Bitcoin, Millennials, and the American Dream

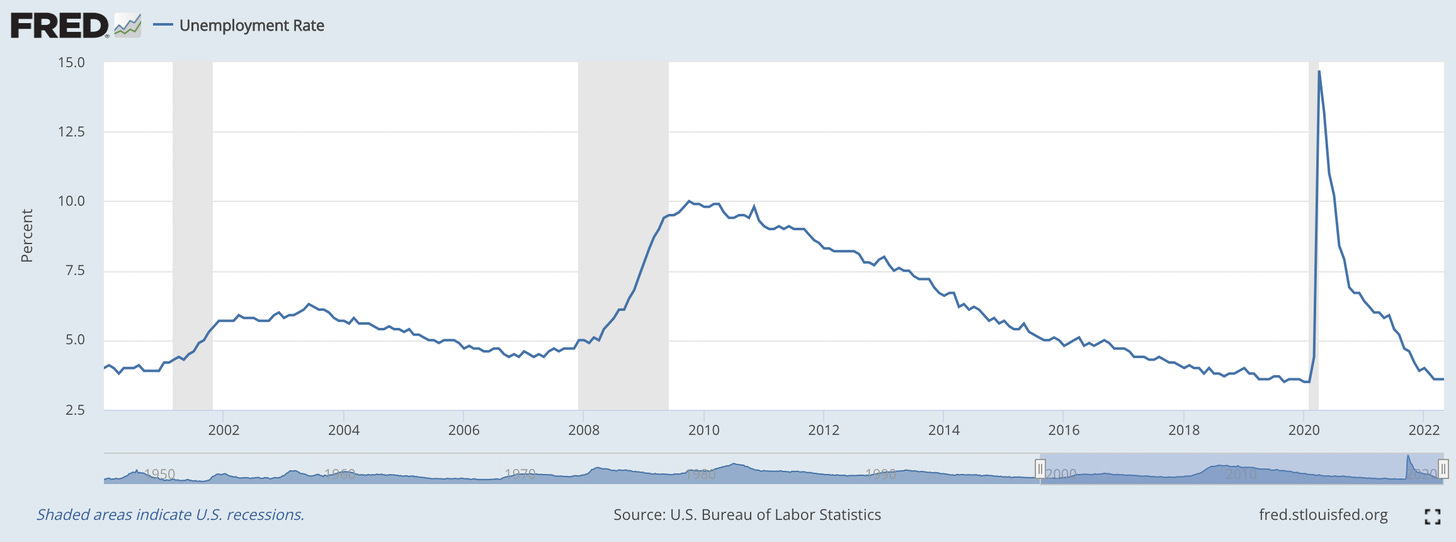

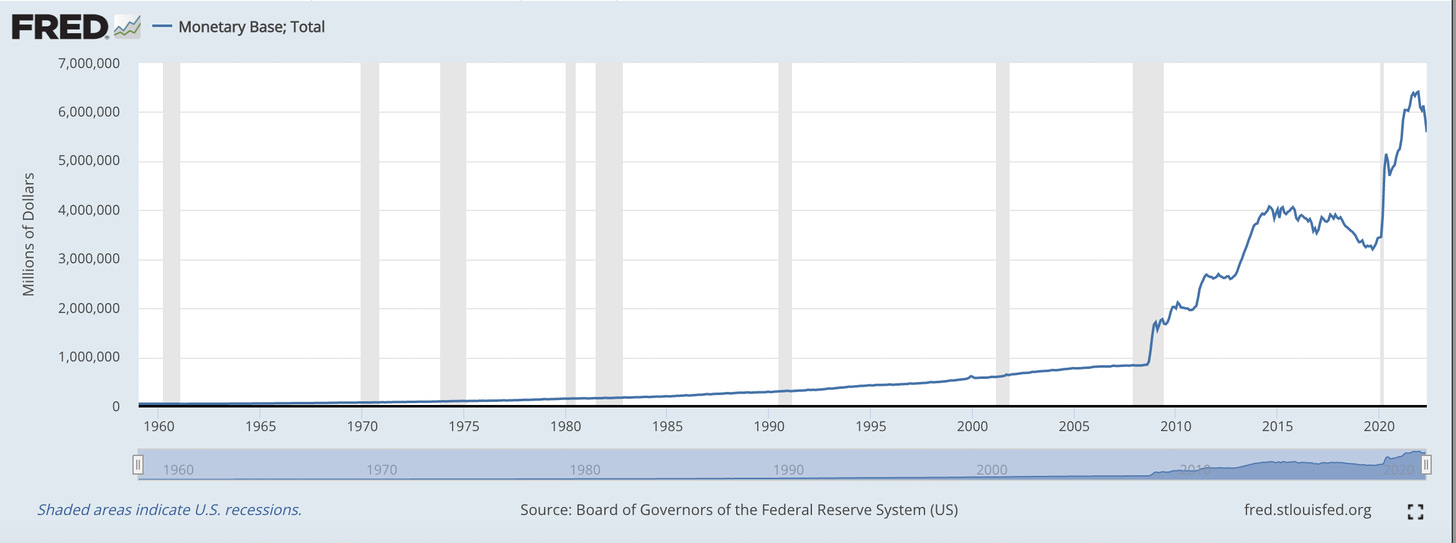

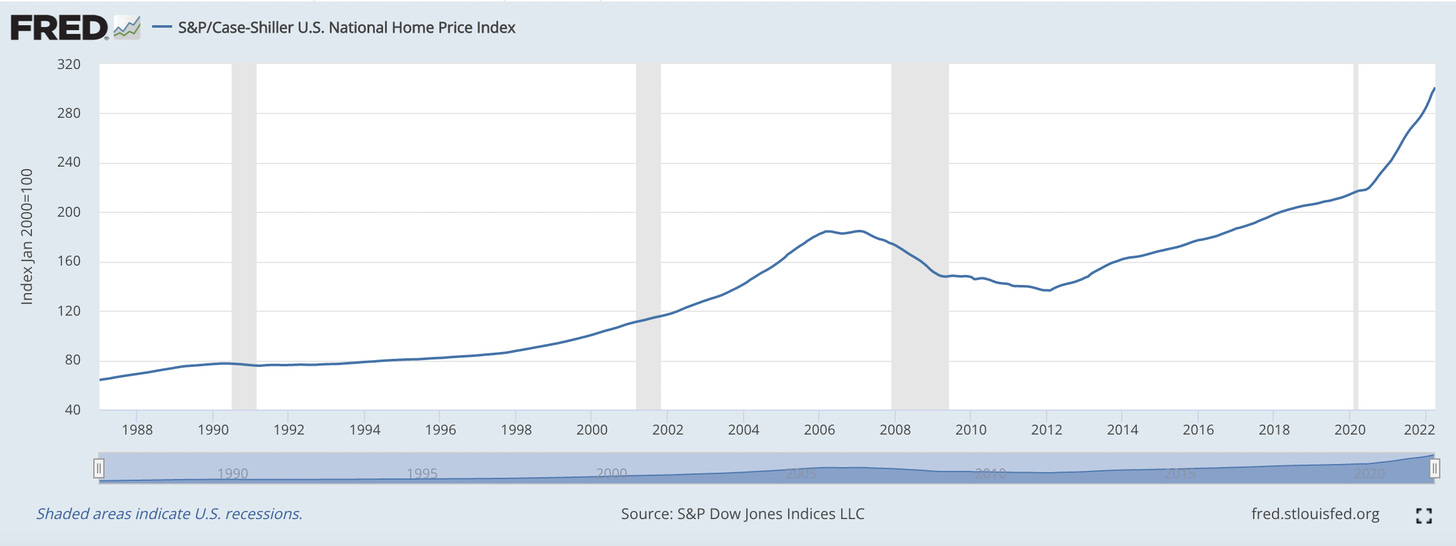

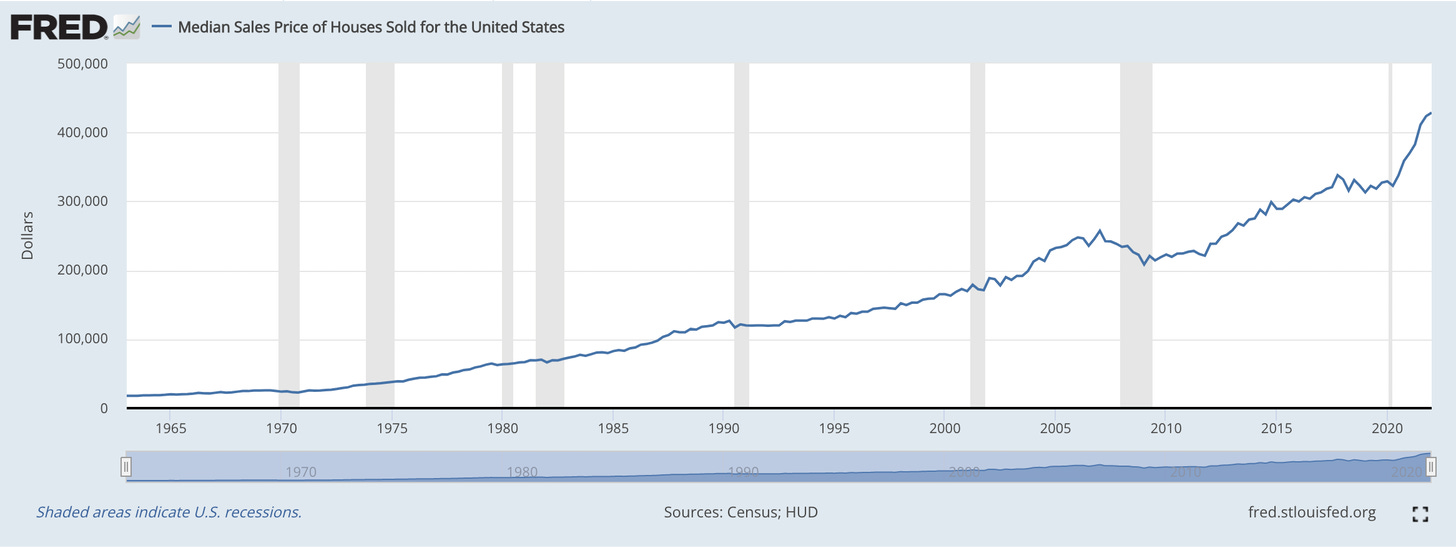

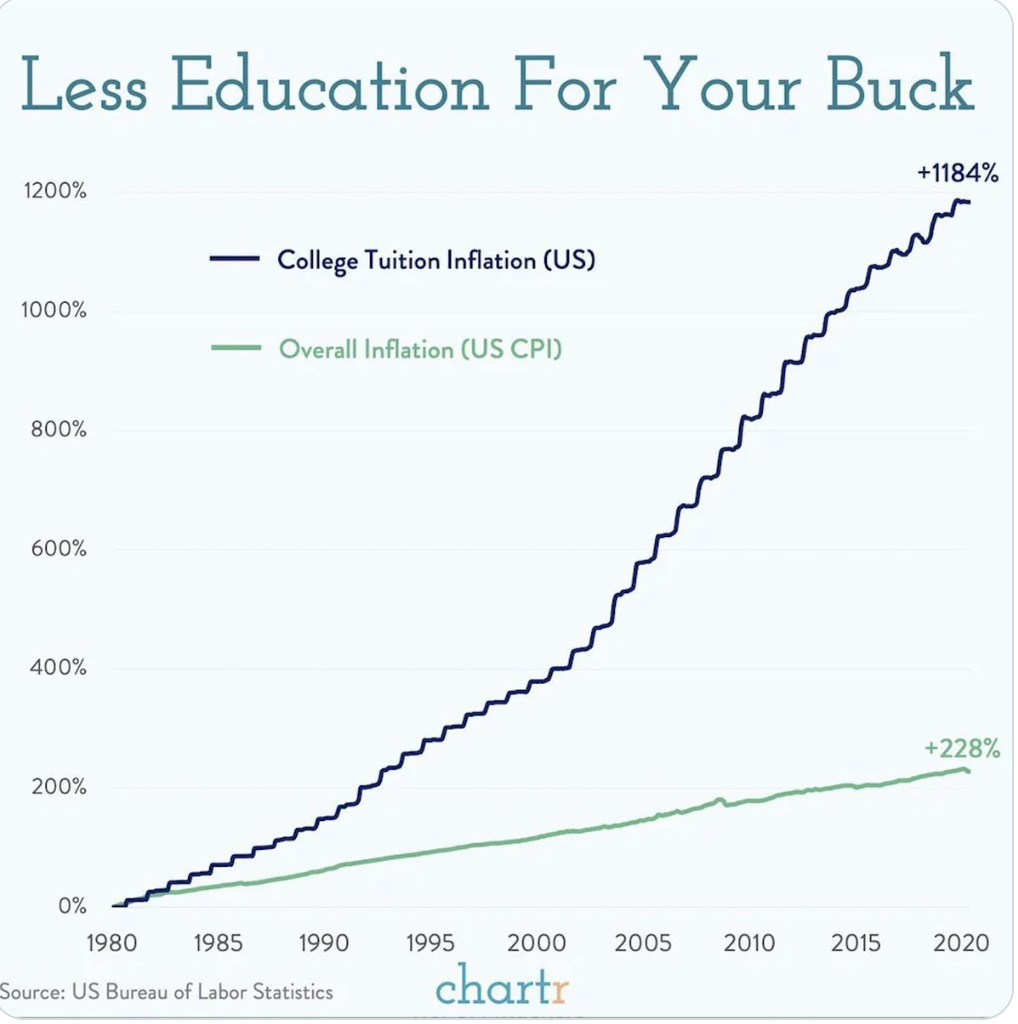

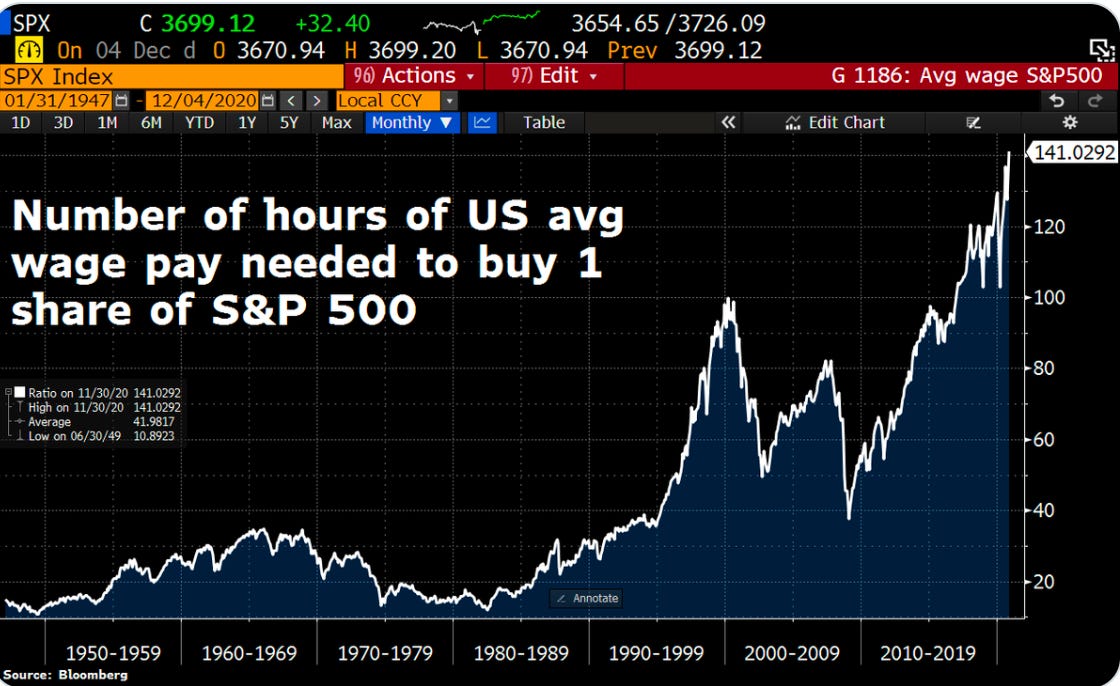

To investors, Below is a guest post from Logan Bolinger, a practicing attorney and the founder of Think Bitcoin LLC, a company devoted to Bitcoin education. Logan publishes a free, biweekly newsletter on Substack and is a contributor to Bitcoin Magazine. Since this is the time when we celebrate America and what America can/should mean, I want to spend some time talking about the mythical, ever-receding idea of the American Dream, its feasibility (or lack thereof) for millennials (and subsequent generations), and how it might be reclaimed through Bitcoin. I’m going to argue that the investing behavior of millennials has, unbeknownst to most of us, been almost entirely conditioned by monetary policy, which has created an illusory sense of safety and an illusory sense of opportunity with respect to markets. A major part of the American Dream (at least in my opinion) is the ability to accumulate and pass down generational wealth (or at least the seeds of generational wealth). The monetary policy of the last quarter century has made this dream exceedingly difficult to achieve in real terms, though it has simultaneously made it appear easier than ever. I was in college when the Great Financial Crisis of 2007-2009 happened. I remember returning to campus my sophomore year to find several classmates conspicuously absent. Due to the financial hardship wrought upon their families by the crisis, they could no longer afford to be enrolled. At that time I was privileged enough to