Cryptowriter - AotC - Wishing for max pain

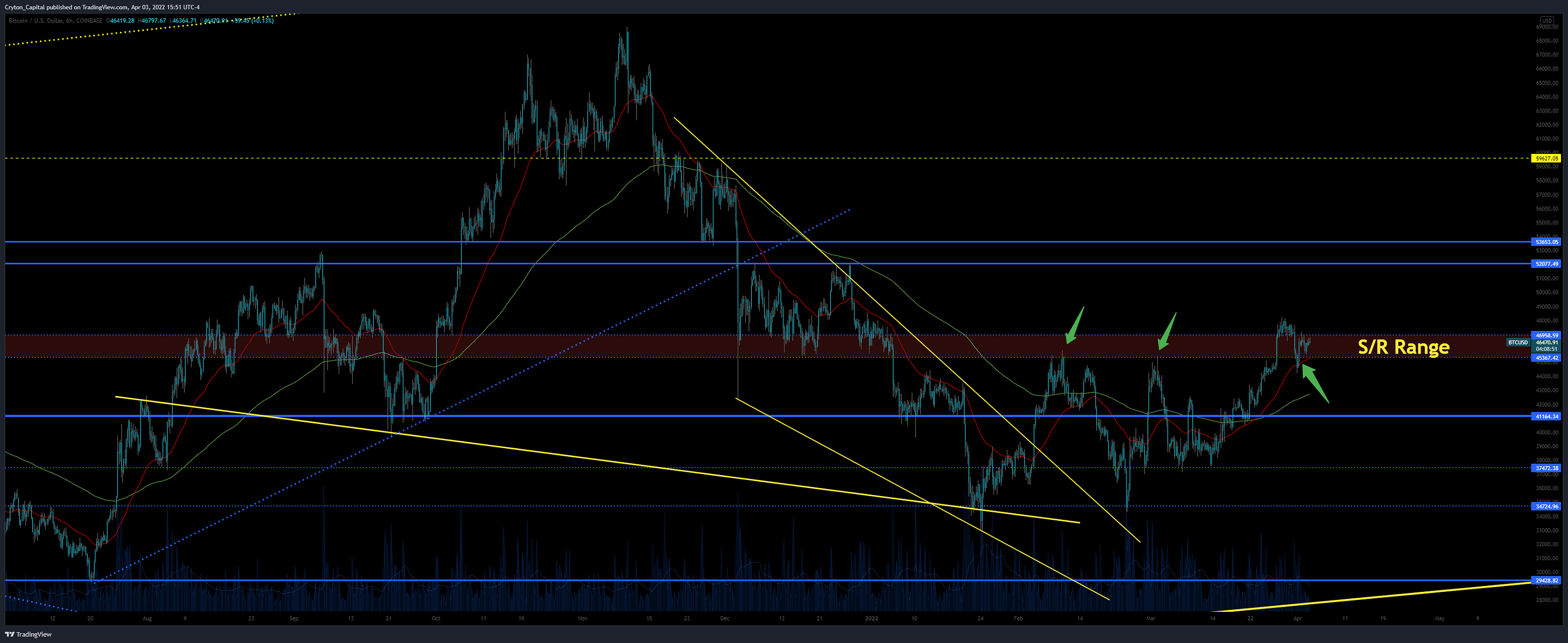

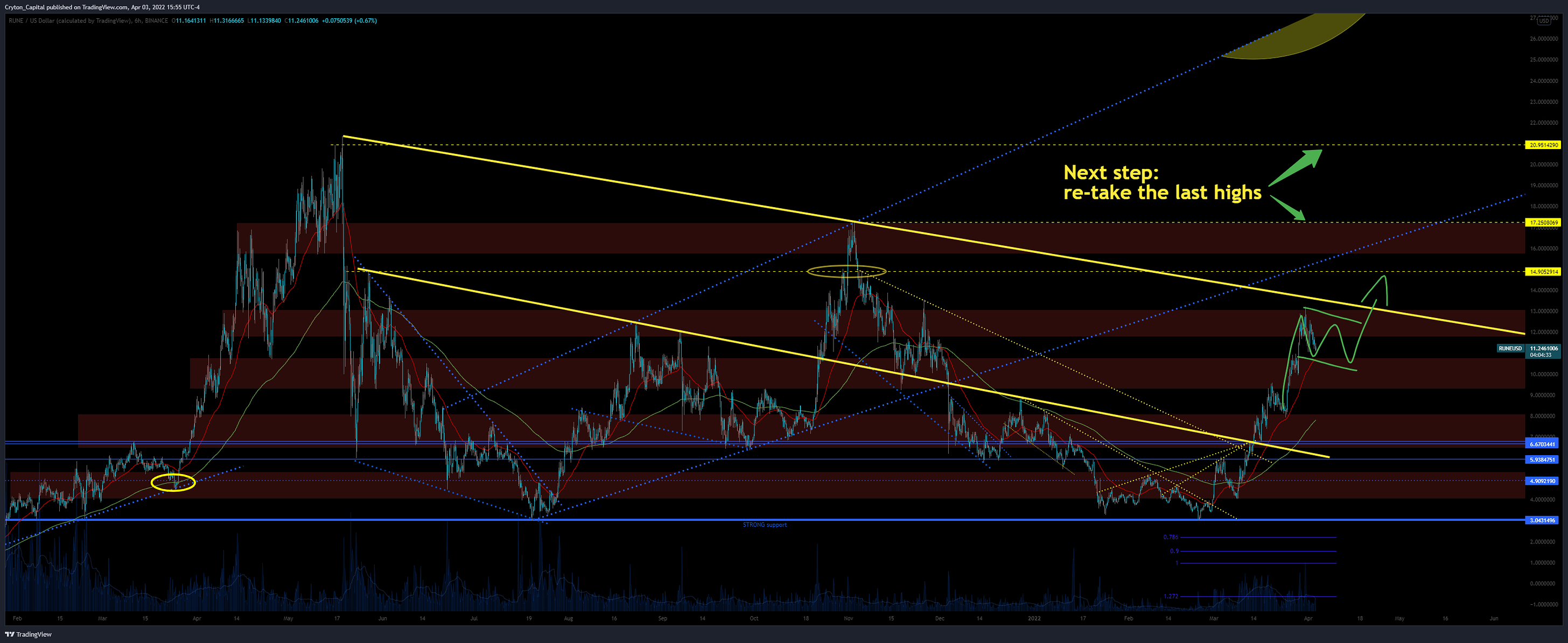

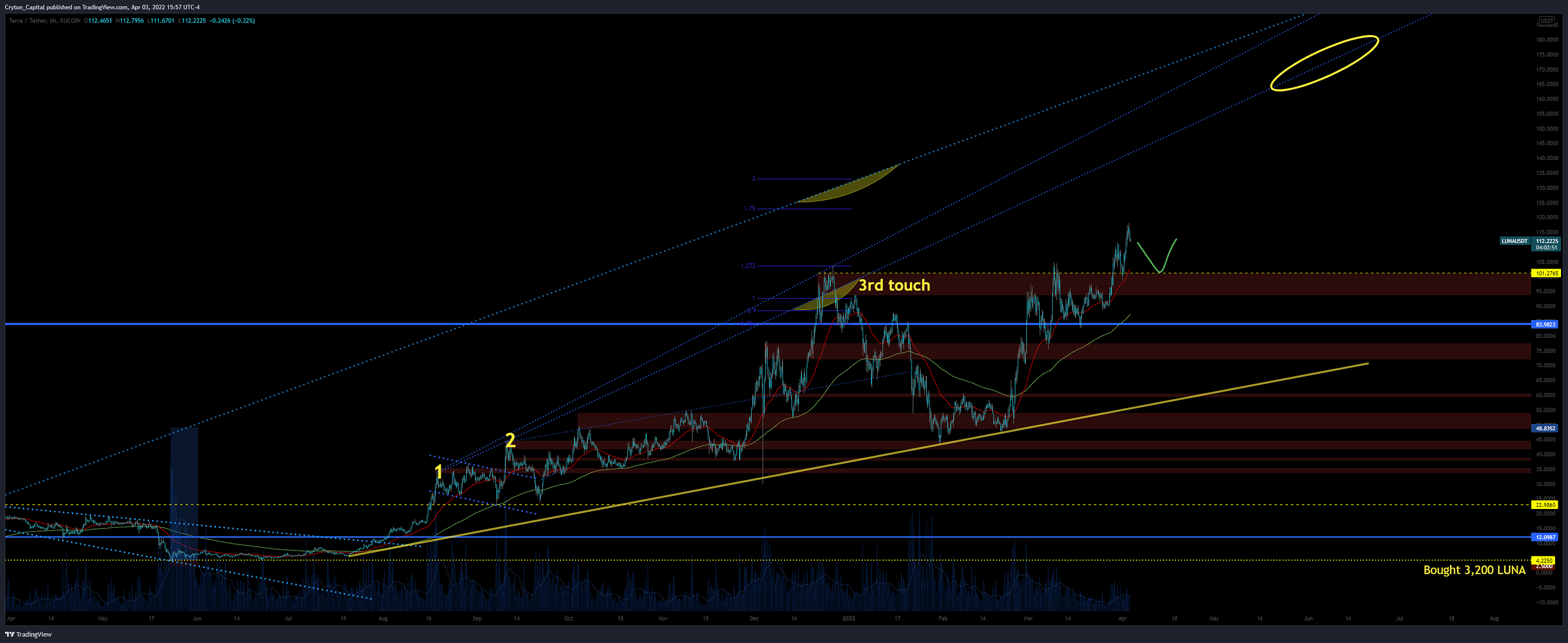

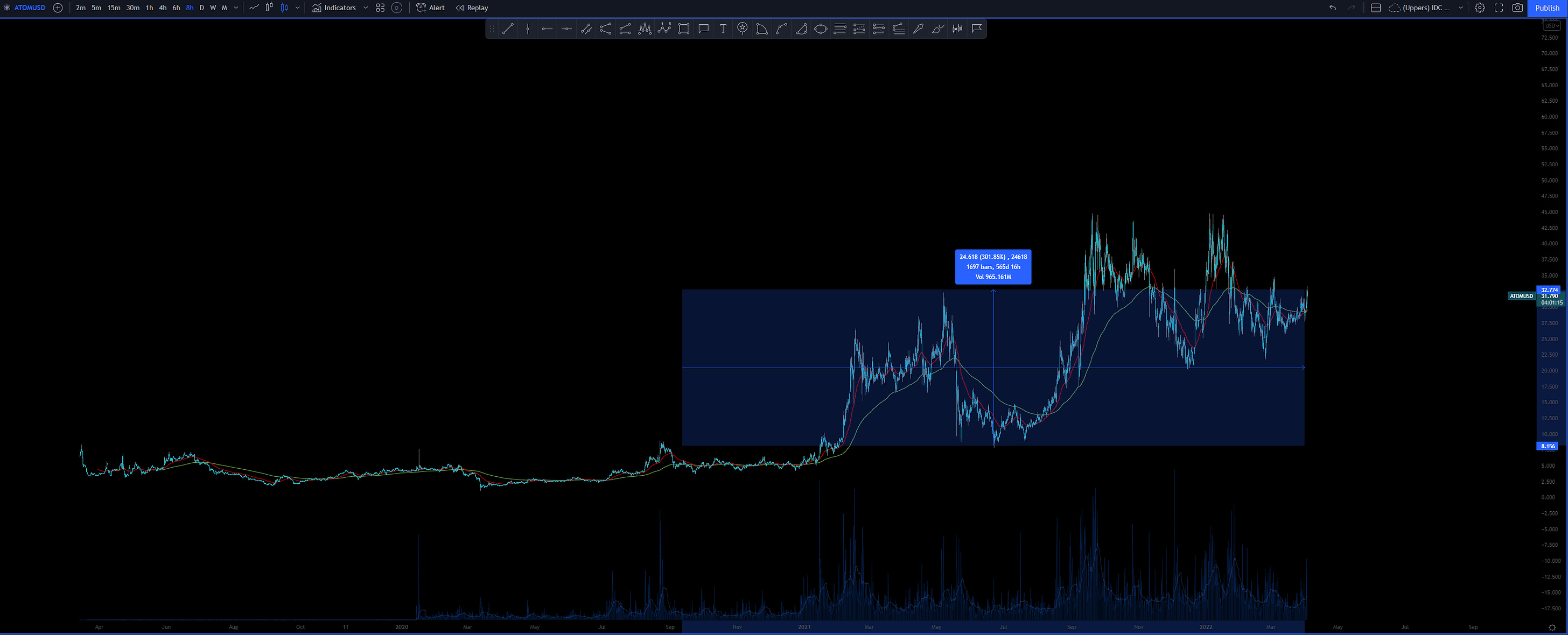

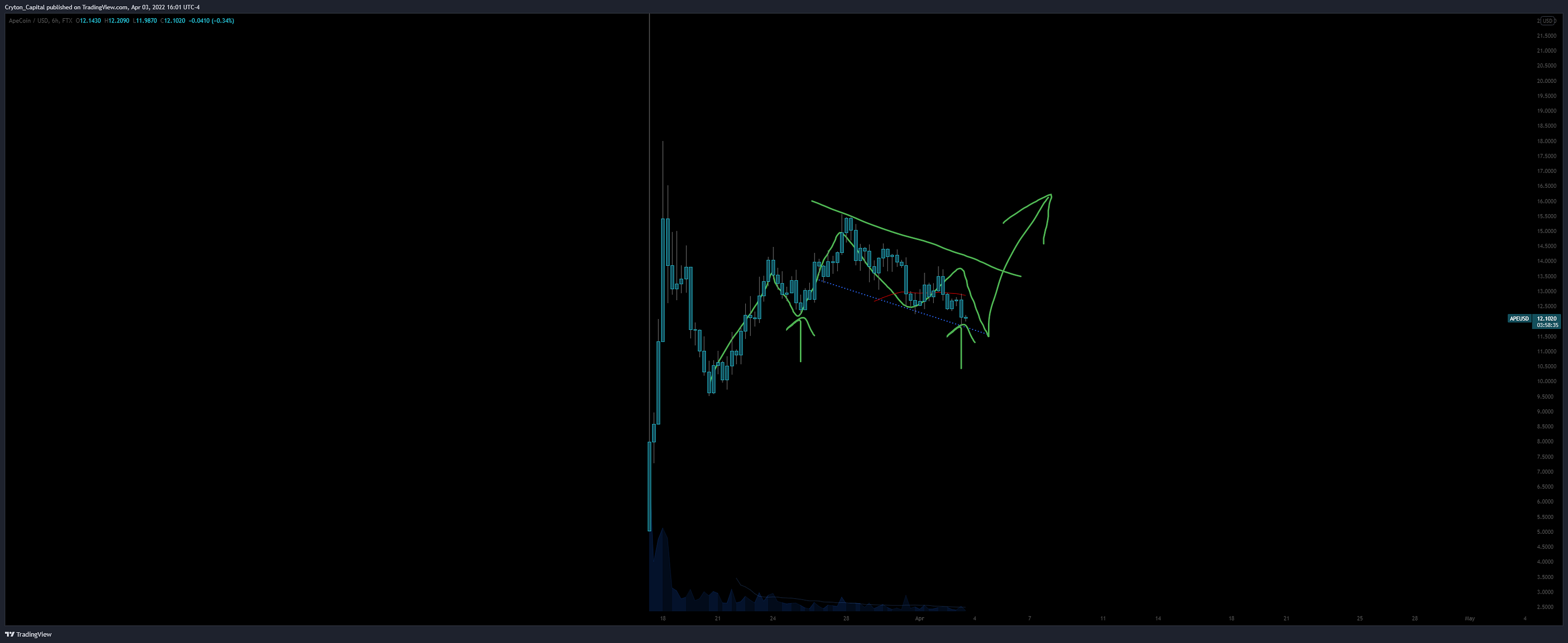

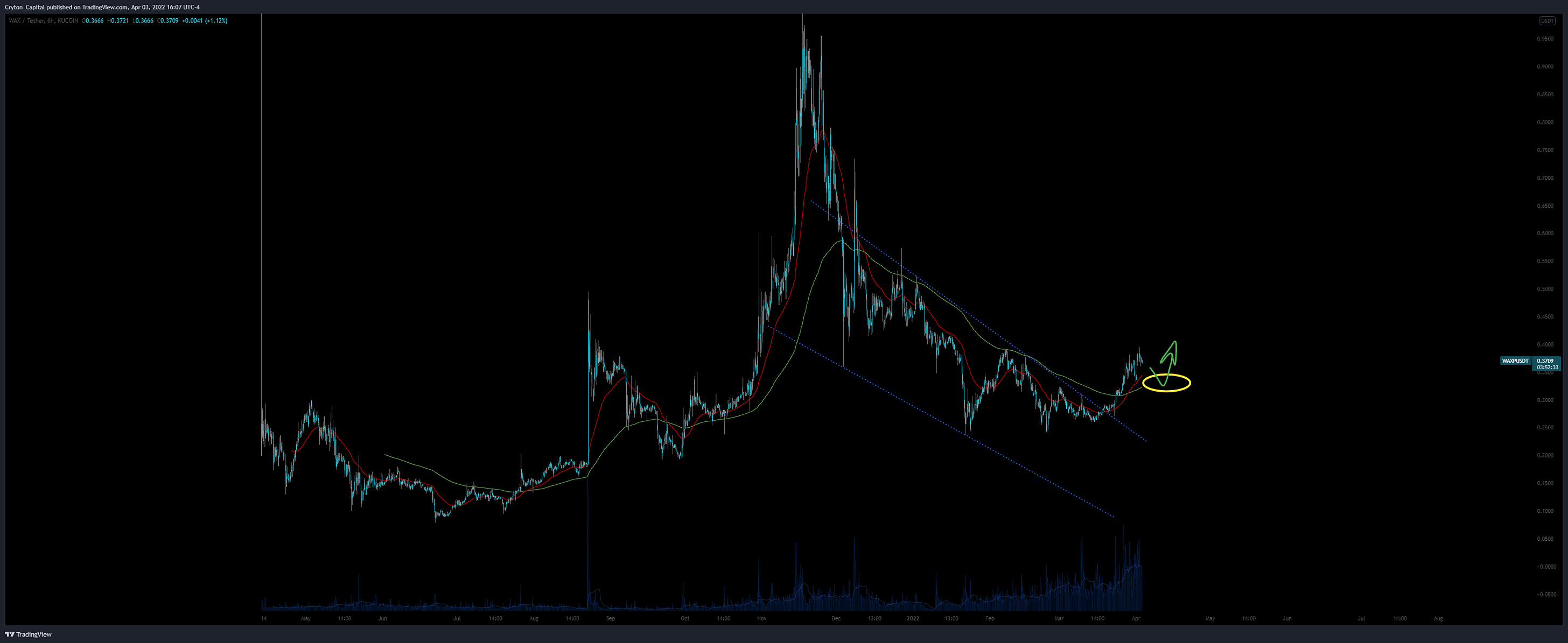

Welcome back!Sorry to have abandoned all you beautiful people during a market downturn but alas, sometimes things overlap in life, and sacrifices must be made. We’re back in action now though, and hopefully at an equally important time: right at a market inflection point & potentially resumed bull run! Lets jump in Total Market Cap - 6H - click to view:Total Market Cap chart is looking good here. Nicely broken out of it’s down-trend and moving up through all intraday EMAs as well as forming “Impulsive > Corrective > Impulsive” type structure (AKA, higher lows & higher highs). This is what we want to see for a resumed Bull Mkt. BTCUSD - 6H - click to