Conflux co-founder How did StepN on BNBchain collapse?

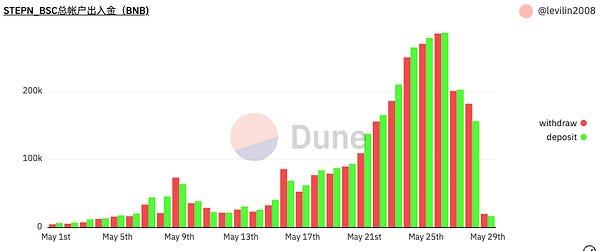

Author: @forgivenever Stepn is currently in a recession, where the Solana chain is still maintaining the economic cycle, but the Bsc chain has completely burst the bubble. This article is a brief review of the tumbling gold rush that lasted a month. On April 20, Bsc chain sneakers started initial sale and hackers snapped them up quickly. On April 24, hackers sold them at a profit, at which point the grey sneaker floor price was $2,500 and the green sneaker floor price was $12,000. From April 26 to 28, the grey sneaker floor price rose to over 20 BNB. On April 30, the Stepn team announced the airdrop of Solana chain sneaker, Bsc chain users dumped sneakers due to panic, causing the floor price to drop to 4-5 BNB. From April 30 to May 1, the first batch of Chinese institutional speculators entered the market, they went bottom fishing, buying 30 pairs of sneakers per capita. From May 2 to 9, the price of sneakers rose to 30-40BNB, when the number of addresses was close to 3000. Then a second group of Chinese institutional speculators entered the market, depositing 40,000BNB in two days. From May 10 to 14, the Luna crash caused the market to plummet, and the sneaker floor price fell below 10 BNB, but then immediately rebounded. From May 15 to 20, the sneaker floor price rebounded to 35 BNB, and a large number of Solana users switched to the Bsc chain. Meanwhile a third group of Chinese institutional speculators entered the market, depositing 90,000 BNB in a single day, and the number of addresses soared to 18,000. Speculative tutorials began to appear online, with claims of 4-day payback. From May 20 to 26, more Chinese institutional speculators poured into the market, with one large investor buying 1,200 pairs of sneakers on the 26th and depositing 280,000 BNB in a single day. At this point, the speculative bubble reached its peak, with the number of addresses exceeding 50,000, including 20,000 to 30,000 real users. On May 27th, the Stepn team announced that they were abandoning the mainland China market, which meant that there were no new users coming in to take on this Ponzi game. From May 27 to 29, the Bsc chain bubble began to burst, and the floor price fell to 3 BNB in two days, close to the cost of mint sneakers. The whole bubble went through three underestimations, the hacked shoe sale, the Solana chain airdrop and the Luna crash, until the final bubble burst. During the process, minting a pair of sneakers was evaluating profits of $2,500 to $6,000. Speculators would buy bGST in large quantities, causing bGST prices to remain high, reaching a high of $50 and a low of $10. In terms of the extent of the bubble, Stepn is a pure Ponzi game, with a dearth of real user growth, except for airdrop users, and the vast majority of profits coming from users who entered the game relatively late. It is estimated that users who started to enter before the third group of Chinese institutional speculators entered the market could still profit, but those who entered after that time lost money. Stepn, with data that is not visible to the outside world, should have realized this problem long ago and could have transferred the profits of speculators to campaigners through macro-regulation. But before the new version of the APP is launched, there is already a situation where the mint price is equal to the market price, and even the price is upside down. So, under the slogan of "4 days back to capital", the booming gold rush instantly collapsed. Bsc chain speculators can get 6 to 10 times profit under the premise of cautiously expanding capacity, and the Stepn team earned 140,000 BNB during the month. Users who received airdrops were also able to earn between $1,500 and $3,000 per day during this time. And the users who came in around the last 10 days became the source of profit. Link:   Follow us Twitter: https://twitter.com/WuBlockchain Telegram: https://t.me/wublockchainenglish If you liked this post from Wu Blockchain, why not share it? |

Older messages

WuBlockchain Weekly:Terra2.0、STEPN CHINA BAN、Winter is coming and Top10 News

Friday, May 27, 2022

1、Terra releases airdrop details, 2.0 is coming, and everything seems to be settling down link Terra officials have now confirmed that Terra 2.0 is expected to on May 28th, 2022 at around 06:00 AM UTC,

