Surf Report - Surf Report: Wakey wakey

You’re getting this email because you signed up for Surf Report, my weekly take on economics, investing, Bitcoin, and business. I really appreciate you being here, but if you’d like to leave, simply scroll to the bottom to unsubscribe.

Hi everyone—I’m so glad to have you here. What a week. Many in the US and EU are unaware of just how bad it’s getting out there. Confidence in government-controlled currencies is imploding across the globe. But most of those in regimes where it hasn’t happened to the same degree appear to be under the impression that it also won’t happen to the same degree. It’s a hubristic stance that resembles lazy slumber more than prudence—a nocturnal faith in the vague sense of inertia propelling you effortlessly through whatever narrative your consciousness has opted itself into during the depths of sleepytime. It’s a comfortable place to be, and certainly preferable to staring economic collapse right in its inky black eye-holes and watching the despair leak out:

Faith in fiat is falling, and fast. The International Monetary Fund appears to agree, as they drafted a white paper last month titled “The Stealth Erosion of Dollar Dominance” for everyone who, for some reason, still has an unshakable faith in the continued global reserve dominance of the ol’ greenback. To be fair, Nobel Laureates (much like the ones behind the epic fall of bigwig hedge fund Long Term Capital Management in 1998) have also been asleep at the wheel. Even model-obsessed academic economists can miss and fail to accept what’s right in front of them. (But don’t expect an apology.) I’ve written before that the writing was on the wall for this financial reckoning well before people recoiled over grainy video clips being sent from China in early 2020 depicting grown adults collapsing in the middle of the street, spurring governments everywhere to lock down their citizens. At the end of October 2019, president of the European Central Bank, Christine Lagarde, said, “People are happier to have a job than to have their savings protected.” Oh we are, are we? The belief that having everyone perform tasks for 8+ hours a day, 5+ days a week, is more important than the integrity and value of all the money they’ve already earned is a judgment call made by governments and the media (not you, notice) based on the notion that people must be “productive” in order to keep “the economy” going. Inflation rates, the logic goes, are not only far less important in comparison, but their continued rise conveniently encourages people to work more in order to try and outpace its effect. People forget that Lebanon’s multi-year banking crisis (“The World Bank has described the crisis as one of the worst the world has witnessed in more than 150 years.”) started well before the pandemic as well, and has just led the IMF to give the Lebanese government (not the Lebanese people) $3 billion in aid over the course of 4 years.

