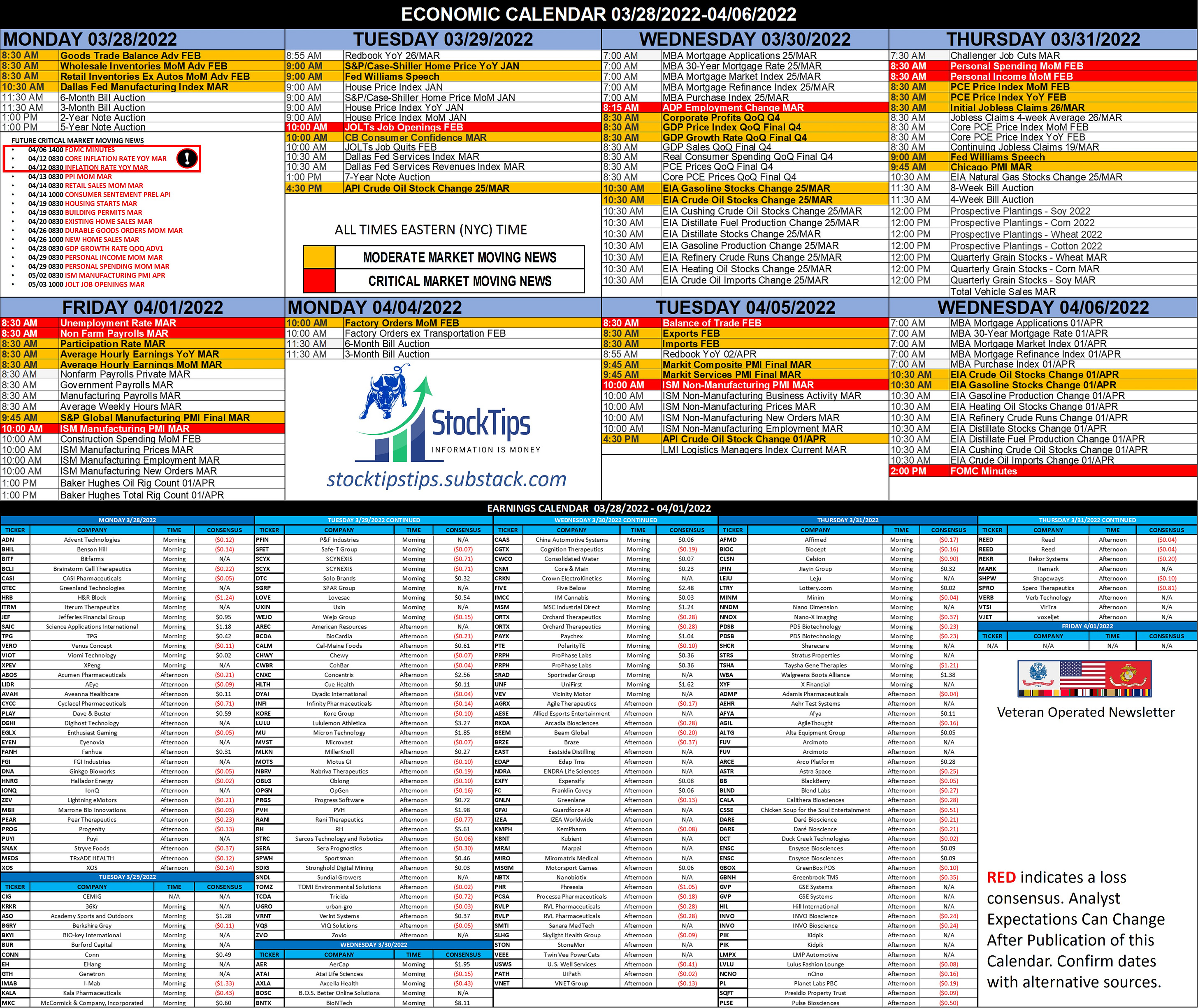

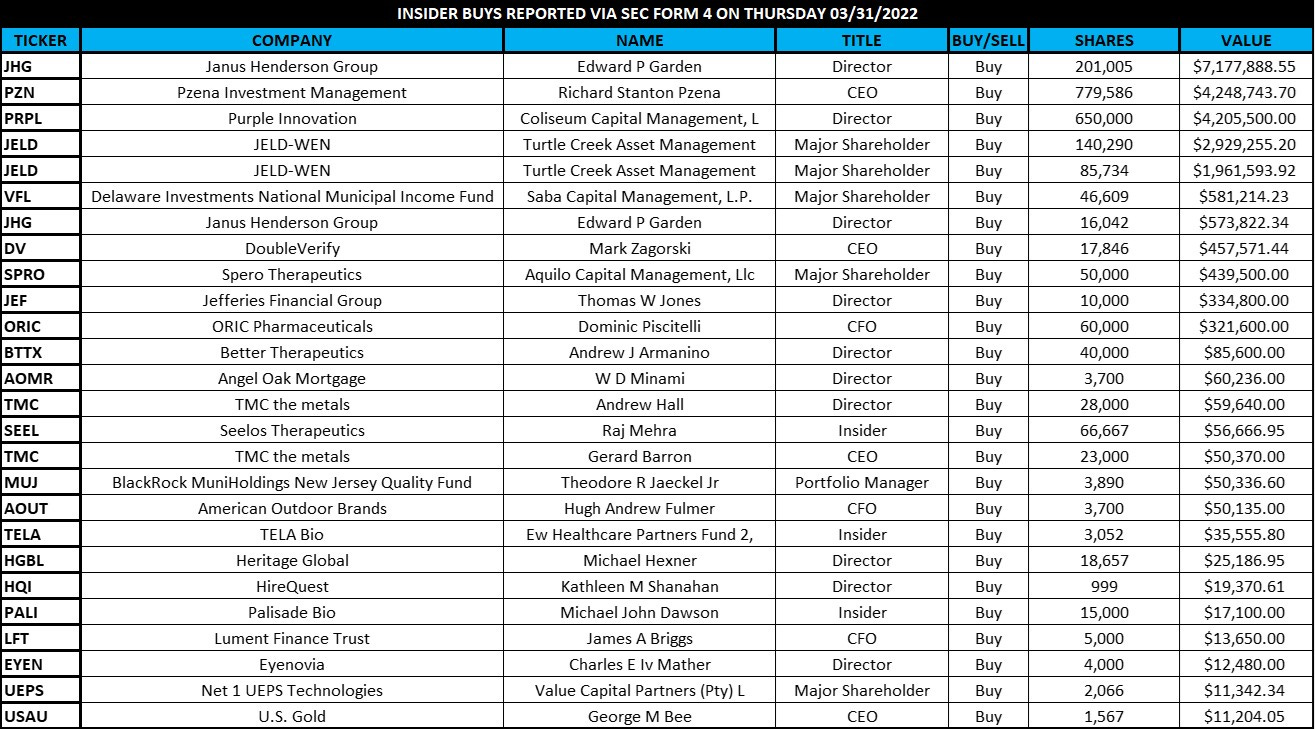

The Daily StockTips Newsletter 04.01.2022I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)CLICK HERE TO SEE THE STOCKTIPS RECORD WE’RE ON YOUTUBE NOW! See HERE, HERE, & HERE (Yeah … I’m REALLY excited about this). Before you Trade Today: Know the Economic Calendar! Also See This Weeks Most Anticipated Earnings (Note: Red Indicates an Earnings Loss [Not Miss] Consensus), & Yesterdays Insider Buys.INSIDER BUYS TODAYS COMMENTARY Get a Cup of Coffee & Enjoy Catching Up! If you aren’t reading this daily you are missing out on a wealth of information that could prevent unforced & unnecessary trading errors. I’VE FOUND A GUARENTEED WAY TO MAKE A 100+% PROFIT IN LESS THAN A WEEK: I’m really excited about this one! Full Explanation HERE! BUY LIST UPDATE: Added another options idea in the paid subscriber section below, but still not adding any more stocks to the BUY LIST for the same aforementioned reasons as yesterday. Beware of the market posturing for those inflation numbers on the 12th! TRADING TODAY: Unemployment & Non-Farm Payrolls are due out today 08:30ET. Consensus unemployment rate (estimate) for March is 3.7%, down from 3.8% in February. The economy is expected to have added 490,000 payrolls (jobs) in March, down from 678,000 in February. So lets say for the sake of argument that the unemployment rate meets or does better than analyst expectations, and/or, more jobs were added than expected. Good news right!!?? Eh, its never that simple. The lower the unemployment rate, the lower the work force participation rate, & the more jobs added, the more we can expect to see high rates of inflation. When multiple companies are competing for a scarce amount of labor, the cost of labor must necessarily rise. Labor, like everything else a company needs to function, is an input. In fact, labor is the number one cost of doing business for most companies. The lower the supply of labor the higher the cost of labor, & therefore the higher the cost of the goods & services businesses provide. Ergo, exceptionally low unemployment numbers & high job additions are like a blessing to the Fed to get more aggressive on taming inflation … which has the tendency to scare professional investors. Oh retail investors will think its great though … because they