Jul 7: Macro conditions hit Entain online

Jul 7: Macro conditions hit Entain onlineEntain trading update, US regionals analyst update, US online preview, Flutter and NeoGames analyst updates +MoreGood morning. In today’s edition:

Entain H1 trading update

Macro troubles: Active customer numbers were up 60% vs. pre-Covid levels, retail performed better than expected and sequential NGR was up, but the “weaker macro-economic environment” was reducing spend levels and “moderating overall online growth versus our previous expectations”, said Entain. CFO Rob Wood saying European markets were the most affected by macro conditions.

Quarterly improvements: Wood said the group expects to see improved performance throughout the remainder of the year as main sports (European football and NFL) return from Q3.

Retail therapy: While online performance suffered in Q2, notably in the UK where it was down 15% due to affordability measures, retail performed well. Wood said this was down to the group “benefiting from outcompeting on the high street and taking market share”.

Affordability impact: Commenting on the implementation of affordability measures, CEO Jette Nygaard-Andersen said they had led to vast increases in “behavioral monitoring, real time data capture and bespoke or hyper-personalized data. It’s a part of our industry as we move forward”.

PoC tax raise: New South Wales in Australia is set to increase its point of consumption tax from 10% to 15% and Wood said this would cause a “£35m EBITDA impact pre-mitigation”. Mitigation efforts will bring the figure to “around half that” but Wood urged caution with regard to increasing margins through higher overrounds.

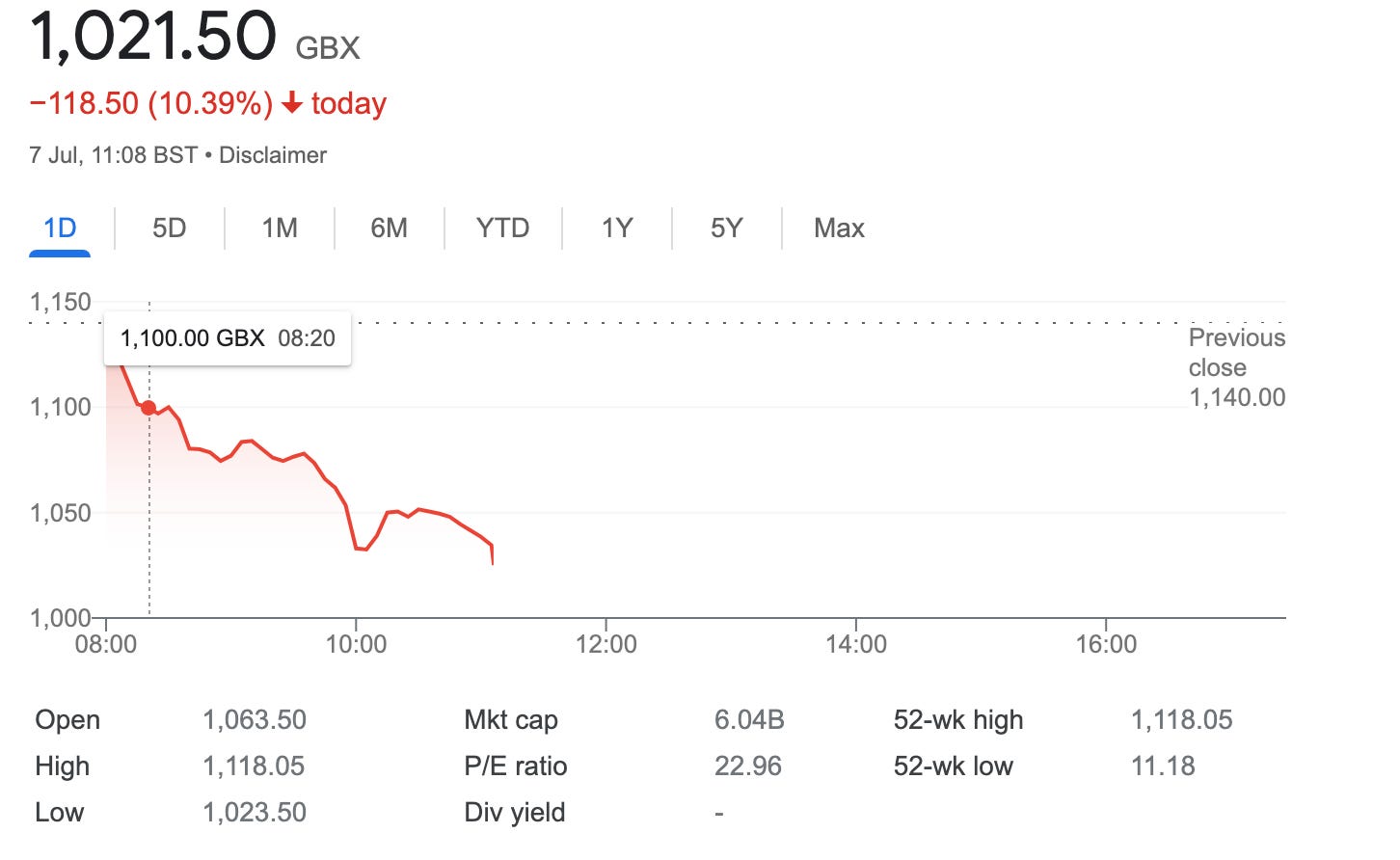

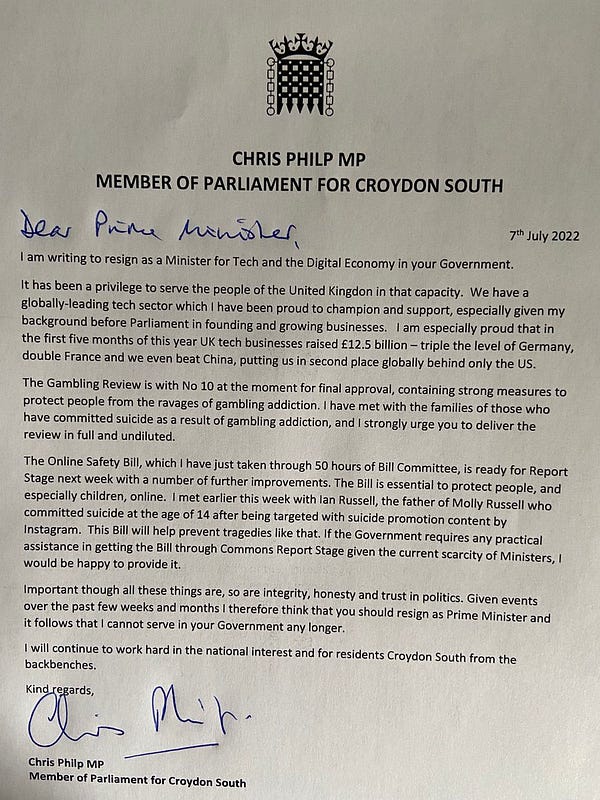

Market reaction: The numbers did not have a positive impact Entain’ share price, it was down 10% at pixel time. **Sponsor's message: Spotlight Sports Group (owned by Exponent Private Equity) is a leading technology, content and media business specialising in sports betting. The company has released its second annual sports betting industry research report. The 2022 edition of ‘BetTech Ecosystem’ has been expanded by more than 60% with the visual now containing seven new sub-segments and 127 new suppliers. Click here to download the full research report and visual. For more information visit: spotlightsportsgroup.com Breaking news - Boris Johnson to resignBoris Johnson has announced that he will resign as Prime Minister following numerous calls from ministers and Cabinet colleagues for him to step down. The BBC reports that Johnson will stay in post until the autumn to allow for a Tory leadership contest to take place. UK gambling minister resigns: Chris Philp, Minister for Tech and the Digital Economy with responsibility for overseeing the UK gambling White Paper, announced his resignation earlier this morning.