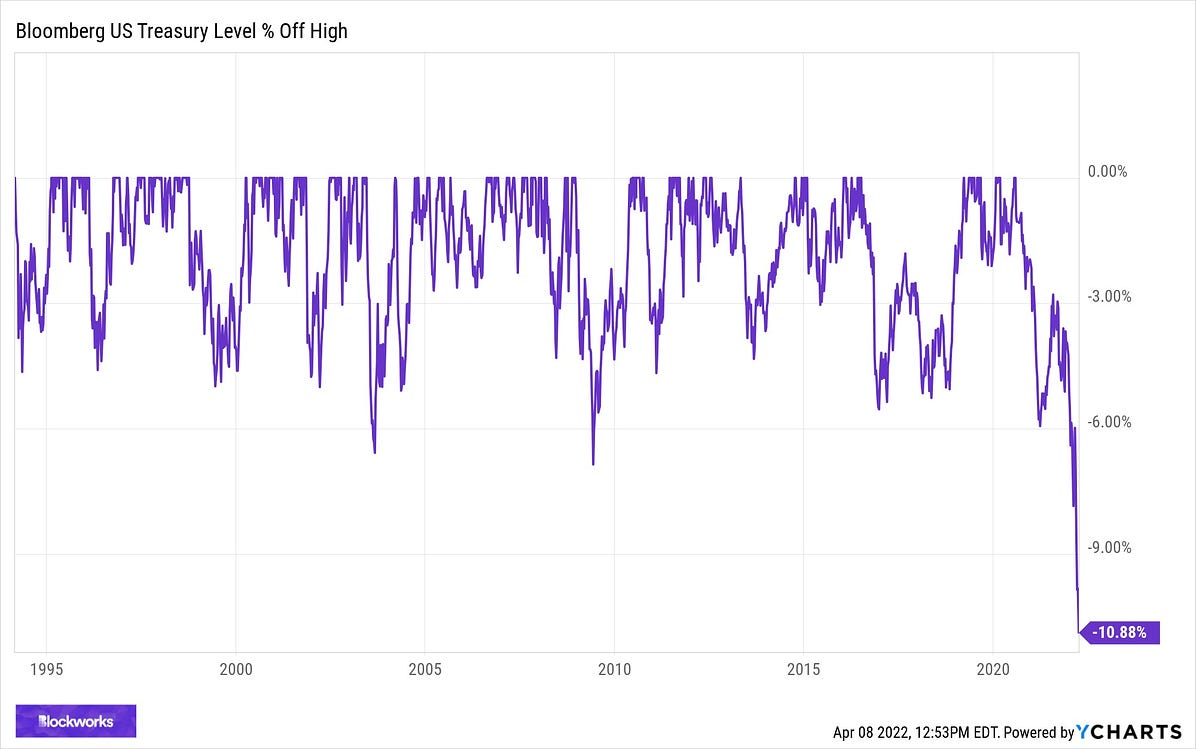

Weird that all these nations had massive debt problems right before the world agreed in unison that it Definitely Needed™️ to print literally insane amounts of money, effectively declaring bankruptcy and whining about the need to have a Reset™️. And they’re clearly addicted at this point.  We’re now in the midst of by far the worst drawdown for U.S. Treasury bonds since the Bloomberg U.S. Treasury Index began in 1994. Nobody wants these garbage pieces of paper. Eventually the government will want/have to step in and artificially buy its own garbage since nobody else will, which isn’t healthy but they will try to package it up as prudent, sensible, and Necessary. They will not, however, take any responsibility for their role in creating the conditions that made it Necessary. Whatever. Garbage is garbage. The U.S. government has torpedoed its reputation on a number of economic fronts as it continues to manipulate, restrict, ban, freeze, and compel its way through a crisis of confidence rather than letting free markets do their thing. Things have changed. Most people haven’t noticed. Marty Bent has said that your savings should be preserved in an asset that is extremely hard to change no matter how hard some men may want to change it. “An asset that allows you to trivially verify its authenticity… an asset that aligns the incentives of everyone who holds it.” I tend to agree. And perhaps as more people gradually awaken and draw similar conclusions we will see more weeks of news like the one we just had:

Like I said, everything has changed but most don’t seem to have noticed yet. A successful investor once told me, “It takes time for the world to wake up.” Conclusions that appear as clear for some isn’t necessarily because certain people are smarter than others, but often because certain people are simply looking at things that most people don’t care to look at. This is human nature. This is how we’re wired. Cognitive dissonance is a powerful bias that keeps us from accepting a reality that conflicts with our existing worldview or understanding. We engage in all sorts of mental gymnastics to avoid waking, looking, and believing if doing so is very inconvenient and unpleasant.

We don’t like failing at things. And we really don’t want to see the system we’re inside of and reliant upon to fail. We would rather stay comfy, trust the process, and hope for the best. Some prefer to stay asleep until their slumber is interrupted and wakefulness thrust upon them by a loud crash. I, and others, prefer to set an alarm clock before falling asleep in the first place. This is the difference between reactive and proactive. The difference between thinking and thinking ahead. This difference is what will separate the winners and losers in the years ahead, as it has in the years past.  Just because you’re tired doesn’t mean you don’t have to wake up, and no one is going to set your alarm clock for you. Until next time 🤙, Recommended Resources For Plan ₿Swan. I became an official Swan partner because I love them so much. So if you're like me and just want an easy, automated way to buy bitcoin on the regular with the lowest fees in the game, head to https://swanbitcoin.com/Mulvey to get $10 in bitcoin for free ✨ Fold Card. Earn bitcoin on everything. You can win up to 100% back on every purchase, and every swipe is a chance to win a whole bitcoin. I use my own Fold card to pay for almost literally everything. If you use this referral link you get 5,000 sats free ✨ Thanks for subscribing to Surf Report. If you liked this post, consider sharing it with someone else who might appreciate it! |

Older messages

Surf Report: You don't own me

Sunday, April 3, 2022

Listen now | Issue 70: 04.03.2022

Surf Report: Time to unwind

Sunday, March 27, 2022

Listen now | Issue 69: 03.27.22

Surf Report: What's normal for the spider

Sunday, March 20, 2022

Listen now | Issue 68: 03.20.22

Surf Report: The soul of the marionette

Sunday, March 13, 2022

Listen now | Issue 67: 03.13.2022

Surf Report: Jokers wild

Sunday, March 6, 2022

Listen now | Issue 66: 03.06.22

You Might Also Like

🌎 Make international sourcing and shipping easier

Tuesday, March 4, 2025

How to prep your business for changing trade regulations. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 How was the masterclass with Arvid Kahl?

Tuesday, March 4, 2025

Your feedback matters + Access the recording ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Letter from the Editor: Why this year's Digiday Publishing Summit matters

Tuesday, March 4, 2025

It's a new era for the media industry. Eras, actually: There's the AI era, the streaming era, the podcast era, the post-cookie era. In other words, media companies are being forced to evolve,

11 social media skills to master (and how AI can help)

Tuesday, March 4, 2025

Perfect these skills now to stay ahead in 2025 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 The masterclass with Arvid Kahl starts in 15 minutes

Tuesday, March 4, 2025

Build In Public Without Giving Away Your Business Secrets ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Age of Economic Chaos

Tuesday, March 4, 2025

Listen now (7 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The next level of content marketing

Tuesday, March 4, 2025

Content marketing isn't just about creating blog posts. If you're still stuck in that mindset, you're leaving money on the table. The best marketers go beyond traditional content and

📱 Google Gemini’s iPhone Hack

Tuesday, March 4, 2025

AI More human-like than ever. Ready to upgrade? ⚡

ET: March 4th 2025

Tuesday, March 4, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 BlueChew (trends) Chart BlueChew is a

🦅 Masterclass with Arvid Kahl: watch the live stream

Tuesday, March 4, 2025

At 10:00 AM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