The Daily StockTips Newsletter 06.16.2022

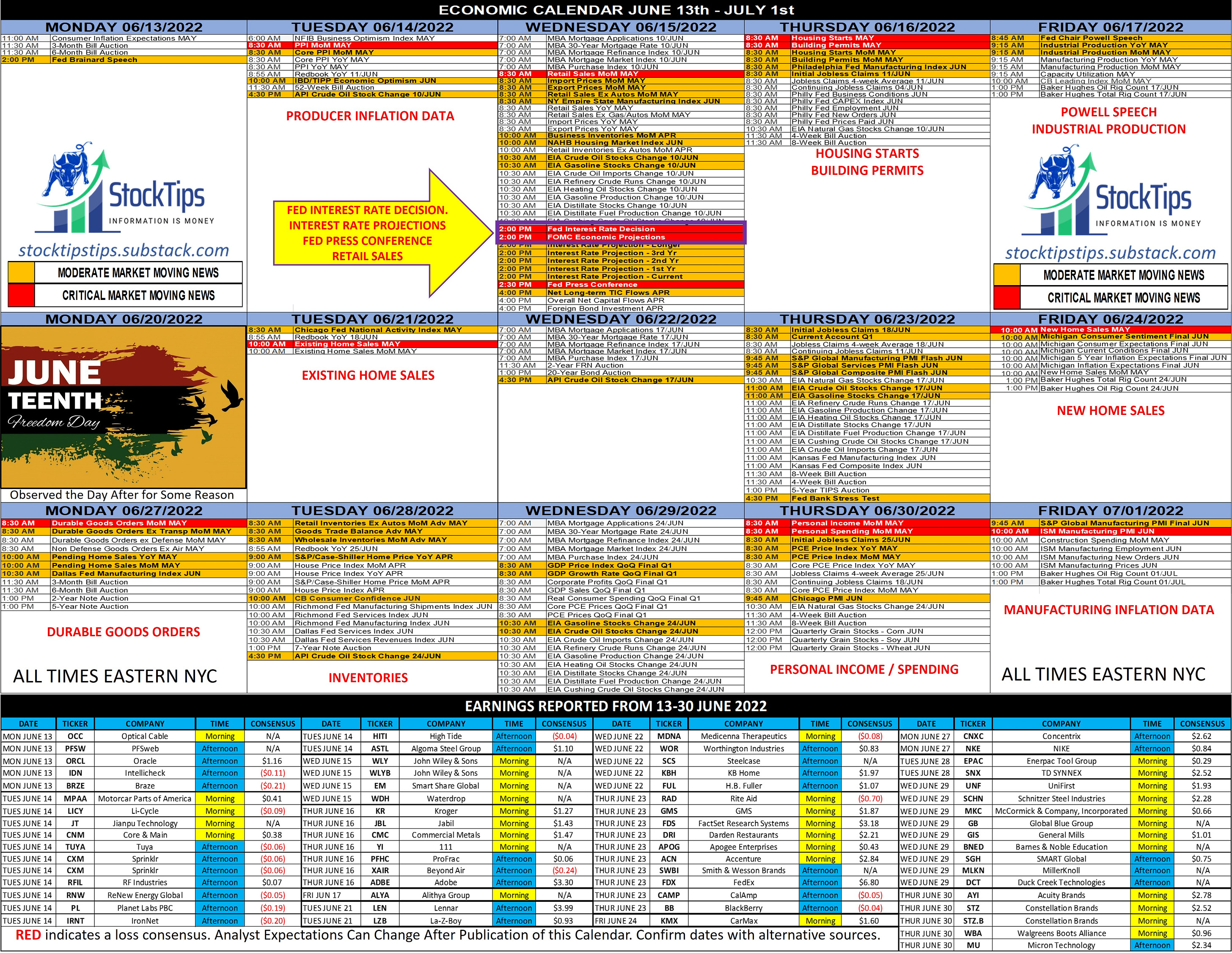

The Daily StockTips Newsletter 06.16.2022I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)CLICK HERE TO SEE THE STOCKTIPS RECORD WE’RE ON YOUTUBE NOW! See HERE, HERE, & HERE (Yeah … I’m REALLY excited about this). Before you Trade Today: Know the Economic Calendar! Also See This Weeks Most Anticipated Earnings (Note: Red on the Earnings Calendar Indicates an Earnings Loss [Not Miss] Consensus), & Yesterdays Insider Buys. NEVER BE SURPRISED BY EASILY ANTICIPATED MARKET BREAKING NEWS. That’s our goal here. StockTips is NOW on Odyssey. It’s like discord but better in my opinion SPECIAL NOTE: THIS POST MAY BE TOO LONG FOR EMAIL. YOU CAN EITHER EXPAND IT ON THE TAB IN YOUR EMAIL OR VISIT THIS POST DIRECTLY HERE. TOMORROW IS A QUADRUPLE WITCHING DAY!!: Don’t forget TODAY’s OBSERVATIONS: Well my prediction yesterday was mixed. I predicted that Powell was too reactive to launch anything higher than a 50-bps rate hike. I predicted that Powell is not the type to deviate from the stated plan. Well, we got a 75-bps rate hike … a deviation from his stated plan. I also predicted the market would dump if he announced a 50-bps rate hike, & rally if he announced a 75-bps rate hike. That part came true!

