The Daily StockTips Newsletter 04.18.2022

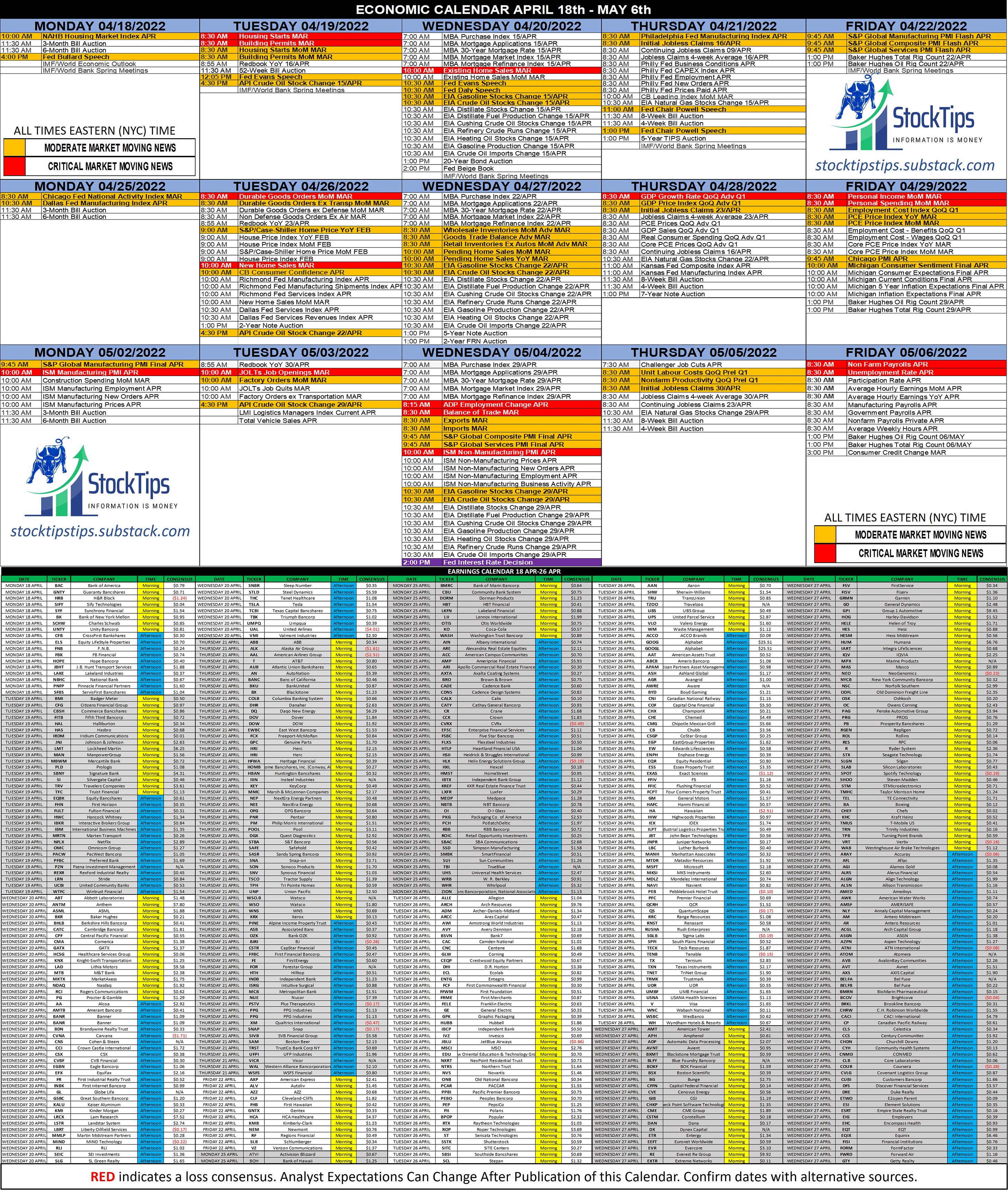

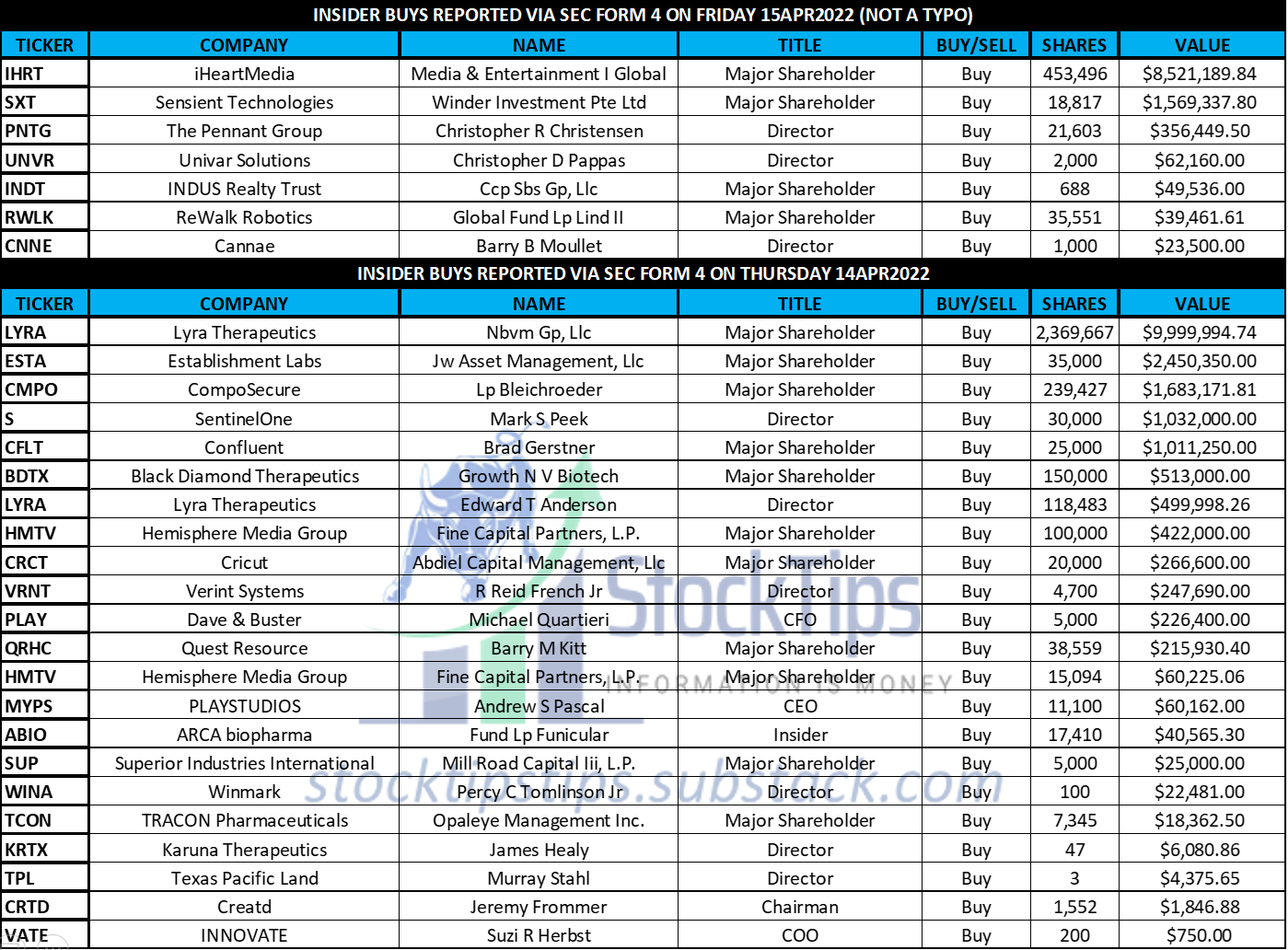

The Daily StockTips Newsletter 04.18.2022I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)CLICK HERE TO SEE THE STOCKTIPS RECORD WE’RE ON YOUTUBE NOW! See HERE, HERE, & HERE (Yeah … I’m REALLY excited about this). Before you Trade Today: Know the Economic Calendar! Also See This Weeks Most Anticipated Earnings (Note: Red Indicates an Earnings Loss [Not Miss] Consensus), & Yesterdays Insider Buys.INSIDER BUYS: (NO, THE 15TH IS NOT A TYPO) TODAYS COMMENTARY Get a Cup of Coffee & Enjoy Catching Up! If you aren’t reading this daily you are missing out on a wealth of information that could prevent unforced & unnecessary trading errors. ADMINISTRATIVE NOTE: SUBSTACK HAS AN APP NOW! Which is good because sometimes substack has issues delivering my emails. INFLATION UP FRONT: You are hearing a lot about inflation topping off in the news. It’s all smoke in mirrors. The change in rate of inflation from March to April 2021 was a massive 1.6% jump. So as long as a similar jump does not happen in April 2022, the YoY inflation rate will decline. It’s smoke & mirrors folks. The average month to month YoY increase in inflation over the last 12 months is roughly 0.5% per month. If inflation jumped an additional 0.5% MoM in April, could we assume 9% inflation given the fact that inflation for March came in at 8.5% YoY? No, because a 0.5% increase MoM this year can’t keep up with the 1.6% jump MoM last year. The rate of inflation that you would read in such a scenario is roughly 4.8% YoY (8.5+0.5-4.2=4.8%). That simplistic math is misleading though, because each increase in inflation given the dollar frozen in time is worse than the increase prior. So a 0.5% increase in inflation today is much more than a 0.5% increase in inflation a year ago when it comes to affecting real purchasing power. What you will need to watch out for is June-September 2022, where the smoke & mirrors will somewhat clear up. June-September 2021 inflation was stagnant at 5.4% YoY & not moving much month to month. Therefore, the more things cost month to month this year during the Summer of 2022, the more it will reflect an increase, not decrease, in inflation YoY. To give you an idea of how serious inflation is, 5% YoY inflation for a sustained 4 years without an increase or decrease in inflation rate would mean a 21% price increase in just 4 years … which means you