Apr 19: Better Collective punts on esoccer

Apr 19: Better Collective punts on esoccerBetter Collective buys Futbin, Ontario downloads data, Light & Wonder refinancing, New Jersey, Pennsylvania, Michigan and Louisiana datalines +MoreGood morning. On today’s agenda:

If you were forwarded this email and would like to subscribe, click below: Better Collective buys Futbin

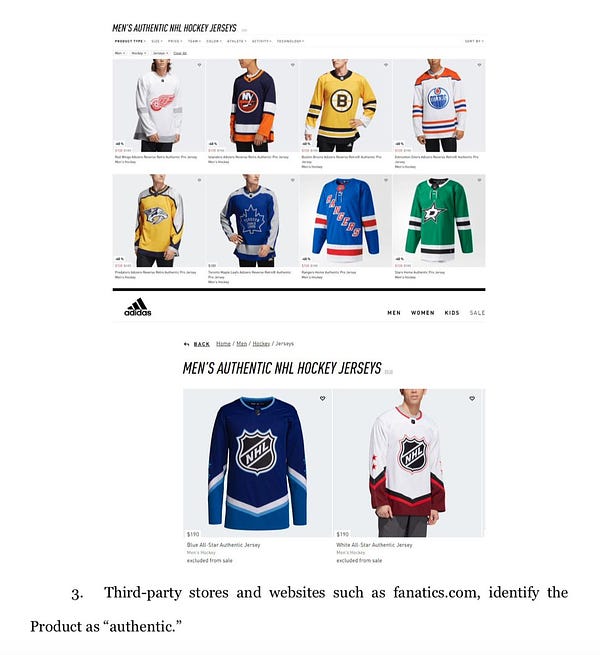

It’s in the game: The augmenting of Better Collective’s existing esports offering sees the company add a collection of FIFA esoccer sites. BC said the sites generate 50m users per month and 3m DAUs.

New targets: Futbin revenues will be consolidated in Better Collective’s accounts as of the end of this month. The company said its EBITDA target for 2022 had risen to €85m from €80m. Other targets remain unaltered. **Sponsor's message: Spotlight Sports Group (owned by Exponent Private Equity) is a leading technology, content and media business specialising in sports betting. Its industry-leading Superfeed is used by the biggest betting brands in the world including bet365, Flutter and Entain. The content engine powers on-site engagement by delivering impartial expert betting insight for 20 sports in 70 languages. For more information visit: spotlightsportsgroup.com Ontario app downloadsScores on the doors: TheScore grabbed an early lead in the app download charts with 50% market share in the first two weeks of the licensed market in Ontario, ahead of bet365 with 36% and then Betway with 5%, according to a report from Morgan Stanley.

Missing in action: The only other apps to note were Betway (5% over the fortnight) and BetMGM (3%). FanDuel did not feature in the download chart. Meanwhile, DraftKings continues to be an absentee from Ontario. Light & Wonder refinancingPayback: Light & Wonder has used part of the $6bn it recouped from the sale of its lottery business to Brookfield to reduce its outstanding debt from $8.8bn to $4.8bn.

