May 9: Better Collective eyes £500m Spotlight deal

May 9: Better Collective eyes £500m Spotlight dealBetter Collective closing in on Spotlight, DraftKings analyst reaction, Penn National analyst reaction, startup focus - Network Gaming +MoreGood morning. On today’s agenda:

We could be so good for you. Click below: Better Collective closes in on Spotlight SportsAt the post: Better Collective is the favorite to acquire Spotlight Sports Group, the publisher of the Racing Post, for £500m. According to the Sunday Times, Spotlight’s private equity owner Exponent is close to selling its 75% stake which it has held since 2016. Spotlight also owns sports-betting affiliate sites My Racing, Free Super Tips and the US-focused Pickswise.

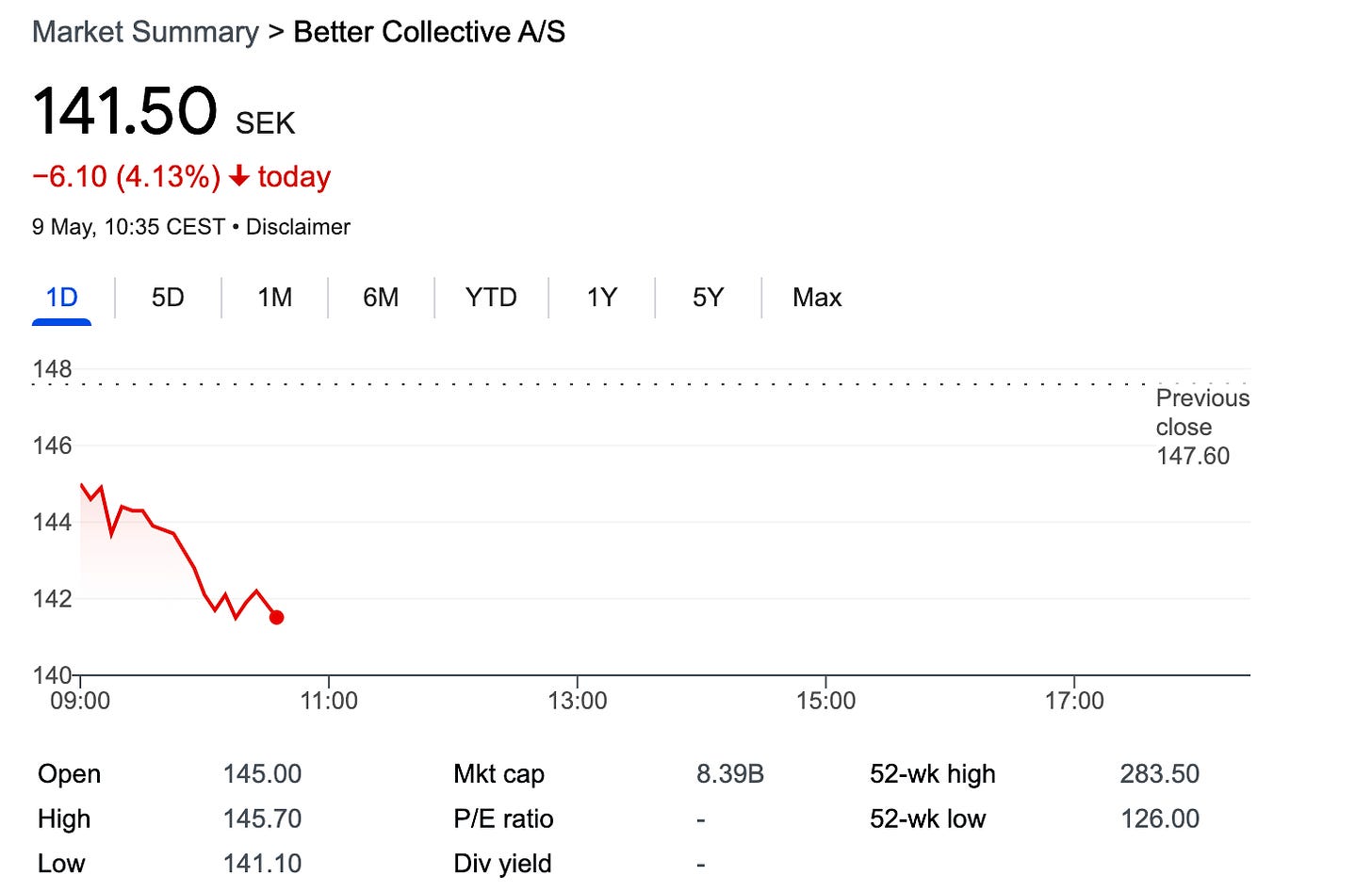

Digital transformation: More than two-thirds of Spotlight’s turnover is now from digital rather than print. It changed its name from the Racing Post Group to Spotlight Sports Group in 2020 to reflect the shift. Speculation: A spokesperson for Better Collective said the report was “highly speculative”, but added: “Given our defined M&A-strategy and track record we are not surprised to be mentioned when there are rumors of sales processes in the industry”. Spotlight didn’t respond to enquiries. Further comment: Better Collective said today its next earnings release will be on May 18. Its shares were down 2.5% in early trading. ** Sponsor’s message: Venture capital firm Yolo Investments is home to €551m of equity in more than 70 of the most exciting companies across fintech, gaming and blockchain. It continues to build one of gaming’s most dynamic portfolios as it eyes up seed and A-stage opportunities across the sector. Its dedicated 29-company, €183m AUM gaming fund already houses holdings in fast-growing suppliers and operators, including Kalamba Games, SimWin and ThriveFantasy. Yolo Investments is also on the lookout for LPs as it looks to scale new concepts, including its high roller live casino brand, Bombay Club. Churchill Downs analyst reactionStrike it lucky: 80-1 outsider Rich Strike won the 148th Kentucky Derby this weekend and Wells Fargo suggested Churchill Down was on to a winner with adj. EBITDA for Derby week as a whole likely to be between $7m-$9m better than 2019 at ~$120m.