always do. They’ll kick & scream & claim “the game is rigged, the unemployment numbers were great, we added record jobs, why isn’t the market printing dollar bills!!??” The answer is simple … the Fed wants to tame inflation & seemingly bullish unemployment numbers & payrolls are major drivers of inflation. So what you think is bullish is actually a signal to the Fed to get more aggressive on interest rate hikes … which is bearish. BIDEN TO RELEASE 180M BBL OIL FROM THE SPR: President Biden agreed to release 1m bbl of oil every day for the next 180 days from the Strategic Petroleum Reserve (SPR). At first glance you might think this will lead to lower gas prices ... & it may initially … until the street remembers that the sanctions on Russian oil are about to hit which will lower daily supply by 700,000 bbl per day. So after deducting the 700K bbl oil, what Biden is actually releasing into the economy is 300,000 bbl per day. Making matters worse, fewer Western countries want to buy from Russia, & are therefore looking to OPEC & the United States. So the 300,000 bbl per day oil may be a complete wash once we take into account increased US demand & deducting the oil we were receiving from Russia. Moreover, the SPR will need to eventually replace the oil Biden is removing, which will increase the price of oil later down the road. After 180 days the SPR will have little over half of its supply left … the lowest stocks since 1984. OPEC has agreed to increase production, but very modestly. So expect oil to continue to rise … albeit slower than before. I seriously doubt its going back down to $90 bbl. CONGRESSIONAL HEARING ON OIL: On 10:30 ET Wednesday April 6th the House will have a hearing with the absolutely non-partisan, honest, & accurate title of "GOUGED AT THE GAS STATION: BIG OIL AND AMERICA'S PAIN AT THE PUMP.” Yes, of course I’m joking about the title. But it should be good TV! A number of oil CEO’s will be there to testify to congress on the status of oil output among other items where some who are venerable in November will attempt to paint them as greedy robber barons. Should be fun! Either way these boring committee hearings are in part how I learned about the oil & gas industry & they are a great way to hear what’s going on directly from the mouths of the CEO’s themselves. Significant News Heading into 04.01.2022:

