MicroAngel State of the Fund: April 2022

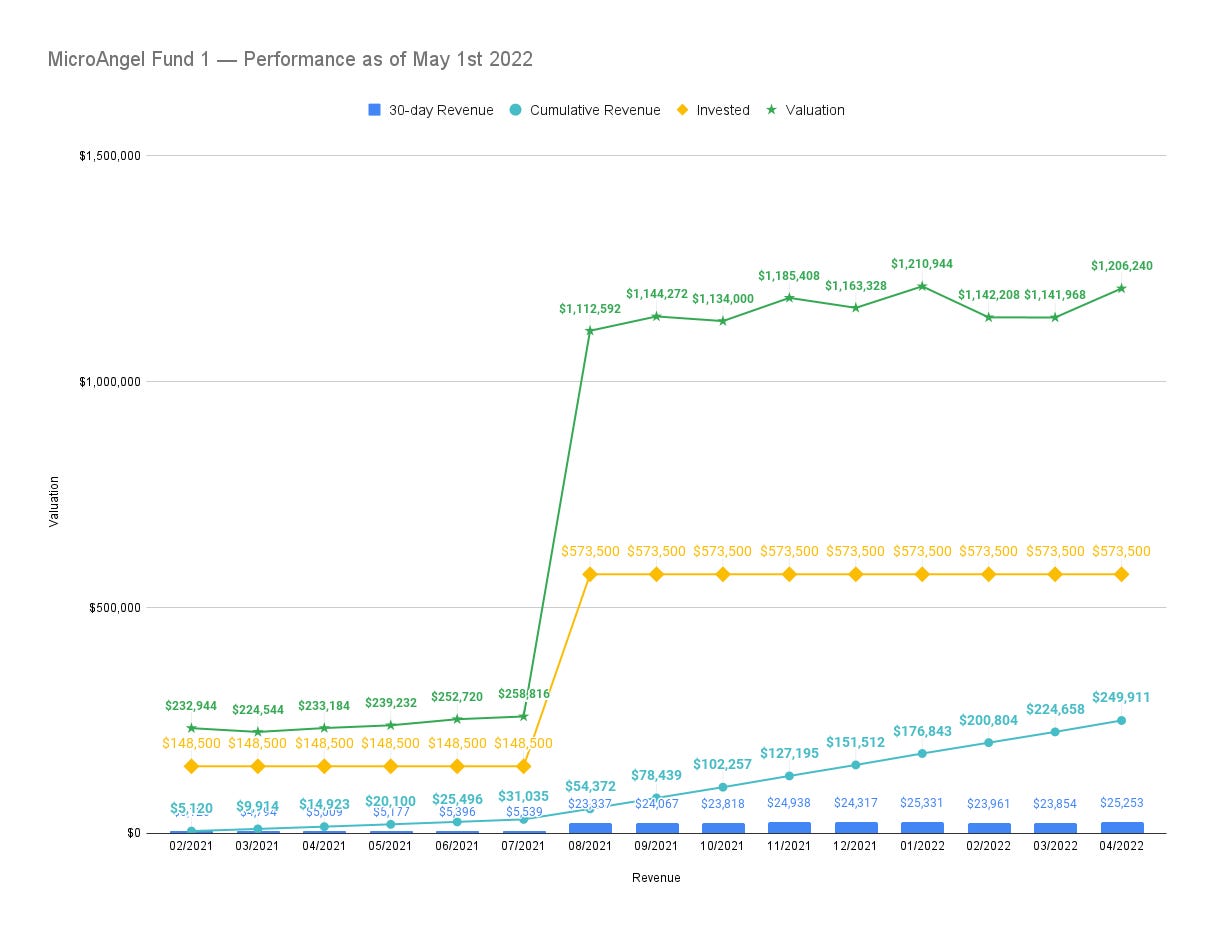

Hey! Eyal from MicroAngel here. Every now and again, I release free deep dives like these to newsletter subscribers. If you get value from them, consider supporting the newsletter so I can continue sharing the journey and my results along the way. Enjoy! MicroAngel State of the Fund: April 2022A quarter million in cash returns, new product improvements, pricing model redesign and a BizDev win. Closing MRR: $25.25kIn the words of Justin Timberlake, it’s gonna be May! We’re closing the books on Month 15 of 24 which means we’re already through 60% of the project’s intended timeline. Things have moved in the right direction this month, with the post-New Year demand slump flipping its head and producing some strong, continued growth for both Reconcilely and Postcode Shipping. With the holidays in the middle, we gave ourselves a bit more flexibility to live life and welcome the first Summer months we could truly enjoy in at least 2 years. I actually did some gardening last weekend! The outdoors have an amazing impact on your body and mind, and that benefit seems to be multiplied when taking care of your own devices. It helps you enjoy the moment and live it fully, which in the grand scheme of things, helps to realign your emotions and regulate your energies. You’ve gotta take the time to live life to recognize what you’re fighting for. And the big contrast between working hard to materialize your life and actually living it acts as the fuel you need to maintain your professional momentum. It’s not so much about taking a step back to take two more forward. It’s about stepping in and out of your zone of value creation so you benefit from the world you help materialize. In that spirit, we enjoyed the holidays but also continued to lay the foundations for Reconcilely’s next stage of growth. As the product surpasses $8k MRR, it’s now clear we have a direct line of sight to $10k MRR and over through a revision of our pricing strategy and mechanisms. Meanwhile, both apps are experiencing positive merchant growth with new all-time highs for active merchants. The systems I’ve built over the past few months are all starting to yield regular results and all in all, we are observing a continued strong pace vis-a-vis the expected vs. achieved growth rate for the portfolio. In the midst of the lull in work, I’ve had the opportunity to start thinking through the future of MicroAngel both as a brand but also as a concept. What this project means to me today is very different than what it represented a year ago, because now I’m interested to scale it beyond myself and to democratize the benefits I’m reaping to other entrepreneurs struggling to get out of the rat race and into full-time entrepreneurship. On to this month’s progress.

Current fund lifecycle stage

Fund Activity

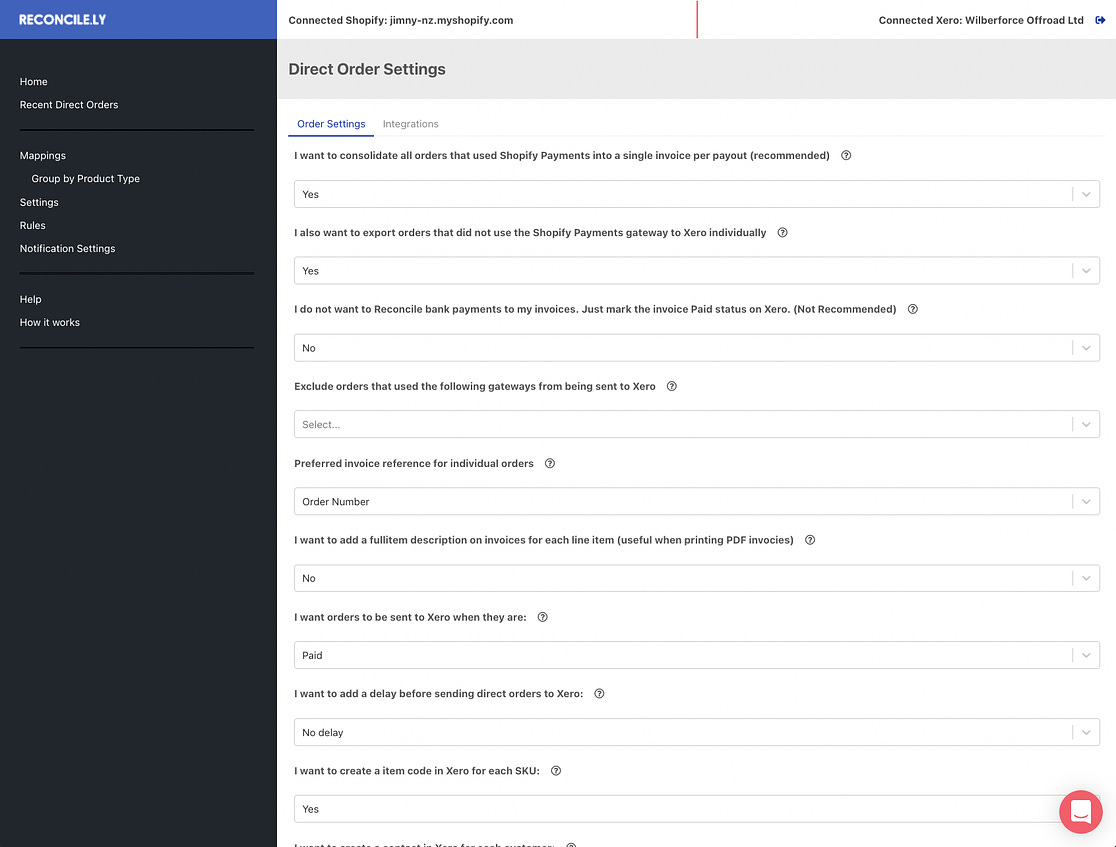

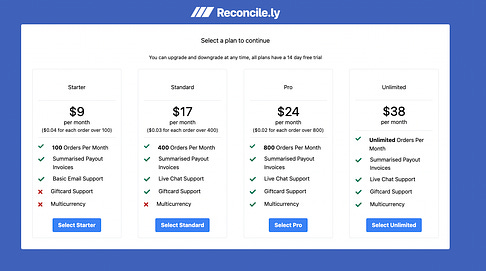

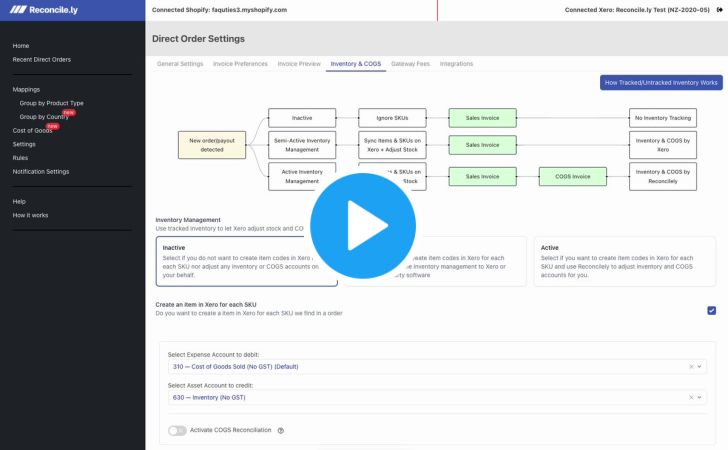

To my surprise, buyer interest in the products has significantly gone up this month, and I took the liberty of having those early conversations with quite a few funds who have varying levels of ambition and vision. While I didn’t necessarily expect to start rolling up early, I have a financial responsibility to the project to produce my expected returns in as little time as I possibly can. In other words, I am likely going to reach my goal by February 2023 provided the current run rate and return rates. We’re headed there. But if I could reap that return today rather than 8 months from now (by selling at the price I’d sell 8 months from now, today), I get a big advantage as I can reroute the proceeds earlier than planned. I’m not focused on exiting right now. I’ve still got so much to build. I’m on the cusp of extracting the first big diamond that I’ve been digging for. It would be really bittersweet to move on from the projects right now. But it also makes it an unbelievable opportunity for the next buyer. There are many levers now ready to be pulled from both product and growth perspectives. Things are in a good place. Content Marketing Since I’ve moved back to product, the content freelancers have continued to produce at a steady clip. Organic clicks have grown nearly 40% since last month, despite the vast majority of the pages not ranking very high and having abysmal CTR from the SERPs. Despite that, it’s deeply encouraging to see things starting to compound, especially within the scope of a limited addressable market vis-a-vis Shopify<>Xero. It’s why we’re focused so intently on delivering integrations moving forward because they enable us to tap directly into organic traffic the volume of which is magnitudes larger than that of the current market we serve through Shopify and Xero. I expect to continue doubling down on content and SEO on the Reconcilely side while laying the foundations for a programmatic SEO project on the Postcode Shipping side, notably to answer the repeatable queries for postcodes specific to a given neighbourhood or city. Product Big product focus this month as I rebuilt the onboarding and UI for one of the most critical parts of the Reconcilely app. I pretty much shelved every marketing project so I could push things over the edge here as it deals with features customers have both asked for and which stand as dependencies in the process of introducing new sales channel and accounting destination integrations. Since the app settings are exposed during onboarding, it was important to redesign and implement them in a way that would be naturally useful, whether in the context of a new customer or if searching for a specific type of functionality without having to reach out to support. The previous iteration of the Settings page, like most of the UI across the app, was dreadful, lol By prioritizing function over form, the Settings page ended up growing into an unruly and inconvenient size, causing a previously simple approach to turn into a mess of options that made it confusing to understand how they would fit and interact with each other. It was a giant wall of on/off switches. It’s a great idea if there are only a few toggles, but becomes completely overwhelming past a number of available options. You can only get so far asking yes/no questions and in many ways, it sells short a lot of the functionality you create. If there’s a feature toggle, it should be descriptive in the way it is implemented and communicative in the way it is designed. This way, users of the product can better understand how each feature contributes to the overall value proposition while benefiting from a user interface that naturally defines what the features are and what they do for the customer. To support a PLG approach, which prioritizes self-service and timely information as much as possible, I reorganized settings into sub-sections and created a new layout that would help surface helpful information given the setting being hovered:   For some time, the app’s interface has been locked into a direction that is incompatible with the idea of having multiple input/outputs. In short, the UI was purpose-built for a Shopify <> Xero use case, and it’s time to refactor it so we can enable more use cases, such as pulling orders from channels other than Shopify or delivering invoices to accounting systems other than Xero. As I redesign different parts of the app’s interface, I have to do so in such a way that those components can behave the same way regardless of which integration is currently active. I designed a new settings page for the inventory management and COGS adjustments features we are soon rolling out. This will be mostly used by merchants in the mid market who don’t want to use Shopify’s inventory management while also not being able to justify a complicated 3rd party tool to get things across. It’ll help merchants understand how to take more control over the inventory management adjustments currently made by Xero. The rest of the app still needs a lot of love, but as I did here, I will refactor as I go now that I’ve established a bit of a design language. The goal isn’t redesign so much as clean up + make it possible to handle other integrations. We made good progress on the QBO side, having made some initial database adjustments, set up the authentication flow and got acquainted with some of the API methods we’ll use to wire everything together. As we finish up the product’s most critical feature releases, which included actually new functionality, the roadmap is looking a lot more stacked on the partnerships and integrations side moving forward. In short, we won’t necessarily create functionality to do new things as much as we will implement integrations to increase the addressable market that Reconcilely can serve. Pricing With the roadmap shifting towards revenue expansion, it will be time to make our first big pass on the pricing model. I’ve got several thoughts as it relates to successful pricing increases, and I’ll introduce some of those here today. For starters, pricing is one of the most fundamentally important things to get right in SaaS. When I bought Reconcilely, it was clear that its strategy was to undercut the competition and to win a slice of the market through pricing. Very quickly, we discovered that merchants don’t mind spending (far) more on their ecommerce accounting provided it is done well and without mistakes that would eat more energy and time. There’s a reason our customers have a high ARPU. Back-office services are a must for every serious store, and the larger you grow, the more complex the job becomes, and the more important it is to get things right. As I kicked off outreach, I ran into an early wall trying to sell to customers outside of Shopify, either due to not supporting their accounting platforms or sales channels, or simply due to features we lacked which made it a show-stopper for them. Feature parity became of strategic importance so that critical marketing channels with a high affinity to our market could realistically be used. It was the proverbial showing up with a knife to a gunfight. Today, there’s a world of difference. We’ve achieved 99% feature parity, but we underserve the market. And the way to fix that is by increasing the places where the market lives, and that explains our product strategy right now. Now that feature parity is non-issue and with big things on the way, increasing ARPU becomes possible by instrumenting changes to pricing that better align customers to the value delivered. At its core, the current model tiers pricing based on a combination of feature locks and capacity limits. There is no free plan — which is another issue entirely affecting customer acquisition — and small stores spend at least $9 per month to get basic functionality (for a small scale store likely only selling locally). I don’t particularly love serving the SMB market because then you get feedback whiplash between them and the larger stores you want to ideally optimize for. And that’s where the improvement juice is. At the moment, Reconcilely enjoys a healthy ARPU around $18.50 per month, driven by the distribution of customers across the existing pricing plans. My goals with the pricing updates are:

To accomplish these goals, this is my strategy:

There’s a lot of baking to do. I’m liable to shelve one or two of the above elements for fear of introducing too many new moving parts at a time. However, when something is well designed and built, it often feels indistinguishable from magic, regardless of how complex the backend systems enabling the magic might be. These changes are intended first and foremost for new customers installing Reconcilely, though they are designed in such a way that MRR will also grow through existing customers. If done right, there won’t be any angry people, our revenue will immediately lift by 20%-50% and we’ll see ARPU growth moving forward as new MRR from new installs take a growing share of the total collected MRR. Agency Partnerships Typically, agency partnerships have a connotation of salesmanship. A good tech partner will enable an agency to sell a new service (using the software) which will create additional value for clients. They don’t care much about things like revenue share because that’s not their core of business. The same holds true for more traditional firms which still fit the agency model. In the case of Reconcilely, that’s accounting firms. I made a change last month that increased my exposure to accounting firms looking to potentially use Reconcilely to service their ecommerce clients. On an app store listing, Shopify apps can define a demo store which presumably demonstrates how the app works and how it will look in your store. Since Reconcilely is a backend tool that doesn’t interact with the store, there is no demo per se. So I decided to populate that button with a Calendly link to a demo and up demos went. To my surprise, 3 of the 5 demo requests I received from the app store were accountants. This unexpected bizdev opportunity ended up creating some solid leads, one of which is confirmed to be moving 10 clients over to Reconcilely at an average ARPU of $38 That call took me just 20 minutes. I ought to pull on this lever. One 20 minute call → 10 new customers → +$4,200 ARR The Danger of Enterprise During the month, we received an RFP from a really big brand operating several Shopify stores and processing as many as 40,000 orders per day. We have many large customers at Reconcilely, but I don’t think any of them do 1.2m orders per month. The DevOps and infrastructural consequences of working with this customer would be pretty devastating, though we could realistically add over $5k in new MRR while creating an entirely new revenue line for Reconcilely focused on serving the mid-market and the enterprise (even in a headless format or through an API). I love the idea of doing that but it would spell doom for our momentum. It’s something I’m pretty much convinced will work though, and it’s the type of play to focus on after executing against the integration roadmap which will increase the addressable market by a lot. Either way, we’re collecting some data for now since we know these types of brands move a little slower. Upon first glance, it looks like we won’t need to touch our product — they want the exact thing we deliver, but at a scale we’ve never done before. So provided we can realistically figure out how to scale our infrastructure to handle that kind of load all day every day on top of our existing load, I don’t see why we wouldn’t do this — and then proceed to immediately build a sales team considering the ACV these types of deals would represent. I’d appreciate your perspective on this! Open Subscription Investigation I’m still mid-investigation with Shopify regarding missing MRR since February. If you’ll recall, I experienced a dip in MRR across February (which I imagined was due to the way billing worked on Shopify). I expected the delta of the dip to appear in March, but it didn’t. Active merchant growth is net positive month on month with no changes to churn and our internal dashboard shows we’re touching $8,200 MRR for Reconcilely despite only seeing 30 day subscription earnings of $7,410. Something is sus. Learnings & Adjustments Jumping back and forth between product and growth is currently a pretty good hustle and flow. I’m able to keep pushing product forward while maintaining a pulse on the needs of the customer and how that should translate into the product or our growth systems. I’m very excited to get close to the carrot we’ve been working for, which is QBO and a supposed doubling of our run rate if all things come together. And I’m equally excited by a deserved raise from our customers as we introduce new pricing that will represent a win-win-win for all parties involved. Because I’m ambitious, I often get discouraged by lack or speed of progress on in a given month, but the zoomed out picture quickly reminds me that things are continuing to head in the planned direction. It’s useless to try making your project into something it’s not. It’s a much easier time making the best out of the project so as to elicit the most possible potential out of whatever iteration you have. I’m looking forward to the next chapters in front of us, and I’m biding my time, maintaining my speed and staying the course on this awesome journey. My vision is to make this 2 year journey possible for any entrepreneur without the need to necessarily operate any products. I want access to outsized cash-on-cash returns without having to commit my time to execute. I may be on to something there, don’t forget to share your thoughts when you have a minute. Catch you again real soon!

You’re on the free list for Micro Angel. If you get value from what you read, consider supporting the newsletter. |

Older messages

Productizing MicroAngel Returns: Part One

Wednesday, April 20, 2022

Where do we go from here? Exploring how to elicit the maximum potential out of the MicroAngel model

MicroAngel State of the Fund: March 2022

Wednesday, April 6, 2022

Doubling down on content, SEO momentum, Shopify billing investigation & COVID time-sink. Closing MRR: $23.80k

MicroAngel State of the Fund: February 2022

Friday, March 4, 2022

New Reconcilely website, reached $200k cash-on-cash, new content and outbound sales process. Closing MRR: $25.5k

MicroAngel State of the Fund: January 2022

Friday, February 11, 2022

One year anniversary, $300K ARR and 30% cash-on-cash milestone, and a focus on growth systems. Closing MRR: $25.37k

MicroAngel State of the Fund: December 2021

Tuesday, January 18, 2022

Seasonal MRR and user acquisition fluctuations, Black Friday + Cyber Monday and deep product work. Closing MRR: $24115

You Might Also Like

Animal Shine And Doctor Stein 🐇

Monday, March 3, 2025

And another non-unique app͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

upcoming analyst-led events

Monday, March 3, 2025

the future of the customer journey, tech M&A predictions, and the industrial AI arms race. CB-Insights-Logo-light copy Upcoming analyst-led webinars Highlights: The future of the customer journey,

last call...

Monday, March 3, 2025

are you ready? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 Dimmable window technology

Monday, March 3, 2025

Miru is creating windows that uniformly tint—usable in cars, homes, and more.

Lopsided AI Revenues

Monday, March 3, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. Lopsided AI Revenues Which is the best business in AI at the

📂 NEW: 140 SaaS Marketing Ideas eBook 📕

Monday, March 3, 2025

Most SaaS marketing follows the same playbook. The same channels. The same tactics. The same results. But the biggest wins? They come from smart risks, creative experiments, and ideas you

17 Silicon Valley Startups Raised $633Million - Week of March 3, 2025

Monday, March 3, 2025

🌴 Upfront Summit 2025 Recap 💰 Why Is Warren Buffett Hoarding $300B in Cash 💰 US Crypto Strategic Reserve ⚡ Blackstone / QTS AI Power Strains 🇨🇳 Wan 2.1 - Sora of China ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⛔ STOP paying suppliers upfront - even if they offer a cheaper price in return!

Monday, March 3, 2025

You're not really saving money if all your cash is stuck in inventory. Hey Friend , A lot of ecommerce founders think paying upfront for inventory at a lower price is a smart move. Not always!

13 Content & Media Deals 💰

Monday, March 3, 2025

Follow the money in media ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📂 EXACTLY how Teachable got the first $1M ARR

Monday, March 3, 2025

Here's what the founder of Teachable, Ankur Nagpal, said about growing Teachable to their first $1M in ARR. Later, they'd sell for $250M! Fall 2013 I was 24 years old and had just moved