The Daily StockTips Newsletter 03.28.2022

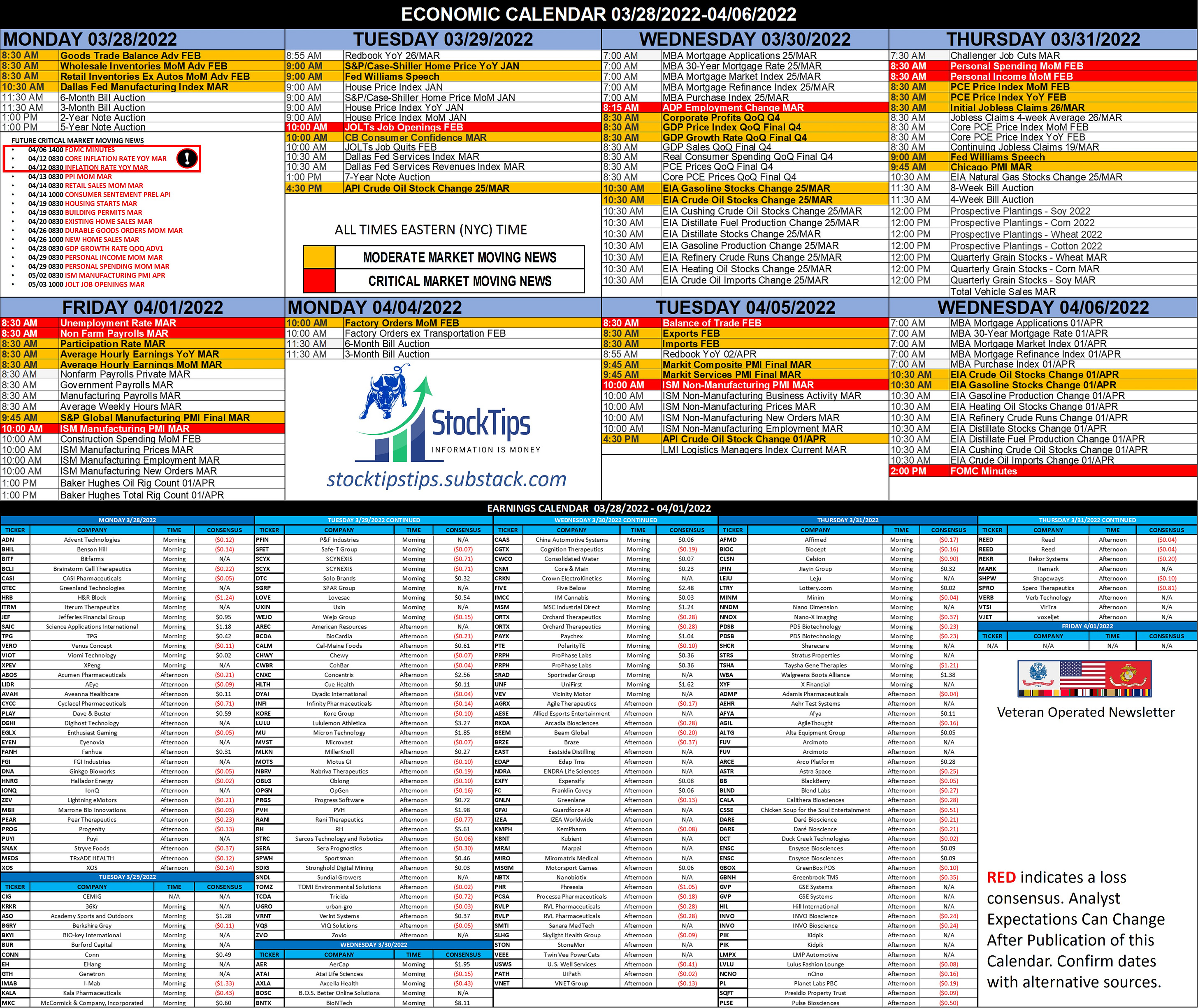

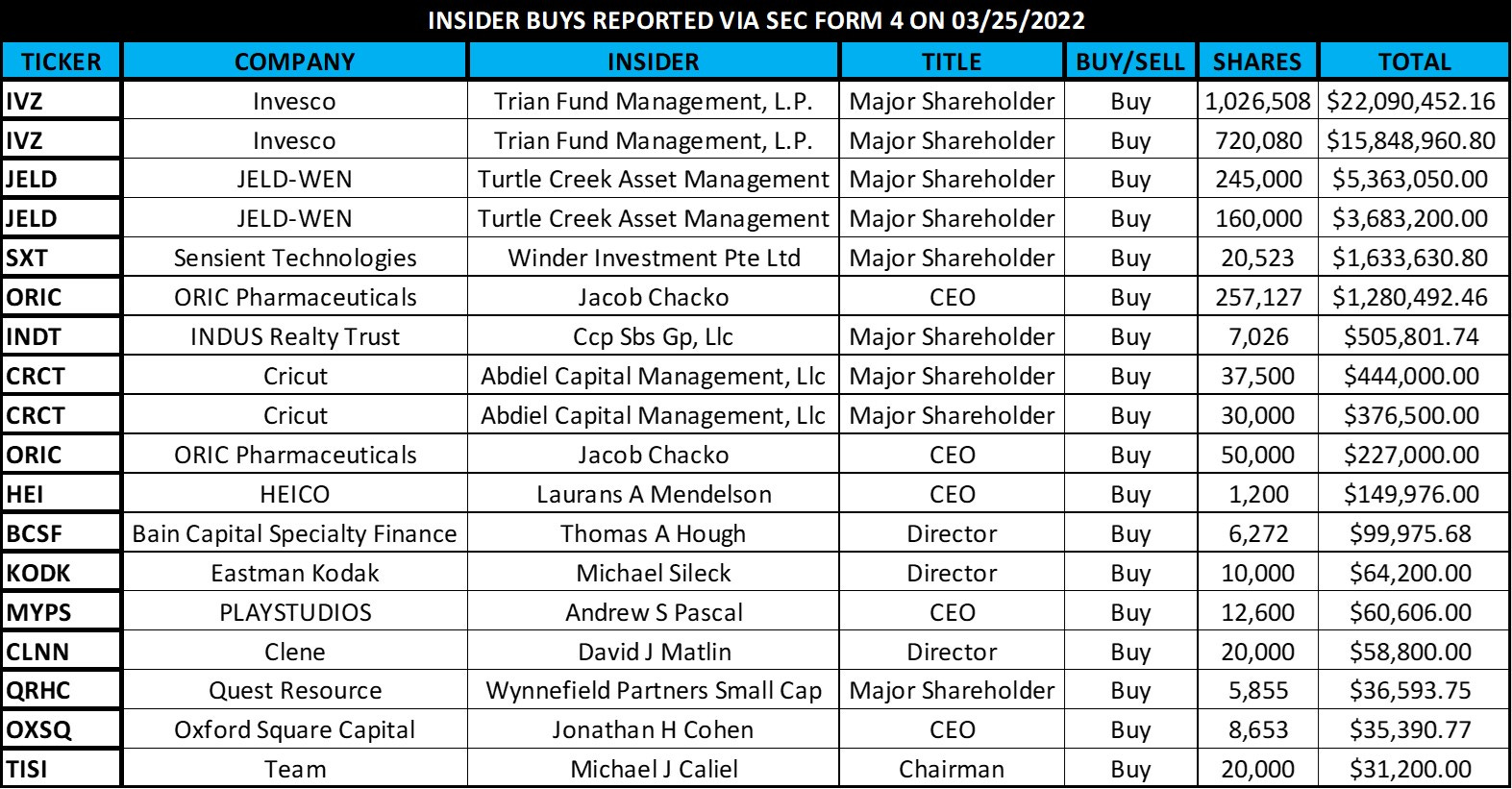

The Daily StockTips Newsletter 03.28.2022I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)CLICK HERE TO SEE THE STOCKTIPS RECORD WE’RE ON YOUTUBE NOW! See HERE, HERE, & HERE (Yeah … I’m REALLY excited about this). Before you Trade Today: Know the Economic Calendar! Also See This Weeks Most Anticipated Earnings (Note: Red Indicates an Earnings Loss [Not Miss] Consensus), & Yesterdays Insider Buys.INSIDER BUYS TODAYS COMMENTARY Get a Cup of Coffee & Enjoy Catching Up! If you aren’t reading this daily you are missing out on a wealth of information that could prevent unforced & unnecessary trading errors. BUY LIST UPDATE: I’ve included some possible short positions under the Price Based Assessment Watchlist with a brief explanations why they’re bearish. More research is needed before I add them to the short list. HEADWINDS AHEAD: Longs are afraid to go long because of inflation (We will be LUCKY if we aren't at 10% by JUL/AUG), supply chain bottlenecks (The backlogs remain), semiconductor shortages (Not helped by the fact that Ukraine/Russia provides 95% of the worlds semiconductor grade neon gas), lackluster Fed rate hikes (25 basis points is NOT going to affect current inflationary pressures ... in fact it could make them worse), Fear of more robust future Fed Rate Hikes (The Fed has left the door open for 50 basis point hikes right at the likely time businesses & people will need loans to fight the rising cost of inputs/goods), increasing oil & natural gas prices (Biden Admin has guaranteed LNG shipments to Europe but we are currently at max capacity, Biden Admin is NOT meeting with oil executives or promoting additional drilling, the oil and gas industry will not invest in further drilling when the government is trying to put a sunset on their industry, & gas inventories are decreasing), increasing food prices (Hungary, Ukraine, & Russia are not exporting grains & fertilizers to the West), geopolitical uncertainty (Increased possibility of cyberattacks, tactical nukes, Taiwan invasion, & possible sanctions on China for helping Russia avoid sanctions), retail spending & home buying seems to be topping off (Indicating that consumers are getting priced out of the market ... note that Fed rate hikes will dis-incentivize retail