not be totally aware of the scope and extent of the economic devastation all around me. It was not until much later that my parents recounted to me what it felt like to watch accounts get shellacked. And, believe me, I am acutely aware of how lucky and, yes, privileged I was to not directly, intimately feel the grave effects of all this in real time, as so many in my generational cohort did. But one way or another all of us millennials have been affected by the Great Financial Crisis. Many of us graduated from college or graduate school during or soon after the GFC and embarked upon our professional lives in a particularly fraught labor market. Those of us who were already investing at that time saw our portfolios crater. Those of us who purchased houses shortly before the crash saw the value of those houses plummet. But the Fed stepped in and embarked on a historic course of quantitative easing which, eventually, led to a recovery. It wasn’t a 15-year recovery, there were no “lost” decades, and a world war was not required to pull us out of the rut. Out of this recovery emerged the modern personal finance movement, including the FI/RE movement. J.L. Collins’ Simple Path to Wealth, an almost biblical text in the FI/RE community, was published in 2016. Countless imitators published knock-offs. A deluge of personal finance podcasts came online. And the underlying premise of all this content was the idea that the stock market always “recovers.” The same movement was supercharged after March of 2020 when everyone was stuck in their homes watching the stock market magically return to pre-March levels by mid-August, after which it accelerated to the upside throughout 2021. The lesson here seemed clear: the stock market always recovers. And many of the folks who were