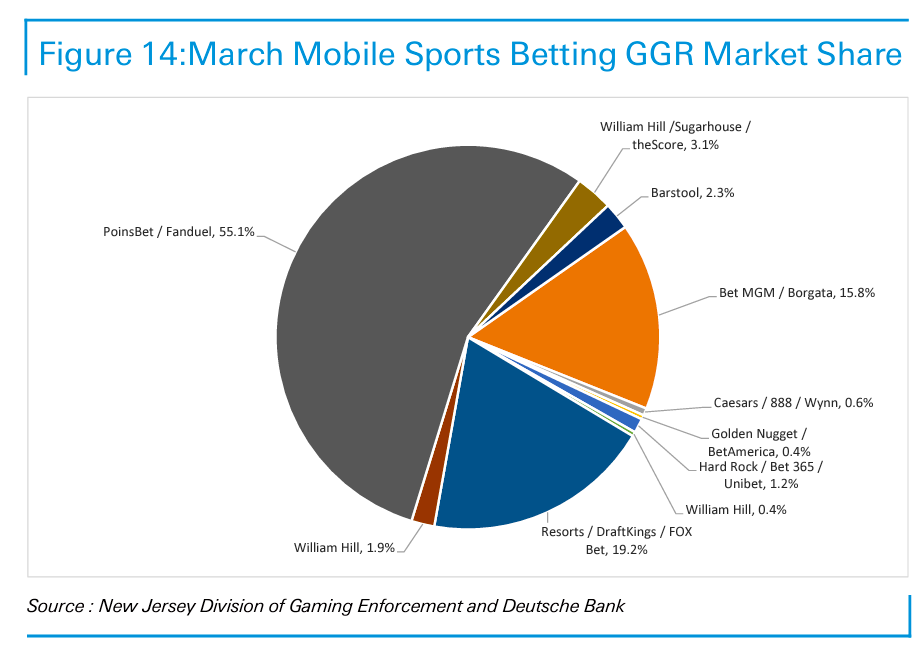

New deal: The group also announced the extension to 2030 of its agreement to supply UK bookmaker Entain with more than 10,000 FOBTs throughout the group’s Coral and Ladbrokes shops. Earnings in briefElys Game Technology saw FY21 betting handle rise 46.6% to $841.8m and revenue increase 22.2% to $45.5m, but net losses were up to $15m from $9.9m the prior year. Retail wagering revenues were up 21% to $45m and software and services revenues rose 35% to $5m. DatalinesNew York: Online sportsbooks generated $335.8m in bets for the week ending April 10. New York-licensed operators have generated more than $5bn in OSB handle since launching on January 8. Halfway there: By way of comparison with New Jersey’s $9.9bn handle in 2021, New York has already generated more than half that total and is more than halfway to achieving that total after 14 weeks of activity. Top duel: FanDuel maintained top spot in both handle ($142m) and revenue ($7.95m). DraftKings ($83.5m handle and $2.45m revenue) was second. Caesars Sportsbook was third for handle ($49.3m), but produced just $694K in GGR while BetMGM was fourth for handle at $36.2m but ahead of Caesars for GGR with $1.2m. DatalinesNew Jersey Mar22: Sports betting handle increased 30.4% to £1.12bn and GGR rose 9.3% YoY and 115.1% MoM to $66.4m, mobile betting made up $61.2m of the figure and was up 8.3% YoY. Margins were down to 5.9% from 7.1% in Mar21, NJ hold to date has been 6.7%. Sports betting handle increased 30.4% YoY and +13.7% MoM to $1.12bn. FanDuel was market share leader for sports betting GGR with 55.1%, DraftKings was second with 19.2% and BetMGM third with 15.8% Retail casino GGR was up 17.2% YoY to $216.6m, online casino GGR rose 23.7% YoY and + 8.2% MoM to $140.7m. Borgata led the online market with 29.4% share, Golden Nugget was second with 27.2% and Resorts third with 21.9%. Michigan Mar22: Betting handle was up 25% YoY to $478m but GGR was down 8% to $32.4m. Hold was 6.8%, which compared with FY21 average margins of 8%. Online casino GGR was up 38% YoY to $131.7m. Aggregate leads:

