Jul 12: LVS’s $1bn lifeline to Sands China

Jul 12: LVS’s $1bn lifeline to Sands ChinaSands China loan, Rank analyst update, Playtika buyout reports, Cipher funding round +MoreGood morning. On today’s agenda:

LVS Sands China loanShow me the money: Las Vegas Sands has agreed to a $1bn loan to majority-owned subsidiary Sands China. The loan is repayable in 2028 and comes with 5% annual interest. LVS said the money would provide Sands China with working capital.

Plunge: The loan comes at the start of a weeklong casino shutdown in Macau which hit the share prices of the major players. LVS itself was down 6.3% on Monday, rival Wynn Resorts was down 6.4% and Melco ended the day down 9.4% having been off by 13.5% during the day. Down and out: The falls came as analysts predicted the weeklong shutdown might be extended. Bernstein noted that expectations for July GGR were now “very poor”. They also predict August will be ~90% lower than 2019 levels.

Straw/clutch: The Jefferies team said one positive was that the internal visa scheme remains in place meaning that the recovery from the shutdown should be quicker than when the original shutdown occurred in Feb20.

** Sponsor’s message: Venture capital firm Yolo Investments is home to €551m of equity in more than 70 of the most exciting companies across fintech, gaming and blockchain. It continues to build one of gaming’s most dynamic portfolios as it eyes up seed and A-stage opportunities across the sector. Its dedicated 29-company, €183m AUM gaming fund already houses holdings in fast-growing suppliers and operators, including Kalamba Games, SimWin and ThriveFantasy. Yolo Investments is also on the lookout for LPs as it looks to scale new concepts, including its high roller live casino brand, Bombay Club. As a proud sponsor of Earnings+More, Yolo Investments wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat. Playtika stake buyingIn play: Joffre Capital, a tech-focused buyout group owned by Chinese deal-makers, is reported by Bloomberg to be seeking finance for a bid to take control of Playtika. The group is already a shareholder in the Isreal-based and Nasdaq-listed casual gaming operator.

Cipher Sports fundraiseOn a dime: The Melbourne, Australia-based Cipher Sports Technology Group has announced a $5m Series A funding round led by Cygnet Capital. It hopes the money raised will accelerate its growth in the US sport-betting market.

The team: Cipher is led by CEO Adam Fiske with co-founders Katie Prowd, Darryl Woodford and Nick Slade and has recently opened an office in New York. Fiske said the funding round was an “incredible milestone”. Swan song: Cygnet Capital is an Australian-based investment fund that says it has made several other (unnamed) investments in the global wagering industry.

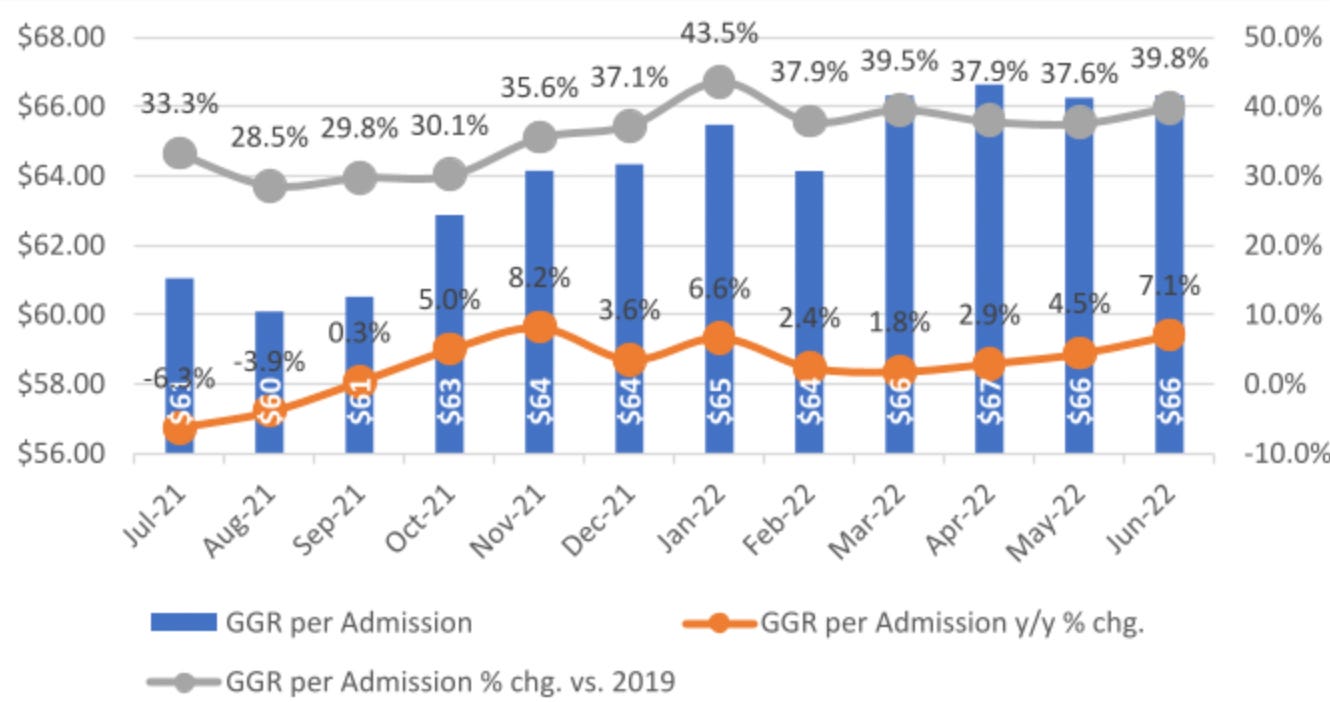

DatalinesMissouri: GGR for June came in at $151.2m, down 2.8% YoY and 5.6% above Jun19. On a quarterly basis, GGR was down 2.7% QoQ. While visitation was down 9.1%, the Deutsche Bank team have done an analysis of spend per visitor up 7.1%. NewslinesFinito: Playtech has completed the sale of Finalto to Gopher Investments for $250m. The adjustment for trading between Jan 1 and the completion date has, however, been lowered to between $15m-$20m from the previous $25m. Caesars will open a sportsbook and World Series of Poker Room at Harrah’s New Orleans this fall as part of an ongoing $325m renovation program. Halt houden: The Dutch gaming regulator has issued a cease-and-desist order against Malta-based operator Gammix for illegally offering games to Dutch customers. Verstopft: Lottoland has been blocked in Germany after the new state gambling regulator issued an order to all ISPs in the country. Stupid punt: Michael Owen has been accused by the UK’s Advertising Standards Authority (ASA) of promoting an unlicensed (in the UK) crypto casino called Punt which is, however, licensed in Curacao. What we’re readingBloomin’ marvelous: Tony Bloom backs the ban on gambling shirt sponsorship. Buy now, blame later: Klarna blames value collapse on ‘worst market conditions since the fall of Mafeking’. Or something. The next big rights deal: UEFA is shopping Champions League US TV rights for $2bn. Calendar

Contact us

If you liked this post from Earnings+More, why not share it? |

Older messages

Jul 11: Could MGM buy Entain on the cheap?

Monday, July 11, 2022

Entain analyst reaction, Macau closure, Q2 transaction tracker, US online analyst update, startup focus - Mojo +More

Jul 8: Weekend Edition #54

Friday, July 8, 2022

UK white paper reaction, E+M startup funding Q2, Bet-at-home UK license suspension, FanDuel analyst update +More

Jul 7: Macro conditions hit Entain online

Thursday, July 7, 2022

Entain trading update, US regionals analyst update, US online preview, Flutter and NeoGames analyst updates +More

Jul 4: 888’s debt sale hits trouble

Monday, July 4, 2022

888 debt sale struggle, Las Vegas analyst updates, the shares week, startup focus - Sports Gambling Guides +More

Jul 1: Weekend Edition #53

Friday, July 1, 2022

OpenBet price cut, Nevada May, Macau June, offshore crackdown call, sector watch - tokens +More

You Might Also Like

How This "1 PAGE" Website Makes $21,000/Month!

Wednesday, January 15, 2025

I just uncovered a website that is just a single page, and get this...it's making over $21000/month! In my video today, I'm going to reveal this website, how its getting traffic, and how its

$1,654 in DAILY sales 😮 (Beta-Tester results + NEW system)

Wednesday, January 15, 2025

This needs to be seen to be believed View in browser ClickBank Hey there, This coming Sunday, I highly recommend attending this private event because you'll be shown something brand new. Here's

Founder Weekly - Issue 669

Wednesday, January 15, 2025

January 15, 2025 | Read Online Founder Weekly (Issue 669 January 15 2025) In partnership with Where tier-one VCs get their news 📰 Get smarter about venture capital. 5x / week <5 minutes / day 15000

Building AI Agents the Easy way

Wednesday, January 15, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Bagel Day, Reader! Do you like yours sweet, savory, or plain? In

Are you a Chaos Coordinator? It's one of the top gifts on Amazon

Wednesday, January 15, 2025

Trending Products on Amazon This Week For the week of Monday, January 13 to Sunday, January 19 Welcome to this week's edition of the hottest trending keywords and products on Amazon over the last

The Market Is Pushing Asset Prices After Inflation Report — But Should It Be?

Wednesday, January 15, 2025

Listen now (2 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

When Video Matters And When It Shouldn't

Wednesday, January 15, 2025

Humans, it seems, like to be all or nothing on things. It's a Twitter-killer or a Google-killer. Not here's another way to access content or do things. It's all or nothing. And that's

😎Wake up, babe. State of Marketing just dropped.

Wednesday, January 15, 2025

Data and insights from 1.4k marketers globally View in browser hey-Jul-17-2024-03-58-50-7396-PM The webcomic XKCD once estimated that, on average, there are 10000 people hearing about something “

VC climate-tech funding falls for 3rd year

Wednesday, January 15, 2025

PE's comeback hits a speed bump; meet Europe's new crypto unicorn; Macquarie inks $5B data center partnership Read online | Don't want to receive these emails? Manage your subscription. Log

🦅 We're rescheduling Jesse Pujji's masterclass

Wednesday, January 15, 2025

It will be in March ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