Hot in Enterprise IT/VC - What's 🔥 in Enterprise IT/VC #297

What's 🔥 in Enterprise IT/VC #297Know when to hold 'em, know when to fold 'em...finding a clear path as you extend runway

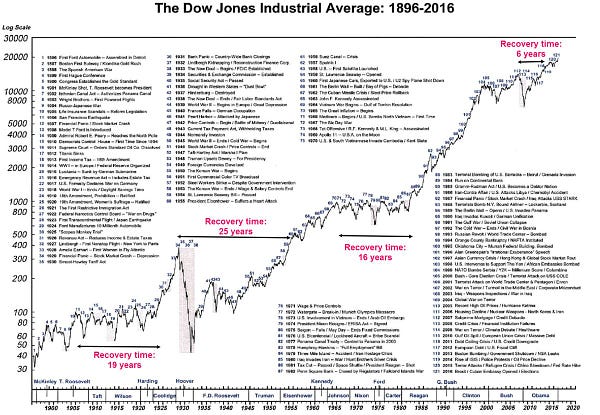

As a number of founders and investors are thinking through burn rate models and balancing growth with expenses, many reference the conventional wisdom of choosing to be default alive or default dead. Frankly I don’t know what any of that means, but the only thing I can say is that there is no conventional wisdom and every company is in a different place and has different reasons for making decisions. Whatever you choose to do as a founder, make sure that you are building a clear path to get to the next milestone and not just extending runway because you simply don’t want to give up. There has to be a there there, call it default fundable or default value creation on exit. I’ve seen times like this before so I’m reviving an old blog post from Feb 2011. Know When to Hold’em, Know When to Fold’em “I had a tough call with an entrepreneur this morning. His company raised a fair amount of seed financing but did not hit the milestones it needed to in order to raise a real round of venture capital. The product is nice but they took too long iterating and releasing a subsequent version while the market around it moved much quicker. In the process, the company ramped up too quickly before it knew exactly what the core value proposition was and to whom. Net net, the entrepreneur was left with a few choices: skinny the company down and try to get to breakeven, look to existing Angel investors for a bridge, shut the company down, or try to sell the business. I am not going to go through each one of the above decision trees in this post, but given the market dynamics today and the overflow of angel funding, I am sure that this is a conversation that many an angel and entrepreneur are having right now. Net net, way too many companies have received angel funding and many of these companies will not raise subsequent rounds of funding. That is ok as that is how markets work. If you are in this position, all I can say is don’t give up but also be honest with yourself and team. Assess your strengths and weaknesses, dive into the market and opportunity, and be as lean as possible to give you as much time to get to where you want to go. If you decide to fight through it and pivot and have the support of your existing investor base then great. Many companies have been successful that way. If you decide it is time to move on and capture whatever value you can for the assets then great as well. Just make sure that you have this conversation with your investors earlier rather than later to ensure you have enough time to execute on the new path. In the end, this process is not unlike what The Gambler from Kenny Rogers song had to go through at the table.”

No matter what choice you make, waiting and 🙏🏼 is not one that will drive a successful outcome. As always, 🙏🏼 for reading and please share with your friends and colleagues. Scaling Startups

