Earnings+More - Jul 8: Weekend Edition #54

Jul 8: Weekend Edition #54UK white paper reaction, E+M startup funding Q2, Bet-at-home UK license suspension, FanDuel analyst update +MoreGood morning. The UK gambling sector can likely assume that the white paper review is now nestling comfortably in the long grass given how the current government is looking to redefine the word shambolic. More worrying commentary for the sector, perhaps, came from Entain which yesterday suggested consumer behavior is now being definitively affected by the cost-of-living crisis. Coupled with analyst warnings about US regional gaming this week, it seems that the twists and turns of the economic cycle will affect gambling as much as other sectors. Meanwhile, E+M publishes its quarterly startup funding survey. The scene remains vibrant even if the stated amount raised of at least $31m is down on the stated Q1 tally of $46.1m. See below for more analysis. On Monday we will also publish our Q2 transaction tracker for major M&A and corporate activity within the sector. UK white paper reactionGoJo mojo: Analysts from JMP Securities suggested the market will view the resignation of UK Premier Boris Johnson as a “slight negative” as it makes the timing of the publication of the white paper “more uncertain”.

Off the scale: JMP added that Flutter and Bally (home of Gamesys) had taken similar measures and suggested that the scale of Entain, Flutter and Bally “can help offset regulatory changes and could result in more concentration in share as smaller operators will no longer be able to compete”. Share price reaction: Entain recovered some ground from being off by 10% at one point yesterday to end the day down by nearly 4%. Flutter and 888 also fell as the market digested the further dose of uncertainty. Overreaction: Peel Hunt said the share price moves were an “overreaction” given that BetMGM “should break into profit sooner rather than later”. Still, Peel Hunt has lowered its target price to 2,000p from 2,400p. ** Sponsor’s message: Venture capital firm Yolo Investments is home to €551m of equity in more than 70 of the most exciting companies across fintech, gaming and blockchain. It continues to build one of gaming’s most dynamic portfolios as it eyes up seed and A-stage opportunities across the sector. Its dedicated 29-company, €183m AUM gaming fund already houses holdings in fast-growing suppliers and operators, including Kalamba Games, SimWin and ThriveFantasy. Yolo Investments is also on the lookout for LPs as it looks to scale new concepts, including its high roller live casino brand, Bombay Club. As a proud sponsor of Earnings+More, Yolo Investments wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat. E+M startup funding Q2E+M has been tracking the funding round announcements for companies in the betting and gaming space. Here are some of the trends from the second quarter.

Q2 startup funding LVS makes its move: The gaming giant has made good on its promise to invest in the digital space, seeking its entry via a series of investments in B2B startups. In the second quarter, the E+M Startup Tracker has noted four deals in what can be viewed as an eclectic bunch, including regtech provider U.S. Integrity, esports data provider Bayes, video engagement provider Streamlayer and in-play tech provider Huddle.

Significant others: Regtech remains an area of significant investor interest with the three investments from Q1 (OddsOn Compliance, XPoint and Synalogik) joined by two more this quarter, OneComply and U.S. Integrity.

Funding round latest: Falling just outside the Q2 window, ‘German-accented’ slot developer Apparat has announced that Yolo Investments has taken a stake in the firm. The sum was not disclosed. Also, the betting marketplace Wagerwire has closed a $3m funding round led by Roger Ehrenberg, co-owner of the MLB’s Miami Marlins and the EPL’s Leeds United, as part of his venture funds IA Sports Ventures and Eberg Capital. Bet-at-home UK licenseBehavior is the mirror: The largely German-facing Bet-at-home has had its UK license suspended after the UK Gambling Commission said it suspected the company of social responsibility and anti-money laundering failings.

Recall: In a Q1 trading statement in late May, Bet-at-home said revenue in the first three months of the year stood at €14m and was “within expectations” for FY22.