just lost 1/5th your purchasing power unless you got a wage increase. Combine this with rising interest rates & “Houston, we have a problem.” Combine this with offloading the Fed balance sheet, which sucks money out of the economy, & the problem gets worse. If inflation next month comes in the range of 8%, it would mean that an item that cost $100 in 2020 would cost $112.5 today!! That would be a 12.5% increase in 2 years. But it isn’t going jump that high (8% YoY), because of the March-April difference from the year prior, though if it does we are in serious trouble. It is far more likely that over time consumers will be slowly priced out of the market & prices will necessarily need to fall for businesses to remain competitive … even if is means a loss, or, a lower profit margin than historically realized. Now you can see why I’m having issues adding picks to the BUY LIST. Nevertheless, the 8.5% inflation for March implies you are paying over 11.1% more for goods than TWO years ago. If prices remain the same in April as they were in May (possible but unlikely), the CPI YoY should come in at around 6.9-7%. So once again the YoY inflation rate may decrease, but the prices will continue to skyrocket beyond historical norms. OTHER NOTES: Lots of housing data this week & the War in Ukraine continues. Keep an eye on consumer spending & behavior as inflation bites & pay close attention to the various bullish & bearish sectors amid earnings season. Personal income & Personal spending Friday next week (Not this week) have the potential to seriously move markets (See Economic Calendar Above). Significant News Heading into 04.18.2022:

PAID CONTENT IN THE PAYWALL BELOW:

👉CLICK HERE TO SEE THE DETAILS OF EVERY STOCK ON THE BUY LIST (AND SEE THE PRICE ASSESSMENT BASED WATCHLIST / THE STOCKS UNDER $20 LIST & THE HIGHLY SPECULATIVE LIST) LOGIN INSTRUCTIONS: You will need to login to see the detailed list. The “email login link” will send the link to login directly to your inbox (Click the link & it will automatically log you in). You can also choose the “login with password” option. You will need to set up a substack password for this option.Subscribe to StockTips Newsletter to read the rest.Become a paying subscriber of StockTips Newsletter to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

The Daily StockTips Newsletter 04.12.2022

Tuesday, April 12, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 04.11.2022

Monday, April 11, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 04.07.2022

