Not Boring by Packy McCormick - Newton's Alchemy

Welcome to the 2,401 newly Not Boring people who have joined us since last Monday! If you haven’t subscribed, join 123,145 smart, curious folks by subscribing here: 🎧 If you’d rather listen to this essay, head over to Spotify or Apple Podcasts Today’s Not Boring is brought to you by… Causal In today’s essay, I make a case for optimism during the crash. But optimism needs to be paired with smart planning, and that’s where Causal comes in. Causal is a spreadsheet built for number-crunching — financial modeling, business planning, but really anything involving calculations. It's like Excel minus the arcane formulas (no more Sheet1!$E$4 or VLOOKUPs), plus live data integrations (accounting systems, CRMs, etc), and really cool shareable dashboards. Given current market conditions, every startup needs a solid financial model to steer the ship. I've worked with the Causal team to create the Startup Suite — a set of 4 template models for early stage companies: They've put together detailed video walkthroughs for each model in their documentation. Use one of my templates above as a starting point, or click below to just sign up for the product and start playing around: Hi friends 👋 , Happy Monday! Let’s hope this week is better than last week. Last week was tough. The markets were brutal. Venture dried up beyond pre-seed and seed. Terra-Luna accelerated the crypto crash. I don’t know what happens in the next few weeks or months. Anyone who tells you they do is full of shit. And I’m certainly not about to jump on the bearish sentiment bandwagon. So instead, let’s zoom out, get a little perspective, and take a shot of historically-informed optimism. Let’s get to it. Newton’s AlchemyLast week, as the markets melted down, a timely gift from Past Packy showed up in my Kindle Library. When I was on my Carlo Rovelli kick a couple months ago, I pre-ordered his upcoming book, There Are Places In The World Where Rules Are Less Important Than Kindness. When I opened my Kindle app on Tuesday, there it was. Perfect timing. There Are Places In The World Where Rules Are Less Important Than Kindness is a collection of newspaper articles Rovelli wrote from 2010-2020 on physics and philosophy. Each is characteristically beautiful and thought-provoking. One was so timely it slapped me in the face. Newton the Alchemist, originally published on March 19, 2017, deals with the seeming contradiction between “the traditional image of him [Newton] as the father of science” and his lifelong pursuit of the now-discredited field of alchemy. Why would such a rational thinker – the rational thinker – waste decades in pursuit of something so frivolous and irrational?