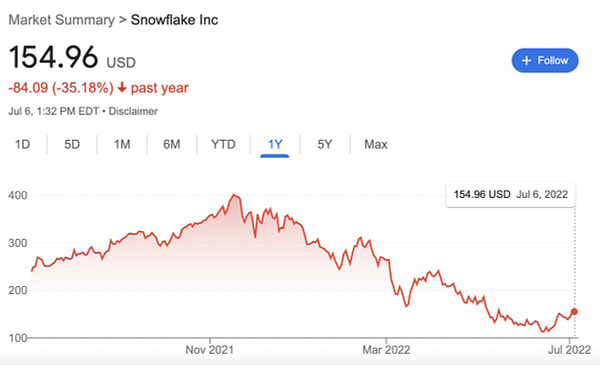

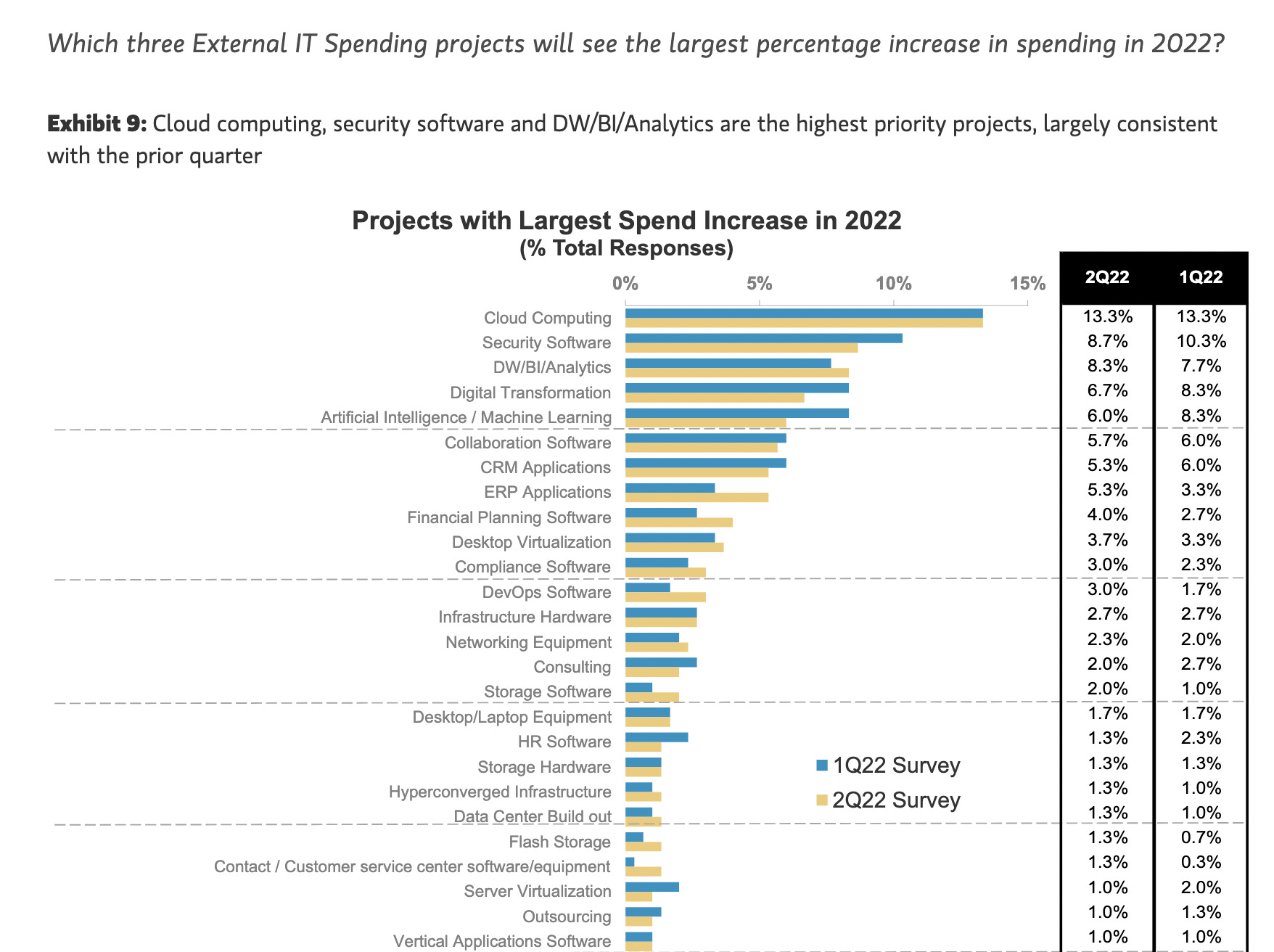

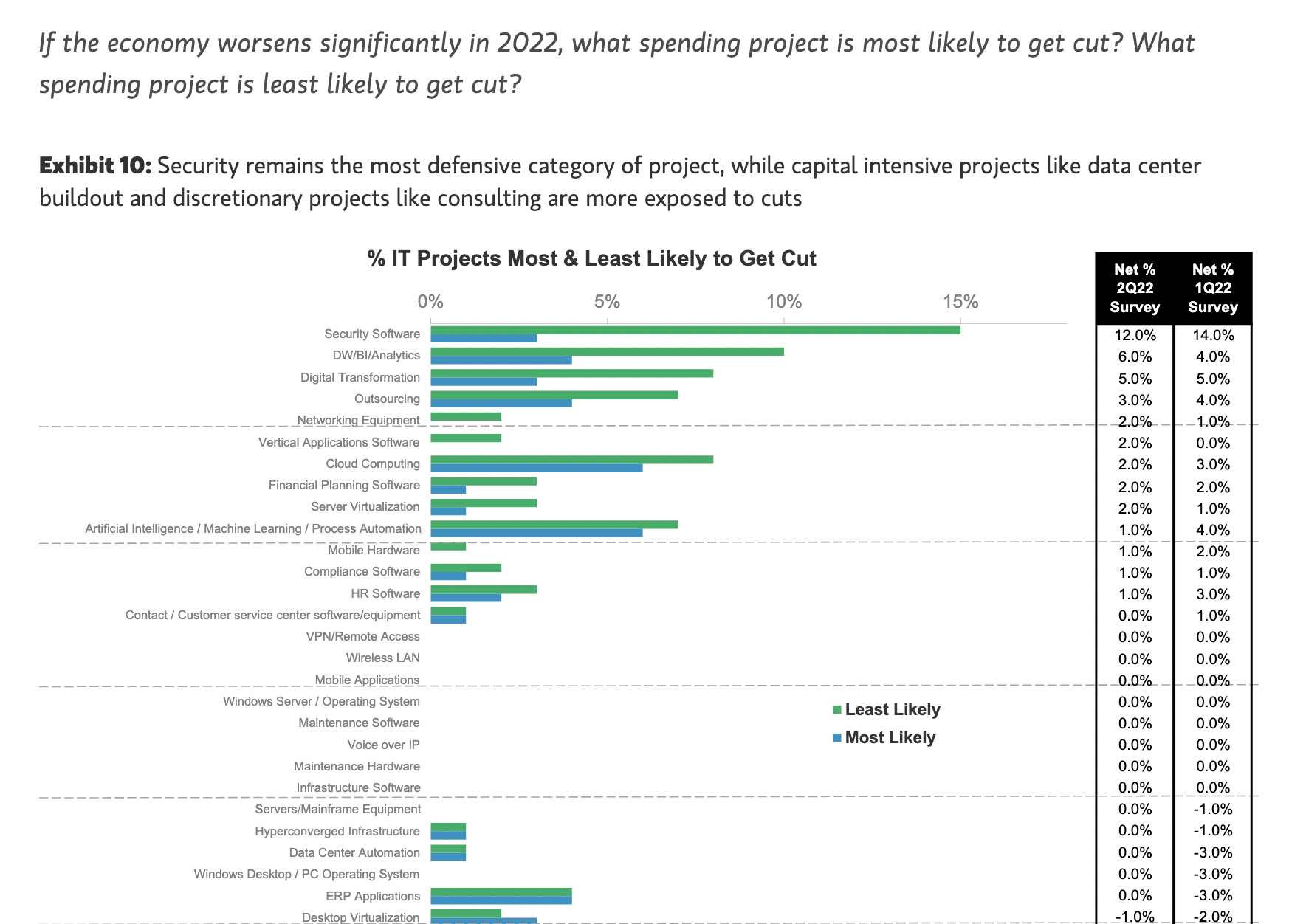

Enterprise Tech

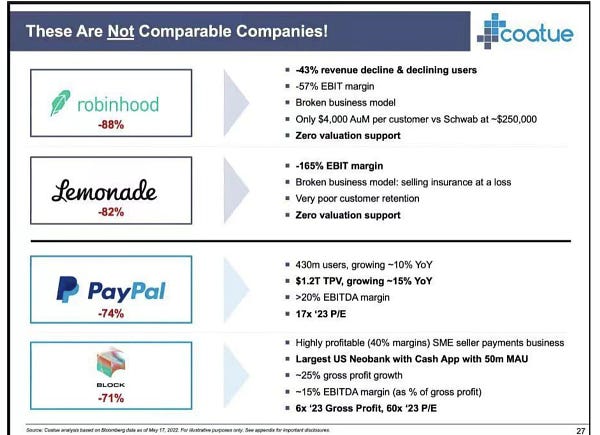

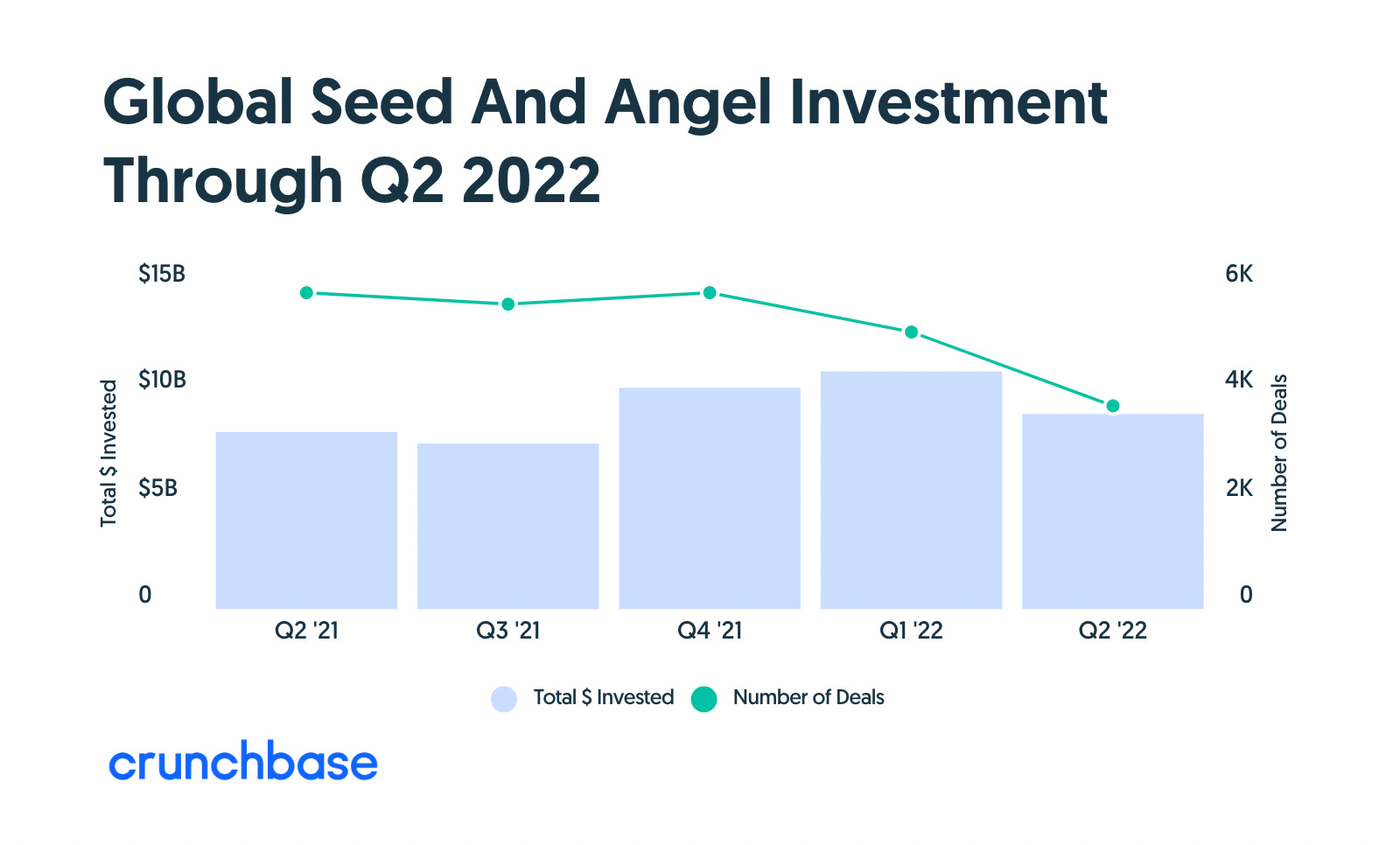

Markets

If you liked this post from What's Hot in Enterprise IT/VC, why not share it? |

Older messages

What's 🔥 in Enterprise IT/VC #296

Saturday, July 2, 2022

Refocusing on relationships vs. transactions, founders who are more 🥩 vs. sizzle 🥓 will rise back to the top

What's 🔥 in Enterprise IT/VC #295

Saturday, June 25, 2022

Developers, developers, developers - Microsoft's massive developer reach + what's next for enterprise adoption

What's 🔥 in Enterprise IT/VC #294

Saturday, June 18, 2022