Further reading: Churchill Downs exits online gaming. DraftKings analyst reactionNit-picking: Wells Fargo said DraftKings’ Q1 statement contained more pluses than minuses, but noted that in the current environment, and with the Nasdaq suffering a 1.4% fall on the day, the fact that investors could “find notes” meant the shares got punished. DraftKings ended the day down nearly 9%. Those nits: Wells Fargo noted that the negative included issues around gross margin and cash flow, that the EBITDA beat though “nice” was against guidance that came more than halfway through the quarter and that half the beat was from shifting expenses to Q2.

Aversion therapy: Still, the team remain concerned that with investors showing minimal appetite for consumer discretionary stocks right now, catalysts for improved sentiment are somewhat lacking.

Mining for gold: Looking at management’s comments on the possibility of success with the OSB ballot measure in California, the Macquarie team make an attempt at pricing up what a California market opening might mean for DraftKings suggesting.

Turning a profit: Truist noted that DraftKings was now “highly profitable” in New Jersey and that 10 more states would turn profitable in 2022. Penn National analyst reactionWorking in a coal mine: Noting the questioning around any deterioration in player spending habits due to macro concerns, the team at CBRE pointed out that while the market is “searching for the canary in a coal mine”, the “moderate impact” seen by Penn at the lower end of its customer base is encouraging. Edging Ontario: Truist pointed out that Penn is saying that theScore in Ontario is “ramping faster than other market launches”. CBRE added that the metrics being reported by theScore in Ontario are encouraging, as is the success of the rollout of the operation’s new PAM and bonusing engine.

Deutsche Bank gaming updateApril showers: The DB team say the early data for April is a mixed bag and that of the six markets they track, four are likely to show YoY increases but that the Las Vegas Locals market and Ohio are likely to show declines.