cooped up inside due to COVID restrictions took to social media to share this lesson with others, sell ebooks, and offer 1-on-1 coaching. I’ve always found the idea that the stock market “recovered” after 2008 and, especially after March of 2020, to be an abuse of the word “recover.” An injured athlete recovers from a knee injury when the knee is no longer symptomatic; not when it’s injected with cortisone to mask said symptoms. Between 1913 and 2008, the Fed increased the money supply gradually from $5 billion to $847 billion. These were comparatively steady, incremental increases. Between 2008 and 2010, the Fed printed $1.2 trillion, doubling the monetary base and doing a century’s worth of money-printing in two years’ time. This is how the market “recovered.” The money-printing after March of 2020 made the 2008-2010 infusions look paltry and slow by comparison. Much too often this monetary policy background gets obfuscated in the millennial discourse about resilient stock market action, inevitable recoveries, and the unstoppable success of American corporations. If you’re unaware of this background, then the logical and rational conclusion is that one should buy any and all dips because every single dip is and ever shall be brief and temporary. Couple this with an acute awareness of the dollar’s ever-diminishing purchasing power and you have the ostensibly pretty bulletproof pillars upon which much of modern personal finance has been built. The dollar loses value and the stock market, even through calamities like the Great Financial Crisis and the COVID crash, always recovers and always creates predictable, reliable wealth. Therefore, one ought to keep as little cash as practicable and invest the rest in the markets. But this sense of security and opportunity