Surf Report - Surf Report: Fury road

You’re getting this email because you signed up for Surf Report, my weekly take on economics, investing, Bitcoin, and business. I really appreciate you being here, but if you’d like to leave, simply scroll to the bottom to unsubscribe.

Hi everyone—I’m so glad to have you here. What a week. Crisis mode continued this week. There was no shortage of news documenting the destructive quakes emanating outward along the faults of central bank irresponsibility. As we learned (or, perhaps, didn’t) during the last financial crisis, an important leading indicator that tends to precede & precipitate systemic financial problems is the housing market. And wouldn’t you know: mortgage rates are soaring according to a number of sources, coinciding with reports of Wells Fargo firing 550 mortgage processors. Why would banks be gutting their mortgage departments? Perhaps they know what’s coming: a glut of people who can’t afford their loan payments just as demand for exorbitantly-priced houses dries up. Existing home sales are at 2-year lows. Mainstream news is starting to normalize the idea that the Federal Reserve can/might/will change the goalposts again, possibly raising their inflation target by 50% to 3%. Just casually planting the seeds of growing inflation being completely deliberate and all part of the plan. We are part of a global financial system, so it’s not just US central banks that are starting to admit defeat and shift to damage control:

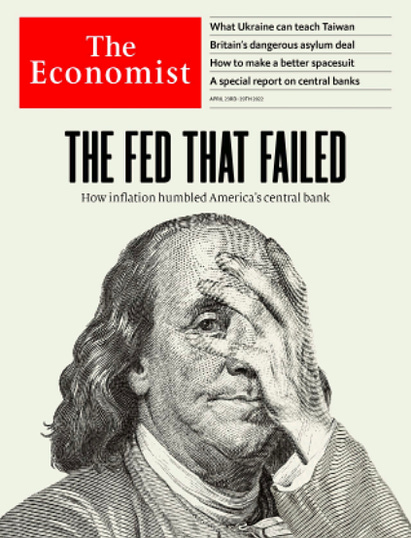

But let’s not forget what the Trustworthy™ newspapers were telling you two years ago in 2020, as a reminder and to keep them from wriggling off this hook they’re on: “Here’s why economists don’t expect trillions of dollars in economic stimulus to create inflation” And here’s my favorite clip of the week, where the Director of the International Monetary Fund tells it like it is right in front of Lagarde & Powell like a damn boss. Directness & honesty of this caliber is rare these days. Soak it in:   3 years ago, right before inflation became the talk of the town, this Bloomberg Businessweek cover stated. “Is inflation dead?” And now: The people whose job it is to tell you what’s going on have consistently had no idea what’s going on. 🤡

All the indicators I know of are flashing red. The world is in a real pickle, and it’s simply a question of when and how a catastrophe unfolds, not if. Those in positions of power are going to try to soften the landing and avoid blame as best they can but history tells us they have a bad track record on this front. But they can certainly fool a lot of people for a long enough time to at least hand off the hot potato to the next poor sap to take their place. The thing is, it’s already very bad and I don’t think people fully appreciate to what magnitude. People are out here wondering when a recession/depression will officially hit and don’t realize they’re already in the middle of living through something just as bad, if not worse. We’re at ~8% yearly inflation (this is the reported CPI figure which we know is a lie, but whatever let’s use it for illustrative purposes). This means that after 9 years, a $1,000,000 retirement/pension will only have $472,000 in purchasing power. If you measure the inflation rate by the rules used in the 1990s it is closer to 15%. 15% year-over-year inflation means that in 9 years your $1,000,000 becomes $213,000 in purchasing power. The money is broken. And when the money breaks down, society breaks down. I remember people telling me that notions of the US dollar not being used as the global reserve currency was a ridiculous fantasy, but de-dollarization is already underway and those galaxy brains are now nowhere to be seen. Funny that. Japan’s currency is also breaking, with the Bank of Japan asking for central bank aid in the same week it was announced that Biden will be doing the same, requesting freshly printed money to pay for Ukrainian weaponry. Notice that everyone keeps turning to the money printer to solve all of their problems and avoid dealing with reality. The reality, of course, is that we have an abundance of money and a scarcity of everything else. The former actually contributes to the latter.  Do not be seduced by the idea that governments Need™ to be able to print their own money. The ability to do so is the problem. Through history, inflating the money supply has never been the cause of sustained prosperity but an indicator of gradual decline & fall. When given the ability, regimes can never resist the temptation to debase the currency for their own benefit. When a government “asks” for more money they’re asking for a loan, which is another way of saying debt. And with sovereign debt levels where they are, a global energy crisis can quickly turn into a global sovereign debt crisis because nations become forced to pay top dollar for energy they’re not producing/sourcing themselves.