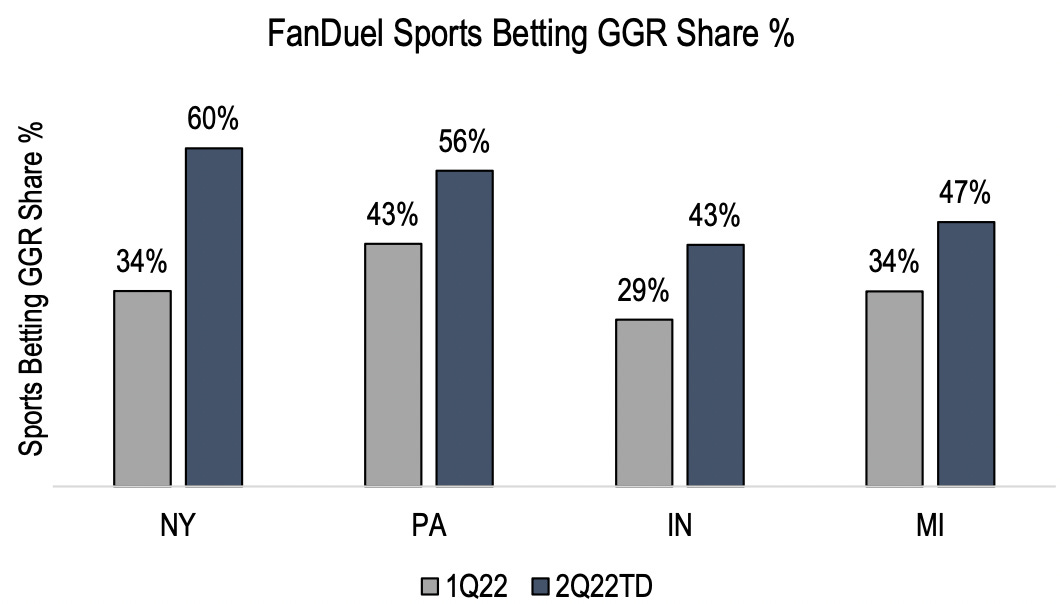

Losing hands: Bet-at-home has suffered a number of other regulatory setbacks in recent months including losing a case in Austria around customer losses that saw it take a hit of €24.6m. It also lost its legal appeal in Switzerland after being blocked from offering its services by the Swiss gaming authority. FanDuel analyst updateStranglehold: Wells Fargo analysts have suggested that FanDuel’s sports-betting market share has “meaningfully accelerated” in the past two months to ~45% reflecting, they suggest, growing handle market share in the key markets of NY, PA, MI and IN.

Combined shares: For Q2, the Wells Fargo team estimates FanDuel’s OSB/igaming share at 33% (up 700 bps QoQ) and sports-betting at ~45%, up 1,200 bps QoQ. BetMGM remained leader in igaming with 30% in May vs. 28% in April. Promo pullback: The team also noted that promo spend declined for the third consecutive month across the markets of PA, CO, MI and VA. Total promotions in these states equaled $44m in May, the lowest level observed since Aug21’s $31m.

Cashless analyst updateAcres wild: Analysts at Truist held a meeting with the principals behind Acres Technology, a provider of cashless gaming technology which plays a central role in Penn National’s cashless mywallet solution.