Government meltdown: Around 50 government ministers and parliamentary aides have resigned in the past 24 hours as Johnson battled to save his scandal-ridden premiership. White Paper doubt: Johnson’s announcement casts further doubt on when the UK gambling White Paper will be published. Further reading: The Guardian on why the White Paper recommendations may not be implemented “in full and undiluted”. US regionals analyst updatesQuake warning: Analysts at Roth Capital suggest “early cracks are starting to form in broader gaming demand” in US regional gaming “signs of demand softening” in the last week of May and early June.

Priced in: The team adds, though, that such a scenario is already priced in and that free cash flow yields are above previous dips in the economic cycle.

Small canary spotted: The team at Macquarie have also looked at Regional prospects. Noting that May GGR was 11% up on May19 by flat YoY they pointed out that slot free-play was up 8% YoY, outstripping the YoY GGR growth and “potentially being a small canary in the coal mine”.

Hattrick: Lastly, the Wells Fargo team analyzed the data from 17 regional markets for June and found that GGR declined 5.9%, marking the third consecutive MoM decline with May at minus 4.2% and April at minus 2.2%.

US online previewFanatical: Looking ahead to the Q2 results, the analysts at Roth speculate that the ongoing pullback in promo spend - led particularly by Caesars - could be upset should a new entrant such as Fanatics cause another wave of across-the-board spending.

Tip-ping point: Noting that a rumored deal with Tipico would only bring market access to four states, the Roth team speculate that a further tie-up with Rush Street UInteractive could bring the necessary wider access.

Flutter analyst previewSpit and polish: The team at Jefferies said it expects a “lackluster update” when Flutter publishes its H1 results in August saying it expected H122 revenues of £3.19bn and EBITDA of £464m. It expects the upcoming UK white paper reforms to cause ~£30m of EBITDA impact or c.3%.

Deutsche Bank for its part forecast FY22 EBITDA of £1.015bn and said license delays in the Netherlands would cause monthly hits of £5m EBITDA. Further headwinds include tax rises in Australia in the state of New South Wales and licensing delays in Brazil. Italian job: Jefferies said the £1.6bn Sisal acquisition should complete in late August but is two months later than consensus and is expected to cause a c£35m EBITDA timing headwind. No drag: Market share data for FanDuel in the US remains strong and profitability is expected in FY23, ahead of any potential California legalization.

Save the date: Jefferies will host a conference call with FanDuel CEO Amy Howe on July 14. NeoGames analyst updateAnalysts at Macquarie noted that having completed the deal for Aspire, NeoGames now offers a “complete offering” across ilottery, sports-betting and igaming.

DatalinesMaryland: GGR came in at $162.7mm for June, up 0.8% YoY and a 13.9% rise vs. June19. For 2Q22, GGR was up 3.3% YoY and up 16.3% versus 2Q19. Maryland Live (~34% market share) generated $56m, down 4.2% YoY. NewlinesFL Entertainment, the group that resulted from the Betclic-Banijay merger and its subsequent merger with the SPAC Pegasus Entrepreneurial Acquisition, has listed on the Euronext Amsterdam exchange. The group listed with an enterprise value of €7.2bn, Betclic has issued FY22 revenue guidance of €850m and EBITDA of €200m. Shut up shop: Macau’s SJM Grand Lisboa Casino will close until at least July 11 after 13 members of staff tested positive for Covid19. Cases have risen to 1,087 as of Wednesday. Wynn Macau: Ian Coughlan will leave his role as president of Wynn Resorts’ Wynn Macau in February. Meanwhile, Wynn Macau COO Ciaran Carruthers is set to join rival Crown Resorts as CEO. This is a Lo: Meanwhile, Suncity - the junket run by now arrested Alvin Chau - has been taken over by director Andrew Lo who now claims he owns 75% of the firm. Suncity has applied for the resumption of trading in its shares. DraftKings: Ad Age reports that DraftKings was the eighth highest spender on national radio ads in the US last year spending $26m, based on data from Kantar. It was the only gaming operator in the top 10. IGT has completed its €160m cash acquisition of iSoftBet. The transaction enables IGT to double its PlayDigital content library to around 225 proprietary games. FansUnite began trading on the Toronto Stock Exchange Wednesday under ticker FANS, closing at 25 Canadian cents. What we’re readingThe Huddle Up newsletter on why a ban on gambling shirt sponsorships in the English Premier League has ramifications for the US. On socialCalendar

