Coin Metrics' State of the Network: Issue 155

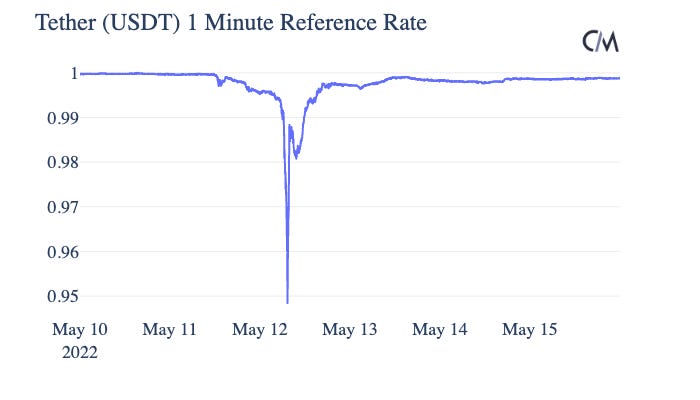

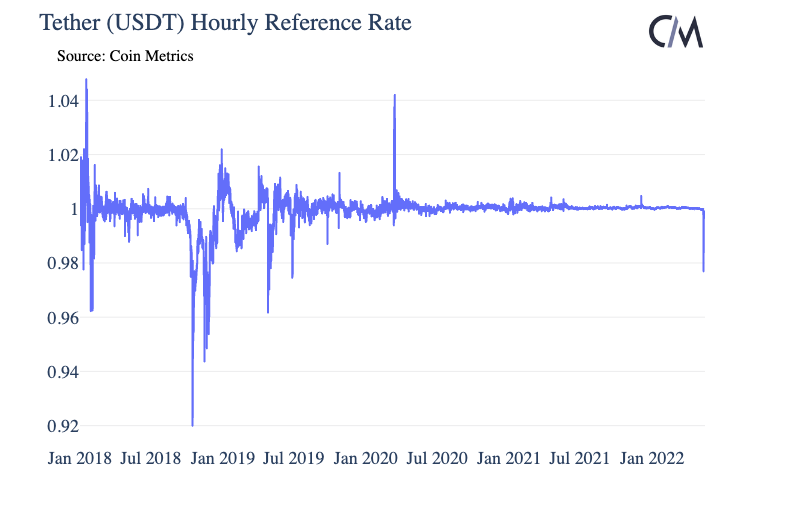

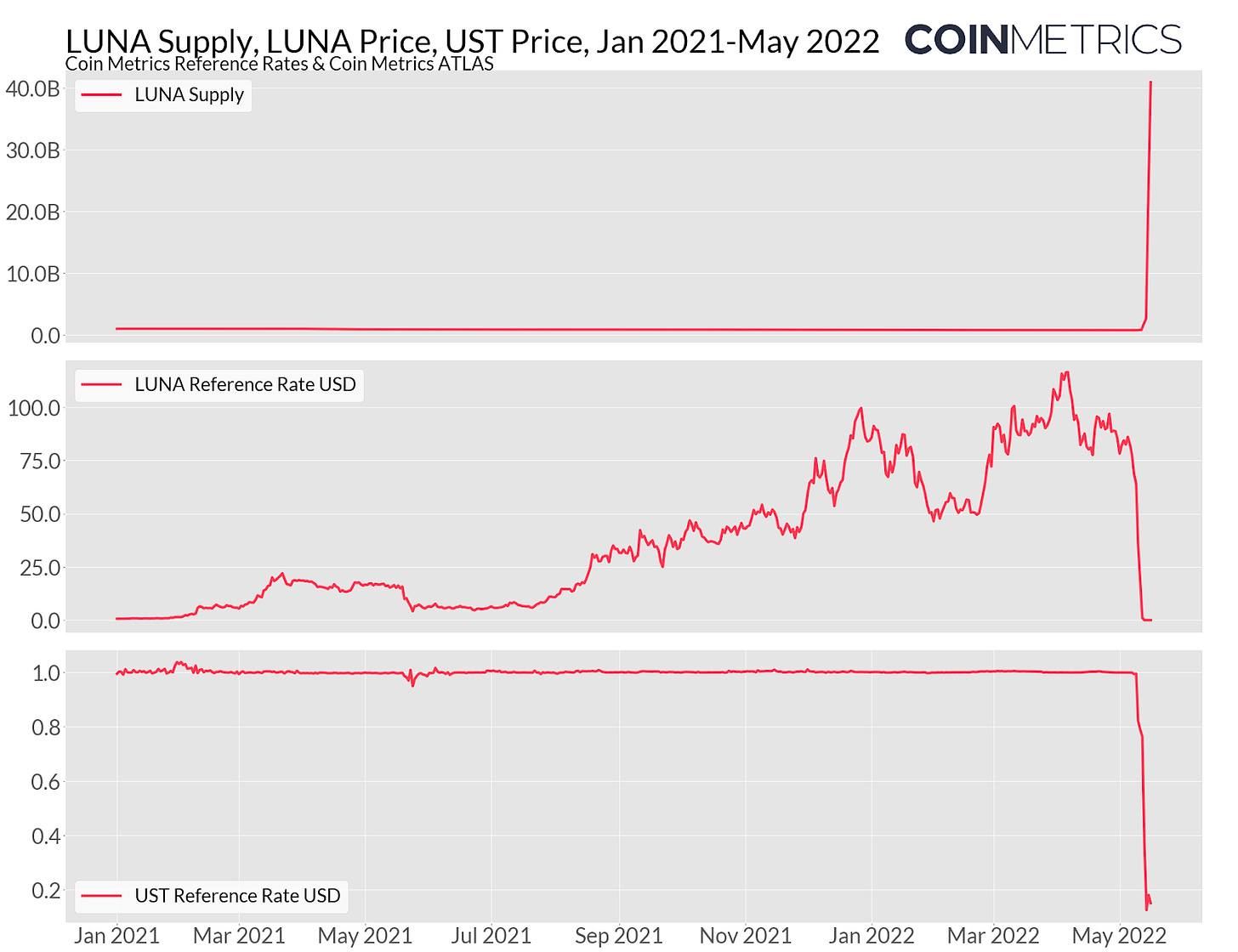

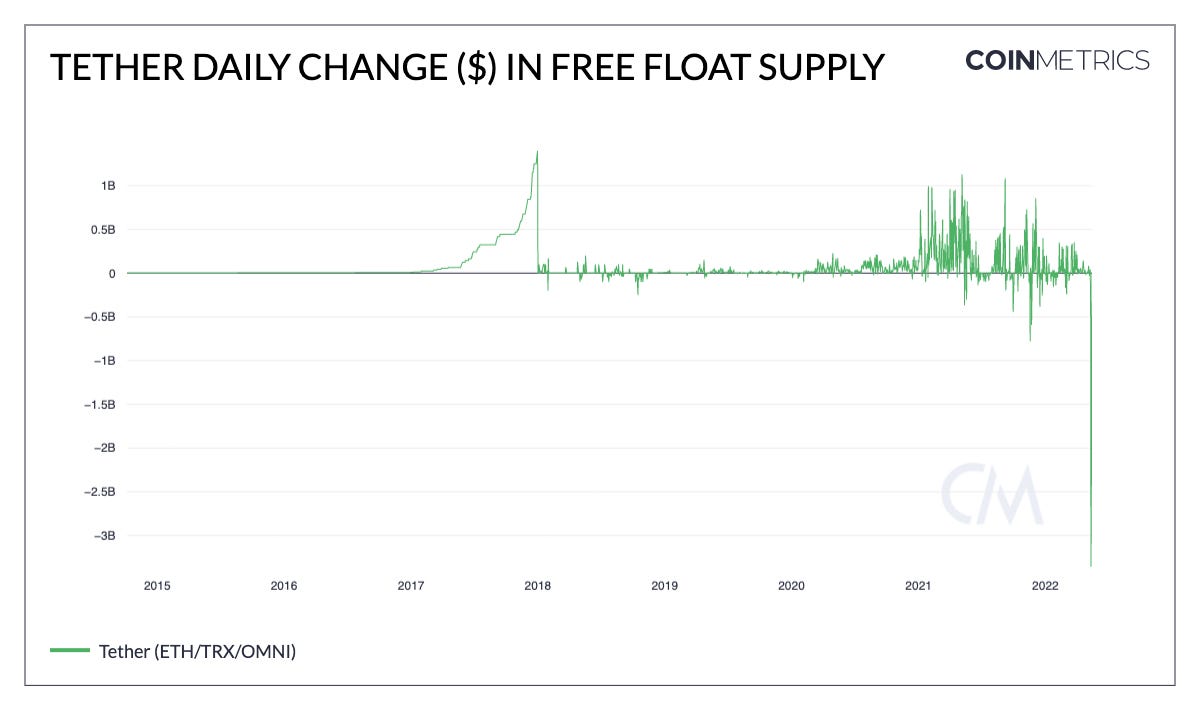

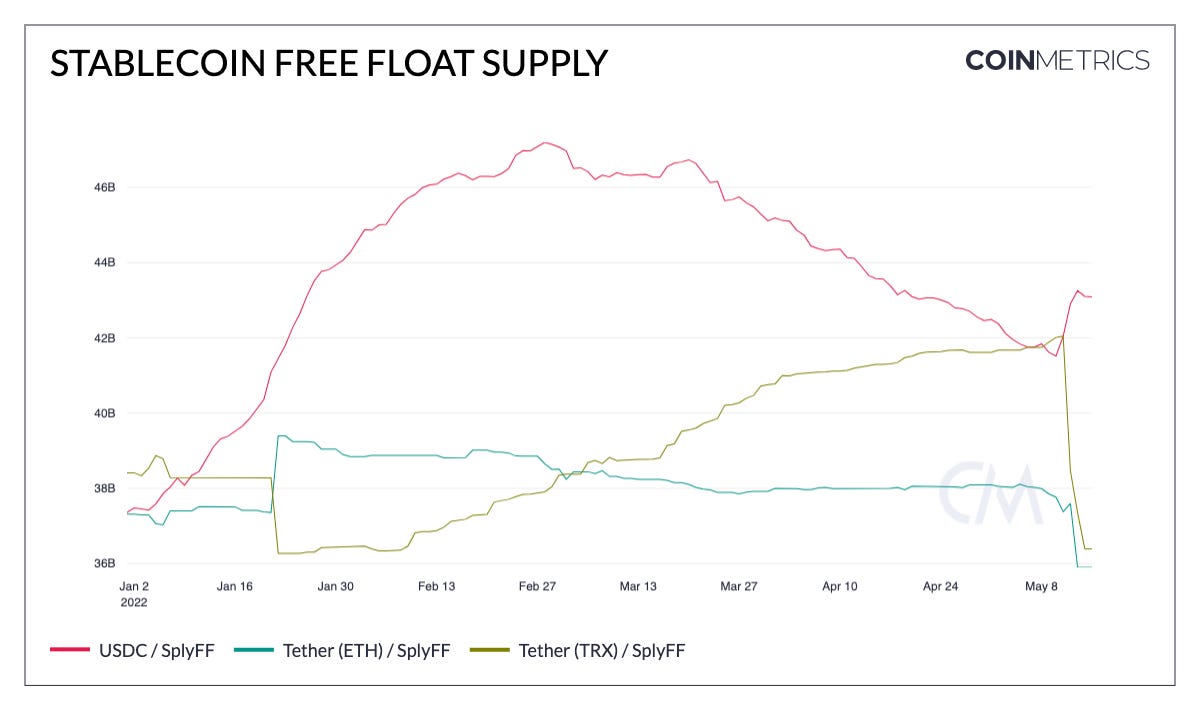

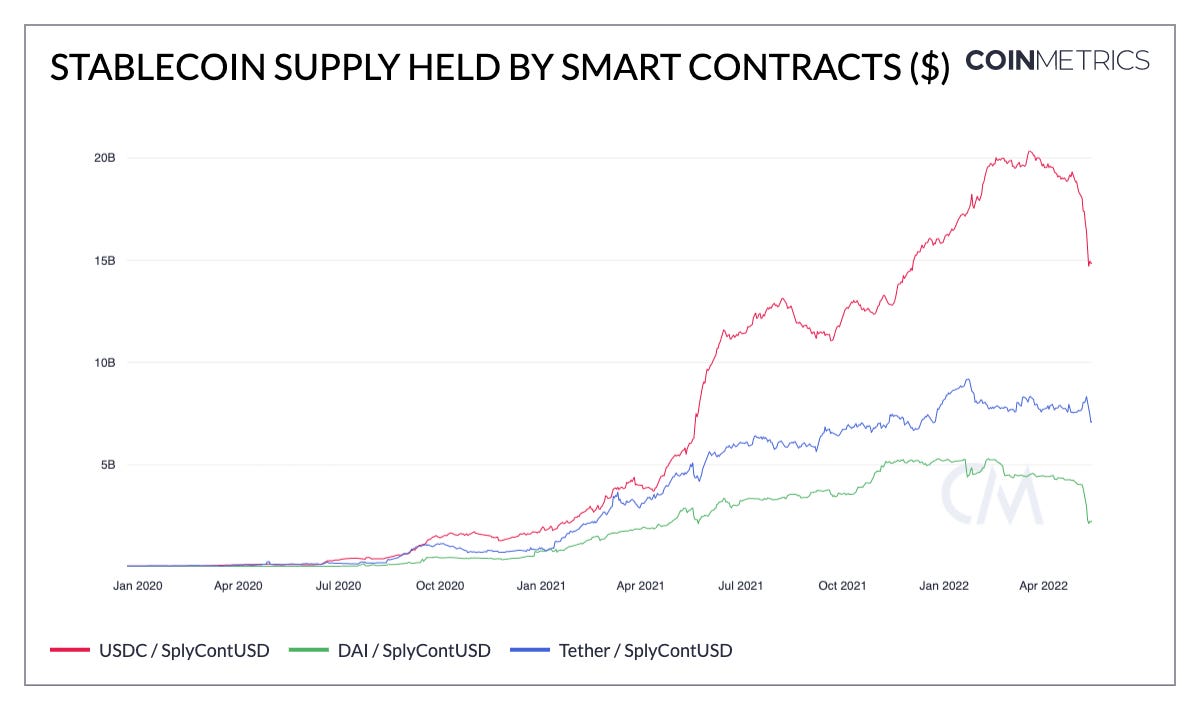

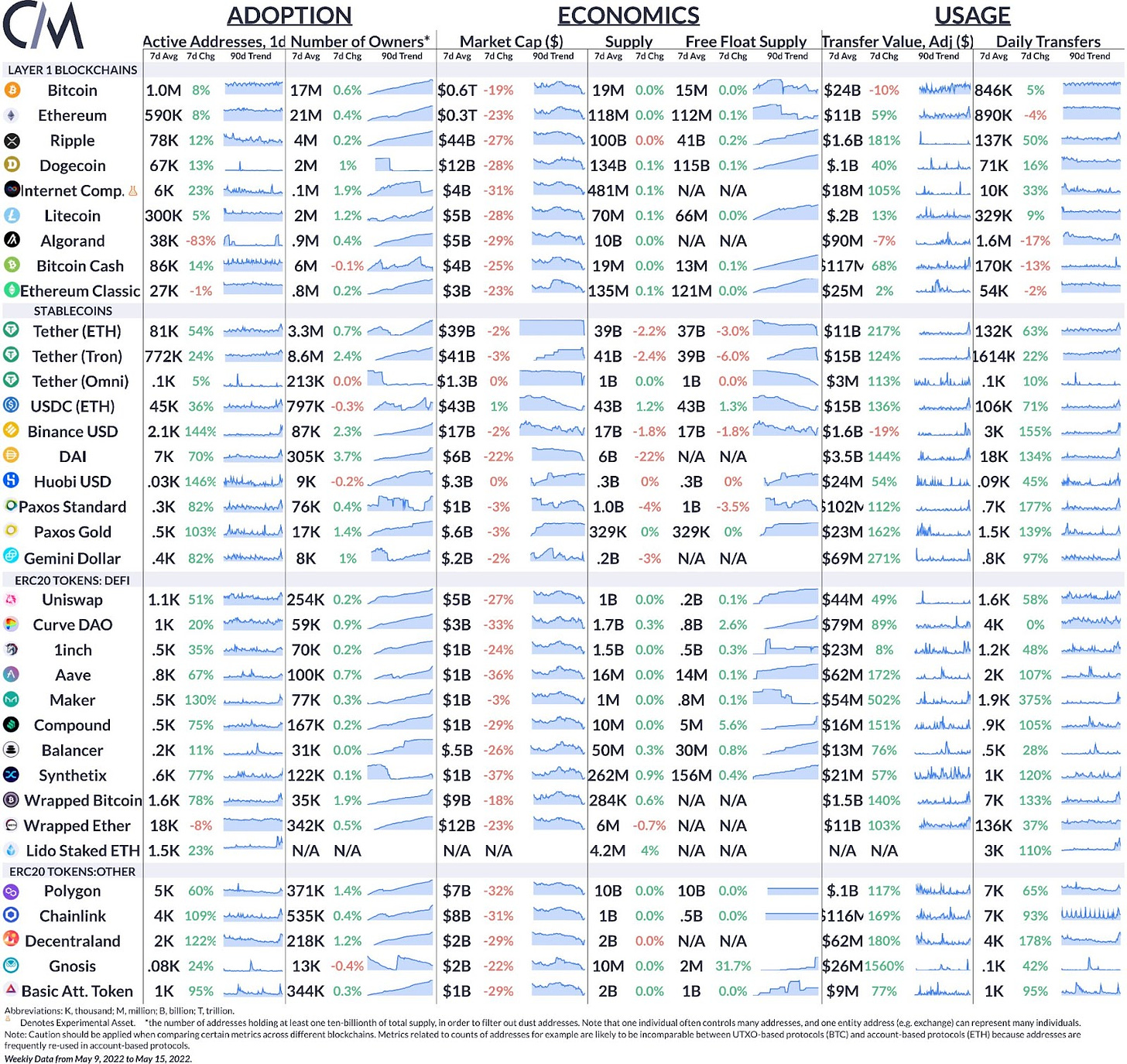

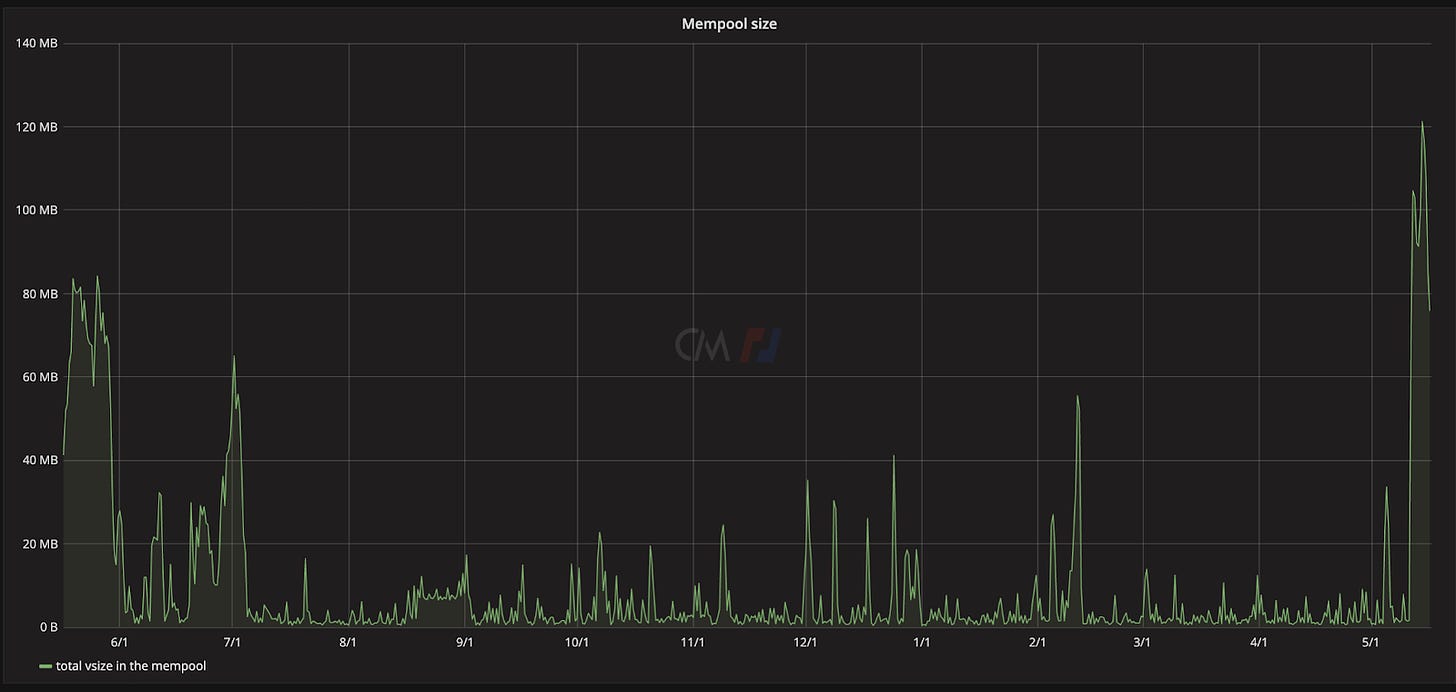

Get the best data-driven crypto insights and analysis every week: Surveying Stablecoins in the Wake of the LUNA/UST CollapseBy Nate Maddrey and Kyle Waters Stablecoins have come under increased scrutiny over the last week following TerraUSD’s (UST) sudden collapse. On May 12th, Tether (USDT) – the largest stablecoin today by total supply – started to dip below its $1 peg, causing some brief panic as price dropped as low as $.95. But it rebounded quickly, returning back to over $.99 within 7 hours. Source: Coin Metrics Reference Rates Despite questions surrounding Tether in the past, USDT has a very