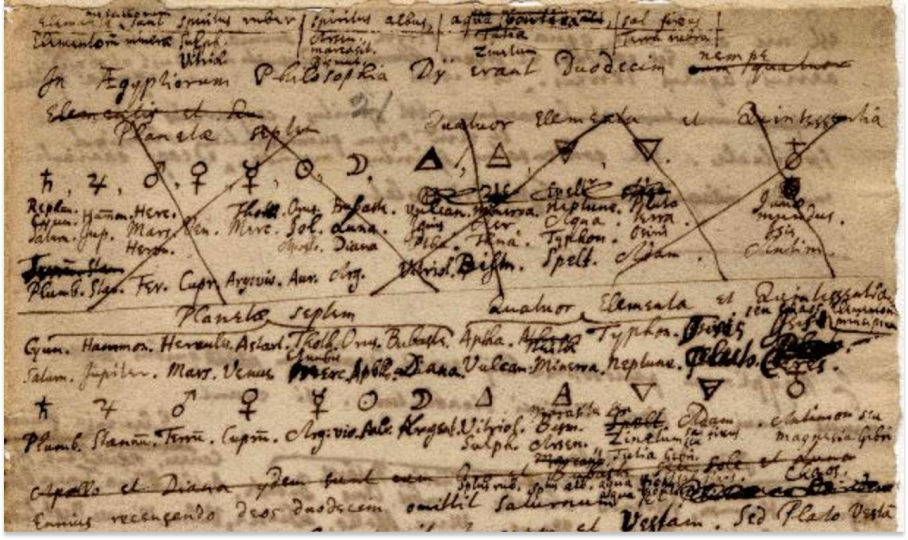

Like a good bubble, alchemy’s promise of gold and immortality attracted a swarm of smart people, including Newton, to try to crack the code. The exhaust of their failed attempt created a new, bigger, and much more important field of study. Without alchemy, there is no chemistry (or, at least, chemistry doesn’t arrive as quickly). More generally, without experimentation and curiosity and adventures down ultimately fruitless rabbit holes, there is no progress. The allure of alchemy is obvious. Greedily, the power to turn base metals into gold would make its early discoverers wealthy and powerful. Beautifully, the ability to turn base metals into gold, to bend the previously-understood laws of the universe, would be a testament to human ingenuity. But alas, not even Sir Isaac Newton could turn shit into gold, not even after decades of work. Isaac Newton seems like an odd person to fail at alchemy. Odd that he failed because we’re talking about the guy who discovered the three laws of motion, the theory of universal gravity, that white light is a mixture of colors, and differential calculus. His tomb at Westminster Abbey reads, “Sibi gratulentur Mortales, Tale tantumque exstitisse HUMANI GENERIS DECUS,” which translates to “Mortals rejoice that there has existed such and so great an ornament of the human race!” (Puja: take notes.) Odd that such an ornament to the human race even tried because we’re talking about alchemy, a debunked pseudo-science. As one Quora user explained, “Alchemy blurs the line between empirical observation and experimentation, baseless speculation, and mysticism in a way that made perfect sense to the alchemists but makes absolutely no sense to us. And the latter two make it not science.” What a shame that he wasted so much of his precious brainspace on alchemy, right? Not so fast. Rovelli points out that, “Today it is easy to rely on the well-digested historical judgment that alchemy had theoretical and empirical foundations that were far too weak. It wasn’t quite so easy to reach this conclusion in the seventeenth century.” In other words, alchemy has been debunked for three centuries now, but when Newton was working, it hadn’t yet been. It took many smart people rigorously (and, to be sure, many dumb people loosely) experimenting and trying to make alchemy work and failing to learn that it couldn’t. And the discoveries in the process led to something much more valuable than all the gold in the world: chemistry. If, with modern day knowledge, you could go back in time and stop Isaac Newton from attempting alchemy so that he could direct his attention to something more practical, you wouldn’t. You gotta, as any Sixers fan would tell you… Innovation is rarely a discrete result of a lightning strike moment. It’s a progression and an evolution, a composition of previous failures and successes with a new twist. Alchemy isn’t the only example of this winding road phenomenon in Newton’s career. In The Beginning of Infinity, David Deutsch explores the progression of theories describing planetary motion from Kepler to Newton to Einstein. Each successive theory seems to throw out the prior one:

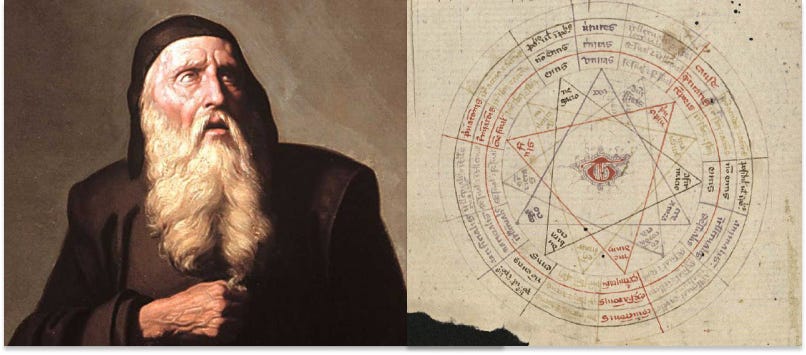

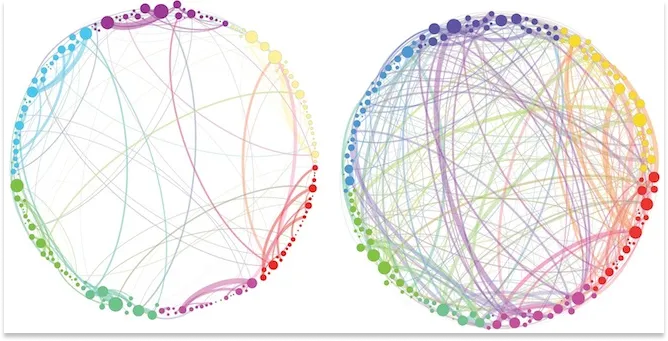

Newton discovered the force of gravity. Einstein threw that idea out, along with uniformly flowing time. So was Newton’s work for naught? Useless? Au contraire. “Although there is no force of gravity,” Deutsch writes, “it is true that something real (the curvature of spacetime), caused by the sun, has a strength that varies approximately according to Newton’s inverse-square law, and affects the motion of objects, seen and unseen.” Keep what’s true and valuable, discard the rest, try the next thing. Once again, Newton pointed future generations in the right direction. Newton showed Einstein where to look and what to improve upon. Without Newton, Einstein may have spent his time making those same discoveries instead of figuring out general relativity, and Heisenberg might have spent his time figuring out general relativity instead of establishing quantum mechanics, and so on. Incomplete or even downright incorrect solutions are a necessary part of the process. Alchemy failed, but science prevailed. Gravity failed, but science prevailed. Newton, of course, is not unique in his ability to fail in the right direction. In another article, October 2016’s Ramon Llull: Ars Magna, Rovelli tells the story of the 13th century Majorcan philosopher, Ramon Llull. Llull’s Ars magna, or “great art,” was a system “oscillating between metaphysics and logic, expressed in the form of tables, graphics, moving paper circles” that “intended to bring order to the world, and to convert Jews and Muslims to Christianity.” “These objectives, it would be fair to say,” wrote Rovelli, “he decidedly failed to reach.” His ideas, though, lived on, and they’ve had an unbelievably huge impact. Four hundred years after Llull’s death, the 17th century mathematician Gottfried Wilhelm Leibniz ran his ideas back, kept the true and valuable, discarded the rest, and rebranded what was left as “combinatorial art.” With the idea, Leibniz designed the first calculating machine, “acknowledged as the progenitor of all modern computers.” The rebranded combinatorial art is also “at the root of modern developments in logic conceived as a universal grammar of rationality.” Graphs, images “that codify the way in which a certain number of elements are connected with each other,” were also invented by Llull. Brain Graph off and on Psilocybin, Proceedings of the Royal Society Interface Llull’s “failure” led to the computer, modern logic, and graphs. History is littered with similar examples, famous and hidden. There is no progress without experimentation and failure. But in a market like the one we’re in right now, it’s easy to lose sight of that. It’s not hard to imagine Ramon Llull as a modern founder getting absolutely obliterated in Business Insider or The Information for failing to bring order to the world. Even Newton – Newton! – would get fileted for his foolish pursuit of fool’s gold. I read Newton the Alchemist in the middle of the most on-the-nose alchemy comparison possible. Do Kwon and Terra tried to turn shit into gold with ponzinomics and bravado, they failed, and kneecapped an already-weakening crypto market in the process. Like alchemy, the allure of creating billions of dollars out of thin air via undercollateralized algorithmic stablecoins was too appealing for humans not to try. The problem was, in this case, algorithmic stablecoins using similar seigniorage mechanics had already been tried over and over again – even, reportedly, by Do Kwon himself! Basis Cash, the project Do Kwon allegedly founded pseudonymously, failed, as did Empty Set Dollar, IronFinance’s TITAN, and more.  Retrying the same ideas in a frothier market and pumping harder with the same broken underlying mechanics wasn’t a useful experiment. No new seed of the real valuable idea was sowed in the process – no chemistry from this alchemy. Worse, regular people lost their life savings, and it seems as if a handful have taken their own lives as a result. That’s tragic and terrible and the people responsible should be held accountable to the fullest extent possible. But I’m worried that in crypto, and across the markets more generally, the sentiment – or vibe, as the kids would say – is in danger of shifting too far away from experimentation. That shows up in all of the proud crypto bears loudly proclaiming the whole thing was a scam all along and the fintwit pseudos ripping Peloton and Shopify and Zoom and the other companies whose inventions made an awful pandemic a lot better for a lot of people. I’d bet (Not Financial Advice™️) that Zoom, Peloton, and Shopify are all worth more in five years than they are today, but even if they go to zero, I don’t see the value in dunking on companies who’ve at the very least made work, fitness, and entrepreneurship more accessible and pushed those categories forward because the market overvalued them. We’re guilty of this on both sides: lionizing companies and their founders for high valuations, and ripping them to shreds when valuations fall. That’s the weirdest part of a bear market: the people who are rooting for something other than other people to succeed and humanity to progress are the ones winning. If the long arc of market history is any indication, they won’t be winning for long, or over the long-term, but the environment that it creates in the interim feels super dark. (And yes, on the other side, idiots like this are not people you want to see winning, either.) A bear market price reset is a good thing in many ways. It’s a much less profitable environment for scammers. Terra doesn’t build up an $18 billion algorithmic stablecoin by promising 20% APY in a market like this. A lot of the me-too companies rushing at the same opportunity for the cash grab opportunity will go away. A higher proportion of talent and resources will flow to the strongest companies, the ones with the biggest ambitions and most differentiated products. But a bear market attitude reset can be harmful to the extent it encourages dunking on those who’ve tried earnestly and failed and discourages experimentation. I saw a tweet the other day – and the person who tweeted it seems smart and nice, and they represent a commonly-held view, so I’m not going to call them out by name – that said something along the lines of: “I’m bullish on cryptocurrency, bearish on nonsensical use cases.” Which sounds like a sensible thing to say, particularly in a market like this, but … entirely misses how things work. You need experiments and nonsensical applications to get to the useful ones. You need alchemy to get to chemistry. You need Ars magna to get to the computer. Apple started out as a nonsensical homemade computer. Facebook started out as a way to creep on Harvard girls. Bull markets and bear markets are both natural parts of the cycle. Having spent so much time in the former, we were overdue for the latter. My hope is that people don’t stop trying weird stuff and that investors don’t stop funding weird stuff. While bull markets invite scams and unproductive rehashings of old ideas, they also create an environment in which risk-taking is celebrated and rewarded. Investors flooding the market with cash is a feature, not a bug. And I’ll say this for tech bubbles: they’re productive, especially compared to banking bubbles. Just a couple of paragraphs left…Thanks to Dan for editing! Thanks to everyone who’s filled out the Not Boring Reader Survey! If you didn’t get a chance to, I’d really appreciate it if you took 3 minutes to do it now: Thanks for reading, and see you on Thursday for something new, Packy If you liked this post from Not Boring by Packy McCormick, why not share it? |