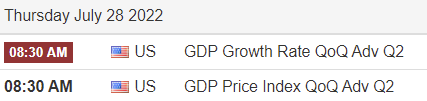

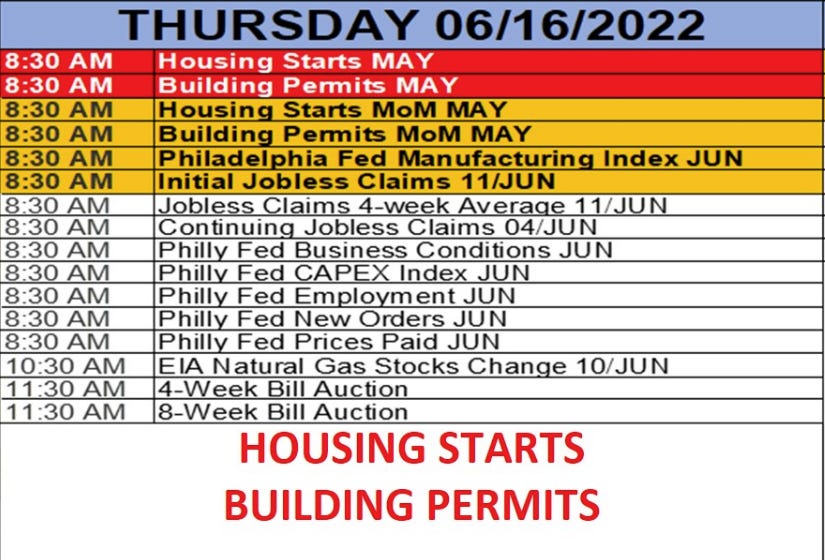

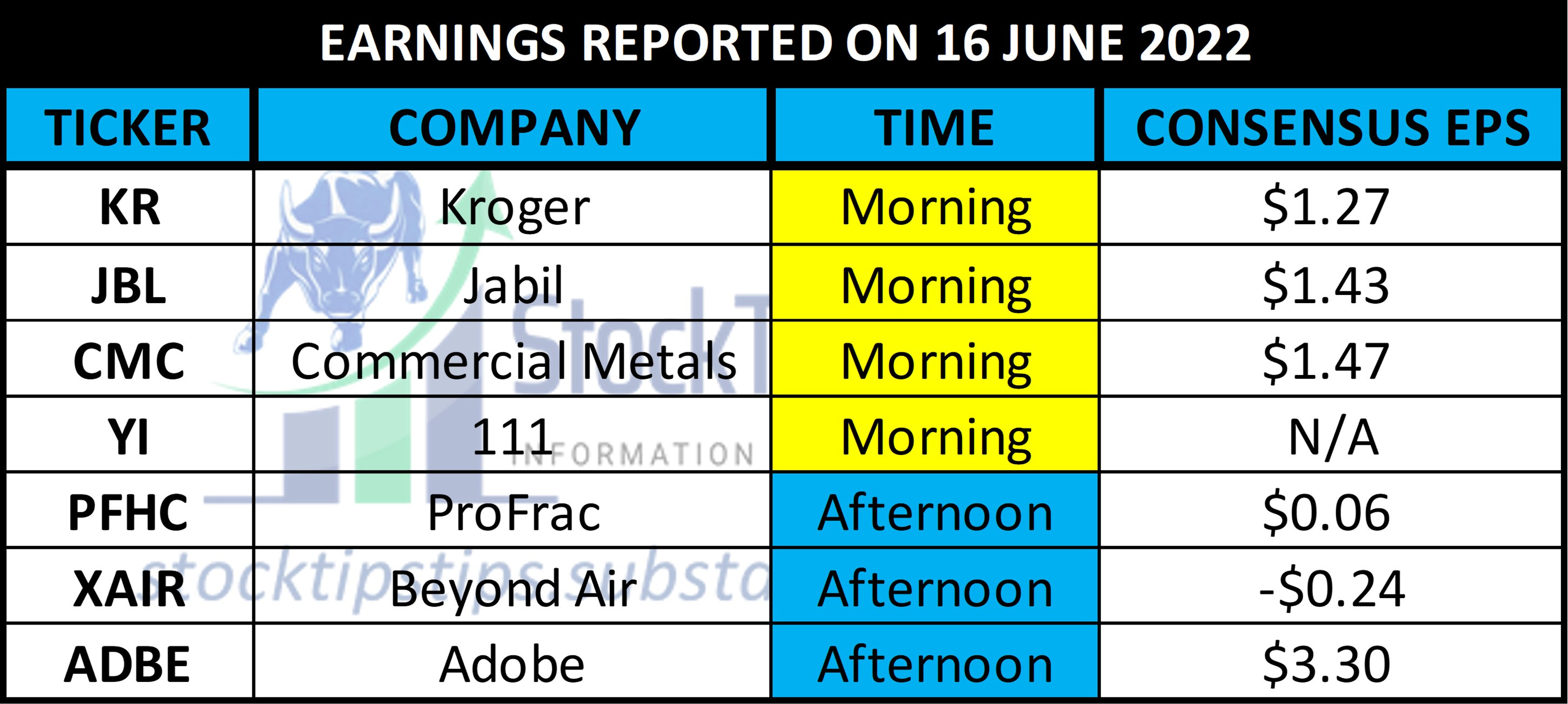

SO WHAT?: Well now we undergo rate hike remorse! The big institutions essentially told Powell through their rate hike forecasts that the Fed had their blessing to increase by 75-bps. Now we need to deal with the consequences. A 75-bps rate hike is a truly massive jump! It demonstrates the Fed is now serious on tackling inflation. Particularly when we take into account the fact that they’re offloading junk from their balance sheet. Indeed I would argue that they will be lucky to get it down by $1T (of the $9T on the books) before they have to stop before wiping out the US economy & sending the markets down an additional 25-30% from current levels. Remember that the pain of inflation doesn’t truly hit hard until either prices are so high the consumer is priced out … or … inflation tops off & begins to decline. If you think inflation topping off, whenever that happens, is a bullish indicator … you couldn’t be more wrong. Remember, for inflation to slow down it means the economy is cooling off. If the economy is cooling off, it means growth slows … people stop hiring, companies make economies, there’s less money exchanging hands … & the downward spiral continues until a probable recession. It will be interesting to see how the market reacts to these rate hikes. It will be even more interesting to see how other central banks react. The Swiss National Bank just increased their rates by 50-bps when no rate hike was expected. We now await the Bank of England for their decision. (Update: increased interest rates by 25-bps & expects economic contraction for the current quarter). The last thing any country wants is for their currency to devalue against the dollar, so there is very strong incentive to raise rates more aggressively if the US Federal Reserve is doing the same. RECESSION BOUND: Speaking of recessions the Atlanta Feds Q2 GDP tracker went from an expected 1.8% GDP growth rate to 0% in less than a month. Remember that Q1 GDP growth contracted -1.5% … meaning