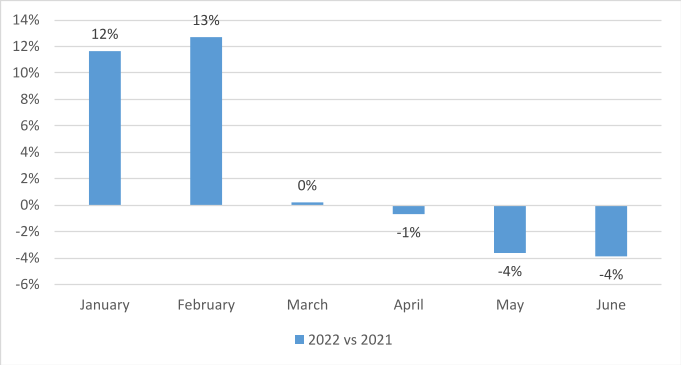

Four to the floor: Acres management said there were four advantages of going cashless: they are automatically assigned to loyalty programs, there is less cash handling and reduced hardware usage (bill validation becoming obsolete), it appeals to younger demographics and responsible gaming messaging can be built in. Murder on the slot floor: Truist noted that Acres likens the move to cashless to the advent of TITO 20 years ago and believe the gaming industry will see “rapid cashless adoption” to ~90% by 2025. The risk of non-adoption, they added, would be to lose out as legacy slot players “age out” and not see them backfilled by a “younger, more tech-savvy consumer”. DatalinesOhio: June GGR came in at $189.2m, down 3.9% YoY and 17.2% above Jun19. Market leader Penn’s four Ohio properties reported GGR of $64.8m, a 5.6% decrease YoY and 13.7% above Jun19. Warning signs: Yesterday, E+M reported on recent analyst commentary that suggested there were “early cracks” in the overall regional gaming picture. NewlinesPest house: SJM is reported to have offered to make its Casino Lisboa a quarantine hotel after 500 staff and guests have effectively been sealed in due to the ongoing Covid outbreak. Rush Street Interactive has launched its rushbet.mx online sportsbook and casino in Mexico in partnership with Grupo Multimedios. RSI will operate the site as part of a 25-year agreement. Spotlight Sports Group will provide its Superfeed data to LiveScore Group as part of a multi-year agreement to supply horse racing content to the group’s Virgin Bet and LiveScore Bet brands. 888 has completed the sale of its B2C and B2B bingo businesses to Saphalata Holdings, part of the Broadway Gaming, for $45.2m. Bonnie and Clyde: Nuvei Corporation and GAN have entered a strategic partnership enabling gaming operators to access Nuvei’s full suite of payments solutions through integration with GAN’s software-as-a-service gaming platform technology. The partnership commenced following the launch of the regulated gaming market in Ontario earlier this year. Sazkabet is now live on the OpenBet platform in its home market the Czech Republic, having migrated from the SBTech backend. FanDuel has opened a retail sportsbook at MLS DC United’s home stadium, Audi Field, the first retail sportsbook at an MLS stadium and the third at a professional sports venue in DC after the Caesars sportsbook at Capital One Arena and BetMGM at Nationals Park. IMG Arena (part of Endeavor) is the new official data distribution partner of the MLS and will provide soccer data, analytics and streaming to the MLS’ betting and media partners. According to Sportico, the agreement is worth more than $270m. What we’re readingJeopardy: Elon Musk’s deal to buy Twitter is “in peril”, according to the Washington Post. On socialCalendar

Contact us

If you liked this post from Earnings+More, why not share it? |

Older messages

Jul 7: Macro conditions hit Entain online

Thursday, July 7, 2022

Entain trading update, US regionals analyst update, US online preview, Flutter and NeoGames analyst updates +More

Jul 4: 888’s debt sale hits trouble

Monday, July 4, 2022

888 debt sale struggle, Las Vegas analyst updates, the shares week, startup focus - Sports Gambling Guides +More

Jul 1: Weekend Edition #53

Friday, July 1, 2022

OpenBet price cut, Nevada May, Macau June, offshore crackdown call, sector watch - tokens +More

Jun 29: UK set for slot stake limits

Wednesday, June 29, 2022

UK white paper rumors, Bally sells RI casinos, new sector coverage, Web 3 igaming analysis, Entain analyst update +More

Jun 27: Gaming stocks stage a rally

Monday, June 27, 2022

The shares week, New York weekly data, Las Vegas analyst update, startup focus - ParlayBay +More

You Might Also Like

How This "1 PAGE" Website Makes $21,000/Month!

Wednesday, January 15, 2025

I just uncovered a website that is just a single page, and get this...it's making over $21000/month! In my video today, I'm going to reveal this website, how its getting traffic, and how its

$1,654 in DAILY sales 😮 (Beta-Tester results + NEW system)

Wednesday, January 15, 2025

This needs to be seen to be believed View in browser ClickBank Hey there, This coming Sunday, I highly recommend attending this private event because you'll be shown something brand new. Here's

Founder Weekly - Issue 669

Wednesday, January 15, 2025

January 15, 2025 | Read Online Founder Weekly (Issue 669 January 15 2025) In partnership with Where tier-one VCs get their news 📰 Get smarter about venture capital. 5x / week <5 minutes / day 15000

Building AI Agents the Easy way

Wednesday, January 15, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Bagel Day, Reader! Do you like yours sweet, savory, or plain? In

Are you a Chaos Coordinator? It's one of the top gifts on Amazon

Wednesday, January 15, 2025

Trending Products on Amazon This Week For the week of Monday, January 13 to Sunday, January 19 Welcome to this week's edition of the hottest trending keywords and products on Amazon over the last

The Market Is Pushing Asset Prices After Inflation Report — But Should It Be?

Wednesday, January 15, 2025

Listen now (2 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

When Video Matters And When It Shouldn't

Wednesday, January 15, 2025

Humans, it seems, like to be all or nothing on things. It's a Twitter-killer or a Google-killer. Not here's another way to access content or do things. It's all or nothing. And that's

😎Wake up, babe. State of Marketing just dropped.

Wednesday, January 15, 2025

Data and insights from 1.4k marketers globally View in browser hey-Jul-17-2024-03-58-50-7396-PM The webcomic XKCD once estimated that, on average, there are 10000 people hearing about something “

VC climate-tech funding falls for 3rd year

Wednesday, January 15, 2025

PE's comeback hits a speed bump; meet Europe's new crypto unicorn; Macquarie inks $5B data center partnership Read online | Don't want to receive these emails? Manage your subscription. Log

🦅 We're rescheduling Jesse Pujji's masterclass

Wednesday, January 15, 2025

It will be in March ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