Contact us

If you liked this post from Earnings+More, why not share it? |

Older messages

Jul 4: 888’s debt sale hits trouble

Monday, July 4, 2022

888 debt sale struggle, Las Vegas analyst updates, the shares week, startup focus - Sports Gambling Guides +More

Jul 1: Weekend Edition #53

Friday, July 1, 2022

OpenBet price cut, Nevada May, Macau June, offshore crackdown call, sector watch - tokens +More

Jun 29: UK set for slot stake limits

Wednesday, June 29, 2022

UK white paper rumors, Bally sells RI casinos, new sector coverage, Web 3 igaming analysis, Entain analyst update +More

Jun 27: Gaming stocks stage a rally

Monday, June 27, 2022

The shares week, New York weekly data, Las Vegas analyst update, startup focus - ParlayBay +More

Jun 24: Weekend Edition #52

Friday, June 24, 2022

Fanatics/Tipico rumors, Bally legal threat, Jackpot.com funding news, sector watch - streaming, US gaming update +More

You Might Also Like

How This "1 PAGE" Website Makes $21,000/Month!

Wednesday, January 15, 2025

I just uncovered a website that is just a single page, and get this...it's making over $21000/month! In my video today, I'm going to reveal this website, how its getting traffic, and how its

$1,654 in DAILY sales 😮 (Beta-Tester results + NEW system)

Wednesday, January 15, 2025

This needs to be seen to be believed View in browser ClickBank Hey there, This coming Sunday, I highly recommend attending this private event because you'll be shown something brand new. Here's

Founder Weekly - Issue 669

Wednesday, January 15, 2025

January 15, 2025 | Read Online Founder Weekly (Issue 669 January 15 2025) In partnership with Where tier-one VCs get their news 📰 Get smarter about venture capital. 5x / week <5 minutes / day 15000

Building AI Agents the Easy way

Wednesday, January 15, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Bagel Day, Reader! Do you like yours sweet, savory, or plain? In

Are you a Chaos Coordinator? It's one of the top gifts on Amazon

Wednesday, January 15, 2025

Trending Products on Amazon This Week For the week of Monday, January 13 to Sunday, January 19 Welcome to this week's edition of the hottest trending keywords and products on Amazon over the last

The Market Is Pushing Asset Prices After Inflation Report — But Should It Be?

Wednesday, January 15, 2025

Listen now (2 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

When Video Matters And When It Shouldn't

Wednesday, January 15, 2025

Humans, it seems, like to be all or nothing on things. It's a Twitter-killer or a Google-killer. Not here's another way to access content or do things. It's all or nothing. And that's

😎Wake up, babe. State of Marketing just dropped.

Wednesday, January 15, 2025

Data and insights from 1.4k marketers globally View in browser hey-Jul-17-2024-03-58-50-7396-PM The webcomic XKCD once estimated that, on average, there are 10000 people hearing about something “

VC climate-tech funding falls for 3rd year

Wednesday, January 15, 2025

PE's comeback hits a speed bump; meet Europe's new crypto unicorn; Macquarie inks $5B data center partnership Read online | Don't want to receive these emails? Manage your subscription. Log

🦅 We're rescheduling Jesse Pujji's masterclass

Wednesday, January 15, 2025

It will be in March ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