is far from safe or guaranteed, nor is it without negative downstream effects. As former Kansas City Fed President Thomas Hoenig has said, the effects of aggressively accommodative monetary policy materialize with “long and variable lags.” And that’s what’s currently happening. As Preston Pysh, Jeff Booth, and others have said, when the money isn’t scarce, the things that people actually value and use to store value become scarce and more expensive. When interest rates are kept too low for too long and quantitative easing is pumping historic amounts of new dollars into the system, those dollars have to go somewhere. They flow into assets and drive asset inflation. When interest rates are kept too low for too long and quantitative easing is pumping historic amounts of new dollars into the system, those dollars have to go somewhere. They flow into assets and drive asset inflation. We get the now quite familiar and increasingly truncated boom/bust cycle, with each boom requiring more assistance from the Fed, which devalues the dollar more every time, and makes actually scarce things more expensive. Millennials are trying to win a game that is inherently rigged against them. College is not getting any cheaper. Monetary policy is making houses and the stock market exorbitantly expensive. And wages simply cannot and will not keep up with the loss of purchasing power of the dollar. Many millennials are turning to index funds, blind to the devaluation of the dollar required to drive stock market prices ever higher. These folks actually have a lot in common with Bitcoiners in terms of perspective and strategy, and I think it’s worth continually reaching out to this cohort to cultivate a dialogue about Bitcoin. Both index fund enthusiasts and Bitcoiners are long-term investors. The former believe, long-term, that the stock market will always go up at 7-10% a year, which inherently includes the belief that the Fed will continue to run monetary policy in a way that ensures this long-term outcome. The latter believe that if the Fed does, in fact, do this it’ll eventually cause a crisis it cannot fix. Bitcoin is a life raft out of a failing system. It is also a path to wealth in the new system that will emerge out of the breakdown of the current one. Millennials have the misfortune of being the probably the penultimate generation of our current post-1971 monetary order. But they also have what no generation before them has had: the opportunity to opt out of it and into a new, emergent order, one in which the moribund American Dream may live again. Hope you enjoyed this piece by Logan Bolinger, a practicing attorney and the founder of Think Bitcoin LLC, a company devoted to Bitcoin education. Logan publishes a free, biweekly newsletter on Substack and is a contributor to Bitcoin Magazine. -Pomp If you are not a subscriber of The Pomp Letter, join 225,000 other investors who read my personal opinion on finance, technology, and bitcoin each morning. SPONSOR:Valour is the first and only publicly traded company built to give investors direct exposure to the rapidly growing space of decentralized finance (DeFi). The company provides simplified, trusted access to crypto, decentralized finance and Web 3.0 investment opportunities. Institutions and investors can gain diversified, secure, compliant, and easily tradable access to a diversified set of industry-leading equity products and protocols, through a single stock purchase on a regulated exchange. Currently listed on U.S. (OTC: DEFTF) and Canadian (NEO:DEFI) exchanges. For more information