Jul 11: Could MGM buy Entain on the cheap?

Jul 11: Could MGM buy Entain on the cheap?Entain analyst reaction, Macau closure, Q2 transaction tracker, US online analyst update, startup focus - Mojo +MoreGood morning. On today’s agenda:

RIP Paulie Walnuts. Entain analyst reactionGrab a bargain: A combination of Entain’s falling share price and sterling weakness might entice MGM Resorts to renew its efforts to buy its BetMGM JV partners, according to analysts at Citi.

Auction house: MGM made an $11bn bid for Entain in Jan21 which at the time was valued in sterling at £8.1bn. But a similar offer now would be worth closer to $9.74bn.

Cheap trick: Analysts at CBRE added that they believe Entain is “uniquely undervalued” at levels of around 8.4x their own FY23 EBITDA estimates.

**Sponsor's message: Spotlight Sports Group (owned by Exponent Private Equity) is a leading technology, content and media business specialising in sports betting. The company has released its second annual sports betting industry research report. The 2022 edition of ‘BetTech Ecosystem’ has been expanded by more than 60% with the visual now containing seven new sub-segments and 127 new suppliers. Click here to download the full research report and visual. For more information visit: spotlightsportsgroup.com Macau updateShuttered: The authorities in Macau have once again closed all commercial properties including casinos for one week from today as part of the Chinese government’s zero Covid policy. As of Saturday, the SAR has seen total infections of 1,374 in the latest outbreak.

The shares week: In Hong Kong trading, the news of the week-long shutdown in Macau hit the gaming–related stocks. At pixel time, Sands China was the worst hit, down 7.4% while Melco’s Hong-Kong-listed vehicle was down just over 7%, Wynn Macau was down 6.7%, SJM by 6.4% and MGM China off by 6.3%. E+M transaction tracker Q2

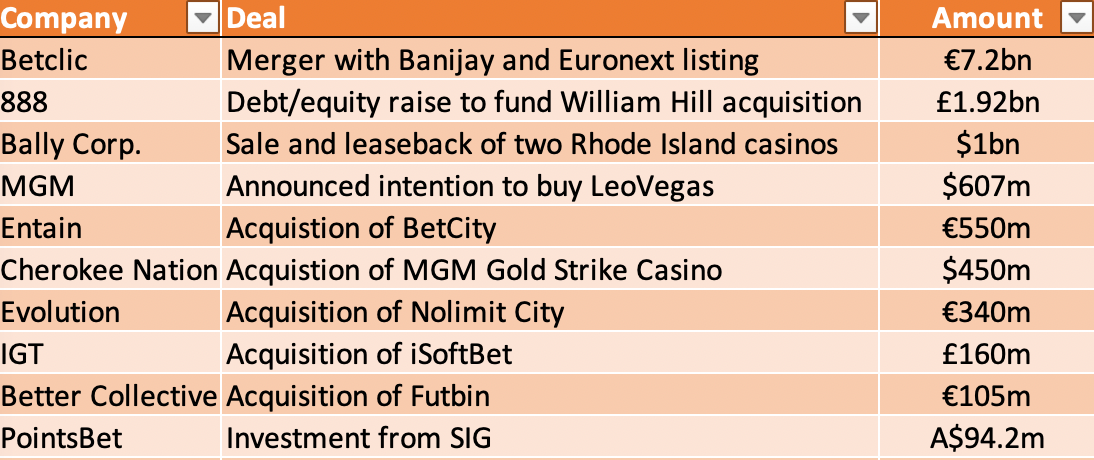

Tighten up: Even while the macroeconomic backdrop is raising concerns about the impact of inflationary conditions on consumer spending patterns, the global betting and gaming sector saw no signs of slowdown in corporate activity in Q2. Yet, the rumored problems encountered by the banks around the take-up of 888’s £1bn bond offer suggest money is tighter than it was last year. Q2 top 10 transactions SPAC spotted: Heading the list of transactions by size was Betclic’s surprise €7.2bn merger with Banijay and the Pegasus Entrepreneurial Acquisition Company Europe SPAC announced in mid-May. Betclic is very much the junior partner in the business with revenues of €741m in 2021 vs. €2.8bn for Banijay. Still, given the current conditions, completing a SPAC deal is very much an achievement.

Rapid turnaround: MGM Resorts and Entain both made acquisitions to extend their online footprints with their respective deals for LeoVegas and BetCity.

