Not Boring by Packy McCormick - Designing Token Economies

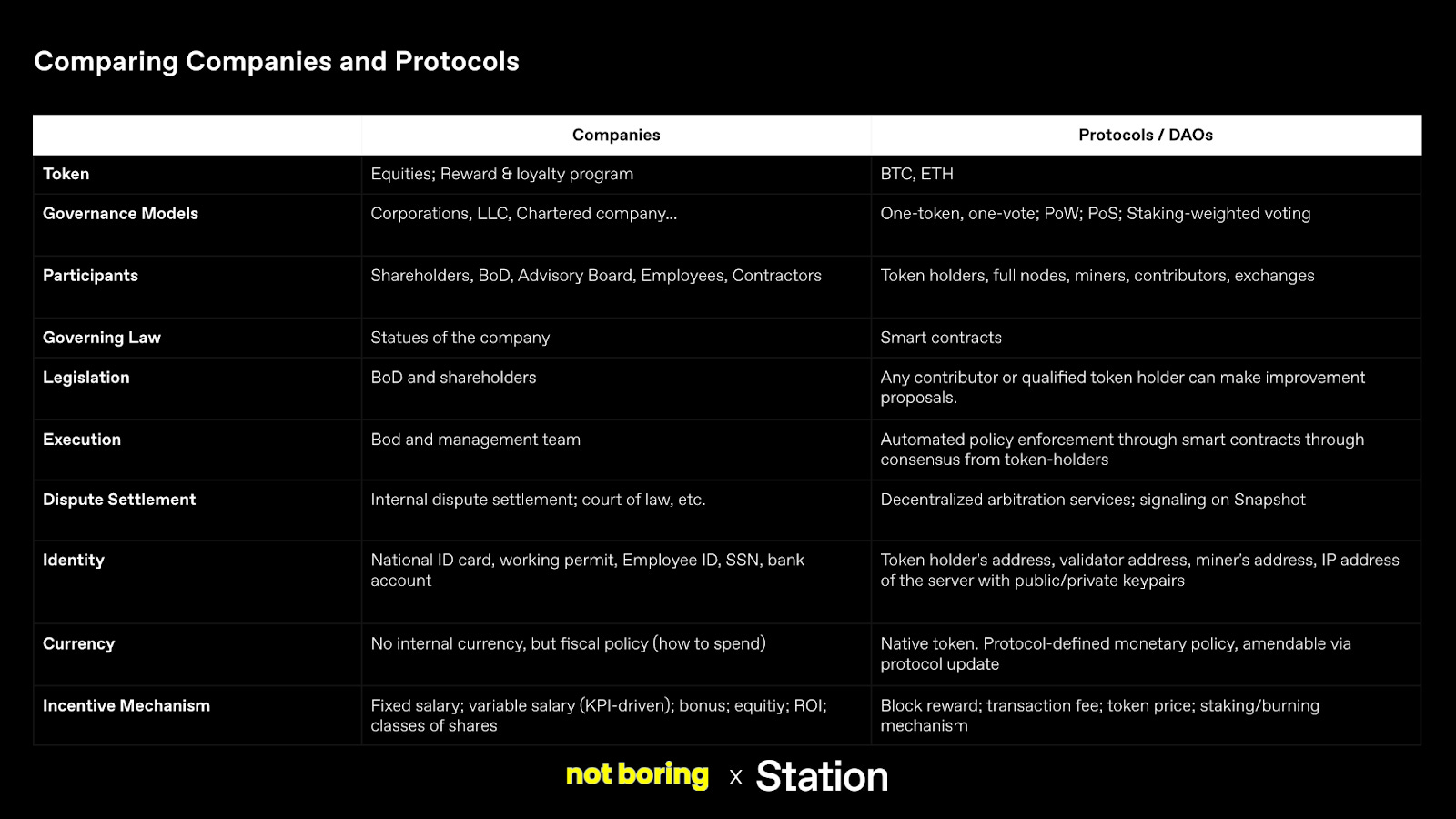

Welcome to the 1,925 newly Not Boring people who have joined us since last Monday! If you haven’t subscribed, join 125,070 smart, curious folks by subscribing here: 🎧 If you’d rather listen to this essay, head over to Spotify or Apple Podcasts Today’s Not Boring is brought to you by… Masterworks Last week, I left out an unexpected detail out of my deep dive: Even Issac Newton couldn't resist a good meme stock. In 1720, Newton's friends invested in the South Sea Trading Company (the GME of their day). But while his friends all got rich, he invested what would now be worth $4,000,000 at the top and lost it all in a week. If Issac Newton could lose everything in the pursuit of riches, it could happen to anyone. That's why I make my portfolio “idiot-proof” with safe-haven assets with solid upside like fine art. As an investment, art checks a lot of boxes: ✅ Inflation resistant: art can help protect your wealth from inflation ✅ Risk-adjusted performance: Nearly 0 correlation to equities according to Citi ✅ Appreciation: contemporary art appreciated by 14% annually (1995-2021) As an asset class, art isn’t a GME or South Sea. You won’t 10x your investment in 24 hours, but you probably won’t lose 90% of it either. Luckily, art investing is easier than ever. With Masterworks, you can invest in million dollar paintings without millions of dollars in the bank. Plus they’ve compiled a metric ton of data, and pick quality works for you. I’m no art expert, but I can invest like one with Masterworks. Use my private link to get priority access today.* Hi friends 👋 , Happy Tuesday! I was a dumb optimist in the bull market, I’m gonna continue to be a dumb optimist in the bear. The technological and cultural shifts I was excited about like three weeks ago haven’t gone anywhere, and in fact, the bear market might give builders more breathing room to get weird. One of the areas in which I think we’ll see the most progress during the bear is token design. This last cycle was full of very early attempts to build new forms of organization and new economies, and I think that over the next [insert length of bear market], people are going to experiment with new models focused less on price and more on creating sustainable new worlds. One of the questions that’s been lodged in my brain as I’ve been thinking about this is whether protocols behave more like companies or countries. What are the competitive and cooperative dynamics at play? How important is it to own the reserve currency of [web3, the metaverse, the Great Online Game]? Unfortunately, I’m not smart enough to answer that question on my own. Fortunately, I’m friends with someone who is: Tina He. Tina is the founder of Station, which I was lucky enough to invest in via Not Boring Capital, and the author of one of my favorite Substacks, Fakepixels. A few months ago, on a catch up call, she told me that after Station, she wants to become a token designer. I didn’t even know that was a thing, but she talked about combining economics and code, aligning incentives, and creating new digital economies. It’s a beautiful idea: coordinating human behavior and resource allocation through smart token design. So when Tina tweeted this…  … I replied that Protocols as Nations was on the to-write list, she asked how she could contribute, and we decided to join forces to write it up. The result is better than I could have hoped for. I think this can be a go-to resource for people designing DAOs and protocols, people building new worlds. Let’s get to it. Designing Token Economies(Psssst… Click this 👆👆 to read the full piece online) When trying to understand tokens, it’s tempting to draw from what we already know. Sometimes, tokens function like equity in a company, and owning a token is akin to