view:BTCUSD also looking good here. We have broken back above the lower boundary of the outlined red S/R Range - the same range that strongly rejected price twice prior - and we will likely get a Bull Flag up & out of this. I suspect we may get a corrective 2nd low to make a Double-Bottom which will fill out the flag, first. We know we’re wrong if the 200EMA breaks short. Always gotta have that line in the sand… ETHUSD - 6H - click to view:ETHUSD, same deal. Looking for a Bull Flag now that the overarching down-trend has broken long once more. I see a coming double-bottom in the yellow-circled area, which will complete the flag formation and drive price higher. From there, the next chart catalyst is the red area above. RUNEUSD - 6H - click to view:RUNE is moving really nicely these last few weeks, and I believe we’re just starting to see the beginning of what it’ll do in the next. As with BTC & ETH above, I think we’ll see a Bull Flag form here which will help generate the force needed to break the DSTL (Downward-sloping Trendline) of which it’ll be hitting for the 3rd time. 3rd touch being the strongest chance of a rejection, I think we’ll be stuck here for a while as price forms a larger flag than is required for the other pairs. I don’t think we’ll see a heavy pullback though… Just sideways for a bit, after which we tackle previous highs. LUNAUSD - 6H - click to view:LUNA has been doing extremely well since I outlined it as one of my top picks in the Spring of last year. It had a pullback after the 3rd-touch Catalyst I outlined would push price down before Christmas, but we’re back up to ATH now, and looking at maybe a short-term flag re-testing previous ATH as New Support. After that, the next catalyst is the yellow circle above, in the upper-right. Reader Request: ATOMUSD - 8H - click to view:ATOM didn’t really pull back that hard in January. Not as bad as the rest, anyway. Nor