Coin Metrics' State of the Network: Issue 154

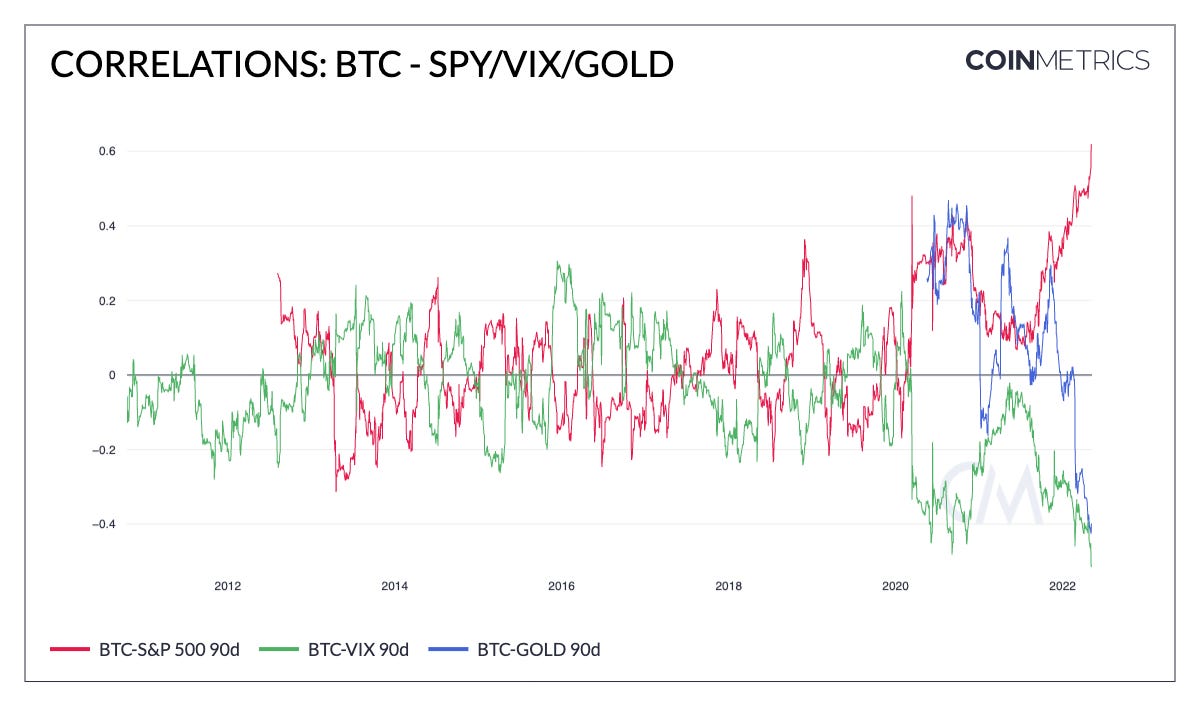

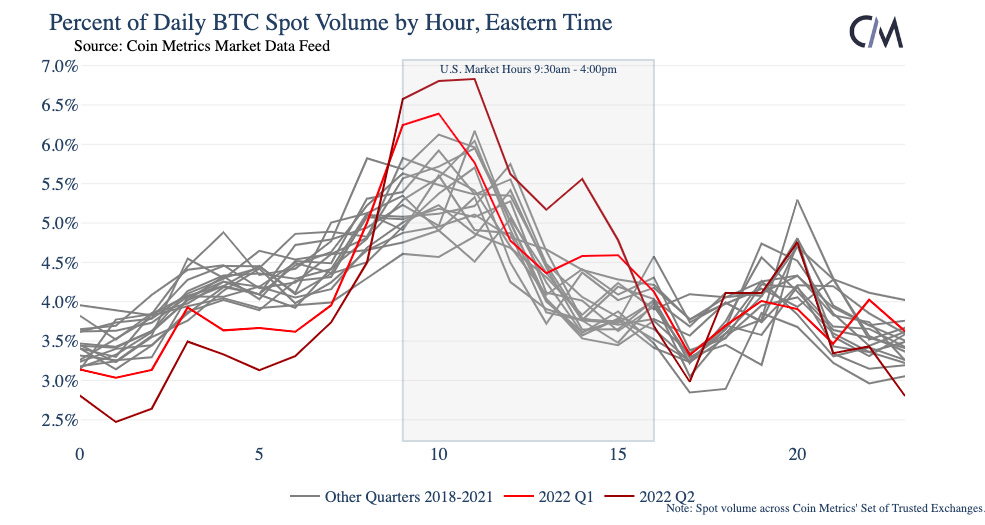

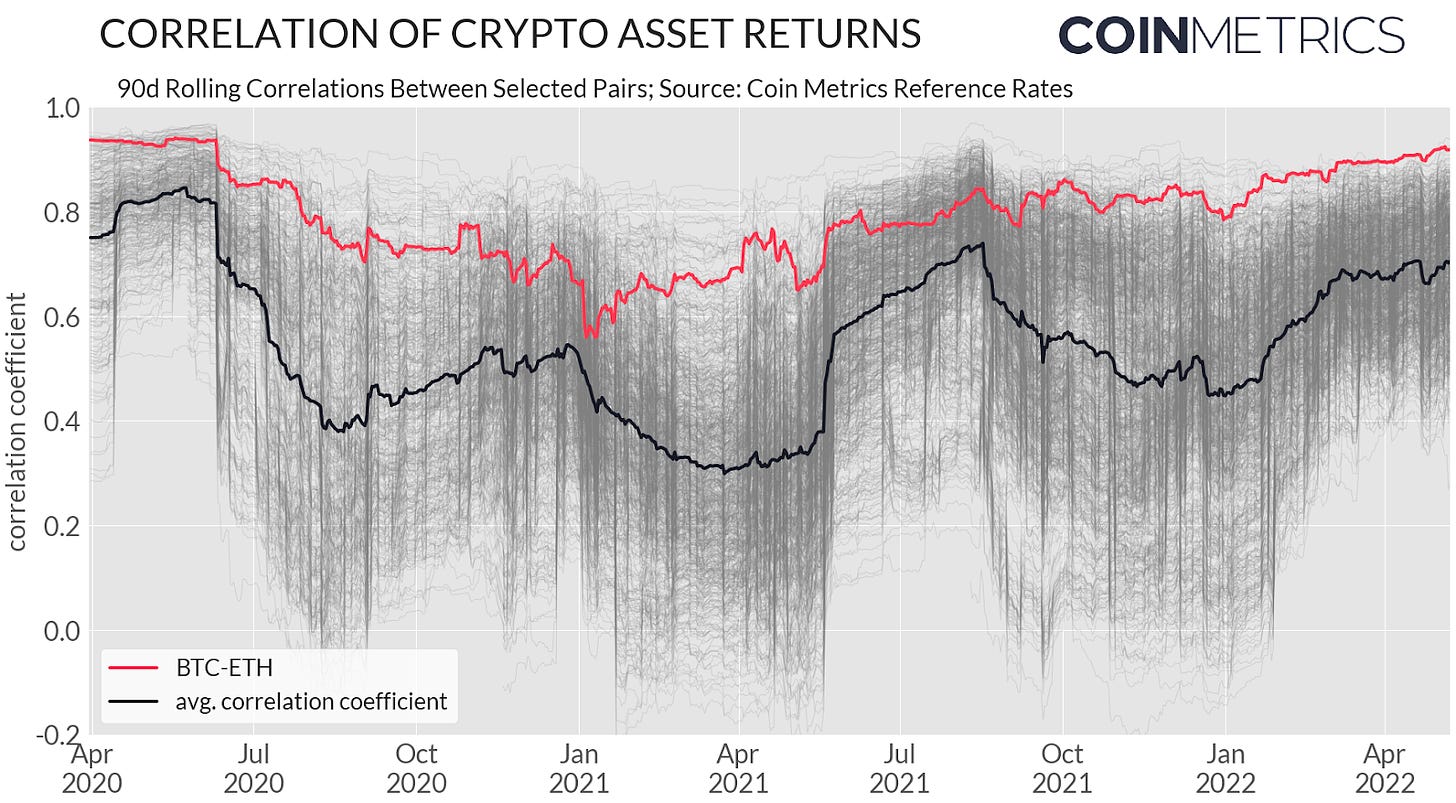

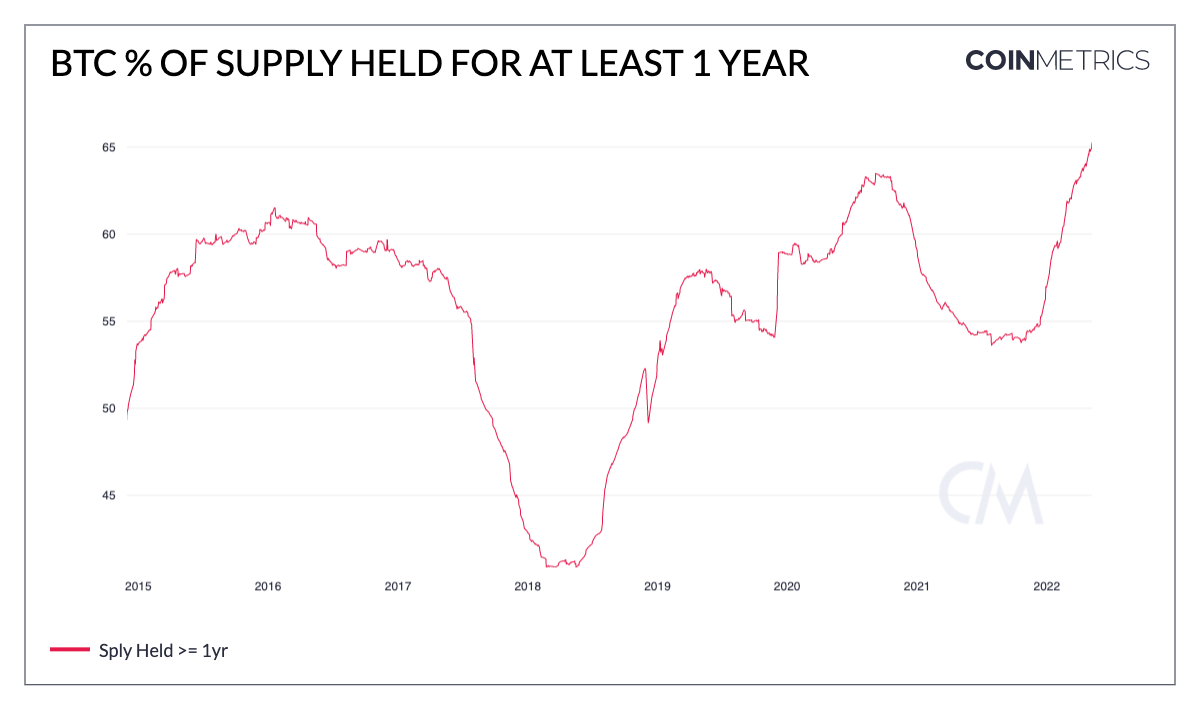

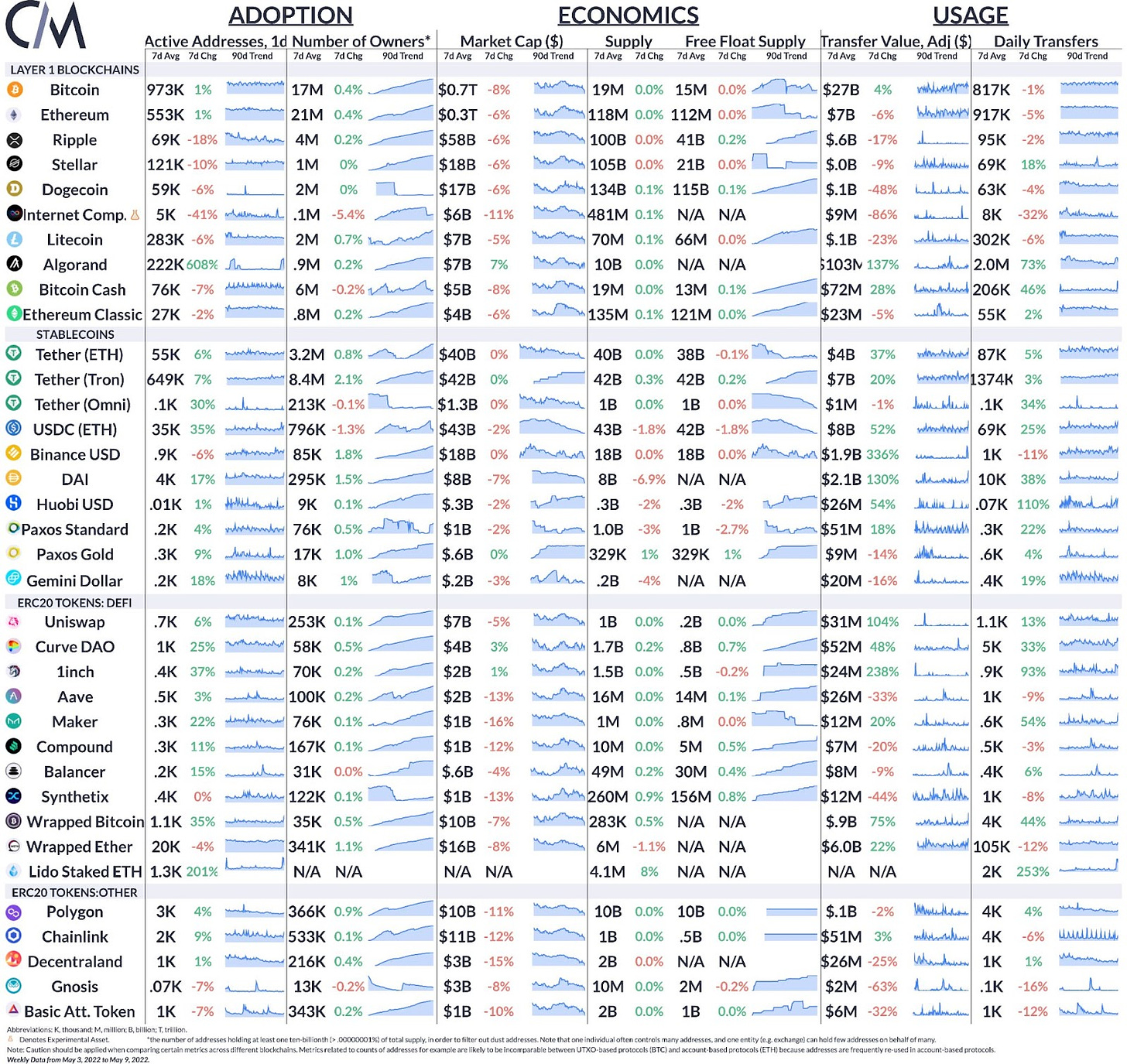

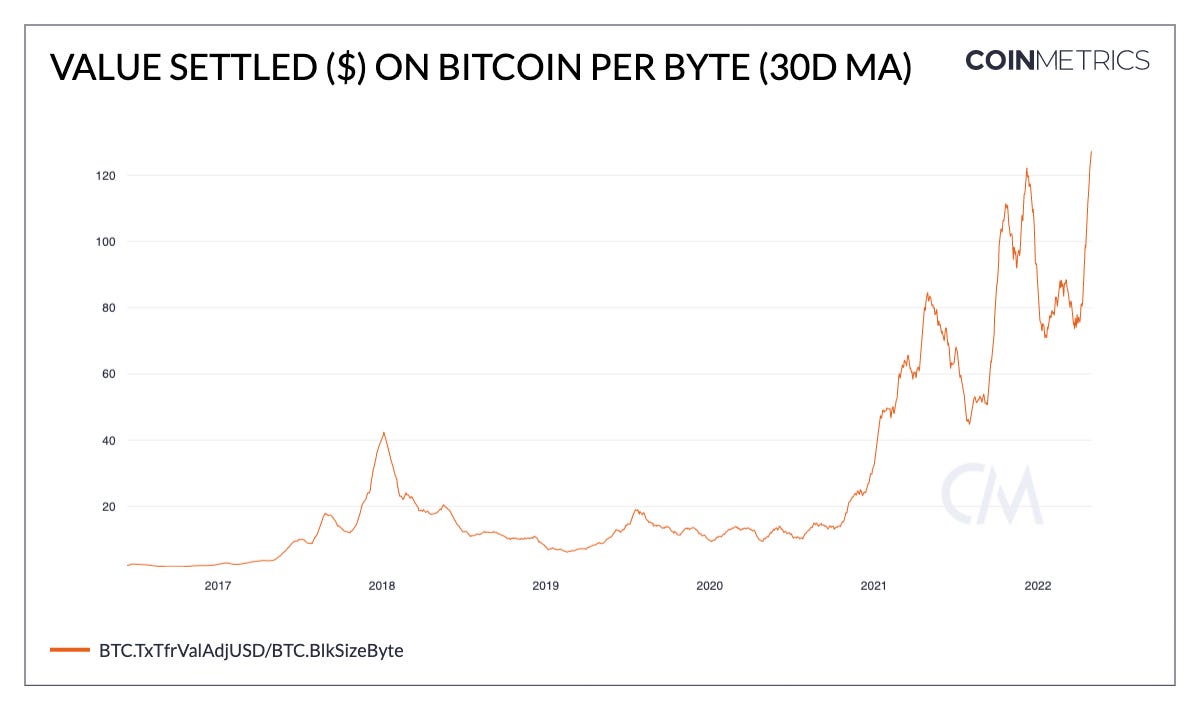

Get the best data-driven crypto insights and analysis every week: Crypto, Global Markets Fall Amid Renewed VolatilityBy Kyle Waters and Nate Maddrey As US equity markets closed Monday, bitcoin (BTC) hovered around $31K, the weakest level this year. As the macroeconomic environment and outlook for future interest rates has quickly shifted in 2022 almost every asset class has been stricken with increased volatility. BTC has increasingly been tracking US equities during the latest correction, and the correlation between BTC and the S&P 500 is nearing all-time highs. At the same time, BTC has moved inversely to risk indicators like the VIX and traditional safe haven assets like gold. Source: Coin Metrics’ Formula Builder Historically, BTC has not been very attached to equity markets. However, the increased correlation could reflect the growing maturity of the crypto asset sector, as relatively more BTC spot trading volume shifts to US market hours. So far, Q2 2022 has featured a record amount of spot volume occurring during US trading hours. Source: Coin Metrics Market Data Feed But within the asset class, many crypto assets are starting to trade more closely with one another as volatility picks up. The average 90-day rolling correlation of daily returns across the pairs below has risen throughout 2022. The correlation of returns between BTC and ETH has also been increasing over the past few months. Source: Coin Metrics Reference Rates; Includes all 861 pairwise correlations for: 1INCH,ADA,AAVE,ALGO,ATOM,AVAX,AXS,BCH,BNB,BSV,BTC,CELO,COMP,CRO,CRV,DASH,DOGE,DOT,EOS,ETC,ETH,FTM,FTT,ICP,LINK,LTC,LUNA,MANA,MATIC,MKR,SAND,SHIB,SNX,SOL,TRX,UNI,XLM,XMR,XRP,XTZ,YFI,ZEC. TerraUSD (UST) Falls Under its $1 PegThe market was thrown into turmoil on Monday as the UST stablecoin rapidly began to fall under its $1 peg. After a tumultuous weekend, UST dropped from about $.995 to $.98 on Monday afternoon. Then starting at 18:27 UTC (14:27 ET), UST suddenly fell from $.98 down to $.92 over the course of about 15 minutes. UST had a market cap of over $18B going into Monday and is used extensively in DeFi applications, so a collapse risked triggering ripple effects throughout the entire crypto ecosystem. Source: Coin Metrics Reference Rates At about 18:34 UTC (17:43 UTC normalized block timestamps) the Luna Foundation Guard (LFG) began moving BTC from their $1B+ reserve. Thirteen minutes later UST price bounced back up to about $.95. All 42,530 BTC from the LFG address was initially transferred out. Then at 19:37 UTC 28,206 BTC were transferred back into the same address. But a few hours later it was transferred back out, leaving the account at 0. The Luna Foundation