Friday, April 8, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 04.06.2022

Friday, April 8, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 04.08.2022

Friday, April 8, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

You Might Also Like

Longreads + Open Thread

Saturday, March 8, 2025

Personal Essays, Lies, Popes, GPT-4.5, Banks, Buy-and-Hold, Advanced Portfolio Management, Trade, Karp Longreads + Open Thread By Byrne Hobart • 8 Mar 2025 View in browser View in browser Longreads

💸 A $24 billion grocery haul

Friday, March 7, 2025

Walgreens landed in a shopping basket, crypto investors felt pranked by the president, and a burger made of skin | Finimize Hi Reader, here's what you need to know for March 8th in 3:11 minutes.

The financial toll of a divorce can be devastating

Friday, March 7, 2025

Here are some options to get back on track ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Too Big To Fail?

Friday, March 7, 2025

Revisiting Millennium and Multi-Manager Hedge Funds ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The tell-tale signs the crash of a lifetime is near

Friday, March 7, 2025

Message from Harry Dent ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

👀 DeepSeek 2.0

Thursday, March 6, 2025

Alibaba's AI competitor, Europe's rate cut, and loads of instant noodles | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March 7th in 3:07 minutes. Investors rewarded

Crypto Politics: Strategy or Play? - Issue #515

Thursday, March 6, 2025

FTW Crypto: Trump's crypto plan fuels market surges—is it real policy or just strategy? Decentralization may be the only way forward. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What can 40 years of data on vacancy advertising costs tell us about labour market equilibrium?

Thursday, March 6, 2025

Michal Stelmach, James Kensett and Philip Schnattinger Economists frequently use the vacancies to unemployment (V/U) ratio to measure labour market tightness. Analysis of the labour market during the

🇺🇸 Make America rich again

Wednesday, March 5, 2025

The US president stood by tariffs, China revealed ambitious plans, and the startup fighting fast fashion's ugly side | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March

Are you prepared for Social Security’s uncertain future?

Wednesday, March 5, 2025

Investing in gold with AHG could help stabilize your retirement ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