has it run as hard either - it’s only up about 3x since the high that formed when it first launched. For what many consider to be a crypto Blue Chip, ATOM is, by most metrics, underpriced. I expect ATOM to do well in the next leg (which, thanks to the Total MC chart, I believe will be “UpOnly”). Reader Request: APEUSD - 6H - click to view:APE looks like it could be turning around here. We have a recent 3rd touch on the lower boundary of this might-be flag, and it so happened to fall at an exact double-bottom as well, aligning perfectly with the previous intraday swing-low. I think this is an easy trade back up to the top of the flag for about 25%, and what’s nice about it is the clear line-in-the-sand for when we’re wrong: it’s when price closes a higher-volume 4H candle below that recent low, invalidating the double-bottom & the flag. Reader Request: WAXUSD - 6H - click to view:I like WAX here too - I think it will continue back toward previous ATHs but can’t say exactly when it’ll get there as it is more corrective in nature than many other crypto charts. I don’t see a tremendous amount of structure in this current area, but typically lower caps like WAX still follow the Total MC chart, and this will likely form a Bull Flag like what I’m expecting with the others now that it’s broken out of the over-all down trend. Summary:I’m cutting it a little short here, as my internet has been off and on all weekend making it quite frustrating to chart and get this episode done. As I mentioned with WAX, for the other lower-cap coins that were requested, the bullishness displayed in the Total MC chart should be a boon to these lower caps as well. I believe we’re heading towards a Total MC climb soon, and CT sentiment & general lack of engagement points to the same. A run up now would be pretty “max pain” after all this chop, which side-lined a lot of capital. With a fairly impulsive leg up, shorts would get obliterated and that sidelined capital would come back to play. I think we’ll see a bullish Summer ahead! Disclaimer: Cryton Capital is not a registered investment advisor, legal advisor, tax advisor, or broker/dealer. All investment / financial opinions expressed in any-and-all posts on this page, including screenshots & captions, are from the personal research and experience of the owner, and are intended to be interpreted as educational material only. Although best efforts are made to ensure that all financial charts and commentary are as up-to-date as possible, there may be times where price moves beyond key levels before the chart can be posted. Alas, this is part of the fast-paced financial sector and cannot be avoided. Also, occasionally unintended errors and/or misprints may occur. Follow Me.Learn how to earn…Become part of our community.Follow our socials.Subscribe to our podcast.Subscribe to this publication.