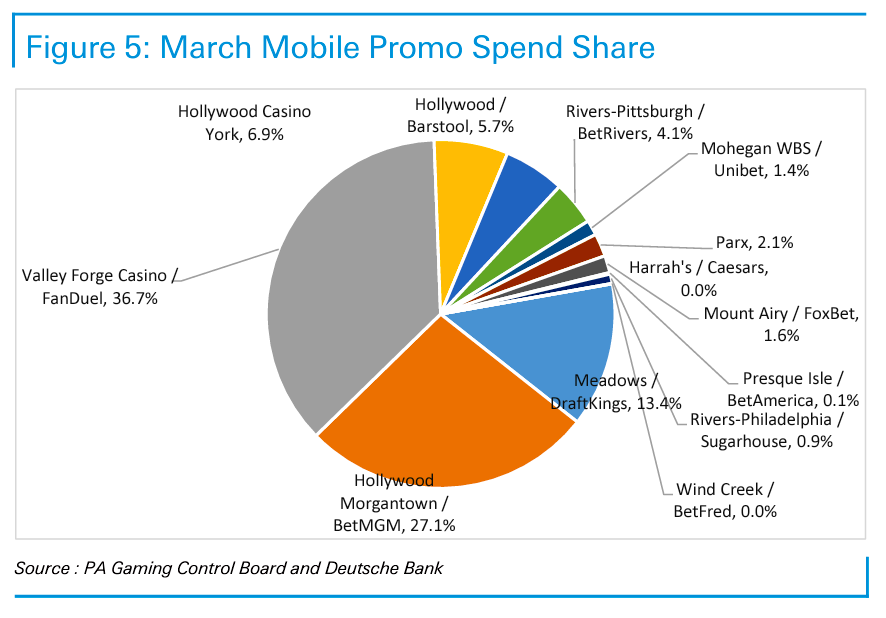

Pennsylvania Mar22: Sports betting revenue increased 18.2% YoY and 119% MoM to $48.5m, $30.4m net of promotions. Betting handle was up 27.6% YoY and +19.7% MoM to $715m, mobile betting handle was $667m. Deutsche Bank said margins were down 50 bps YoY and up 310 bps MoM to 6.8% vs. LTD hold of 7.4%. iCasino GGR was up 20.9% YoY and +15.3% MoM to $118.1m. FanDuel and DraftKings accounted for around 65% of OSB handle at 40% and 24.7% respectively. BetMGM was third with 11.8% share, Barstool maintained fourth place at 8.3%. FanDuel led in promotional spend at 36.7% of GGR, BetMGM was second at 21.7% and DraftKings third at 13.4%. Illinois March Madness: Lincoln State bettors staked $286.2m on March Madness, a 62% rise on the $176.8m bet on the tournament last year, but revenue was down $300K to $14.6m, with hold at 5%. The state banked $2.1m in taxes. Nearly 96% of total handle was bet online and the requirement for in-person registration expired at the end of March. In-play betting made up a quarter (25.1%) of all wagers. DraftKings led in share of handle at 36.7%, while Pointsbet led in share of revenue at 40%. Louisiana Mar22: Sports betting and casino GGR was up 7.4% to $332.7m. Sports betting GGR came in at $30.1m, with mobile GGR up 70.6% MoM to $28.4m and retail betting GGR up 168% MoM to $1.7m. Casino GGR was down 1.6% YoY to $221.5m. Penn National Gaming's properties recorded revenues of $88.1m, Boyd Gaming $40.1m and Caesars $38.5m. Indiana Mar22: Handle was up 16.5% to $476.8m, revenue hit $32.3m vs. $17m in Feb22 and $3m paid in taxes. March Madness dominated the sporting calendar and basketball generated $274m of the total handle, with parlay bets recording $121.3m in bets. FanDuel led for share of handle and revenue at 32.6% and 42.1% respectively, DraftKings was second at 31.7% and 24.2% and BetMGM was third at 12.8% and 17.3%. iGaming NEXT New YorkThe iGaming NEXT New York conference will take place on May 12-13 and will bring together the leading OSB/iGaming executives, institutional investors and leaders in the Web3.0 space. The event is supported by the likes of Morgan Stanley, Playtech, Spectrum Gaming and Evolution and is limited to 700 high-level delegates. To register with a special 10% discount, use the code: 10UNL050. Conference agenda, ticket purchases and registration details: www.igamingnext.com/nyc22 Regulatory roundupMassachusetts Gaming Commission Chair Cathy Judd-Stein has said the Commission is ready to go if sports betting is legalized in the state. Sports betting bill H3993 was passed by the House in July 2021, but has been held up in the Senate. In Maine, bill LD 585 was passed by the House. It gives exclusive control of mobile sports betting to three Maine tribes, with the state's two commercial casinos allowed to offer retail betting, but not mobile betting. A rival bill (LD 1352) that would include mobile betting for commercial casinos was introduced in the Senate last week. Hopes that Kentucky would regulate online sports betting and poker ended last Thursday after the state concluded its 2022 legislative session without passing any legislation. According to a survey by ABC network in St Paul, 64% of Minnesota respondents are in favor of legalizing sports betting, 17% are against and 19% are undecided. The final version of Arizona’s sports betting regulations are causing concerns for tribal operators. The most contentious clause could see an online sportsbook's entire operation closed down if the license holder decides to change management service providers. NewslinesIntegrity extension: Sportradar has expanded its current partnership with Nascar and will supply its sports integrity solutions to the racing body as part of a new multi-year agreement. Rules and regulations: The Mid-American Conference (MAC) has asked the National Collegiate Athletic Association (NCAA) to clarify its sports betting rules that prevent athletes, staff, conference employees and university leaders from betting on sports or providing information to anyone associated with sports betting. MAC signed a data and sponsorship agreement with Genius Sports last month but under the NCAA's current rules Genius is not permitted to MAC data to sportsbooks. Fly like an eagle: Michigan’s Saginaw Chippewa Tribe has gone live with its Soaring Eagle online sports betting and casino website playeagle.com. The site is powered by GAN and means all 15 ODB and casino licensees are now live in the state, although Churchill Downs’ TwinSpires online portal is set to close in H222. What we’re writingLife in UK listings yet: Scott Longley on the prospects for Playtech staying a public entity. What we’re readingTerra twilight: Bloomberg on the King of the Lunatics. On socialJersey wars…      Calendar