spending & home buying), record input prices (Business inputs have never increased by 10% YoY in recorded history), record increasing rent & home prices, & consumer sentiment is dropping lower than analyst expectations. Have you adjusted your spending due to increasing prices? I know I have. And as a result I am buying less with the same amount of money. Indeed, each dollar we spend due to increasing prices is one less dollar we can spend on other things. So what's the result? We economize on our needs & cut back on our wants. As a result discretionary retail takes the biggest hit. Watch the discretionary retail industry! it will provide indicators to come! This is to say, things that folks don't need but often buy. If spending on discretionary consumer goods decreases, businesses will need to lower their prices to stay afloat. In many cases this may lead to layoffs, and therefore, even less spending. Our economy is very fragile right now. Also watch for nasty geopolitical events. We are one major geopolitical disaster away from an almost certain recession. For example, if China were to invade Taiwan (Not likely yet), the markets would tank and prices would instantly explode. Indeed the more fragile our economy becomes (I think "fragile" is a good description), the more bad actors will test the US. It's just a fact folks. Always has been. ETF’s to stay away from … or short … as inflation skyrockets. $XLY $VCR $FXD $FXD $FDIS $IYC $XRT $RCD $RXI $RTH $RETL. March inflation numbers to be reported on Tue April 12 2022. Forecasted rate at 8.2% (THATS A LOW ESTIMATE FOLKS!). This will be the first report to capture the effects of war/sanctions Of course there is good reason to fear going short as well. Any significant progress out of Ukraine will certainly send the markets higher. This places me in a tough spot. Many of the stocks that can benefit from current conditions are way overvalued. Many of the stocks that are getting slammed by inflation have already dumped. Of course, there are plenty of stocks in between that could go either way, … but overall I’m bearish in this economy for all of the stated reasons above. I therefore think that opening up a position of 100 shares & selling deep in the money covered calls for an easy 2-3% monthly profit may be warranted. I will be keeping my eye out for such plays. Significant News Heading into 03.28.2022:

PAID CONTENT IN THE PAYWALL BELOW:

👉CLICK HERE TO SEE THE DETAILS OF EVERY STOCK ON THE BUY LIST (AND SEE THE PRICE ASSESSMENT BASED WATCHLIST / THE STOCKS UNDER $20 LIST & THE HIGHLY SPECULATIVE LIST) LOGIN INSTRUCTIONS: You will need to login to see the detailed list. The “email login link” will send the link to login directly to your inbox (Click the link & it will automatically log you in). You can also choose the “login with password” option. You will need to set up a substack password for this option.Subscribe to StockTips Newsletter to read the rest.Become a paying subscriber of StockTips Newsletter to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

The Daily StockTips Newsletter 03.25.2022

Friday, March 25, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

Removing the Other Half of TITN Today

Thursday, March 24, 2022

Great EPS, but I don't like the Guidance

The Daily StockTips Newsletter 03.24.2022

Thursday, March 24, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 03.22.2022

Tuesday, March 22, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

UFI FLEX THO OUT & 50% of TITN REMOVED FROM THE BUY LIST THIS MORNING

Tuesday, March 22, 2022

Trimming the Fat Amid Uncertain Economic Times (Inflation / War / Supply Chain Bottlenecks / Semiconductor Shortages / Record High Energy Prices)

You Might Also Like

Longreads + Open Thread

Saturday, March 8, 2025

Personal Essays, Lies, Popes, GPT-4.5, Banks, Buy-and-Hold, Advanced Portfolio Management, Trade, Karp Longreads + Open Thread By Byrne Hobart • 8 Mar 2025 View in browser View in browser Longreads

💸 A $24 billion grocery haul

Friday, March 7, 2025

Walgreens landed in a shopping basket, crypto investors felt pranked by the president, and a burger made of skin | Finimize Hi Reader, here's what you need to know for March 8th in 3:11 minutes.

The financial toll of a divorce can be devastating

Friday, March 7, 2025

Here are some options to get back on track ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Too Big To Fail?

Friday, March 7, 2025

Revisiting Millennium and Multi-Manager Hedge Funds ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The tell-tale signs the crash of a lifetime is near

Friday, March 7, 2025

Message from Harry Dent ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👀 DeepSeek 2.0

Thursday, March 6, 2025

Alibaba's AI competitor, Europe's rate cut, and loads of instant noodles | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March 7th in 3:07 minutes. Investors rewarded

Crypto Politics: Strategy or Play? - Issue #515

Thursday, March 6, 2025

FTW Crypto: Trump's crypto plan fuels market surges—is it real policy or just strategy? Decentralization may be the only way forward. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What can 40 years of data on vacancy advertising costs tell us about labour market equilibrium?

Thursday, March 6, 2025

Michal Stelmach, James Kensett and Philip Schnattinger Economists frequently use the vacancies to unemployment (V/U) ratio to measure labour market tightness. Analysis of the labour market during the

🇺🇸 Make America rich again

Wednesday, March 5, 2025

The US president stood by tariffs, China revealed ambitious plans, and the startup fighting fast fashion's ugly side | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March

Are you prepared for Social Security’s uncertain future?

Wednesday, March 5, 2025

Investing in gold with AHG could help stabilize your retirement ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