PAID CONTENT IN THE PAYWALL BELOW:

👉CLICK HERE TO SEE THE DETAILS OF EVERY STOCK ON THE BUY LIST (AND SEE THE PRICE ASSESSMENT BASED WATCHLIST / THE STOCKS UNDER $20 LIST & THE HIGHLY SPECULATIVE LIST) LOGIN INSTRUCTIONS: You will need to login to see the detailed list. The “email login link” will send the link to login directly to your inbox (Click the link & it will automatically log you in). You can also choose the “login with password” option. You will need to set up a substack password for this option.Subscribe to StockTips Newsletter to read the rest.Become a paying subscriber of StockTips Newsletter to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

The Daily StockTips Newsletter 03.31.2022

Thursday, March 31, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 03.30.2022

Wednesday, March 30, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 03.28.2022

Monday, March 28, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 03.25.2022

Friday, March 25, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

Removing the Other Half of TITN Today

Thursday, March 24, 2022

Great EPS, but I don't like the Guidance

You Might Also Like

Longreads + Open Thread

Saturday, March 8, 2025

Personal Essays, Lies, Popes, GPT-4.5, Banks, Buy-and-Hold, Advanced Portfolio Management, Trade, Karp Longreads + Open Thread By Byrne Hobart • 8 Mar 2025 View in browser View in browser Longreads

💸 A $24 billion grocery haul

Friday, March 7, 2025

Walgreens landed in a shopping basket, crypto investors felt pranked by the president, and a burger made of skin | Finimize Hi Reader, here's what you need to know for March 8th in 3:11 minutes.

The financial toll of a divorce can be devastating

Friday, March 7, 2025

Here are some options to get back on track ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Too Big To Fail?

Friday, March 7, 2025

Revisiting Millennium and Multi-Manager Hedge Funds ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The tell-tale signs the crash of a lifetime is near

Friday, March 7, 2025

Message from Harry Dent ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👀 DeepSeek 2.0

Thursday, March 6, 2025

Alibaba's AI competitor, Europe's rate cut, and loads of instant noodles | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March 7th in 3:07 minutes. Investors rewarded

Crypto Politics: Strategy or Play? - Issue #515

Thursday, March 6, 2025

FTW Crypto: Trump's crypto plan fuels market surges—is it real policy or just strategy? Decentralization may be the only way forward. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What can 40 years of data on vacancy advertising costs tell us about labour market equilibrium?

Thursday, March 6, 2025

Michal Stelmach, James Kensett and Philip Schnattinger Economists frequently use the vacancies to unemployment (V/U) ratio to measure labour market tightness. Analysis of the labour market during the

🇺🇸 Make America rich again

Wednesday, March 5, 2025

The US president stood by tariffs, China revealed ambitious plans, and the startup fighting fast fashion's ugly side | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March

Are you prepared for Social Security’s uncertain future?

Wednesday, March 5, 2025

Investing in gold with AHG could help stabilize your retirement ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