DeFi Rate - This Week In DeFi – July 8

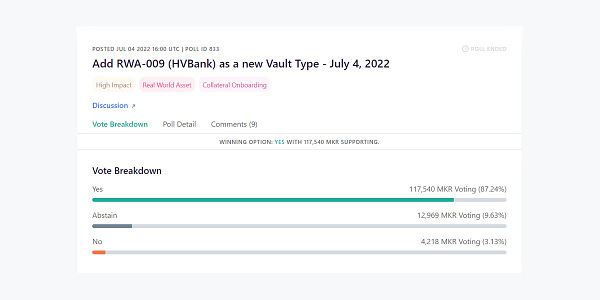

This Week In DeFi – July 8This week, Aave looks to launch a stablecoin, Shiba Inu is expanding its ecosystem and MakerDAO lends to a legacy bank.To the DeFi community, This week, Aave Companies has submitted a proposal to the Aave governance forum for the creation of a new stablecoin, called GHO. The GHO stablecoin would be over-collateralized in a similar fashion to Maker’s Dai, with users being able to mint the token against assets they have supplied to the Aave protocol. Assets backing GHO would continue to earn yield while being used as collateral. Aave Companies says the vision behind the stablecoin would be to push adoption through Ethereum Layer-2 platforms.   Shiba Inu has detailed several new elements to be launched within its ecosystem, including new details on its own “SHI” stablecoin, a reward token (TREAT) and a new collectible card game. All three elements are intertwined on some level, with TREAT being tied to the card game, as well as “providing balance” to SHI. Plans don’t stop there, with a Layer-2 protocol also in the works, dubbed “Shibarium”. The platform will have its own gas token (BONE) and will support native app creation and deployment.   MakerDAO governance has approved a proposal to allow US-based Huntingdon Valley Bank to borrow $100 million worth of DAI stablecoins, secured against off-chain loan assets. HV Bank will eventually be permitted to borrow up to $1 billion DAI, with MakerDAO setting up a Delaware Trust to manage the collateral. The move is intended to bridge DAI to traditional finance, normalizing the connection of DeFi to the legacy system.   CeFi lending platform Nexo is moving to acquire its competitor, Vauld, who has become the latest crypto lending company to run into liquidity issues. Vauld was forced to suspend customer withdrawals earlier this week and sought to restructure its company to weather losses. Nexo has signed a term sheet with the Singapore-based firm, which will provide Nexo with up to 12 months to perform due diligence before deciding to purchase Vauld.  Two important trends appear to be forming over the last few months:

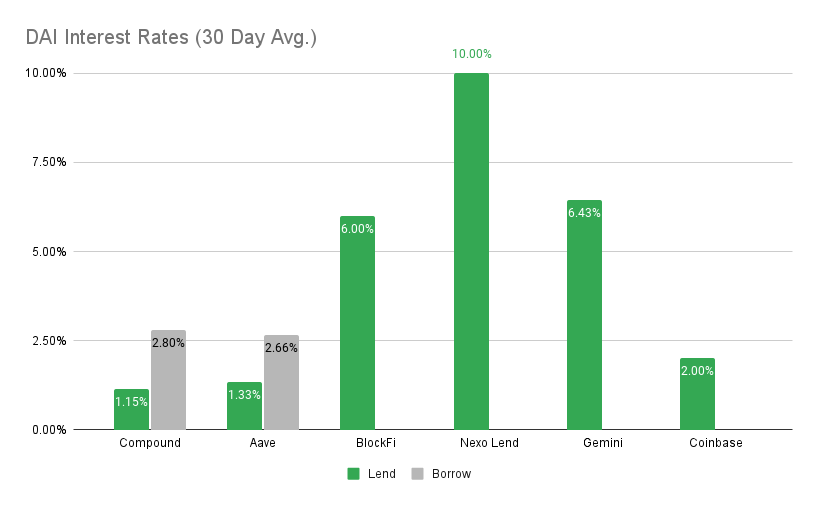

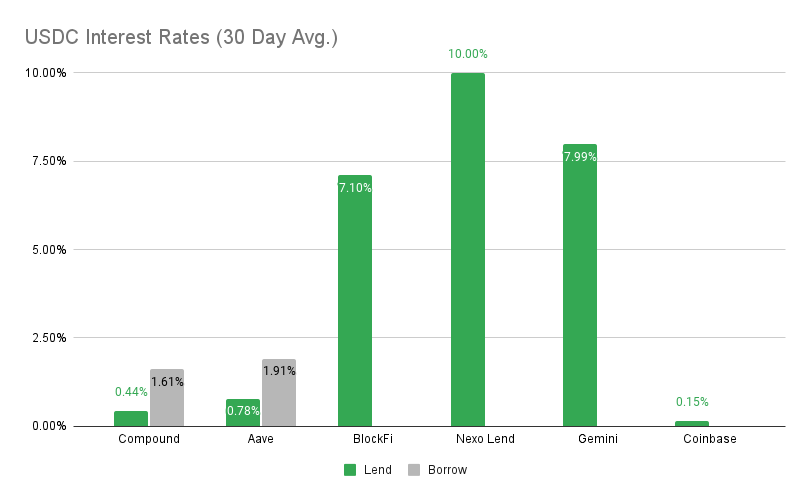

The combination of these two trend is resulting in an interesting divergence, one that I have alluded to previously: An emerging "split" between DeFi and regulated crypto. Whereas crypto was previously somewhat unregulated and flew under-the-radar, the space has finally become too large for governments and regulators to ignore. This is especially true of stablecoins, which now capture tremendous trading volumes and large-scale utilization – also proving to be much more useful for a variety of uses than regular fiat currency. The jig may be up for centralized stablecoins, whose traditional banking components will now begin to be more ruthlessly restricted by regulators. The UK, EU and US central banks have all made stablecoins a primary focus in recent discussions, looking to contain a clear threat to their financial control, as well as investor safety (i.e. Terra USD). China has also ruled stablecoin payments for salaries illegal, as they continue to roll out their digital yuan. As lawmakers scramble to put clamps on centralized stablecoin issuers, decentralized stablecoins continue to gain popularity as an alternative. Aave is the latest major platform to propose its own stablecoin, with a strong chance of success. Shiba Inu has released more details for a stablecoin too, also with some decent firepower behind their project. Add this to the likes of every other up-and-coming chain having its own stablecoin project, and its clear we have an entire new world of these tokens and mechanisms being tested in real-time. The most major question on most people's minds may be, what will become of the centralized stablecoin giants, Tether and USDC? The likely answer is more regulation, more know-your-customer/anti money-laundering rules, and more surveillance. A garden-walled area of DeFi may be on its way, cut away from the truly-decentralized side of crypto. How long will it all take? We might find out sooner than we realize... Thanks to our partner: Nexo – Unlock the power of your crypto with up to 17% interest and borrowing starting at 6.9%. Read our Nexo review. Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, Gemini at 6.43% APY Cheapest Loans: Aave at 2.66% APY, Compound at 2.80% MakerDAO Updates DAI Savings Rate: 0.01% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 1.00% WBTC Stability Fee: 0.75% USDCHighest Yields: Nexo Lend at 10% APY, Gemini at 7.99% APY Cheapest Loans: Compound at 1.61% APY, Aave at 1.91% APY Top StoriesFederal Reserve conference casts doubt on CBDC and dollar digitizationGenesis Trading CEO confirms 3AC exposure, parent company helps plug lossesCrypto owners banned from working on US Government crypto policiesSalary payments in USDT stablecoin ruled as illegal in the Chinese courtStat BoxTotal Value Locked: $41.37B (up 3.1% since last week) DeFi Market Cap: $39.8B (up 11%) DEX Weekly Volume: $12B (unchanged) Bonus Reads[Yashiu Gola – Cointelegraph] – Circle's USDC on track to topple Tether USDT as the top stablecoin in 2022 [Tom Carreras – Crypto Briefing] – Celsius Fully Repays MakerDAO Debt [Brandy Betz – CoinDesk] – Aztec Launches DeFi Privacy Bridge Aztec Connect [Timothy Craig – Crypto Briefing] – Ethereum Layer 2 Immutable X Launches ETH-to-Dollar Withdrawals If you liked this post from This Week in DeFi , why not share it? |

Older messages

This Week In DeFi – July 1

Friday, July 1, 2022

This week, FTX looks to acquire a distressed BlockFi, Compound goes multi-chain and ConsenSys partners with StarkWare.

This Week In DeFi – June 24

Friday, June 24, 2022

This week, dYdX decides to ditch Ethereum scaling for its own chain on Cosmos, Solend stirs up governance drama and Uniswap steps into NFTs.

This Week In DeFi – June 17

Friday, June 17, 2022

This week, Circle announces a new euro-pegged stablecoin, while Celsius and Three Arrows battle solvency issues – also involving stETH.

This Week In DeFi – June 10

Friday, June 10, 2022

This week, Ethereum completed its Ropsten testnet merge, Wintermute unveiled its DEX aggregator and TronDAO decides to overcollateralize USDD

This Week In DeFi - June 3

Saturday, June 4, 2022

This week, Binance Labs raises $500M for a new web3 fund, Ethereum prepares for its testnet merge and the Lightning Network sets a new record.

You Might Also Like

Donald Trump to reportedly unveil Bitcoin reserve strategy at White House crypto summit

Wednesday, March 5, 2025

Key industry figures, including Michael Saylor and Brian Armstrong, to join Trump at White House crypto summit. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 🚀 Cronos pioneers seamless crypto-to-debit transfers; Virtuals Protocol saw a 95% drop in tr…

Wednesday, March 5, 2025

Cronos pioneers seamless crypto-to-debit transfers. Virtuals Protocol saw a 95% drop in trading volume. Ondo Finance joined the Mastercard network to improve cross-border payments. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Global Crypto Mining News in February:U.S. Customs Increases Scrutiny of Chinese Bitcoin Mining Machines, Bitdeer …

Wednesday, March 5, 2025

1. Bitfarms said it is exploring ways to enter the artificial intelligence and high-performance computing space, as bitcoin miners continue to explore alternatives following last April's bitcoin

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask