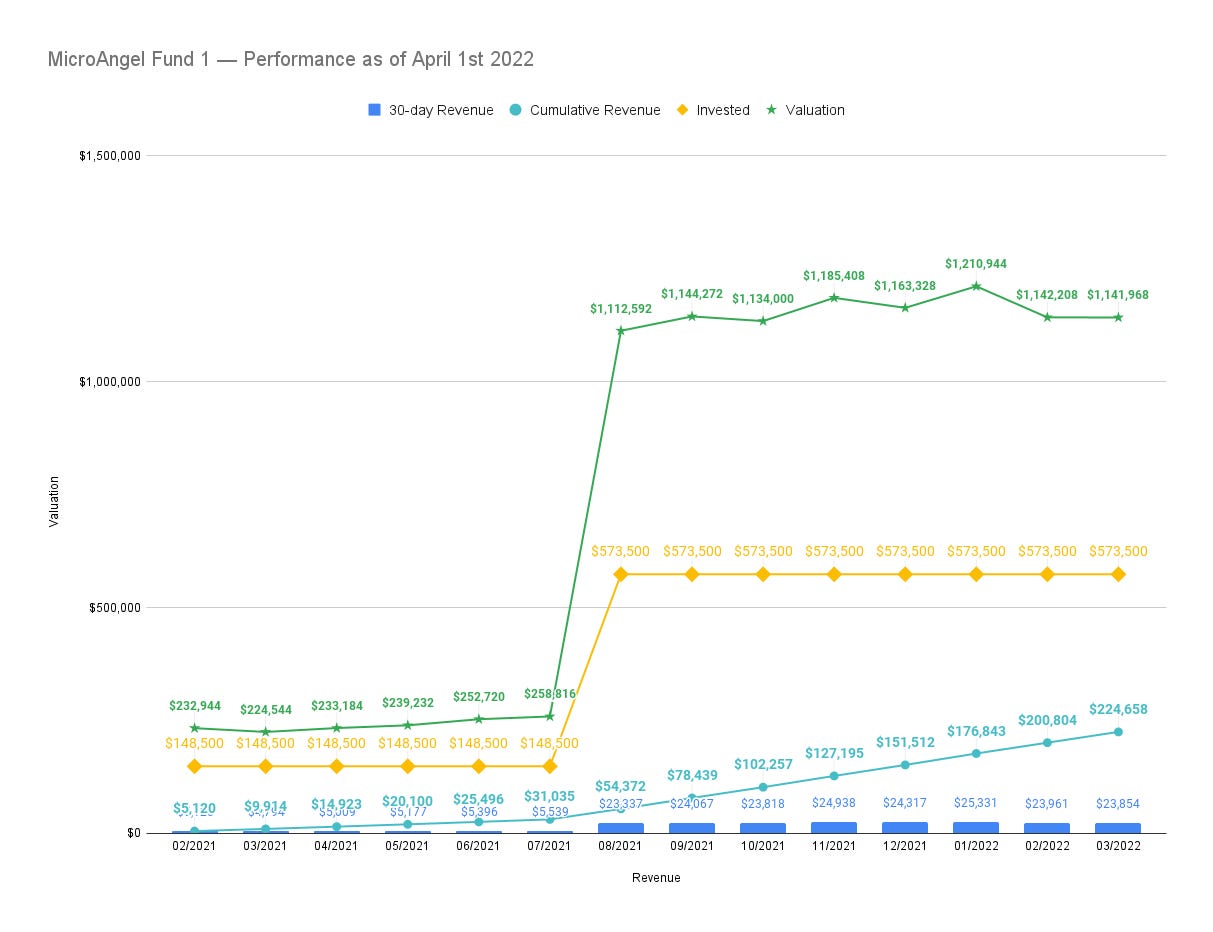

MicroAngel State of the Fund: March 2022

MicroAngel State of the Fund: March 2022Doubling down on content, SEO momentum, Shopify billing investigation & COVID time-sink. Closing MRR: $23.80kGood morning and evening to you, dear friend, and thanks for checking out this month’s report. There are no large headlines this month as two-thirds of it was written off due to COVID making it into my household. I spent the better part of the month wearing PPE to avoid catching it from some family members while simultaneously taking care of other family members. I’m glad we’re out of that miserable stretch of time. I’m also glad the type of businesses I’m operating and the systems I’ve put in place worked very well without any direct involvement during difficult times. The true value of the microangel approach is the luxury of switching between holding and growing based upon the unique circumstances made possible by the realities of your life. As I look back at the origin of this story, and the frustrations foreshadowing the genesis of the fund, I know I chose to experiment with a new entrepreneurial approach to solve a very clear 0 to 1 problem. But today I also recognize the context within which my journey started. The deeper Why behind a buy or hold strategy. With a young child and another on the way, entrepreneurs tend to choose a bridge-job to provide the financial and risk stability needed while raising a family (and enjoy the process). There’s no doubt in my mind that the primary non-financial advantage I’ve enjoyed, unbeknownst to me at the start of this journey, is the ability to actually focus on family without sacrificing career momentum. I get to stay close, very close to the game, play at a pace that fits the ever-changing context of a household raising young children, while creating enough upside and compounding momentum to give myself a better set of tools to succeed than I’d have after a cold-start. There are so many things you can tackle or may need to solve. If your goal is avoid that which is strong and strike that which is weak, then you may be faced with personal challenges that impede your ability to succeed as a microangel. Just as you should have an initial nest egg to make a first acquisition, your own state of mind should be compatible with the journey upon which you are embarking. I saw my momentum take a huge hit when my first child was born so I figured the impact would be multiplied with two or three in tow. And it made sense to shift my career into a mode that allows me to go as fast or as slow as life commands it. Despite a tepid month on the ops side, I did get started strong by doubling own on what has been working and beginning a gradual reintegration into product. My work was suddenly interrupted by the virus on the second week of the month and we’ve been quarantined ever since. This is the state of the fund, and not the State of the Mind, so let’s jump into some of the results, discoveries and progress items for the month. Current fund lifecycle stage