one more subsequent quarter of contraction puts us in a technical recession. The markets will not be happy. Everyone assessed a recession in 2023 … we may be in one now! The initial Q2 GDP print comes in on Thursday July 28th. Expect some volatility around that time! HOUSING DATA TODAY: Today, God save us, we have housing data. Housing Starts & Building Permits for May. Analyst Consensus is 1.701m on the Starts & 1.885m on the Permits. What housing stocks will be affected? BZH MTH MHO TPH LL DHI LSEA PHM TOL LEN are ones that I can name off the top of my head. EARNINGS REPORTED ON 16 JUNE 2022: KR JBL CMC YI PFHC XAIR ADBE BUY LIST UPDATE: It’s always tough after a market dump to add either long or short plays. Be patient folks. All of the suggested short plays I posted earlier worked marvelously! But I’m hesitant to add more given the market lows. It seems to me that shorts are holding & when they cover the markets will rally. PAID CONTENT IN THE PAYWALL BELOW: 1 Stocks on the BUY LIST near/at/above the Buy Zone (Waiting to Swing) / 1 Options Strategy / A Detailed Breakdown of Yesterdays Earnings Beats & Misses / Most Recent Insider Buys/Sells / IPO Lockup & Quiet Period Expirations / 19 Stocks on the Price Based Assessment Watchlist / 3 Stocks on the Stocks Under $20 List (Read the Warning/Disclaimer) / 3 Stocks on the Highly Speculative Highly Volatile Small Cap List (Read the Warning/Disclaimer) / 5 Stocks on the short possibilities list. 👉CLICK HERE TO SEE THE DETAILS OF EVERY STOCK ON THE BUY LIST (AND SEE THE PRICE ASSESSMENT BASED WATCHLIST / THE STOCKS UNDER $20 LIST & THE HIGHLY SPECULATIVE LIST) LOGIN INSTRUCTIONS: You will need to login to see the detailed list. The “email login link” will send the link to login directly to your inbox (Click the link & it will automatically log you in). You can also choose the “login with password” option. You will need to set up a substack password for this option.Subscribe to StockTips Newsletter to read the rest.Become a paying subscriber of StockTips Newsletter to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

The Daily StockTips Newsletter 06.14.2022

Tuesday, June 14, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 06.13.2022

Monday, June 13, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 06.10.2022

Friday, June 10, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 06.09.2022

Thursday, June 9, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 06.08.2022

Wednesday, June 8, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

You Might Also Like

Crypto Politics: Strategy or Play? - Issue #515

Thursday, March 6, 2025

FTW Crypto: Trump's crypto plan fuels market surges—is it real policy or just strategy? Decentralization may be the only way forward. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What can 40 years of data on vacancy advertising costs tell us about labour market equilibrium?

Thursday, March 6, 2025

Michal Stelmach, James Kensett and Philip Schnattinger Economists frequently use the vacancies to unemployment (V/U) ratio to measure labour market tightness. Analysis of the labour market during the

🇺🇸 Make America rich again

Wednesday, March 5, 2025

The US president stood by tariffs, China revealed ambitious plans, and the startup fighting fast fashion's ugly side | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March

Are you prepared for Social Security’s uncertain future?

Wednesday, March 5, 2025

Investing in gold with AHG could help stabilize your retirement ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Issue #275: You're preapproved… to spend a bunch of money

Wednesday, March 5, 2025

plus Soup Watch 2025 + snacking cakes ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Harry's Take 3-5-25 Economy Suddenly Weakens: Recession Coming Soon?

Wednesday, March 5, 2025

Harry's Take March 5, 2025 Economy Suddenly Weakens: Recession Coming Soon? I've been seeing the economy as the most stretched in history after the longest $27T US stimulus program, by far.

💀 RIP, world's biggest dividend

Tuesday, March 4, 2025

Aramco slashed its billion-dollar handouts, the US faced retaliation, and bitcoin went up against organs | Finimize Hi Reader, here's what you need to know for March 5th in 3:14 minutes. Aramco –

RIP to the 4% Rule

Tuesday, March 4, 2025

How to ignore the retirement strategy ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

President Trump is asserting extraordinary power over independent agencies. Is the Fed next?

Tuesday, March 4, 2025

The rise and potential fall of independent agencies. View this email online Planet Money Not-so-independent agencies anymore? by Greg Rosalsky President Trump vs. the independent agencies. It's a

No Sales, No Survival - Issue #514

Tuesday, March 4, 2025

What smart businesses are doing to win in the long run. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