SIGnificant other: PointsBet received a boost over the quarter when it announced that US investment house SIG had taken a A$92.4m stake in the business.

Raw nerve: While Evolution (with its €340m Nolimit City takeout) and IGT (via its £160m deal for iSoftBet) took the B2B igaming headlines, lower down the scale Raw iGaming made two acquisitions over the period.

BREAKING NEWS: 888 has announced the details of its new debt arrangements saying that the £1.17bn of new debt facilities “significant portion” will be held by its mandated lead arrangers. The company said its weighted average cost of debt is currently expected to be approximately 7.3%.

US online analyst updatesBeats, rhymes and life: The team at Macquarie suggest they are expecting to see OSB and igaming revenue and EBITDA beats “almost across the board” in Q2. Stronger May GGR and better hold (~9%) “as well as containment around marketing” will be a positive catalyst for operators, they suggest.

👀 Over at JPM the team note that in the YTD gaming-related stocks are down 28% in line with consumer discretionary sectors but gaming-related stocks with online exposure are off by 43%. DraftKings casino callDraftKings CEO Jason Robins has called on states to regulate online casino “not in the future but now”.

Startup focus - MojoWho, what, where and when: Mojo is a newly created sports stock market that lets fans invest in athletes’ on-field performances, just like a stock. Led by founders Marc Lore, Alex Rodriguez, Vinit Bharara and Bart Stein, Mojo hopes to “supercharge sports fandom” by enabling fans to use their passion and sports knowledge like never before. Funding backgrounder: Mojo announced a $75m Series A led by Thrive Capital in March, with significant participation from Tiger Global, Lore and Rodriguez. So what’s new? Versions of sports stock markets have been tried before, but according to Mojo’s co-founder and CEO Vinit Bharara none have done what Mojo sets out to do. “Most notably, allow fans to make real-money bets on an athlete’s career prospects, with real-time price changes and instant liquidity, meaning users can enter or exit their position at any time,” he adds.

The longer pitch: What Mojo is building requires an enormous amount of data analytics and engineering expertise, he says, effectively predicting the career projections of every professional athlete.

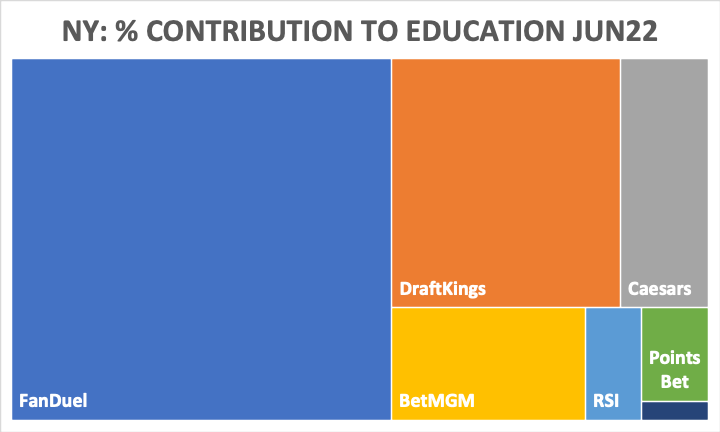

DatalinesNew York: June GGR came in at $72.4m from a handle of $1.05bn. The brutal economics of the state meant that operators received $35.5m net while the state gathered in $36.9m of tax revenue to go towards its education fund. In the week to July 3, GGR hit $20.2m on handle of $212.8m.

All give: top % contributors to NY state coffers Illinois: GGR hit $110.7m, up 5.1% YoY and 0.1% below Jun19. Note, Illinois casinos were operating at 60% capacity for the month of Jun21. On a same-store basis (excluding the Hard Rock Rockford opened Nov21), GGR was up 1.3% YoY and 3.7% below Jun19. Iowa: GGR for June was down 48% MoM to $12.6m due to margins dropping ~320 bps to 5.4%. Handle for was down 17.2% MoM and -22% YoY to $122.4m. Casino GGR was down 2.4% YoY and -1.9% QoQ to $138.2m. Arizona: Sports-betting GGR in April was down 21.5% to $29.2m while handle was down 25% to $512.9m from the March record. Retail handle was $3.3m. Operators’ free bets and promotional credits came to $12.7m. The state collected $1.6m in taxes from $16.5m in taxable revenue.

Virginia May22: Sports-betting GGR was $42.5m while adj. GGR (after state taxes) came in at $27.5m. Handle for May was down 12% MoM. Portugal: Land-based casino GGR for Q2 was down 7.2% YoY to €53.9m while online casino stakes increased 37.3% YoY to €2.21bn. Online sports-betting wagers were down 12.8% to €369.4m. GGR across both verticals was up 23.6% YoY to €158.6m, with online casino GGR up 37.6% to €80.9m and sports-betting GGR up 11.8% to €77.7m. The GGR rises came despite the number of new account openings dropping 34.6% YoY to 215K. NewslinesFanDuel is now the official betting partner of the NFL in Canada and will be able to use the league's name and branding for marketing and product-related operations. GAN has repurchased $1m of its shares as part of its shareholder authorization of up to $5m. Betfred has signed a market access deal in Maryland with Long Shot’s Frederick restaurant and bar where it will operate in-person betting windows and self-serve betting kiosks. What we’re readingMatt Levine at Bloomberg on getting pranked by Elon Musk: “The next time Elon Musk announces that he is going to buy a public company — and he will do it again! — I will know not to believe him. I will definitely know not to write about it.” Battle lines: Meanwhile the New York Times says Twitter is ready for the potential legal battle that could ensue. On socialCalendar

Contact us

If you liked this post from Earnings+More, why not share it? |

Older messages

Jul 8: Weekend Edition #54

Friday, July 8, 2022

UK white paper reaction, E+M startup funding Q2, Bet-at-home UK license suspension, FanDuel analyst update +More

Jul 7: Macro conditions hit Entain online

Thursday, July 7, 2022

Entain trading update, US regionals analyst update, US online preview, Flutter and NeoGames analyst updates +More

Jul 4: 888’s debt sale hits trouble

Monday, July 4, 2022

888 debt sale struggle, Las Vegas analyst updates, the shares week, startup focus - Sports Gambling Guides +More

Jul 1: Weekend Edition #53

Friday, July 1, 2022

OpenBet price cut, Nevada May, Macau June, offshore crackdown call, sector watch - tokens +More

Jun 29: UK set for slot stake limits

Wednesday, June 29, 2022

UK white paper rumors, Bally sells RI casinos, new sector coverage, Web 3 igaming analysis, Entain analyst update +More

You Might Also Like

How This "1 PAGE" Website Makes $21,000/Month!

Wednesday, January 15, 2025

I just uncovered a website that is just a single page, and get this...it's making over $21000/month! In my video today, I'm going to reveal this website, how its getting traffic, and how its

$1,654 in DAILY sales 😮 (Beta-Tester results + NEW system)

Wednesday, January 15, 2025

This needs to be seen to be believed View in browser ClickBank Hey there, This coming Sunday, I highly recommend attending this private event because you'll be shown something brand new. Here's

Founder Weekly - Issue 669

Wednesday, January 15, 2025

January 15, 2025 | Read Online Founder Weekly (Issue 669 January 15 2025) In partnership with Where tier-one VCs get their news 📰 Get smarter about venture capital. 5x / week <5 minutes / day 15000

Building AI Agents the Easy way

Wednesday, January 15, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Bagel Day, Reader! Do you like yours sweet, savory, or plain? In

Are you a Chaos Coordinator? It's one of the top gifts on Amazon

Wednesday, January 15, 2025

Trending Products on Amazon This Week For the week of Monday, January 13 to Sunday, January 19 Welcome to this week's edition of the hottest trending keywords and products on Amazon over the last

The Market Is Pushing Asset Prices After Inflation Report — But Should It Be?

Wednesday, January 15, 2025

Listen now (2 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

When Video Matters And When It Shouldn't

Wednesday, January 15, 2025

Humans, it seems, like to be all or nothing on things. It's a Twitter-killer or a Google-killer. Not here's another way to access content or do things. It's all or nothing. And that's

😎Wake up, babe. State of Marketing just dropped.

Wednesday, January 15, 2025

Data and insights from 1.4k marketers globally View in browser hey-Jul-17-2024-03-58-50-7396-PM The webcomic XKCD once estimated that, on average, there are 10000 people hearing about something “

VC climate-tech funding falls for 3rd year

Wednesday, January 15, 2025

PE's comeback hits a speed bump; meet Europe's new crypto unicorn; Macquarie inks $5B data center partnership Read online | Don't want to receive these emails? Manage your subscription. Log

🦅 We're rescheduling Jesse Pujji's masterclass

Wednesday, January 15, 2025

It will be in March ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