Fund Activity

A weird revenue gapFor the past 30 or so days, I’ve been trying to solve a confusing gap in between our internal MRR dashboard for Reconcilely and billed revenue at the Shopify payout level. In March, we received the payouts for the app revenue as usual. But I noticed a steep decrease that was unjustified vis-a-vis the churn rate and installation velocity of the month prior. Couldn’t explain it, and it smelled fishy. I know that, regrettably, Shopify payouts are paid out on a 30-day rolling basis. That means that, inevitably, when the special month of February comes around, it breaks the alignment of the date ranges and makes reconciliation (pun intended) a nightmare. So I had initially chalked up the gap in revenue to the weird month of February. I say weird because I was seeing a -10% gap. Not nothing. Realistically, each day I should be collecting 3%-5% of the month’s MRR. So to see a -10% gap for 2-3 days of action seemed to make sense, and I forgot about it. When I looked at the numbers this month, I was surprised MRR had only gone up by about $250, which is about the norm. Over the month, I noticed a clear acceleration in installs, deceleration of uninstalls and about $250 in new MRR signed across the month (through the internal dashboard). Our active merchant total increased, and despite some of those installs still being on their trial, there was very little churn. March has been an up month. So I accounted for that $250 growth. But where the hell was the revenue from February?... Keep reading this post and get 7 days freeBecome a paid subscriber of Micro Angel to keep reading and get 7 days of free access to the full post archives. A subscription gets you:

|

Older messages

MicroAngel State of the Fund: February 2022

Friday, March 4, 2022

New Reconcilely website, reached $200k cash-on-cash, new content and outbound sales process. Closing MRR: $25.5k

MicroAngel State of the Fund: January 2022

Friday, February 11, 2022

One year anniversary, $300K ARR and 30% cash-on-cash milestone, and a focus on growth systems. Closing MRR: $25.37k

MicroAngel State of the Fund: December 2021

Tuesday, January 18, 2022

Seasonal MRR and user acquisition fluctuations, Black Friday + Cyber Monday and deep product work. Closing MRR: $24115

MicroAngel State of the Fund: November 2021

Friday, December 10, 2021

Cash-on-cash wins, shipping product improvements, removing zombie accounts and a brand refresh. Closing MRR: $24.7k

How to plan and implement a customer data tracking strategy for your Micro-SaaS

Tuesday, November 16, 2021

From start to finish, learn how I'm tracking customer key events and behaviour across the portfolio

You Might Also Like

Animal Shine And Doctor Stein 🐇

Monday, March 3, 2025

And another non-unique app͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

upcoming analyst-led events

Monday, March 3, 2025

the future of the customer journey, tech M&A predictions, and the industrial AI arms race. CB-Insights-Logo-light copy Upcoming analyst-led webinars Highlights: The future of the customer journey,

last call...

Monday, March 3, 2025

are you ready? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 Dimmable window technology

Monday, March 3, 2025

Miru is creating windows that uniformly tint—usable in cars, homes, and more.

Lopsided AI Revenues

Monday, March 3, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. Lopsided AI Revenues Which is the best business in AI at the

📂 NEW: 140 SaaS Marketing Ideas eBook 📕

Monday, March 3, 2025

Most SaaS marketing follows the same playbook. The same channels. The same tactics. The same results. But the biggest wins? They come from smart risks, creative experiments, and ideas you

17 Silicon Valley Startups Raised $633Million - Week of March 3, 2025

Monday, March 3, 2025

🌴 Upfront Summit 2025 Recap 💰 Why Is Warren Buffett Hoarding $300B in Cash 💰 US Crypto Strategic Reserve ⚡ Blackstone / QTS AI Power Strains 🇨🇳 Wan 2.1 - Sora of China ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⛔ STOP paying suppliers upfront - even if they offer a cheaper price in return!

Monday, March 3, 2025

You're not really saving money if all your cash is stuck in inventory. Hey Friend , A lot of ecommerce founders think paying upfront for inventory at a lower price is a smart move. Not always!

13 Content & Media Deals 💰

Monday, March 3, 2025

Follow the money in media ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📂 EXACTLY how Teachable got the first $1M ARR

Monday, March 3, 2025

Here's what the founder of Teachable, Ankur Nagpal, said about growing Teachable to their first $1M in ARR. Later, they'd sell for $250M! Fall 2013 I was 24 years old and had just moved