Looking for positivity in 📉 - ❄️ Summit + plans for world domination

What's 🔥 in Enterprise IT/VC #293

Saturday, June 11, 2022

The bull 💪🏼 case for DevOps - GitLab's big quarter + what's next on product roadmap

What's 🔥 in Enterprise IT/VC #292

Saturday, June 4, 2022

How we thought about scaling our seed firm from a team of 2 + $1M proof of concept fund to a partnership of 4 & $367M of new funds

You Might Also Like

🚀 Ready to scale? Apply now for the TinySeed SaaS Accelerator

Friday, February 14, 2025

What could $120K+ in funding do for your business?

📂 How to find a technical cofounder

Friday, February 14, 2025

If you're a marketer looking to become a founder, this newsletter is for you. Starting a startup alone is hard. Very hard. Even as someone who learned to code, I still believe that the

AI Impact Curves

Friday, February 14, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. AI Impact Curves What is the impact of AI across different

15 Silicon Valley Startups Raised $302 Million - Week of February 10, 2025

Friday, February 14, 2025

💕 AI's Power Couple 💰 How Stablecoins Could Drive the Dollar 🚚 USPS Halts China Inbound Packages for 12 Hours 💲 No One Knows How to Price AI Tools 💰 Blackrock & G42 on Financing AI

The Rewrite and Hybrid Favoritism 🤫

Friday, February 14, 2025

Dogs, Yay. Humans, Nay͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 AI product creation marketplace

Friday, February 14, 2025

Arcade is an AI-powered platform and marketplace that lets you design and create custom products, like jewelry.

Crazy week

Friday, February 14, 2025

Crazy week. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

join me: 6 trends shaping the AI landscape in 2025

Friday, February 14, 2025

this is tomorrow Hi there, Isabelle here, Senior Editor & Analyst at CB Insights. Tomorrow, I'll be breaking down the biggest shifts in AI – from the M&A surge to the deals fueling the

Six Startups to Watch

Friday, February 14, 2025

AI wrappers, DNA sequencing, fintech super-apps, and more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How Will AI-Native Games Work? Well, Now We Know.

Friday, February 14, 2025

A Deep Dive Into Simcluster ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