Older messages

Terra: To the Moon and Back

Thursday, May 12, 2022

Jon Wu on What's Happening With Terra-Luna, UST, and the Broken Peg

If We Ruled the Tweets

Monday, May 9, 2022

Twitter's Power Users, the WeChat Opportunity, and TweeterDAO

Three Not Boring Things

Thursday, May 5, 2022

Reader Survey, Talent Collective, Founders Podcast

Tokengated Commerce

Monday, May 2, 2022

Alex Danco Joins to Explain NFTs and How Shopify is Becoming Wallet-Aware

Primer: The Ambitious Home for Ambitious Kids

Thursday, April 28, 2022

Announcing a $15M Series A, Microschools, and Expert-Led Clubs

You Might Also Like

🔮 $320B investments by Meta, Amazon, & Google!

Friday, February 14, 2025

🧠 AI is exploding already!

✍🏼 Why founders are using Playbookz

Friday, February 14, 2025

Busy founders are using Playbookz build ultra profitable personal brands

Is AI going to help or hurt your SEO?

Friday, February 14, 2025

Everyone is talking about how AI is changing SEO, but what you should be asking is how you can change your SEO game with AI. Join me and my team on Tuesday, February 18, for a live webinar where we

Our marketing playbook revealed

Friday, February 14, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Cribbage Day, Reader... Don't get skunked! In today's

Connect one-on-one with programmatic marketing leaders

Friday, February 14, 2025

Enhanced networking at Digiday events

Outsmart Your SaaS Competitors with These SEO Strategies 🚀

Friday, February 14, 2025

SEO Tip #76

Temu and Shein's Dominance Is Over [Roundup]

Friday, February 14, 2025

Hey Reader, Is the removal of the de minimis threshold a win for e-commerce sellers? With Chinese marketplaces like Shein and Temu taking advantage of this threshold, does the removal mean consumers

"Agencies are dying."

Friday, February 14, 2025

What this means for your agency and how to navigate the shift ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Is GEO replacing SEO?

Friday, February 14, 2025

Generative Engine Optimization (GEO) is here, and Search Engine Optimization (SEO) is under threat. But what is GEO? What does it involve? And what is in store for businesses that rely on SEO to drive

🌁#87: Why DeepResearch Should Be Your New Hire

Friday, February 14, 2025

– this new agent from OpenAI is mind blowing and – I can't believe I say that – worth $200/month