In-depth: NFT lending is on the rise Exploration and prospect of financialization

Thursday, May 26, 2022

With CryptoPunks, BAYC and others out of the loop and the exploration of the metaverse on and off the field, more and more users and institutions are running into NFT. Although it is still niche, but

TSE Sponsored :Global Crypto Mining News (May 16 to May 22)

Monday, May 23, 2022

1. BitFarms announces that it mined 961 Bitcoin in Q1 2022 at an average cost of $8700/Bitcoin and revenues improved to $40 million in Q1 2022, up 42% from $28 million in Q1 2021. Bitfarms presented a

WuBlockchain Weekly:Terra2.0 Summary, FASB, Tether new report and Top10 News

Saturday, May 21, 2022

1、Create a new Terra chain & Regulatory pressure link Do Kwon proposed to create a new Terra chain without the algorithmic stablecoin and distribute the new coins among eco-stakeholders. In

吴说每周精选:新闻Top10与热门文章 Terra2.0专题(0517-0521)

Saturday, May 21, 2022

每周行业十大新闻 1、Terra生态系统复兴计划提案 2.0 进行了修订 目前社区对 Terra 的未来规划是分叉成一条没有算法稳定币的新链,并将新币在生态利益相关者之间进行空投分配。另外,此次暴雷,不管是对于 Do Kwon 本人还是加密货币行业来说,都将引来更多的监管压力。 2、美国财会准则委员会或将加密货币纳入财报标准 2022 年 5 月 15 日,MicroStrategy CEO

You Might Also Like

Texas doubles down on crypto with new $250 million Bitcoin reserve bill

Tuesday, March 11, 2025

Texas' second crypto bill seeks to enhance state and local government participation in digital asset investments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How-ey Can Get Out of Here

Tuesday, March 11, 2025

How On-Chain Data Can Clarify the Regulation of Cryptoassets ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

February CEX Data Report: Significant Decline in Trading Volume Across Major CEXs - Spot Down 21%, Derivatives Dow…

Tuesday, March 11, 2025

In February 2025, the spot trading volume of major CEXs decreased by 21% compared to January. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

El Salvador defies IMF, continues Bitcoin purchases amid market downtrend

Monday, March 10, 2025

El Salvador's Bitcoin holdings grow to $504 million, challenging IMF directives amid sharp price declines. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🖊️ Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO …

Monday, March 10, 2025

Trump signed an Executive Order for a US Strategic Bitcoin Reserve; Cronos proposed to reissue 70 billion CRO for a Cronos Strategic Reserve; Texas's Senate passed bitcoin reserve bill SB-21 ͏ ͏ ͏

Vitalik TAKO AMA: ETH Positioning, Sequencer Centralization, L1 vs L2, Governance, and Success Metrics

Monday, March 10, 2025

On the evening of February 19th at 12 PM UTC and lasting until 12 PM UTC on February 20th, Vitalik Buterin, the founder of Ethereum, was invited to participate in a flash text interview on Tako (a

Donald Trump Creates U.S. Bitcoin Reserve

Monday, March 10, 2025

March 10th, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Donald Trump Creates US Bitcoin Reserve Diddy Shows 'Kindness' To Sam Bankman-Fried Robinhood Conducts $1M Crypto Trivia

Bitcoin’s realized volatility surges in as traders face extreme price swings

Sunday, March 9, 2025

Volatility clustering in Bitcoin reveals the impact of turbulent rallies and sharp pullbacks. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Mar 3 to Mar 9)

Sunday, March 9, 2025

Ms. Sun Xueling, Minister of State, Ministry of Home Affairs of Singapore, said that cryptocurrency fraud cases accounted for a quarter of the total loss amount involved in fraud last year. ͏ ͏ ͏ ͏ ͏ ͏

Trump declares end to ‘war on crypto,’ vows to propel America to Bitcoin supremacy

Saturday, March 8, 2025

Trump brands the Biden era as a crypto setback, .President Trump vows to make America the Bitcoin leader, ending Operation Chokepoint 2.0 and bolstering crypto strategies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