Analysis of OpenSea's Acquisition of NFT Aggregator GEM: A Monopolist's Move to "Root Out the Threat"

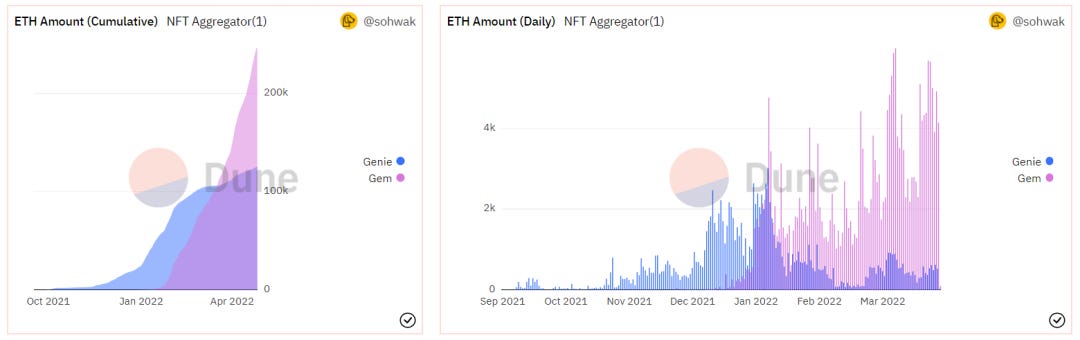

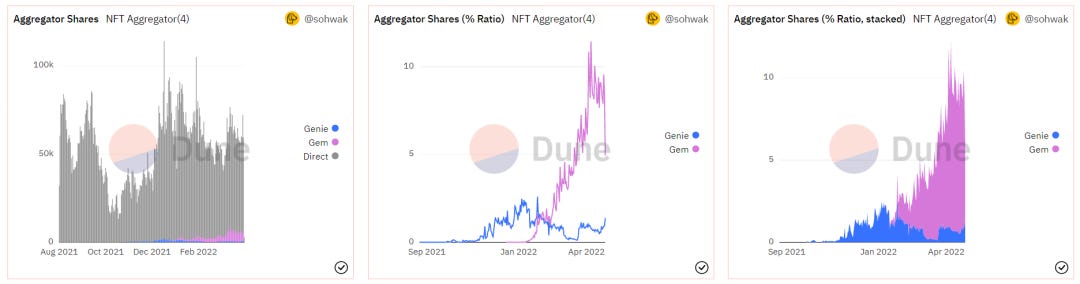

OpenSea's acquisition of Gem is a very centralized approach. When a competitor emerges, even though it is not yet a threat, the monopoly company will quickly acquire/merge it through its strong capital power to nip the threat in the bud. Chinese gamers should be very familiar with OpenSea's actions, which are comparable to Tencent's. I have to praise Gem.xyz, the shopping cart, rarity, flashbot, whales purchase notification and other functions are very good, not only can save the fee, but also can always pay attention to the market dynamics, and in critical times can also grab rare NFT. Many of these features are what the community has always wanted OpenSea to add, and then the evil dragon always ignore the voice of the community, the emergence of Gem to fill the gap in functionality. So we also laughingly call Gem is OpenSea's dragon slayer. In fact, as an aggregator, Gem's NFT data is excellent. Since its launch in mid-December last year, Gem has accumulated over 246,000 ETH(~ $400million) of trading volume, twice as much as Genie, which launched much earlier. The main reason that Gem has been able to bend the rules in such a short time is that Gem aggregates more mainstream NFT markets than Genie, OpenSea, LooksRare, X2Y2, etc., while Genie is mainly OpenSea and other smaller markets, and its long period of inactivity made it lose market share, until early April this year when it integrated LooksRare. In addition, Gem is also ahead of Genie by aggregating the analytical data dial of Dune Analytics and its own anti-pinch bots. Gem has achieved a downscaling of Genie. Despite the excellent data, NFT Aggregator does not charge fees such as platform fees, and the profit model still being explored planted the seeds for Gem to be acquired. (Source:Dune Analytics) Thanks to the ease of functionality and as an aggregator, Gem has naturally absorbed users of its aggregation platform and captured a certain market share, especially the whales. And in this respect, Gem may pose a greater threat to OpenSea than LooksRare. The current ratio of NFT purchases through aggregator Gem to direct purchases through the NFT market is 10:90. Although a significant portion of that still contributes to OpenSea, but for its, which has long held more than 95% of the NFT market share, users are separated and diverted by Gem. More like Web2's OpenSea, private traffic is still a key part of the equation, and would not want its growing number of users to be shared with other platforms. (Source:Dune Analytics) OpenSea also faces a choice between Crypto and IPO. Especially after one of OpenSea's inappropriate comments, the voices that OpenSea will issue airdrops are becoming less and less vocal. In addition, OpenSea has not always paid attention to community advice, has caused dissatisfaction among community users, and more community-oriented platforms such as LooksRare and X2Y2 began to challenge it. Compared to OpenSea, the community has a large voice in Gem's products and features. Gem has a popular feedback system and a great interaction system on community platforms like Discord. Gradually, the likelihood and call for a Gem airdrop is growing, which is definitely more detrimental to the swinging OpenSea. As monopolies often do to nip threats in the bud, OpenSea has acquired Gem. Despite the promise that Gem will operate as an independent unit, it is highly unlikely that OpenSea will have a Token plan in the near future, which is more interested in chasing regulatory compliance. And with Gem already part of OpenSea, the likelihood of an airdrop is slim in this acquisition. In the Web2, we have seen too many cases of small but beautiful companies being acquired by giants and then falling down. This acquisition is probably because Gem, as an NFT aggregator, has not found a profit point to support the development of the platform without charging any platform fees, and no funding has been announced before. Perhaps the team is indeed facing difficulties in operating funds, although there is no excuse, but it is more disappointing for Crypto Native, which is more like a compromise with capital and a lack of confidence in tokenomics. Although Gem stressed that OpenSea's acquisition did not kill the possibility of Token, similar words were said by OpenSea last year. To this day, we have not seen a single possibility from OpenSea regarding Token. Gem currently enjoys a significant market share in aggregators, but it is believed that a more community-oriented and decentralized challenger is on the way, perhaps leading to a new profitable growth model for NFT aggregators as well. Follow us Twitter: https://twitter.com/WuBlockchain Telegram: https://t.me/wublockchainenglish If you liked this post from Wu Blockchain, why not share it? |

Older messages

Global Crypto Mining News (Apr 11 to Apr 18)

Monday, April 18, 2022

1. trent.eth has reposted a discussion from the Reddit community about what happens to graphics miners after the ethereum merger. The view, led by trent.eth, is that other graphics card mining tokens

Global Crypto Mining News (Apr 4 to Apr 10)

Monday, April 11, 2022

1. Marathon Digital Holdings Inc. is open to the possibility of being acquired at the right price, its chief executive said. The Las Vegas, Nevada-based company is one of the world's largest

5 FAQ: Know About The Merge and Ethereum Latest Roadmap

Friday, April 8, 2022

As The Merge is approaching, the community is becoming more and more concerned about the implications of the merger and the future roadmap planning for ethereum. In this article, we will focus on this

Global Crypto Mining News (Mar 28 to Apr 3)

Monday, April 4, 2022

1. Russian Deputy Energy Minister Evgeny Grabchak said on Saturday that the legal vacuum in the field of cryptocurrency mining needs to be eliminated as soon as possible, according to TASS. He also

Move to Earn: Reasons for StepN's Success. Is StepN Sustainable? What's the direction?

Friday, April 1, 2022

Editor's Note: StepN has not only become a global sensation, but also sparked extensive thinking in the industry. Its success is due to the choice of niche industry, the satisfaction of user needs,

You Might Also Like

Texas doubles down on crypto with new $250 million Bitcoin reserve bill

Tuesday, March 11, 2025

Texas' second crypto bill seeks to enhance state and local government participation in digital asset investments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How-ey Can Get Out of Here

Tuesday, March 11, 2025

How On-Chain Data Can Clarify the Regulation of Cryptoassets ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

February CEX Data Report: Significant Decline in Trading Volume Across Major CEXs - Spot Down 21%, Derivatives Dow…

Tuesday, March 11, 2025

In February 2025, the spot trading volume of major CEXs decreased by 21% compared to January. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

El Salvador defies IMF, continues Bitcoin purchases amid market downtrend

Monday, March 10, 2025

El Salvador's Bitcoin holdings grow to $504 million, challenging IMF directives amid sharp price declines. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🖊️ Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO …

Monday, March 10, 2025

Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO for a Cronos Strategic Reserve; Texas's Senate passed bitcoin reserve bill SB-21 ͏ ͏ ͏

Vitalik TAKO AMA: ETH Positioning, Sequencer Centralization, L1 vs L2, Governance, and Success Metrics

Monday, March 10, 2025

On the evening of February 19th at 12 PM UTC and lasting until 12 PM UTC on February 20th, Vitalik Buterin, the founder of Ethereum, was invited to participate in a flash text interview on Tako (a

Donald Trump Creates U.S. Bitcoin Reserve

Monday, March 10, 2025

March 10th, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Donald Trump Creates US Bitcoin Reserve Diddy Shows 'Kindness' To Sam Bankman-Fried Robinhood Conducts $1M Crypto Trivia

Bitcoin’s realized volatility surges in as traders face extreme price swings

Sunday, March 9, 2025

Volatility clustering in Bitcoin reveals the impact of turbulent rallies and sharp pullbacks. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Mar 3 to Mar 9)

Sunday, March 9, 2025

Ms. Sun Xueling, Minister of State, Ministry of Home Affairs of Singapore, said that cryptocurrency fraud cases accounted for a quarter of the total loss amount involved in fraud last year. ͏ ͏ ͏ ͏ ͏ ͏

Trump declares end to ‘war on crypto,’ vows to propel America to Bitcoin supremacy

Saturday, March 8, 2025

Trump brands the Biden era as a crypto setback, .President Trump vows to make America the Bitcoin leader, ending Operation Chokepoint 2.0 and bolstering crypto strategies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