Coin Metrics' State of the Network: Issue 149

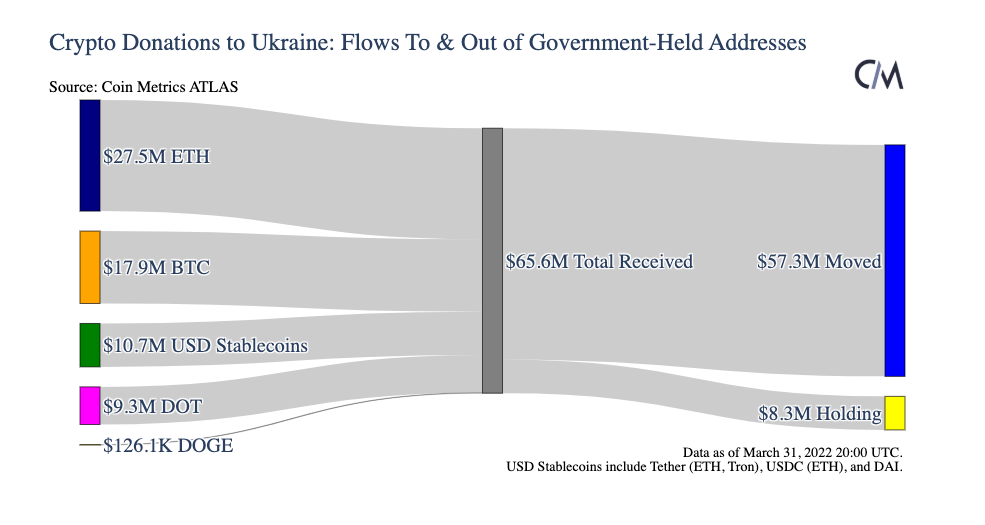

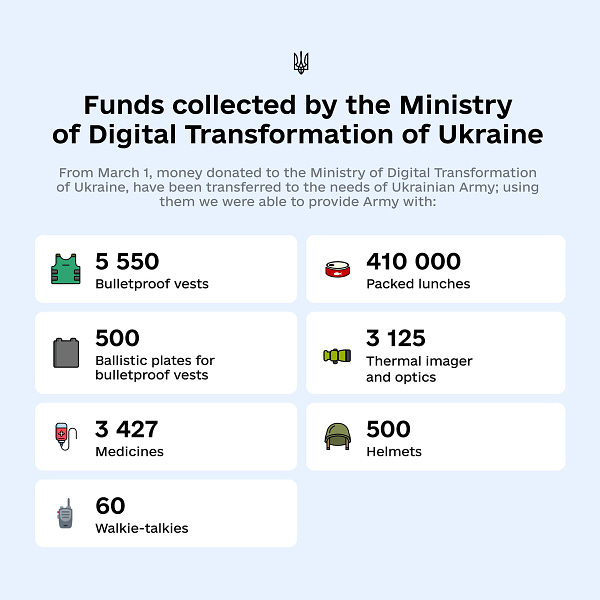

The State of the Network Q1 2022 Wrap-UpGet the best data-driven crypto insights and analysis every week: By Kyle Waters and Nate Maddrey In this special edition of State of the Network we take a data-driven look at crypto’s biggest storylines of Q1, 2022. Crypto on the World StageSince the beginning of Russia’s invasion of Ukraine in late February, crypto has been a vital lifeline for Ukraine. Within days of announcing a crypto-funding campaign, tens of millions of dollars worth of BTC, ETH, and other crypto assets quickly flowed in from across the world to addresses controlled by Ukraine’s Ministry of Digital Transformation. As of the end of Q1, over $65M worth of crypto assets have now been donated. Of the ~$66M received, over $57M has now moved out of the government’s crypto wallets. The government has bought everything from bulletproof vests to night vision goggles to prepared food packs with the funds. Many of these suppliers have even accepted crypto as payment.   Michael Chobanian, the head of Ukraine’s biggest crypto exchange KUNA, recently explained in an interview with Bloomberg why Bitcoin and other crypto assets’ fast time-to-settlement is a crucial property in urgent times of crisis:

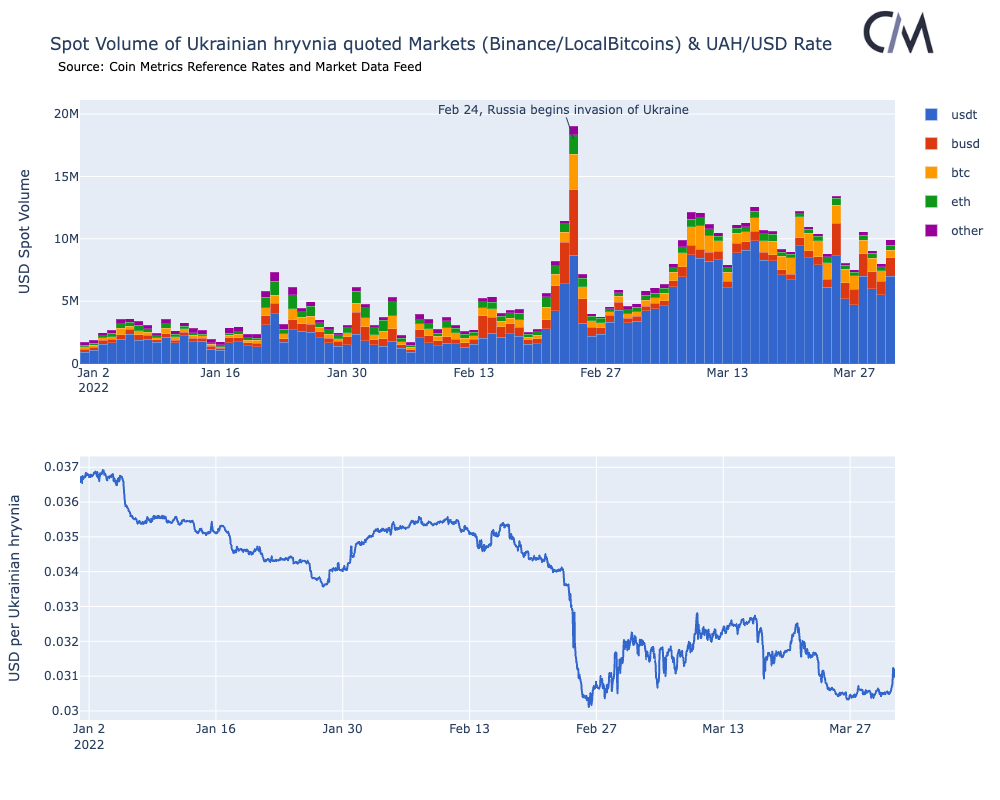

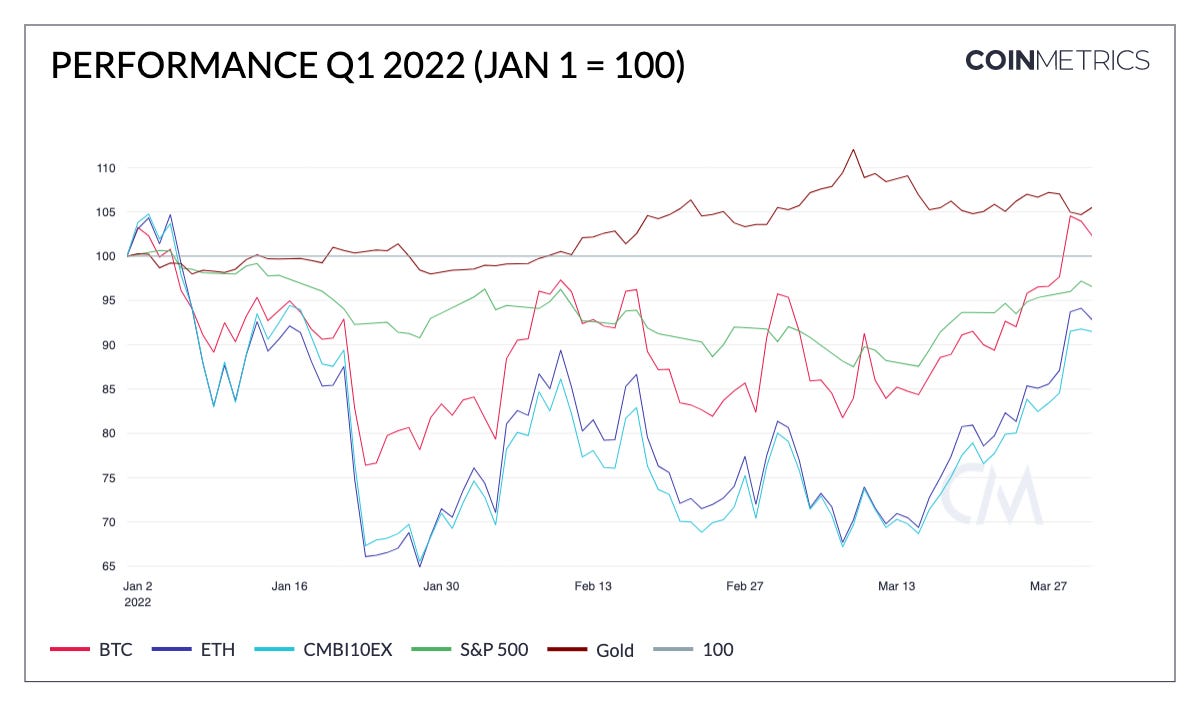

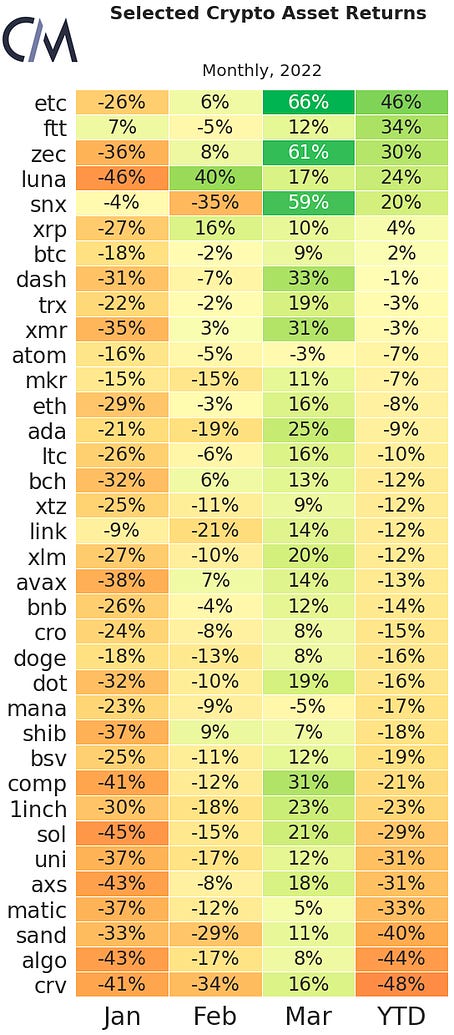

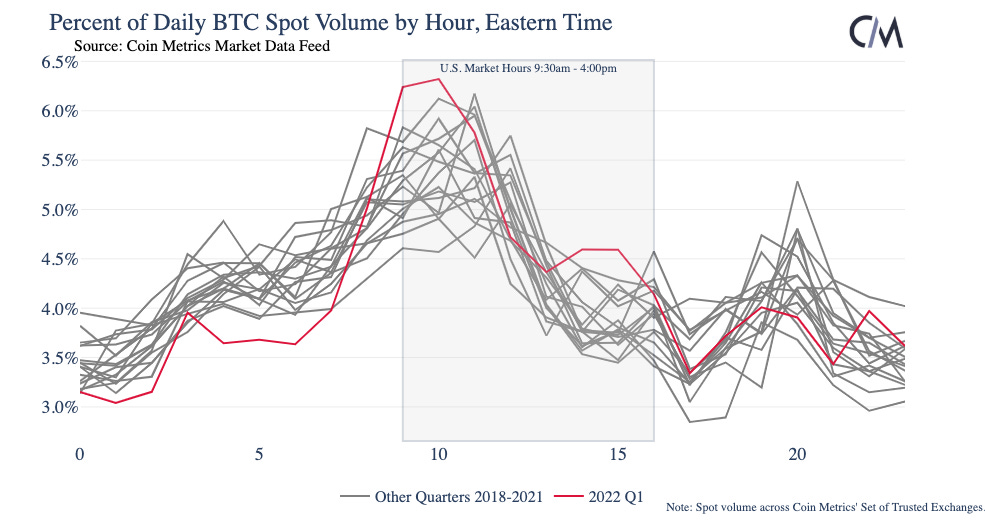

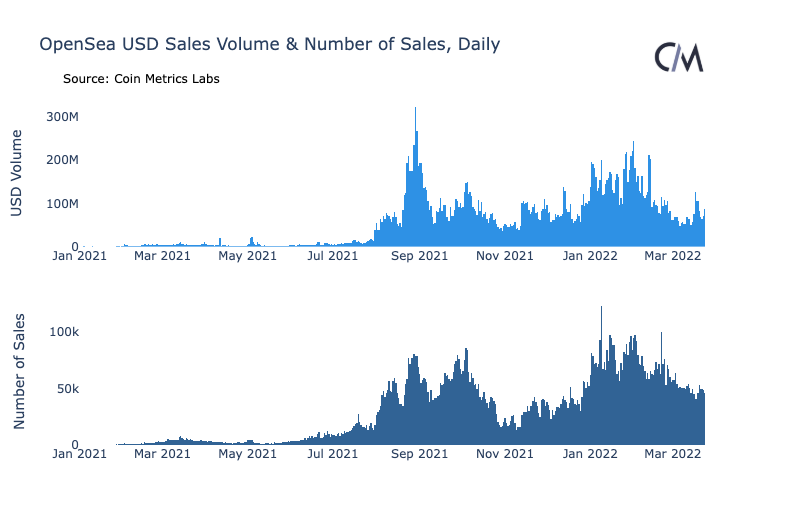

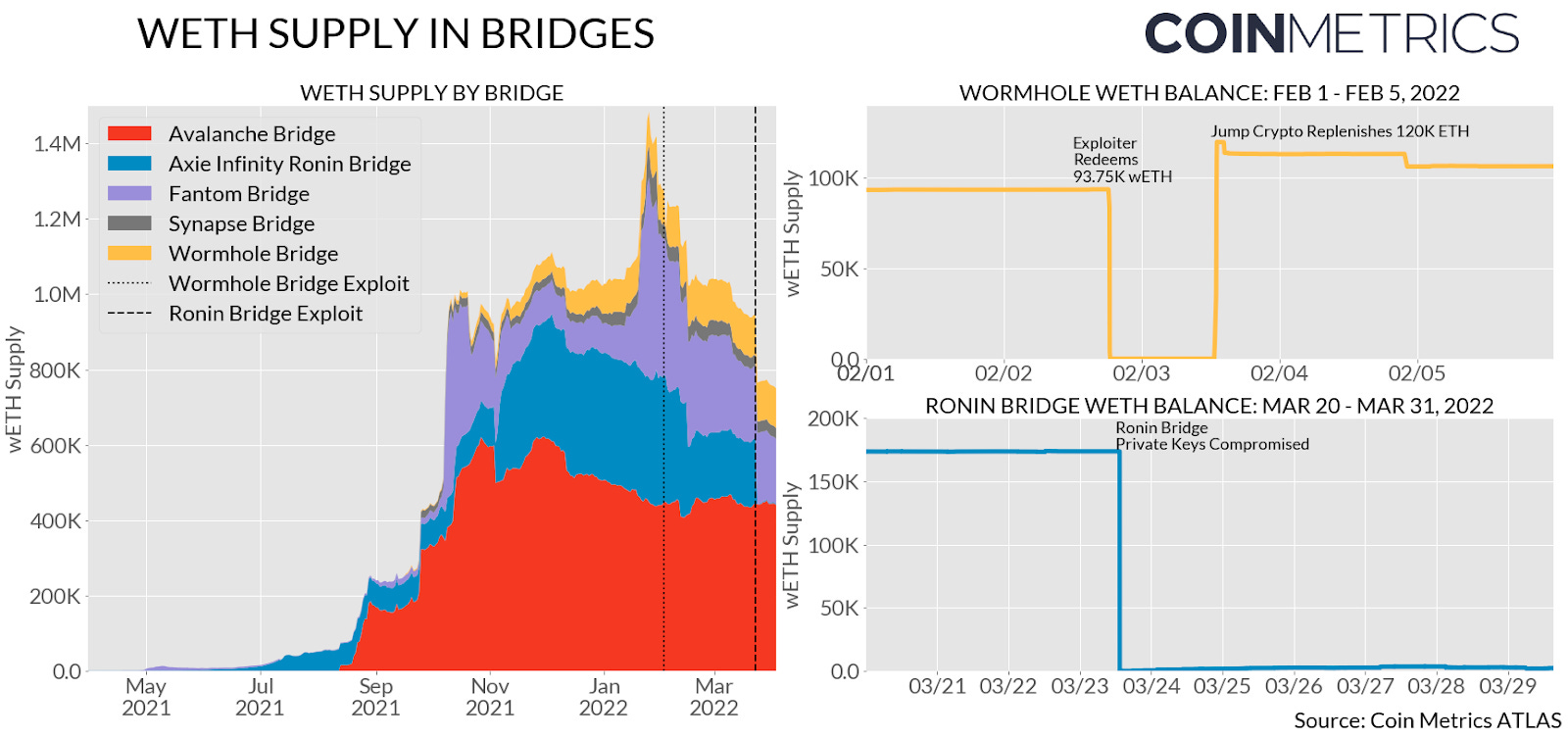

Many Ukrainians have also turned to crypto assets in the face of uncertainty and a devaluing local currency. BTC, ETH, stablecoins, and other crypto assets can be trivially self-custodied without third parties and are highly portable – properties that are of utmost importance when you may have to relocate unexpectedly. Sources: Coin Metrics’ Reference Rates and Market Data Feed In the tragic fog of an ongoing war, crypto infrastructure is proving to be a highly potent mechanism for mobilizing financial resources and empowering grassroots support. While most crypto asset prices might not have breached new all-time highs this quarter, crypto’s geopolitical relevance has arguably never been more apparent. Macro Environment Grips Crypto AssetsIn addition to geopolitical tension, a fast-changing macro environment in Q1 also impacted crypto assets and global financial markets at large. Against the backdrop of inflation in the US hitting its highest level since 1982 at 7.9% YoY in February, the Federal Reserve raised rates for the first time since 2018. The prospect of a more aggressive cycle of rate hikes weighed on riskier assets like high-growth tech stocks, which crypto assets more closely followed in Q1. Bitcoin (BTC) finished