Guard issued a statement that the withdrawn BTC had been loaned to market makers and used to help support the UST peg. The loan was in addition to the $750M that the LFG loaned to an OTC desk on Sunday May 8th also to help defend the peg, as well as a loan of $750M UST with plans to repurchase BTC once market conditions normalized. Throughout the ordeal billions were withdrawn from Anchor Protocol, which at one point held over 70% of circulating UST supply. After the initial de-pegging UST dropped as low as $.63 overnight. As it dropped below $.70 UST trading was effectively halted on Binance, the largest exchange in the world. But with support from the LFG reserves and others it was able to partially bounce back, climbing back to about $.90 by Tuesday morning. LUNA, however, did not see a similar recovery - LUNA remained at about $30 on Tuesday morning, down 50% over the previous 24 hours. Despite the tumult, many fundamentals remain strong. There are signs that BTC holders that bought over the last couple of years have resolutely kept their positions, with only 34% of total BTC supply moving in the last year (66% held for at least 1 year). Source: Coin Metrics’ Formula Builder Amidst a bloody day in almost every major market, BTC managed to close the day above $30K.  Network Data InsightsSummary MetricsSource: Coin Metrics Network Data Pro (updated through Monday May 9th) Many network fundamentals held steady throughout the last week despite the price volatility. BTC and ETH active addresses both rose ~1% week-over-week. Active addresses and value transferred for USDC and USDT, the largest stablecoins by supply, rose as many looked to seek refuge from the latest market decline. Network HighlightsAs transfer value on Bitcoin has picked up, adjusted value settled (in USD) per byte is at an all-time high. Value settled per byte is one of the best measures of a network’s economic density and efficient use of block space. Source: Coin Metrics’ Formula Builder Coin Metrics UpdatesThis week’s updates from the Coin Metrics team:

As always, if you have any feedback or requests please let us know here. Subscribe and Past IssuesCoin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. Check out the Coin Metrics Blog for more in depth research and analysis. © 2022 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. If you liked this post from Coin Metrics' State of the Network, why not share it? |

Older messages

Coin Metrics' State of the Network: Issue 153

Tuesday, May 3, 2022

Tuesday, May 3rd, 2022

Coin Metrics' State of the Network: Issue 152

Tuesday, April 26, 2022

Tuesday, April 26th, 2022

Coin Metrics' State of the Network: Issue 151

Tuesday, April 19, 2022

Tuesday, April 19th, 2022

Coin Metrics' State of the Network: Issue 150

Tuesday, April 12, 2022

Tuesday, April 12th, 2022

Coin Metrics' State of the Network: Issue 149

Tuesday, April 5, 2022

Tuesday, April 5th, 2022

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