holding a stake in the project’s potential upside. Other times, tokens function like a “token-of-gratitude” and symbolize goodwill among close friends in the purest sense. The wide-ranging role isn’t a bug but a feature representing value in the most abstract sense, whose meaning is given by the system's very design. In other words, a token doesn’t necessarily have any intrinsic value but relative value. It’s the encapsulation of a unit of value universally recognizable and enforceable by a system. Tokens are barely a new concept. Shells and beads were the earliest types of tokens as a medium of exchange. Others that we’re familiar with today — casino chips, credit card points, stock certificates, concert tickets, and club memberships – are all forms of tokens as they represent a unit of value universally recognized and enforced by the system that issues that token. When the respective systems fail to enforce and recognize the value of these tokens, the jurisdiction can step in to protect the token holders. Think about the last token you interacted with — What does it allow you to do that you otherwise cannot? Why are you holding it and want to own more of it? What happens if you discard or transfer ownership of your tokens? To many, the answer to these questions would be “getting even more tokens.” To others, holding tokens allows for participation rights in projects and communities that they care deeply about. The former speaks to the economics of holding a token, the latter to access rights. A token design is poor when there’s value misalignment between value accrual in the system and value accrual to the token. Gabriel Shapiro aptly describes tokens like UNI, COMP, and the recently launched APE, as “value by association,” as he acutely identifies the fragmentation in value streams for the protocols aforementioned — the prime slice has been preserved for the insiders, while the “illusion of power” gets distributed to the rest. One of the reasons that there is so much confusion around token design, and value accrual specifically, is that tokens, and the DAOs and protocols that issue them, are so multifaceted. Sometimes, the issuers want them to behave like shares in a corporation. Others issue “governance” rights to skirt regulations while insiders pump the tokens in the hope of getting out before the price tumbles. Others still want to build and unify digital nations. Often, even the issuers aren’t clear exactly what they want to do with the token, but they know that tokens are a great way to capture value. While token design isn’t the only important aspect of creating a new protocol or digital economy – delivering value to users should always be priority #1 or else the token’s price will inevitably crumble – it’s a critical one. Just like a messy cap table can inflict mortal wounds on a startup or poor monetary policy can derail a nation’s economy, bad token design can doom a protocol before it even gets off the ground. The crypto graveyard is littered with examples of good projects whose token designs cemented their eventual demise from day one – maybe the tokenomics encouraged too much growth, too fast – and we’ll cover some of them here. There are others whose token designs allow them to do things that non-web3 companies can’t by properly aligning incentives in the system, and connecting the system to the larger ecosystem. We’ll cover those, too. Why does it matter? Everything is falling apart. Terra collapsed largely thanks to its token design. Projects that attracted millions or billions of dollars with the promise of absurd APYs are learning the truth of the old adage, “Easy come, easy go.” The regulators are coming. Tokens that were worth a lot of fiat a couple weeks ago are worth a lot less today. All of those reasons and more are exactly why it’s critical to understand good token design today. Not