different risk profile than non-collateralized stablecoins like UST. In short, Tether has a fundamentally different stabilization mechanism than TerraUSD: USDT is backed by a reserve of cash and cash equivalents as well as some secured loans and corporate bonds. A full breakdown of Tether’s reserves (as of December 31, 2021) can be found on their website. May 12th’s Tether price de-pegging was its largest deviation from $1 since March 2020. But prior to 2020, it survived even larger de-peggings. The last year has been the most stable period in USDT’s history. Source: Coin Metrics Reference Rates TerraUSD, on the other hand, was “backed” by LUNA and a basket of other cryptocurrencies including BTC and AVAX. However, UST was not collateralized in the same sense as Tether - UST’s price stability essentially depended on continuous demand for LUNA. TerraUSD’s redemption system let any holder redeem 1 UST for $1 worth of LUNA. This worked while the price of LUNA was going up but quickly spiraled out of control as LUNA price plummeted. LUNA supply eventually ballooned to over 40B as more LUNA was printed to keep up with demand for UST redemptions. Source: Coin Metrics Reference Rates UST’s reliance on LUNA created an increased risk of loss of faith and de-pegging during sudden drops in the crypto market, especially considering most cryptoassets are still highly correlated to each other. As the price of LUNA and other cryptoassets plummeted holders of UST lost confidence which effectively sparked a bank run. Tether’s redemption system works differently. Tether holders can redeem their USDT for USD, but Tether has a minimum fiat withdrawal amount of $100,000, and redeemers also must follow Tether’s KYC procedure. When the price of Tether falls below $1 there is an incentive to buy it below the peg and redeem it for the full dollar, capturing an arbitrage. This is contingent upon being able to actually redeem the USDT, however. Tether had over $3.3B of redemptions on May 12th, by far the largest in its history. USDT free float supply dropped by another $2.8B on May 13th, and $961M on May 14th. Source: Coin Metrics Formula Builder But as some redeemed their USDT, others apparently moved into USD Coin (USDC). USDC free float supply has increased by about 1.5B since May 10th, despite declining since late February. Source: Coin Metrics Formula Builder USDC is fully backed by cash and cash equivalents and publishes monthly attestation reports, making it highly trusted amongst the major stablecoins. Last year, USDC issuer Circle announced its plans to become a national bank in the United States under the supervision of the Federal Reserve, U.S. Treasury, OCC, and FDIC. The market reactions over the past week are a reminder that stablecoins are far from homogenous and carry different reserve profiles with varying risk, not unlike banks in traditional finance. The crypto markets are still assessing the aftermath of the UST collapse but one immediate effect has been a drawdown in stablecoin liquidity within DeFi. The amount of USDC held in smart contracts on Ethereum has fallen by about $5B since its peak in March. Similarly, the supply of DAI (an over-collateralized, crypto-backed stablecoin) in smart contracts has also fallen about $2B. Most of this decline can be attributed to weakening demand for DAI on decentralized exchanges, cross-blockchain bridges, and lending protocols. Estimates of total value locked (TVL) have also come down, but these measures are often exaggerated due to rehypothecation of assets. Source: Coin Metrics Formula Builder Stablecoins are a critical part of the crypto ecosystem and will undoubtedly continue to come under scrutiny over the upcoming months. To follow the stablecoin data used in this piece and explore our other on-chain metrics check out our free charting tool, correlation tool, and mobile apps. Network Data InsightsSummary MetricsSource: Coin Metrics Network Data Pro On-chain activity was up across the board last week as volatility accelerated in the crypto markets. Bitcoin daily active addresses averaged over 1M for the first time since Dec 2021. Ethereum active addresses averaged close to 600K/day last week, up 8% week-over-week. Every stablecoin tracked above had higher daily active addresses over the week. Every ERC-20 token with the exception of wrapped ETH (WETH) saw higher transfer volume and active addresses. Network HighlightsAs market activity has picked up, Bitcoin's mempool has been the most busy it's been since last July. The mempool is where nodes keep unconfirmed transactions that have been broadcasted to the network but have not yet been included in a valid block. The mempool is important to track because a more congested mempool can mean a more competitive Bitcoin fee market. However, Bitcoin fees remain somewhat subdued compared to this time last year; the average transaction fee on May 12, 2021 was $13, last Friday it was ~$3. Coin Metrics UpdatesThis week’s updates from the Coin Metrics team:

As always, if you have any feedback or requests please let us know here. Subscribe and Past IssuesCoin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. Check out the Coin Metrics Blog for more in depth research and analysis. © 2022 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. If you liked this post from Coin Metrics' State of the Network, why not share it? |

Older messages

Coin Metrics' State of the Network: Issue 154

Tuesday, May 10, 2022

Tuesday, May 10th, 2022

Coin Metrics' State of the Network: Issue 153

Tuesday, May 3, 2022

Tuesday, May 3rd, 2022

Coin Metrics' State of the Network: Issue 152

Tuesday, April 26, 2022

Tuesday, April 26th, 2022

Coin Metrics' State of the Network: Issue 151

Tuesday, April 19, 2022

Tuesday, April 19th, 2022

Coin Metrics' State of the Network: Issue 150

Tuesday, April 12, 2022

Tuesday, April 12th, 2022

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