Earnings+More - May 5: Profits in sight, says RSI

May 5: Profits in sight, says RSIRush Street Interactive Q1, Playtech trading statement, Kindred’s activist investor, VICI Q1 +More.Good morning. Another busy Q1 schedule:

C’est magnifique. Click below to sign up: Rush Street Interactive Q1

Profitability beckons: CEO Richard Schwartz preceded his remarks on the earnings call by saying RSI was “on the path towards building a sustainable and long-term profitable business”. The company hopes to achieve EBITDA profitability in H223.

Not so bleak house: Jefferies noted the ”pendulum has swung too far” on the pessimism about sector profitability. “The quarter defines reasons for RSI to succeed as a smaller and disciplined player,” they added.

Sitting it out: Schwartz noted RSI was more confident of achieving profitability in states with both icasino and OSB. Wells Fargo noted RSI might opt out of future OSB-only state launches.

Growing the base: RSI said real-money monthly active users rose 32% to over 150,000 with an ARPMAU of $265. On the earnings call, CEO Richard Schwartz said RSI had a “solid history of attracting high-quality players that produce meaningful revenues over time”.

Calling a trend: On marketing, Schwartz said RSI was seeing “a more rational approach” on the part of its competitors since the Super Bowl, confirming recent comments from Caesars and Flutter.

Branching out: Having launched in Ontario, Schwartz noted RSI will be launching in Mexico thanks to the partnership it signed in January with Grupo Multimedios. Schwartz said there were no specific timeframes for RSI’s Mexico launch. Download downer: Schwarz made some interesting comments on the app download data emerging from Ontario, suggesting the company doesn’t regard them as too important.

** Sponsor’s message: Venture capital firm Yolo Investments is home to €551m of equity in more than 70 of the most exciting companies across fintech, gaming and blockchain. It continues to build one of gaming’s most dynamic portfolios as it eyes up seed and A-stage opportunities across the sector. Its dedicated 29-company, €183m AUM gaming fund already houses holdings in fast-growing suppliers and operators, including Kalamba Games, SimWin and ThriveFantasy. Yolo Investments is also on the lookout for LPs as it looks to scale new concepts, including its high roller live casino brand, Bombay Club. Playtech trading updateTon-up: In a brief statement, Playtech said adj. EBITDA for the first three months of the year came in at “more than €100m”. It added that the positive run rate continued through April. The company said it saw a “strong performance” in both B2B and B2C.

Transaction inaction: Speaking of CaliPlay, Playtech said that although capital market conditions are “currently challenging”, the company continued to “explore a possible transaction” (i.e. the merger with Tekkorp) that would “allow Caliplay to enter the U.S. market on an accelerated basis”.

Raise: Peel Hunt noted the “earlier-than-usual” trading update and said it was upgrading its 2022 EBITDA forecast to €375m compared to the company’s implied €400m+. Kindred’s activist investorTo the barricades: Corvex, a New York-based activist investor which recently amassed a 10%+ stake in Kindred, went public via comments to Reuters about its wish for the Stockholm-listed Kindred to pursue strategic alternatives including a potential sale of the business.

Getting defensive: Kindred issued a statement from chairman Evert Carlsson noting the comments.

Call me Meister: HT iGaming NEXT which noted that Keith Meister (pictured above), founder of Corvex, is also a board member at MGM Resorts International. VICI Properties Q1In brief: Revenues were up 11.3% to $416.6m. The company is on track to complete the $17.2bn MGM Growth Properties (MGP) buyout this quarter and completed the Venetian transaction this week. VICI also recently underwent a $5bn loan notes offer.

Get real: Noting Realty Income’s entry into the gaming space with the Boston Encore deal announced by Wynn in February, Pitonisk said it was an “unallowed positive” to have a storied REIT operating in the space. Realty Income was founded in 1969.

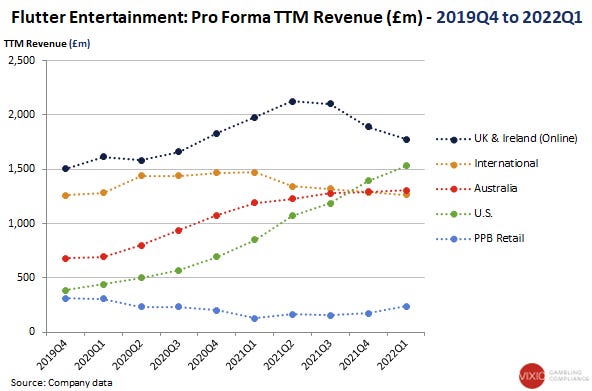

Flutter analyst updateMajor disconnect: Analysts at Wells Fargo said they see a “major valuation dislocation/conglomerate discount” with Flutter.

Pathfinder: “We recognize that aside from a public listing, there’s not a clear path to fully unlock this value, and the FOX arbitration is still an overhang,” the team adds.