only because good token design can help avoid catastrophic outcomes, but because, assuming we’re entering a sustained bear market, now is the perfect time to experiment with novel token designs without the pressure of the expectation of high prices and “up only.” Tokens are naturally economic; they have a price attached from inception, and are instantly tradeable on liquid, global, 24/7 markets. But tokens can be much more than that. They’re programmable primitives that allow DAOs and protocols to signal what matters in their ecosystem, to reward good participation, to trade with each other and build interconnected webs of support, and to support new forms of digital organizations and nations. So what are you building? Are you building a club or a co-op, a corporation or a country? Protocols can be all of the above, so we’ll start by walking through how they compare to companies and countries, before laying out a framework for token analysis, and imagining what the world will look like when the dust settles. We hope that it’s useful to the builders, contributors, and investors alike. We know you wanted a break, anon, but it’s time to jump back down the rabbit hole. 🕳 🐇 DefinitionsA quick pause here to define three key terms will pay dividends throughout the piece. Protocol: a system of logic that coordinates exchange between suppliers and consumers of a service, based on rules written into the code. SMTP, which coordinates email, and Ethereum, are both protocols. Only Ethereum captures value, thanks to ETH tokens. Token: a unit of value universally recognized and enforced by the system that issues it. There are different kinds of tokens – including governance tokens, DeFi tokens, non-fungible tokens, security tokens – all designed to do different things. Tokens are code, and as such, can be programmed to do nearly anything its creator dreams up. DAO (Decentralized Autonomous Organization): a group organized around a mission that coordinates through a shared set of rules enforced on a blockchain. (Linda Xie) Protocols are governed by DAOs once the protocol has a token and is fully decentralized. Protocols as CompaniesThe easiest analogy for protocols is that they’re like corporations, but digital. DAOs are Digitally-Native Corps. Thinking of protocols as companies is convenient from a strategy perspective. There are countless books written on and frameworks created for corporate strategy. We talk about them a lot in Not Boring. Competitive Strategy, 7 Powers, 5 Forces, Good Strategy, Bad Strategy. The list goes on. Most of the people creating and running protocols come from the corporate world (with the exception of those who come from academia, either as professors or students). It’s tempting to port those ideas and experiences over. It’s convenient from a finance perspective, too. There are rules and textbooks and models and an entire industry built on valuing companies. To understand companies, we need to understand how value gets created, the sustainability and defensibility of the value creation (unit economics and moat), as well as governance and control dynamics (management team). We derive the value of a company by looking at its net assets (or equity, which is the value of all assets minus that of all liabilities). Savvy investors would look at a company’s assets and assess the quality of each source cash flow to conclude a fair value. Not all cash flow is created equal. Good managers of traditional businesses understand the investor lens, thus focusing most of the company’s resources to improve the core assets that drive enterprise value and ignore or spend minimal effort on the rest. Employees are allowed and encouraged to contribute ideas from the bottom-up, but it’s up to the CEO, and sometimes the board, to decide which of these ideas will compound value to the core assets. For a company like