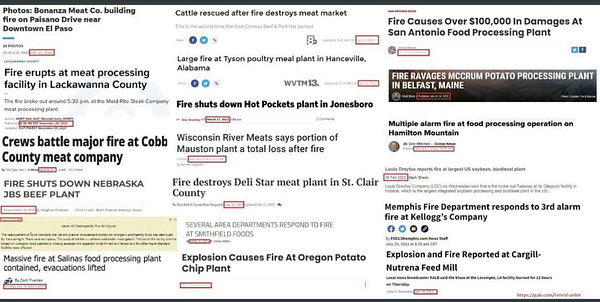

Add to all of this the fact that food processing plants are being destroyed in a strangely synchronized fashion across the US, with new, mysterious explosions surfacing almost daily. Just this week a plane crashed into General Mills’ facility in Covington, GA, erupting in flames. So in addition to a money crisis and an energy crisis we are being ensured a food crisis as well. (All forms of energy mind you)   Wait, you haven’t been seeing investigative reports on The News™ about these fires but you can definitely tell me all about a celebrity courtroom trial and the latest Russian sports team we’re cancelling? Interesting. An establishment in crisis inevitably resorts to desperation tactics that attempt to obfuscate responsibility and place blame where they would like it to be rather than where it actually is. Bitcoin has been a popular scapegoat indeed, as I am being informed by The News™ that people like me tend to have low levels of financial literacy. Harsh! ☹ They’re running out of ways to criticize the thing so they’re resorting to criticizing people who like the thing. I am a proponent of the maxim that says to understand what someone thinks you should look to what they do and not what they say. And what I see is a board member of one of the biggest German banks holding up his Bitcoin fullnode. 🧐 It’s looking as dystopian as ever these days, but Einstein’s observation that we cannot solve our problems with the same thinking we used when we created them is vital. People are increasingly viewing Bitcoin as a potential raft—an escape hatch—precisely because it sits outside of the current paradigm entirely, and provides a check on central bank forces and incentives. Remember, only the government can spend the money they’re printing for themselves. You are not allowed to print your own money. When they do it it’s called policy. When you do it it’s called counterfeiting. The best first step for people who haven’t yet explored the decentralized alternative to central banking is to get off zero. If you think Bitcoin has a 1% chance of being the solution many say it can or will be, then allocating 1% of your entire investment portfolio to it would mean that you’re employing the very same risk-mitigation hedging strategy that the pros use. Right now we are barreling down Fury Road attempting to escape a life of indebtedness and dependency, so the primary goal right now is survival. In financial terms, as popularized by author Phil Town, this is known as Rule #1: don't lose money. And you are living within a system in the middle of doing its absolute damnedest to make you do just that. Hope lies in embracing a money with unforgeable costliness backed by energy used to do actual work, and betting on eventual societal understanding that what got us into this fiscal hellscape will not be what gets us out of it. Until next time 🤙, Recommended Resources For Plan ₿Swan. I became an official Swan partner because I love them so much. So if you're like me and just want an easy, automated way to buy bitcoin on the regular with the lowest fees in the game, head to https://swanbitcoin.com/Mulvey to get $10 in bitcoin for free ✨ Fold Card. Earn bitcoin on everything. You can win up to 100% back on every purchase, and every swipe is a chance to win a whole bitcoin. I use my own Fold card to pay for almost literally everything. If you use this referral link you get 5,000 sats free ✨ Thanks for subscribing to Surf Report. If you liked this post, consider sharing it with someone else who might appreciate it! |

Older messages

Surf Report: Dogs and tails

Sunday, April 17, 2022

Listen now (12 min) | Issue 72: 04.17.2022

Surf Report: Wakey wakey

Sunday, April 10, 2022

Listen now | Issue 71: 04.10.2022

Surf Report: You don't own me

Sunday, April 3, 2022

Listen now | Issue 70: 04.03.2022

Surf Report: Time to unwind

Sunday, March 27, 2022

Listen now | Issue 69: 03.27.22

Surf Report: What's normal for the spider

Sunday, March 20, 2022

Listen now | Issue 68: 03.20.22

You Might Also Like

🌎 Make international sourcing and shipping easier

Tuesday, March 4, 2025

How to prep your business for changing trade regulations. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 How was the masterclass with Arvid Kahl?

Tuesday, March 4, 2025

Your feedback matters + Access the recording ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Letter from the Editor: Why this year's Digiday Publishing Summit matters

Tuesday, March 4, 2025

It's a new era for the media industry. Eras, actually: There's the AI era, the streaming era, the podcast era, the post-cookie era. In other words, media companies are being forced to evolve,

11 social media skills to master (and how AI can help)

Tuesday, March 4, 2025

Perfect these skills now to stay ahead in 2025 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 The masterclass with Arvid Kahl starts in 15 minutes

Tuesday, March 4, 2025

Build In Public Without Giving Away Your Business Secrets ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Age of Economic Chaos

Tuesday, March 4, 2025

Listen now (7 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The next level of content marketing

Tuesday, March 4, 2025

Content marketing isn't just about creating blog posts. If you're still stuck in that mindset, you're leaving money on the table. The best marketers go beyond traditional content and

📱 Google Gemini’s iPhone Hack

Tuesday, March 4, 2025

AI More human-like than ever. Ready to upgrade? ⚡

ET: March 4th 2025

Tuesday, March 4, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 BlueChew (trends) Chart BlueChew is a

🦅 Masterclass with Arvid Kahl: watch the live stream

Tuesday, March 4, 2025

At 10:00 AM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