the quarter in the green, up roughly 2% and returning back above $45K. BTC beat out most other crypto assets in Q1. Coin Metrics’ CMBI 10 Excluding Bitcoin (CMBI10EX), which measures the return of a basket of the next 10 largest crypto assets after BTC weighted by their free-float market caps, finished the quarter down about 11%. Most crypto assets underperformed gold on the quarter, which finished up ~5% amidst the geopolitical uncertainty. Source: Coin Metrics’ Formula Builder Despite a late-quarter rally in March, prices for most major crypto assets were down to start 2022. The following chart shows returns by month and for the full quarter for a selection of assets, ranked from highest quarterly return to lowest quarterly return. Source: Coin Metrics’ Reference Rates The quarter also reflected crypto’s changing geography. Relatively more BTC spot volume was concentrated during US market hours in Q1 2022 than in previous quarters over the last few years. Source: Coin Metrics’ Market Data Feed Across the broader crypto-economy, the NFT market is showing signs of consolidation – as well as some cooling – after the market’s torrid pace of growth in 2021. Daily sales volume on OpenSea, the largest NFT marketplace on Ethereum, started rising to start the year, topping on February 1st at ~$245M, but then fell back to a sub-$100M per day pace in March. Daily sales followed a similar pattern. But with Yuga Labs purchasing the rights to CryptoPunks and the launch of new