Meta, the core asset is the user data and the algorithm that’s able to surface the right content for higher conversion. The trillion gigabrain things that Zuck seems to be orchestrating — from the fashionable Instagram to the highly utilitarian WhatsApp — are all meant to collect more data, diversify sources the of data, increase the quality of the data, and de-risk the irrelevance of the data, thereby increasing core asset quality and its revenue-generating potential. Everything feeds the core. The absence of this kind of compounding focus is why companies that do a bunch of unrelated stuff, like conglomerates, often get valued at a discount. Investors on Twitter are taking initiatives to value protocols similarly. An investor can conduct a DCF (discounted cash flow) analysis to understand value accrual to xSUSHI holders by projecting the growth of the 0.05% fee on all protocol transactions. In addition to its core DEX (decentralized exchange), Sushiswap, offers a diverse set of financial products from lending to an NFT marketplace. Investors may discount these non-core, auxiliary cashflows as they’re still early and highly speculative, and focus on valuing the protocol based mainly on its DEX fees. Here, protocols seem similar to companies. Both companies and protocols are trying to coordinate human and financial capital to accomplish a set of goals. A company’s main goal is to produce a return on capital invested. Many protocols certainly share a similar goal of generating profits, but these objectives tend to be much more diverse — from maintaining a piece of public digital infrastructure to creating one of the most cost-efficient lending platforms in the world. When you look at all of the functions of companies and protocols or DAOs line-by-line, the parallels are clear: With a quick glance at the table above, it’s striking that DAOs and companies do many of the same things. Both have “tokens” of sorts, both need to establish governance models, both write governing laws, etc. A closer inspection shows that there are major differences within key line items. Governance is where the analogy breaks down most cleanly: corporate governance and protocol governance are very different. The former relies on centralized management, while the latter relies on the good judgment of token holders. Protocols can run like corporations for a while in the beginning, when the founders and core team need to make the fast, life-or-death decisions startups need to make. But after they’ve progressively decentralized, protocols need to fully hand over the reins to their communities. This presents a difficult trade-off: it’s challenging for a protocol to retain both corporate-like efficiency and include token holders in decision-making. That’s one of a few internal areas in which companies and protocols diverge. Externally, where companies and protocols derive their competitive advantage and how they distribute value – how they sustain profits and split them up – differ wildly as well. In an excellent recent article for Harvard Business review, Why Build in Web3, Jad Esber and Scott Kominers explain that companies building in web3 have a different set of competitive advantages than companies building in web 2.0. In web 2.0, as highlighted above, one of the greatest sources of strength is data ownership and the most dominant moat, the strongest of the 7 Powers, is network effects. Every action we perform on Facebook (lol we don’t use Facebook, but go with us) stays on Facebook’s servers. All of that data allows Facebook to build features that keep you more engaged with the product and to help advertisers target you better. Then, as more of your friends engage with Facebook, there’s more of an incentive for you to use, and continue to use, Facebook. You know this story. Web3, according to Esber and Kominers, is built different:

Data ownership and portability might be the most important difference between web 2.0 and web3 from a strategic perspective. The implications of that subtle shift – while far from realized in the current instantiations of many web3 projects – are tectonic. Take Lens Protocol, a “decentralized social graph.” Lens lets creators own their creations and take them anywhere in web3. It also creates a shared database of that content, and of the connections between people, that anyone can build on top of. Facebook, Twitter, and the like derive power from the data they own and from the strength of the social graphs that only they have access to. Lens envisions an internet where that’s flipped, where the data and social graphs are out in the open for anyone to build on top of. As web3 developer Miguel Piedrafita tweeted:   That not only means that a richer ecosystem of applications can flourish by tapping into a growing source of content and connections, it also means that the sources of power and where value accrues shift completely. Don’t like the Twitter algorithm? Great, tap into all of the underlying data and build something different. Building new social products has essentially been a dead-end – it’s practically impossible to bootstrap the network effects built up by incumbents over the years – but Lens Protocol aims to eliminate that cold-start problem for social app developers, which could lead to more social apps. As Esber and Kominers write:

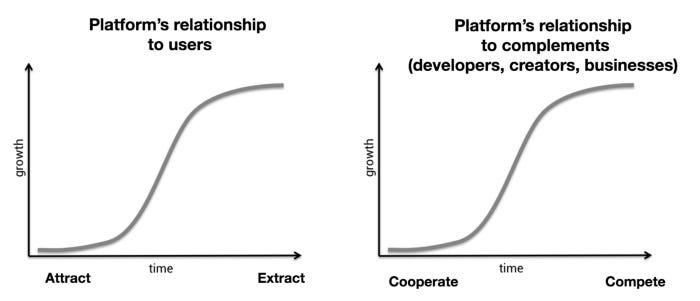

While the value creation opportunity can be bigger, there are still open questions about value capture. As Packy wrote in Shopify and the Hard Thing About Easy Things, “Here’s the hard thing about easy things: if everyone can do something, there’s no advantage to doing it, but you still have to do it anyway just to keep up.” If the protocols make it easier for developers to build applications, more people may build applications and compete away profits. New web3 primitives might spell trouble for the incumbent networks, but it’s still unclear where the value accrues in this new world. Esber and Kominers propose that sharing infrastructure drives “towards a greater emphasis on platform design as a competitive advantage” and that “user insight will continue to differentiate consumer apps.” That seems to be a less durable competitive advantage than the incumbents enjoy. In Why Decentralization Matters, Chris Dixon explains that “as platforms move up the adoption S-Curve, their power over users and 3rd parties steadily grows,” and they move from friendly “attract” moves – like designing more delightful platforms and opening APIs to developers – to adversarial “extract” ones – like prioritizing features that get users to click on ads and locking down APIs. In web3, when the content and connections are open and available for anyone to build on top of, it’s much harder for applications to move to the “extract” phase, which happens to be the phase in which most of the profits are generated. Dissatisfied users can pick up and move to another app, and dissatisfied developers can either fork the project or start their own on top of the same infrastructure, content, and connections. That’s likely healthier for users, developers, and the overall ecosystem, but presents a murky profitability picture for applications. It seems, then, that value may accrue to the protocols, which can take advantage of cross-side (“indirect”) network effects, in which two groups of participants – users and app developers – attract each other. As more developers build on top of Lens Protocol, for example, they attract more users, who share more of their content and connections with the protocol, which makes it a more obvious choice for the next developer. Lens Protocol can take a lot of nibbles in the form of fees, benefiting from the overall growth of usage on the platform without concern for the stickiness of any particular application built on top. But not so fast! In the classic Protocols as Minimally Extractive Coordinators, Chris Burniske observes that, “As coordinators of exchange, protocols should be minimally extractive.” If a protocol’s fees are too high, if it moves from “attract” to “extract,” developers will leave and bring their users with them. So protocols are incentivized to keep fees low enough to retain developers while still taking a small enough margin such that it doesn’t make economic sense for a new protocol to try to compete. That said, protocols can still make money. As Burniske clarifies (emphasis ours):