If you liked this post from Cryptowriter, why not share it? |

Older messages

EOSweekly: ETP, La Rose, Pierce, Object Computing, Feedback+, Pomelo, Eden Election on April 9

Saturday, April 2, 2022

TOP HEADLINES Developer Commitment, Loyalty, and Follow Through The Dawn of EOS was exciting. Block.One centralized development and in turn stifled mainnet growth? B1 seems long gone. Helios and co-

Bitcoin’s Data Models are Dead? Hardly

Tuesday, March 29, 2022

When you see only what you want to see, you might miss the bigger picture

3 Reasons Why Russia Accepting Bitcoin for Oil and Gas Is Not a Game-Changer in the Short Term.

Sunday, March 27, 2022

Let's be Bullish, but let's be Bullish for the right reasons.

Art of the Chart - TAking Requests!

Friday, March 25, 2022

Art of the Chart is BACK, baby! We're all moved into our new place, and I've got the new office all set up. I'm digging back in on charts, and I see it's a great time to fire up TAking

There’s No Such Thing As Bitcoin’s Fair Value. There’s Just the Price You Are Willing To Pay for What Bitcoin Offe…

Wednesday, March 23, 2022

Ask yourself the right question with Bitcoin.

You Might Also Like

Bitcoin sees brief rebound to $99,000 on Christmas day

Wednesday, December 25, 2024

Holiday excitement lifted Bitcoin past $99000, but it quickly corrected to $98000 where it still holds strong support. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Opinion: Market Panic After FOMC Shows Some Overreaction

Wednesday, December 25, 2024

Last night, the market experienced a significant pullback, primarily due to investor concerns over the Federal Reserve possibly shifting towards a more “hawkish” policy stance. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s pro-crypto pledge could see day-one executive orders, industry players hope

Tuesday, December 24, 2024

A Bitcoin strategic reserve, access to banking services, and the creation of a crypto council are among the items on the industry's 'wishlist.' ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

State of the Network’s 2024 Year in Review

Tuesday, December 24, 2024

A data-driven overview of events that shaped crypto in 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

OKExChain: Will the Federal Reserve and Jerome Powell Prevent the U.S. from Creating a National Bitcoin Reserve?

Tuesday, December 24, 2024

In the early hours of today, Federal Reserve Chairman Jerome Powell made it clear during a press conference following the monetary policy meeting that the Fed has no intention of participating in any

Crypto community cheers as Trump names pro-crypto advisors Stephen Miran and Bo Hines for economic and digital ass…

Monday, December 23, 2024

Trump fosters economic expansion and digital innovation with Miran and Hines at the helm of economic and crypto councils. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 BTC-to-Gold ratio hit a historical peak on 17 Dec; Crypto.com renewed its partnership with Formula 1 until 2030

Monday, December 23, 2024

BTC-to-Gold ratio hit a historical peak on 17 Dec; Crypto.com renewed its partnership with Formula 1 until 2030; Crypto.com and the Philadelphia 76ers unveiled Web3 mobile game 'Spectrum Sprint

Bitcoin Hits A New ATH Once Again After Touching $108K

Monday, December 23, 2024

Monday Dec 23, 2024 Sign Up Your Weekly Update On All Things Crypto TL;DR In this issue, we dive into: Bitcoin Hits A New ATH Once Again After Touching $108K Avery Ching To Become New Aptos Labs CEO As

Yi He on Binance Alpha and Wallet: Most Projects Are Air, Facing Talent Shortage in Web3, and Wallet as an Airdrop…

Monday, December 23, 2024

This article is a summary of a recent AMA hosted on Binance's official Twitter, focused on the relaunch of Binance Wallet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Finish signing in to Crypto.com DeFi Research

Monday, December 23, 2024

Here's a link to sign in to Crypto.com DeFi Research. This link can only be used once and expires in one hour. If expired, please try signing in again here. Sign in now © 2024 Crypto.com 1