Contact us

If you liked this post from Wagers.com Earnings+More, why not share it? |

Older messages

Apr 12: IGT bolsters igaming with iSoftbet buyout

Tuesday, April 12, 2022

IGT agrees to by iSoftBet, Sportradar acquires VAIX, ICE day 1, Acroud trading update, YOLO invests in Enteractive +More

Apr 11: ICE is back

Monday, April 11, 2022

ICE is back, Kindred issues a profit warning, American Affiliate analyst call, startup focus - quarter 4 +More

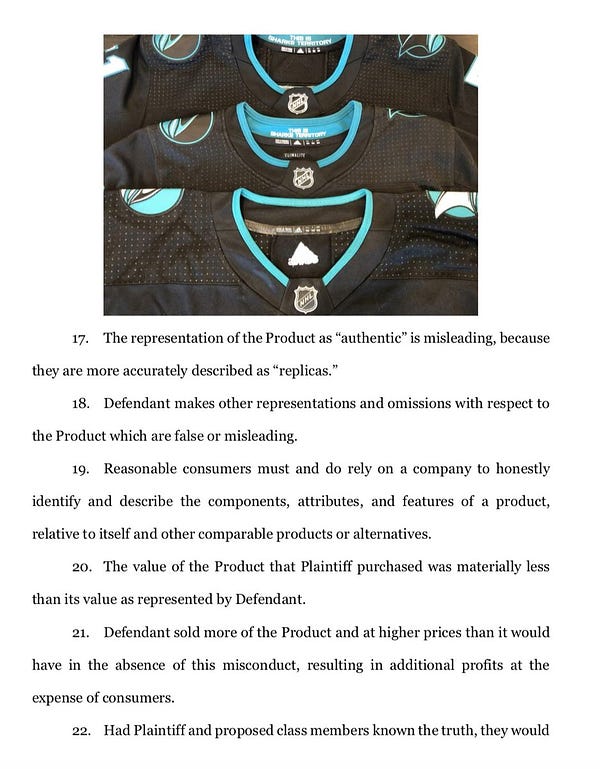

Apr 8: Weekend Edition #41

Friday, April 8, 2022

888 completes cash raise, Entain analyst reaction, MGM Resorts analyst update, WE+M quarterly awards +More

Earnings+More podcast #4

Thursday, April 7, 2022

Watch now (30 min) | I've got a feeling we're not in Kansas anymore

Apr 7: 888 knocks £250m off William Hill pricetag

Thursday, April 7, 2022

888 revises William Hill buyout terms, Entain Q1 trading update, NFL Fanatics investment, affiliates in Ontario, Gaming Society seed finding +More

You Might Also Like

Am I Devoted to My Calling or Distracted by My Device?

Wednesday, January 8, 2025

The question isn't whether technology can enhance our lives; it's whether we will use it as a tool or allow it to use us.

Started From The Bottom

Wednesday, January 8, 2025

Brand growing pains.

🔔Opening Bell Daily: Trump vs. Powell heats up

Wednesday, January 8, 2025

The president-elect said his team is preparing to inherit a difficult economic situation.

Fourth down

Wednesday, January 8, 2025

Flutter warns after 'historically bad' NFL season ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Skyrocket your audience growth

Wednesday, January 8, 2025

One Time Promo ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Disrupt the cost of YouTube video marketing

Wednesday, January 8, 2025

I love that you're part of my network. Let's make 2025 epic!! I appreciate you :) Today's hack Disrupt the cost of YouTube video marketing Turn your blog into a video blog. Turn your plain-

🆕 New Year, New Biz: Your entrepreneurial resolution

Wednesday, January 8, 2025

How to bring your business goals to life in 2025. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Podcast app setup

Tuesday, January 7, 2025

Open this on your phone and click the button below: Add to podcast app

👨🎤Turn and face the strange ch-ch...

Tuesday, January 7, 2025

Plus data from 700 marketing leaders View in browser hey-Jul-17-2024-03-58-50-7396-PM 56% of marketing leaders believe that marketing has changed more in the last 3 years than in the previous 50. And

The Profile: The Nike founder’s next act & the fentanyl victims suing Snapchat

Tuesday, January 7, 2025

This edition of The Profile features Phil Knight, Nicole Kidman, and more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