In theory, web3 will create more value by making it easier for applications to build on top of open protocols and databases, capture more value through tokens that are intrinsically linked to the use of the protocols and applications, and importantly, share value with builders and users, building token-powered network effects. Here, too, it’s still so early, and that thesis will need to be proven at scale. But if it is, it will likely be because of potentially the biggest difference between web 2.0 companies and web3 protocols: the cryptoassets, or tokens. Tokens can give both applications and protocols superpowers – like power boosts on their strengths – provided they start from a place of creating real user value. For the scope of this piece, we’ll focus on protocols. Protocols need to do many of the same things that companies do, but they also face additional challenges in coordinating decentralized groups of user/owner/contributors/voters. Luckily, they have an ace up their sleeves, tokens, that give them potential advantages in both coordinating activity and capturing value, often alongside their builders and users. In that sense, they’re not building companies as much as they’re building economies. These strategic differences suggest that protocols might be more similar to open source software projects, a comparison that’s frequently made, with some key differences like native tokens and the fact that contributors get paid. A less obvious comparison, though, is that protocols might behave a lot more like countries than companies. To learn about Protocols as Countries, a Framework for Token Design, and What the World Looks Like When the Dust Settles…Thanks to Tina for lending us her brilliance, to Dan for editing, and to Conner Swenberg and Mind Apivessa for inspiring thoughts that informed this piece! Important programming note: we’re taking off next week for Memorial Day. We’ll be back to our regularly scheduled programming the following week! Thanks for reading, and see you in a couple weeks! Packy *See important reg A disclosures If you liked this post from Not Boring by Packy McCormick, why not share it? |

Older messages

The Founder's Letter: Mackenzie Burnett, Ambrook

Thursday, May 19, 2022

Building sustainable and resilient agriculture through better financial products and pragmatic environmentalism

Newton's Alchemy

Monday, May 16, 2022

A Celebration of Failed Experiments and Progress

Terra: To the Moon and Back

Thursday, May 12, 2022

Jon Wu on What's Happening With Terra-Luna, UST, and the Broken Peg

If We Ruled the Tweets

Monday, May 9, 2022

Twitter's Power Users, the WeChat Opportunity, and TweeterDAO

Three Not Boring Things

Thursday, May 5, 2022

Reader Survey, Talent Collective, Founders Podcast

You Might Also Like

🛍️ Advise.so Black Friday DEAL IS LIVE

Monday, November 25, 2024

GM Nerds You probably already know I run hands-down the BEST SEO community on the internet–certainly the most active by a mile. That's the Advise community, and it's 10/10. Currently it costs

$1 Million Blog (without Google) + Best Early Black Friday Deals!

Monday, November 25, 2024

What happens when you try to grow a website without even worrying about Google? Sure, you still might follow some of Google's best practices like building internal links...but you're really

The #1 Reason You’re Struggling on LinkedIn

Monday, November 25, 2024

Yo Reader, In yesterday's email, we talked about why most LinkedIn strategies flop harder than a bad infomercial. Today, let's dig deeper. Here's the cold, hard truth: Most people are stuck

Big, sexy, expensive... and great for your next product launch [Roundup]

Monday, November 25, 2024

Say goodbye to the traditional agency and hello to algorithm-driven results. No more slick-talking account managers or convoluted strategies. All-in-one Amazon Advertising solution, minus the fluff and

Going from acquaintance to trusted referral

Monday, November 25, 2024

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo Tomorrow is World Olive Tree Day, Reader! Where are my Castelvatrano fans? In

Bitcoin Stalls Just Below $100K as Traders Lock in Profits

Monday, November 25, 2024

Plus SEC Commissioner Lizárraga Joins Gensler in Early Departure

Cyber Week Offer: Save 50% on 3-month Digiday+ membership

Monday, November 25, 2024

Access weekly briefings, original research, case studies, member-only events and more

Off Your Plate 🍽️

Monday, November 25, 2024

Give web mgmt to AI.

When 'Jump Around' Stands in the Way

Monday, November 25, 2024

We can all take a page from Dan Lanning's playbook. By creating a conditioned stimulus in our own lives, we can pair neutral cues with desired behaviors or responses.

Off Your Plate 🍽️

Monday, November 25, 2024

Give web mgmt to AI.