marketplaces like LooksRare and adoption of aggregators like genie.xyz and gem.xyz, the NFT market is showing signs of maturation and continued development. Growing Pains of a “Multichain” WorldOne of the most persistent challenges in the crypto ecosystem is scalability. In recent years, Ethereum has commanded the decentralized finance (DeFi) and NFT ecosystems. But it has also been a victim of its own success with fees rising to levels that often price out retail users. Even as the Ethereum ecosystem progresses with layer 2 (L2) technology to help scale the network, it’s becoming clear that there is demand for multiple blockchains that can optimize for different applications and sets of users. However, building infrastructure for users to interact across blockchains has been difficult. Token bridges have recently emerged as a popular tool to move crypto assets across multiple networks. Ethereum-linked bridges quickly amassed billions of dollars worth of assets in 2021 and became some of the largest ETH holders alongside centralized exchanges and DeFi protocols. The chart on the left below shows the amount of wrapped ether (wETH, the ERC-20 compliant version of ETH) held in a selection of the largest bridges. But some token bridges’ underlying fragilities were unfortunately revealed in Q1. First, in early February, an attacker exploited a vulnerability found in the token bridge Wormhole initially leading to a loss of 120K wETH worth about $325M at the time. The attacker was able to mint 120K of unbacked (wormhole) ETH on Solana, and redeem it for actual (wrapped) ETH tokens on Ethereum. However, less than a day later, Jump Crypto announced that they had re-collateralized the contract by depositing a fresh 120K wETH. Then, in late March, the bridge connecting Ethereum and Axie Infinity developer Sky Mavis’ Ronin side-chain was exploited, with the attackers able to obtain the private keys to the bridge contract. A total of 173K wETH (~$600M) was drained from the contract in addition to ~$26M of USDC. But despite the new attacks, lots of progress was made over the quarter in identifying bad actors from some of the most infamous hacks in the history of crypto. In early February, the US DOJ seized 94K BTC (worth about $3.6B at the time) and arrested two individuals allegedly directly linked to the 2016 hack involving the exchange Bitfinex. Later that month, author and crypto journalist Laura Shin released a detailed investigation identifying a suspect behind the 2016 hack of The DAO – the source of Ethereum’s 2016 hard fork. Looking ahead, it will be important for the ecosystem to develop less trusted and more secure cross-chain infrastructure to lower the chances of an exploit. But advances in on-chain forensics also show that malicious actors are increasingly being tracked down and caught, which may help in deterring such acts in the first place. ConclusionFrom Ukraine to Turkey to other regions, real-world examples of crypto adoption are increasingly highlighting the promise of public blockchains. But there is still much to build as some of the fragilities of a still-nascent ecosystem are also becoming more apparent. Ultimately, recent events are providing valuable information to policymakers and other industry participants that could lead to productive regulatory clarity and opportunity for development. Q2 is bound to be full of new discussion and focus around crypto’s growing role across the globe. Coin Metrics’ Q1 UpdatesThis quarter’s updates from the Coin Metrics team:

As always, if you have any feedback or requests please let us know here. Subscribe and Past IssuesCoin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. Check out the Coin Metrics Blog for more in depth research and analysis. © 2022 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. If you liked this post from Coin Metrics' State of the Network, why not share it? |

Older messages

Coin Metrics' State of the Network: Issue 148

Tuesday, March 29, 2022

Tuesday, March 29th, 2022

Coin Metrics' State of the Network: Issue 147

Tuesday, March 22, 2022

Tuesday, March 22th, 2022

Coin Metrics' State of the Network: Issue 146

Tuesday, March 15, 2022

Tuesday, March 15th, 2022

Coin Metrics' State of the Network: Issue 145

Tuesday, March 8, 2022

Tuesday, March 8th, 2022

Coin Metrics' State of the Network: Issue 144

Tuesday, March 1, 2022

Tuesday, March 1st, 2022

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