or to subscribe to receive company updates and financial information, visit https://valour.com/ Dylan LeClair is the Senior Market Analyst at UTXO Management, a digital asset fund investing in the analog to digital transformation of money and the emergent financial system. In this conversation, we discuss why miners are selling their Bitcoin, how the fed is destroying demand, and where the Bitcoin & Crypto industry currently stands after weeks of market crashes and failing crypto companies. Listen on iTunes: Click here Listen on Spotify: Click here Podcast SponsorsThese companies make the podcast possible, so go check them out and thank them for their support!

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You’re a free subscriber to The Pomp Letter. For the full experience, become a paid subscriber. |

Older messages

Podcast app setup

Saturday, July 2, 2022

Open this on your phone and click the button below: Add to podcast app

Should We Brace For Higher Unemployment?

Friday, July 1, 2022

Listen now | To investors, The unemployment rate in the United States is sitting near historic lows. This is impressive, especially post-COVID chaos, because it took nearly a decade to reach the ~3.5%

Bitcoin is a hedge for loose policy, not inflation?

Wednesday, June 29, 2022

To investors, The number one question I am being asked right now by many of you is related to bitcoin as an inflation hedge asset. I thought it would be interesting to present a nuanced response from

Podcast app setup

Tuesday, June 28, 2022

Open this on your phone and click the button below: Add to podcast app

Podcast app setup

Tuesday, June 28, 2022

Open this on your phone and click the button below: Add to podcast app

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these