Century Casinos analyst updateEastern retreat: The Macquarie team suggest that Century is being penalized by investors for its interest in Polish casinos, adding that the proposed sale of the business will help close the valuation gap, thus closing the gap with its pure-play regional peers. That’s execution: The Macquarie team also noted in relation to the Nugget acquisition that the multiple of 5.6x 2021 EBITDA that the company has a strong track record of driving down purchase multiples post-acquisition. They point to three acquisitions completed in 2019 at 4.1x EBITDA that finished 2021 at 2.1x. The shares weekBear trap: As noted, it was a bad week for equities with interest decisions and general economic commentary weighing heavily. As noted, DraftKings was down nearly 9% on Friday while RSI was down 8.5% and Penn fell by 6%. Bear hug: The worst performer on Friday, however, was Genius Sports which was down over 10% to $3.54. It is now down over 80% against its debut price of $18.69. Genius reports its Q1 earnings on Thursday. The week aheadMain event: With major rivals DraftKings, Flutter (FanDuel) and Caesars all having reported last week, BetMGM gets its chance to shine on Wednesday with a business update.

The deep end: Earnings from the gaming supply sector are in the mix this week with Tuesday seeing IGT, Light & Wonder, SciPlay and Everi all reporting. Analysts at Jefferies said that recent market weakness means these stocks are attracting attention for their low valuations.

The line up: Wednesday also sees Wynn Resorts report, while Full House reports after close on Monday. Gaming Innovation Group report on Tuesday and Raketech on Wednesday. Endeavor (Thursday) and Codere Online round off the week.

Startup focus - Network GamingWho, what, where and when: Network Gaming is a provider of sports prediction games and was founded in 2019 by Harry Collins, former CMO at the bookmaker Fitzdares. Funding backgrounder: Its most recent funding round raised £1.25m at the end of March. The round was spearheaded by Betfair co-founder Andrew Black, who was joined by Colossus Bets CEO David O’Reilly, Einar Knobel, CEO at TXOdds, Best Odds CEO Will Armitage, Sandford Loudon, a partner at Oakside Capital and Garry Otto, a Los Angeles-based angel investor and owner of Sutton United FC. So what's new? Network Gaming clients include talkSPORT, Fitzdares and The Sun newspaper and the business is in discussions with potential US partners.

The North American market is interesting, Collins says, because his company's games “work really well” for US sports, whether in fixed-odds formats as well as DFS-style-license games. The longer pitch: Collins says his company builds game experiences that offer the best possible combination of low cost and high enjoyment. “That in a nutshell is our innovation - a highly scientific approach to the cost/enjoyment equation”. He adds that Network Gaming’s products have enjoyed significant interest and enthusiasm for three key reasons.