Chart of the day  Earnings in briefAccel Entertainment Q1

Forced removal: Accel removed equipment from 30 locations with 150 VGTs in January following the Illinois Gaming Board enforcing a rule that requires operators to remove equipment from a location if there is no activity for 72 hours.

Regulatory roundupOhio regulators will open online sportsbook applications June 15, potentially opening the door for the first operators to launch during or even before the 2022-23 football season. Missouri lawmakers are working on a potential compromise that could save sportsbook legalization hopes this session after a betting bill stalled in the Senate. There will be at least two sports betting proposals on California’s November ballot following the FanDuel-BetMGM-DraftKings proposal obtaining the number of required signatures. Another proposal backed by the San Manuel Band of Mission Indians, Wilton Rancheria and Rincon Band of Luiseño Indians has until July 11 to gather the required number of signatures. Further reading: Wagers.com’s Steve Ruddock dives into the California ballot detail. NewslinesQuickfire deal: Microgaming has completed the sale of the Quickfire casino games provider to Games Global, the private-equity-backed company led by Walter Bugno and Tim Mickley. Drop zone: Affiliate provider Playmaker has acquired theSportsDrop.com, a US-focused site for major leagues and College sports which generates 30m monthly page impressions and 3m monthly users. The Sports Drop founder Mike Bellom has joined Playmaker’s senior leadership team as head of paid media. Financial details were not disclosed. Boys from Brazil: Genius Sports will supply its sports betting data, odds and streaming feeds to Brazilian sportsbook Betsul. Brazil published its sports betting licensing rules this week. These include a €4.2m/$4.4m license fee, operators currently active in the market have six months in which to apply. What we’re writingBig deal: Scott Longley writes for Wagers.com on MGM’s LeoVegas offer. What we’re readingMost coveted: A 2016 interview with Carlo Ancellotti, the man with an eyebrow arch for the ages. On socialSpeaking of which, City crash or Real steel?   Calendar

Contact us

If you liked this post from Wagers.com Earnings+More, why not share it? |

Older messages

May 4: Caesars hits half a billion digital losses

Wednesday, May 4, 2022

Caesars Entertainment Q1, Red Rock Resorts Q1, Flutter Entertainment trading update +More.

May 3: MGM: LeoVegas ‘puts us on the map’

Tuesday, May 3, 2022

MGM Resorts international Q1, MGM/LeoVegas analyst reaction, Q1 gaming supplier analyst preview +More

May 2: MGM makes online move with LeoVegas offer

Monday, May 2, 2022

MGM resorts offers $607m for LeoVegas, betting and gaming's earnings week, Gaming and Leisure Partners Q1, MGM Resorts analyst upgrade, startup focus - OneComply +More

Apr 29: Weekend Edition #44

Friday, April 29, 2022

Pointsbet Q3, Las Vegas Sands analyst reaction Churchill Downs analyst call, GAN debt raise, sector watch - streaming +More

Earnings +More podcast #6

Thursday, April 28, 2022

Watch now (26 min) | Kambi, Boyd Gaming, DAZN and the streaming marketplace

You Might Also Like

🎉 Only 3 Days Left: Save 40% on Turing Post

Friday, January 3, 2025

Invest in learning more every week

Customer Return Rates Were 13% Overall in 2024 [Crew Review]

Friday, January 3, 2025

You're an Amazon whiz... but maybe not an email whiz. Omnisend makes setting up email for your brand as easy as click, drag, and drop. Make email marketing easy. Hey Reader, Happy new year everyone

🚨 You MUST try this mobile App. 🚨

Friday, January 3, 2025

TGIF. This is the Niche Nugget. A monthly roundup where we bring you SEO and creator news and insights from across the industry. What happened? What's it all mean? We've got you covered.

How to Use User Intent for SEO Funnel Creation

Friday, January 3, 2025

SEO Tip #67

Facebook content strategy for 2025

Friday, January 3, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's Festival of Sleep Day, Reader! Have yourself a little nap… It's the

Bitcoin Is The New S&P 500

Friday, January 3, 2025

Listen now (4 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Influence Weekly #370- MrBeast Claims ‘Beast Games’ Is Amazon Prime’s #1 Most-Watched Show In 50+ Countries 200k+ YouTube Creators Targeted In Massive Brand Deal Scam

Friday, January 3, 2025

MrBeast Claims 'Beast Games' Is Amazon Prime's #1 Most-Watched Show In 50+ Countries

Issue #49: AI's New Angles

Friday, January 3, 2025

Issue #49: AI's New Angles

PE investment jumped 22% in 2024

Friday, January 3, 2025

European VC mega-rounds grow rare; Asian PE fundraising drifts awat from China; micromobility sector zips ahead Read online | Don't want to receive these emails? Manage your subscription. Log in

"Notes" of An Elder ― 1.3.25

Friday, January 3, 2025

A new day brings the promise of new beginnings, requiring courage to transform our lives and live uncommonly.