Not Boring by Packy McCormick - If We Ruled the Tweets

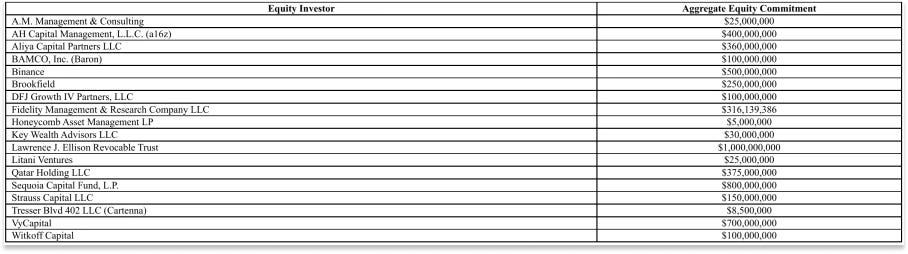

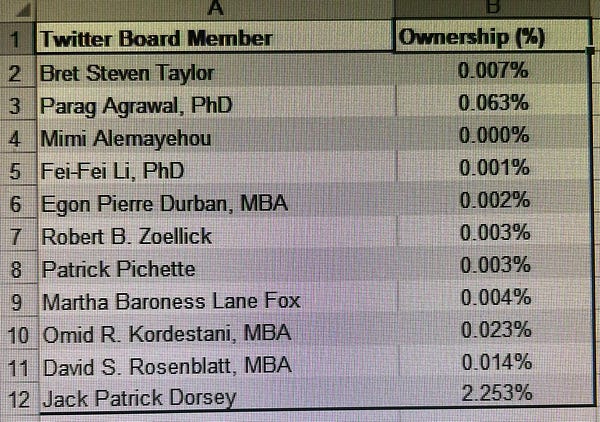

Welcome to the 2,349 newly Not Boring people who have joined us since last Monday! If you haven’t subscribed, join 120,744 smart, curious folks by subscribing here: 🎧 If you’d rather listen to this essay, head over to Spotify or Apple Podcasts Today’s Not Boring is brought to you by… Composer It’s scary out there. While I remain optimistic, the day-to-day market activity is choppy. Over $9 trillion has been erased from U.S. equities and the Nasdaq-100 is down 23% YTD. With my focus on Not Boring Capital and the newsletter, and the fact that I’m not a great trader, I don’t have time to trade stocks. But I’m not going to watch this sell-off pass me by. I’m shifting a significant amount of my liquid portfolio to a Rising Rates Risk Parity strategy on Composer that is only risk-on if both treasuries and SPY are stable - otherwise it invests in a basket of risk-off assets. For those that don’t know, Composer gives the power of rules based trading (aka quant trading) to regular investors, 100% free to use. Think tech has bottomed? Jump into Big Tech Momentum. Think Inflation is going to get worse? Dive into Inflation Spiral Hedge. Want to stay in stocks with more security? Try Paired Switching: S&P 500 and Gold. Composer is the next generation of active investing. No code, no spreadsheets, no Robos and no YOLOs. Just smart investing for smart investors. If you want access to the Rising Rates Parity strategy (it’s not publicly available on the website), use this private Not Boring link for a limited time.* Hi friends 👋 , Happy Monday! And a very happy belated Mother’s Day to all the mothers out there, especially to Puja and both of our moms! Speaking of mothers, today, we need to talk about the mama’s boy who brought his mom to the Met Gala… Elon Musk. When the Twitter acquisition was a story about free speech and content moderation, I didn’t have much to say. Those are really hard problems about which I have no special insights to contribute. But over the past week, the story has evolved into one with which I’m much more comfortable: how to better monetize Twitter. I have some ideas, one of which is that Twitter’s users should have a seat at the table, and upside in the outcome. Let’s get to it. If We Ruled the TweetsOk, hear me out… TweeterDAO. On Thursday, a new amended 13D filing showed that Elon Musk rallied the troops to pony up $7.1 billion of his $44 billion Twitter bid. This is interesting for a few reasons. First and foremost, it means that Elon’s assertion that he “doesn’t care about the economics at all” no longer holds. He needs to care about economics now. Twitter will need to generate enough money to pay Elon’s debt service, and to generate a return for its investors, including VC firms a16z and Sequoia. VC firms don’t typically play for 2x returns; while Elon and Twitter make this a special case, their involvement signals that economics do matter. Second, it cuts Elon’s margin loan from $12.5 billion to $6.25 billion, lowers the debt burden, and gives him some more room to experiment from a cash flow perspective. He can get a little more aggressive in this scenario. Third, Elon is rumored to be telling investors that he’s stepping in as interim CEO. He’s not known for doing things in a small way. Finally, crypto exchange Binance is a fascinating inclusion, particularly after its founder CZ tweeted, “Privatize it, issue a token, decentralize it” last month. While I think it’s unlikely that Elon decentralizes Twitter in the near-term, Binance’s involvement means more decentralized solutions may be on the table. Speaking of which… Elon should give a DAO made up of Twitter’s power users a place on Twitter’s cap table and a seat on its board. Call it TweeterDAO. Giving TweeterDAO a board seat is a step short of issuing a token and fully decentralizing. It’s a step short of the direct democracy he thinks humans should use to govern Mars. But it’s a big step in the right direction from a board made up of people with practically no ownership and famously little usage of the product.   In a TED interview last month, Elon told Chris Anderson that he wanted as many Twitter shareholders as possible to retain ownership, so that they could share in the governance of the platform, and that he thought the SEC limited it to 2,000 people. This DAO structure might be a workaround. Not surprisingly, I think that investing in the equity – directly or via DAO – of the new private Twitter is a compelling bet. It was one of my top picks at the Acquired Arena Show the night before the investment was announced.  I had no inside knowledge, just a longstanding belief that Twitter can and should be so much more than it is. Prognosticating on, and being overoptimistic about, Twitter’s future is a treasured pastime here at Not Boring. In July 2020, I wrote If I Ruled the Tweets. In February 2021, I followed up with How Twitter Got Its Groove Back. Hell, in March 2021, Marc Rubinstein and I even kinda defended Jack in Jack of Two Trades. In If I Ruled the Tweets, I wrote, “Twitter is the most undermonetized product in the world, because it doesn’t know what it is.” While its ad business has grown and improved slightly since then, and it finally introduced some light subscriptions, the point stands. The delta between Twitter’s importance and its business performance is gaping. But the company has seemingly infinite shots on goal to try to turn the business around because its power users are incredibly sticky (read: addicted to Twitter) and the magical experiences are unbelievably magical. It’s the home base for The Great Online Game. Elon, my inspiration for that essay and a power user himself, has some thoughts on how to turn things around. Over the weekend, The New York Times shared information from a leaked pitch deck Elon is using to raise money for the deal. According to The Times, plans include:

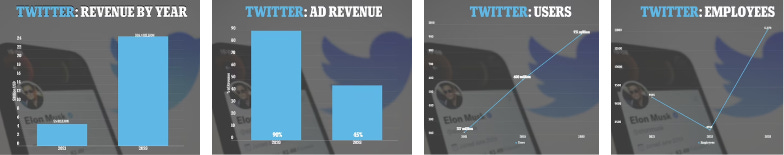

And of course, he expects there to be 69 million Twitter Blue subscription users by 2025. Nice. While the projections are characteristically aggressive, and the underlying products (“X”) that would get Twitter there are vague, I don’t doubt that Elon will be able to multiply Twitter’s business. You don’t even need to be an Elon fanboy to believe that; you just need to agree that Twitter has been leaking value that a strong management team should be able to capture. While Elon talks a lot about free speech, and I think he genuinely believes it’s a key reason for doing this, when he buys Twitter, Elon will also be buying one of the rarest assets on the planet: one of the few at-scale social graphs (in this case, the interest graph) where more of the world’s decision-makers shape ideas, and have their own ideas shaped. That presents both an incredible financial opportunity, and a largely unprecedented governance challenge. Twitter’s users should be able to participate in both. So today, we’ll cover three things:

What does Twitter think it is, and what is Twitter?Twitter’s problems stem from confusion about what it is, and the advertising-based business model choices it’s made as a result. In If I Ruled the Tweets, I wrote that Twitter’s main challenge was its confusion over its identity:

Look, it was early 2020 and I was a newly-full-time *creator* and the Passion Economy was hot, so maybe I focused a little too narrowly, but two years later, the main point stands. Twitter isn’t a social network as much as it is a professional network. In How Twitter Got Its Groove Back, I summarized why understanding what it is, who it’s for, and which business model was so important for Twitter:

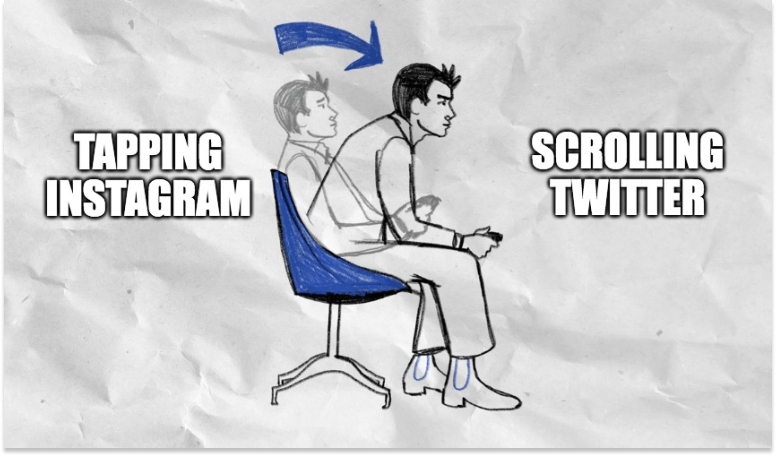

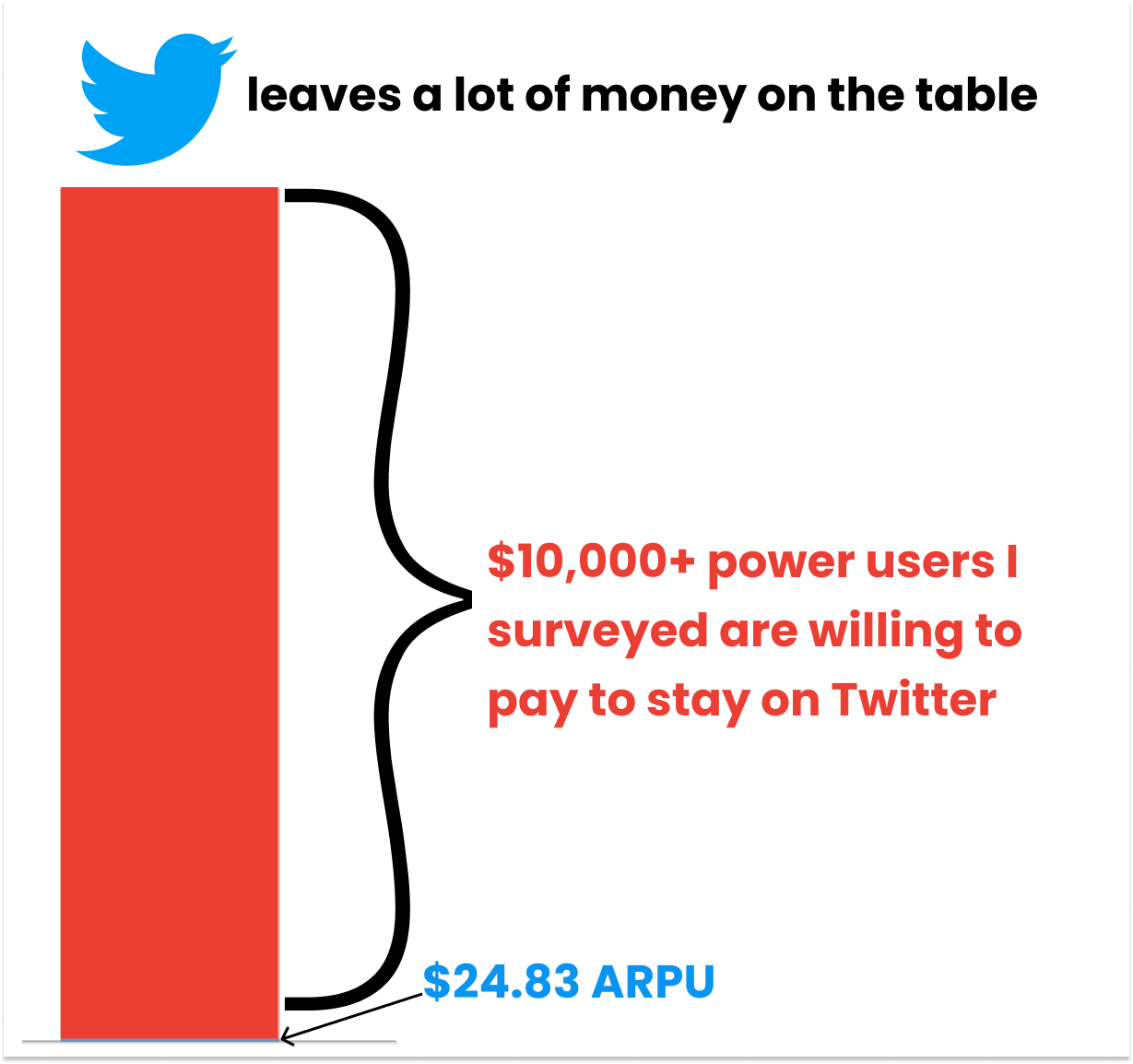

Again, Creator sounds too narrow and too 2020, but I’m referring to the users who create content on Twitter – individuals and businesses alike. And again, I think the argument stands. Instead of an Aggregator that operates like a social network and monetizes through ads, Twitter should be a Platform that operates like a professional network and monetizes through subscriptions. With a couple more years of evidence and wisdom, though, I think I undershot it. Because for as strong and focused as LinkedIn’s business is, it’s more focused and narrow than Twitter needs to be. Twitter is addictive, engaging, and valuable to its users in a way that LinkedIn isn’t. Addictive. Twitter behaves like a professional network sometimes, but it’s also where many of the world’s most powerful people go when they’re feeling curious, feisty, inspired, or just bored. I don’t know anyone who checks LinkedIn as compulsively as Twitter. Engaging. And when they check, they engage. This image that Ben Thompson included in his recent Back to the Future of Twitter captures the difference between how users interact with Twitter and Instagram well. Valuable. There’s a question that goes around Twitter every so often that goes something like “How much would someone have to pay you to not use Twitter?” I asked it myself while I was writing this piece, and the answer is eye-popping but not surprising. Across over 1,100 responses to my very unscientific poll, 40% of respondents said they’d need to be paid more than $10,000 per year to not use Twitter. Again, not scientific, but I think it’s directionally accurate for a subset of Twitter’s most valuable users – the “Creators” who send 80% of all tweets – and specifically the subset of that group whose business or income benefits from Twitter. For that 40%, Twitter is leaving so much money on the table that you can’t even see its current ARPU on the graph unless I make it really tall. I don’t think Twitter should start charging power users $10,000 per year (Elon: please don’t start charging power users $10,000 per year), but there’s somewhere between the $0 it currently charges and the $10,000+ people would be willing to pay that Twitter can charge its users for a better user experience and access to better products from Twitter (or built on Twitter). Twitter doesn’t need to build the biggest network in the world to be wildly successful. It just needs to make sure it serves its smaller segment of higher-value users better, and monetizes them much better, than it does today. That view informs what I think New Twitter should build. To learn what I think Twitter should build and how a TweeterDAO might work… Thanks to Dan for editing! Thanks to everyone who filled out the Not Boring Reader Survey last week! If you didn’t get a chance to, I’d really appreciate it if you took 3 minutes to do it now: Thanks for reading, and see you next Monday, Packy *See important disclaimer If you liked this post from Not Boring by Packy McCormick, why not share it? |