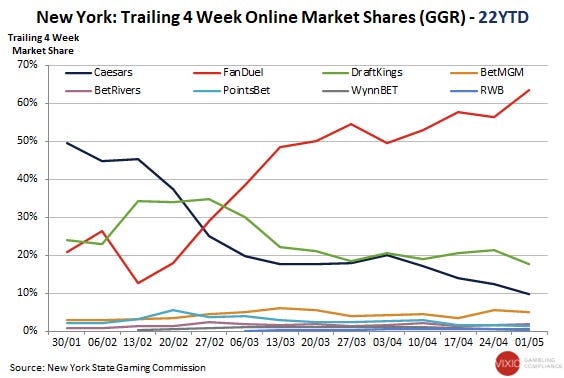

DatalinesNew York: Sports betting handle reached $295.2m for the week ending May 1, its lowest handle total since New York regulated OSB in January as the sports betting calendar slows down. FanDuel continues to lead the market, taking $135.6m for the week, DraftKings was second with $64.6m. Since launching on January 8, New York has generated $6.27bn in handle.   Iowa Apr22: Casino GGR was up 1.7% YoY to $163.2m. Sports betting handle was up 49.9% to $177.4m, betting revenues were up 75% to $13.5m, with overall hold at 7.6% vs. average hold of ~7%. Online margins were 7.9% and retail hold 5.2%. Online betting represented 91% of handle, and retail 9%. Illinois Apr22: Gaming GGR was up 13.7% YoY to $122.5m, although Illinois casinos operated at 50% capacity throughout Apr21. On a same-store basis, GGR was up 8.9% to $117.4m. Maryland Apr22: GGR rose 5.3% YoY to $170.7m. MGM’s National Harbor and Caesars’ Horseshoe Baltimore were subject to 50% capacity restrictions last April. The period had 10 weekend days vs. nine in 2021. NewslinesVegas GP’23: Liberty Media, the parent company of the Formula 1 championship, has acquired a 39-acre site for $240m in Las Vegas that it will use as a pit-and-paddock area and other hospitality activities during the Las Vegas Grand Prix it will be running in the city in 2023. F1 announced in March that The Strip would be the location for its third race in the US. The city of Miami hosted its grand prix yesterday and the Austin grand prix will take place in October. White Sox-Caesars partnership: Caesars Entertainment will be the new sports betting and casino partner of Chicago White Sox MLB franchise. The new partnership will enable Caesars to advertise its land-based casinos in Illinois and Indiana, but not its online casino in the latter jurisdiction as the vertical is not regulated in the Hoosier State. What we’re readingNot crying wolf: Michael Dugher from the Betting and Gaming council warns on black market activity. Bland leading the bland: How Europeans lost their spice. Give it back: The day trading army has lost all its gains from the meme stock era. Police and thieves: The rise of crypto muggings in the square mile. On social  CalendarMay 9: Full House Q1 May 10: GIG, IGT, Everi, Light & Wonder, Wynn Resorts, Inspired, SciPlay Q1s May 11: Raketech, NeoGames, Inspired Q1 call, BetMGM investor day May 12-13: iGaming Next New York 2022 May 12: Genius Sports, Endeavor Q1, NeoGames Q1 call May 13: Codere Online Contact us

If you liked this post from Wagers.com Earnings+More, why not share it? |

Older messages

May 6: DraftKings bangs earnings beat drum

Friday, May 6, 2022

DraftKings Q1 earnings extra, Century Casinos Q1

May 6: Weekend Edition #45

Friday, May 6, 2022

Watch now (28 min) | FuboTV, Golden Entertainment Q1s, AGS Q421, Bally and Penn analyst reaction, sector watch - financial trading +More

May 5: Bally board nixes Standard General bid

Thursday, May 5, 2022

Earnings extra: Bally Corp, Penn National Gaming Q1, DraftKings completes GNOG acquisition

May 5: Profits in sight, says RSI

Thursday, May 5, 2022

Rush Street Interactive Q1, Playtech trading statement, Kindred's activist investor, VICI Q1 +More.

May 4: Caesars hits half a billion digital losses

Wednesday, May 4, 2022

Caesars Entertainment Q1, Red Rock Resorts Q1, Flutter Entertainment trading update +More.

You Might Also Like

How to automate your feedback and sharing

Wednesday, January 1, 2025

These deals are ending: Inro, Qolaba, MySEOAuditor, ContentRadar, and SEO Pilot - get them now to start off your 2025 right!! Get these lifetime deals now! (https://www.rockethub.com/) Today's hack

Special Message from Anthony Pompliano 🙏🏼

Tuesday, December 31, 2024

Hey - thank you for being a free subscriber to The Pomp Letter. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

SEO Year in Review + Link Whisper Deal Ends Today!

Tuesday, December 31, 2024

As 2024 closes, I wanted to give you a heads up on a couple of things. First, a couple of days ago, I decided to start running a special deal of $30 off Link Whisper...but that deal ends today! If you

Local Newsletters - The New Ad Kings?

Tuesday, December 31, 2024

How One Email Made $300k

[Closes Tomorrow] Vote for the Most Popular Amazon Software Now

Tuesday, December 31, 2024

Hey Reader, Did you miss our course deal during Black Friday? You still can get the course for free! Fill out The Most Popular Amazon Software poll of 2024 and get a chance to win our best-selling

ET: December 31st 2024

Tuesday, December 31, 2024

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 AI Drug Discovery (trends) Chart AI Drug

Last chance to get 4 months of Litmus, free

Tuesday, December 31, 2024

Less than 24 hours before your offer expires. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Yes, You Need to Focus

Tuesday, December 31, 2024

But in 2025, Step Up or Step Aside To view this email as a web page, click here saastr daily newsletter This edition of the SaaStr Daily is sponsored in part by Prismatic Yes, You Need to Focus. But in

Quick one…

Tuesday, December 31, 2024

You'll be in the draw for the final days View in browser ClickBank If you haven't already, there's still time to join the '12 Day Giveaway' celebration from Steven Clayton and Aidan

2024 in Review ⌛

Tuesday, December 31, 2024

A year in marketing.