Older messages

Three Not Boring Things

Thursday, May 5, 2022

Reader Survey, Talent Collective, Founders Podcast

Tokengated Commerce

Monday, May 2, 2022

Alex Danco Joins to Explain NFTs and How Shopify is Becoming Wallet-Aware

Primer: The Ambitious Home for Ambitious Kids

Thursday, April 28, 2022

Announcing a $15M Series A, Microschools, and Expert-Led Clubs

Celo: Building a Regenerative Economy

Monday, April 25, 2022

The Carbon-Negative Blockchain Making Money Beautiful

The Invisible Hand's Visible Swarm

Tuesday, April 19, 2022

Or, Why I'm Optimistic the Problems that Matter Will Get Solved

You Might Also Like

🔮 $320B investments by Meta, Amazon, & Google!

Friday, February 14, 2025

🧠 AI is exploding already!

✍🏼 Why founders are using Playbookz

Friday, February 14, 2025

Busy founders are using Playbookz build ultra profitable personal brands

Is AI going to help or hurt your SEO?

Friday, February 14, 2025

Everyone is talking about how AI is changing SEO, but what you should be asking is how you can change your SEO game with AI. Join me and my team on Tuesday, February 18, for a live webinar where we

Our marketing playbook revealed

Friday, February 14, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Cribbage Day, Reader... Don't get skunked! In today's

Connect one-on-one with programmatic marketing leaders

Friday, February 14, 2025

Enhanced networking at Digiday events

Outsmart Your SaaS Competitors with These SEO Strategies 🚀

Friday, February 14, 2025

SEO Tip #76

Temu and Shein's Dominance Is Over [Roundup]

Friday, February 14, 2025

Hey Reader, Is the removal of the de minimis threshold a win for e-commerce sellers? With Chinese marketplaces like Shein and Temu taking advantage of this threshold, does the removal mean consumers

"Agencies are dying."

Friday, February 14, 2025

What this means for your agency and how to navigate the shift ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Is GEO replacing SEO?

Friday, February 14, 2025

Generative Engine Optimization (GEO) is here, and Search Engine Optimization (SEO) is under threat. But what is GEO? What does it involve? And what is in store for businesses that rely on SEO to drive

🌁#87: Why DeepResearch Should Be Your New Hire

Friday, February 14, 2025

– this new agent from OpenAI is mind blowing and – I can't believe I say that – worth $200/month