The Daily StockTips Newsletter 07.15.2022

The Daily StockTips Newsletter 07.15.2022I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)WE’RE ON YOUTUBE NOW! See HERE & HERE (Yeah … I’m REALLY excited about this). Before you Trade Today: Know the Economic Calendar! Also See This Weeks Most Anticipated Earnings. NEVER BE SURPRISED BY EASILY ANTICIPATED MARKET BREAKING NEWS. That’s our goal here. TODAY’S COMPLETE NEWSLETTER FOR FREE: I’m Releasing todays complete Newsletter for Free so free subscribers can see the short plays. Paid subscribers should have already profited big so there isn’t much premium left in keeping my little gems locked behind a paywall. It will be tough at these lows to find additional plays but I will do my damndest over the weekend. However when I find good plays they usually pay for this subscription many many many times over. The short plays were really the bottom of the barrel stocks that were sure to get slammed by inflation. Yes the overall markets were back & forth, but these plays were nothing but red red red giving us green green green. Note I had the days screwed up yesterday. If you haven’t already done so, its time to cover. each of these plays likely netted you over 10%-14! If you played them your subscription to StockTips is well more than paid for. Congrats!

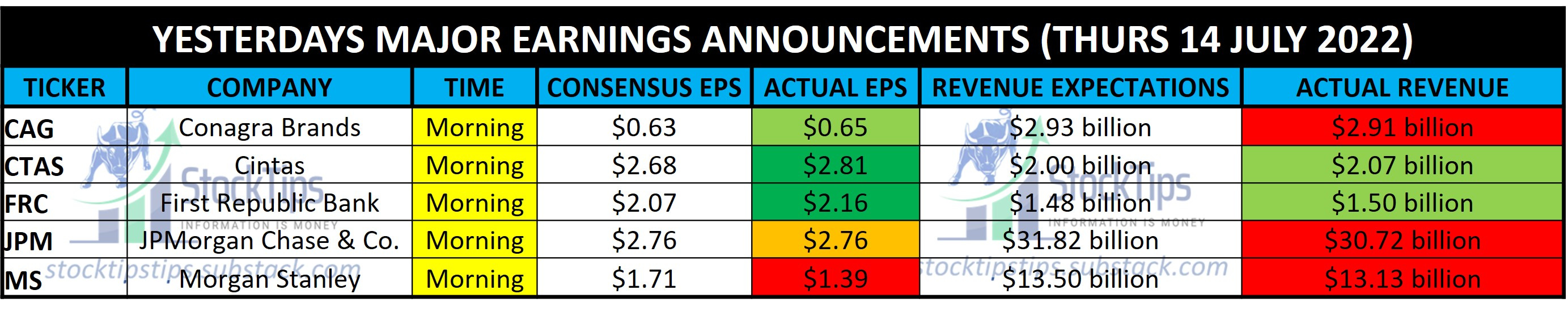

WARNINGS: I issued my warnings on this earnings season & what to look for yesterday. YESTERDAY’S PRODUCER PRICE INFLATION & OTHER DATA: YoY June Producer Wholesale Inflation came in at an whopping 11.3%! 10.7% was expected. Core PPI YoY June came in at 8.2% when 8.1% was expected. Jobless & Continuing Claims were in line. The Wholesale Data implies that firms are paying 11.3% more on average than they were a year ago. Meaning if they want to undercut their competition, retailers & discount retailers will need to figure out a way to keep prices low, while paying more for the product. Not an easy task! TODAY’S OBSERVATIONS: Today we have Retail Sales (0.8% MoM Expected / 6.5% YoY Forecasted). This WILL make or break our day. And though Retail Sales will be the headline hog, We also have the July NY Empire State Manufacturing Index (-2 Expected), June Industrial Production (-0.1% YoY expected), June Manufacturing Production (-0.1% YoY Expected), Consumer Sentiment, May Business Inventories (an increase of 1.3% MoM expected), & the all important May Retail Inventories (+0.8% MoM Forecasted). WORLD MARKETS:

RECOMMENDED:

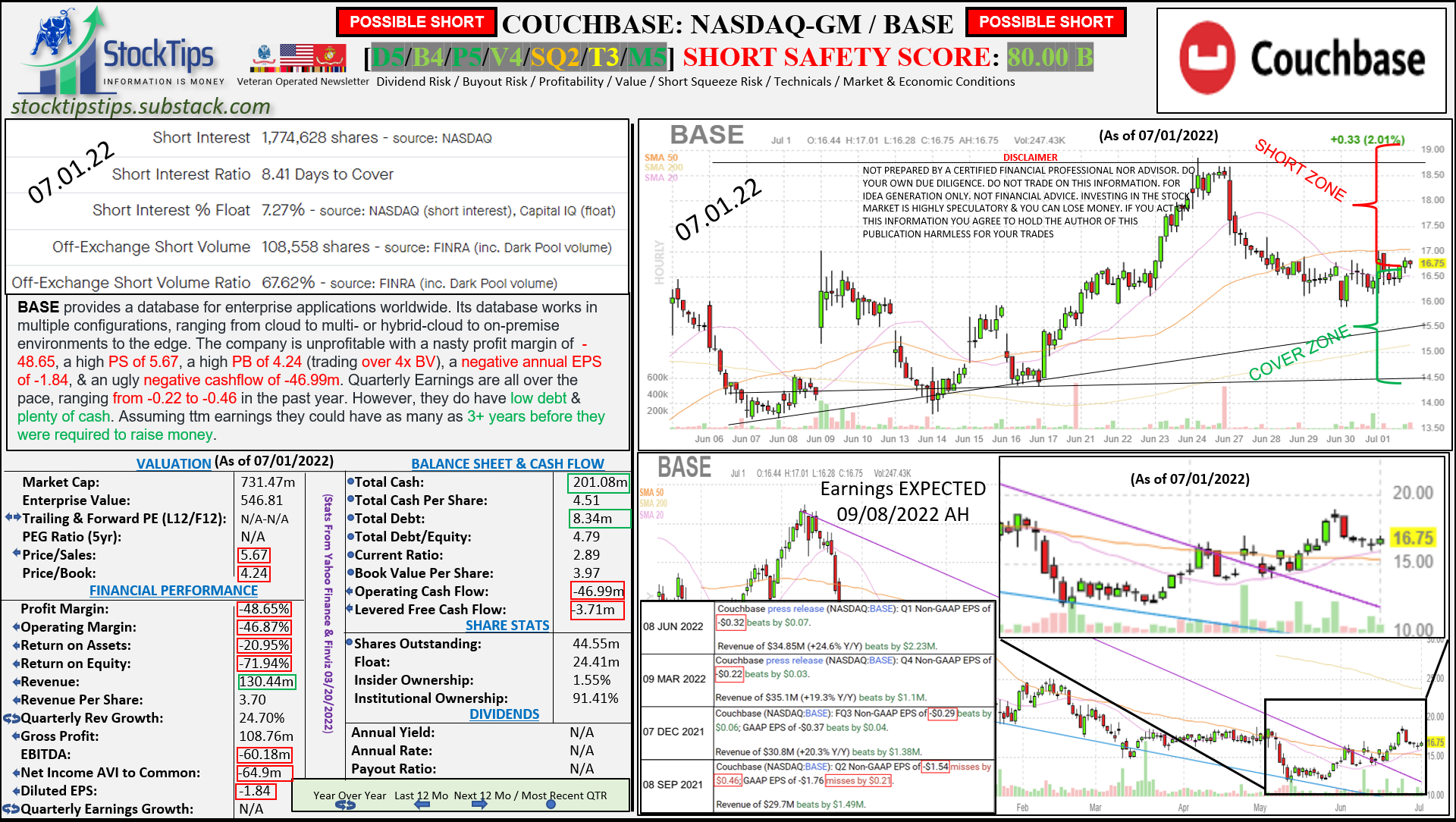

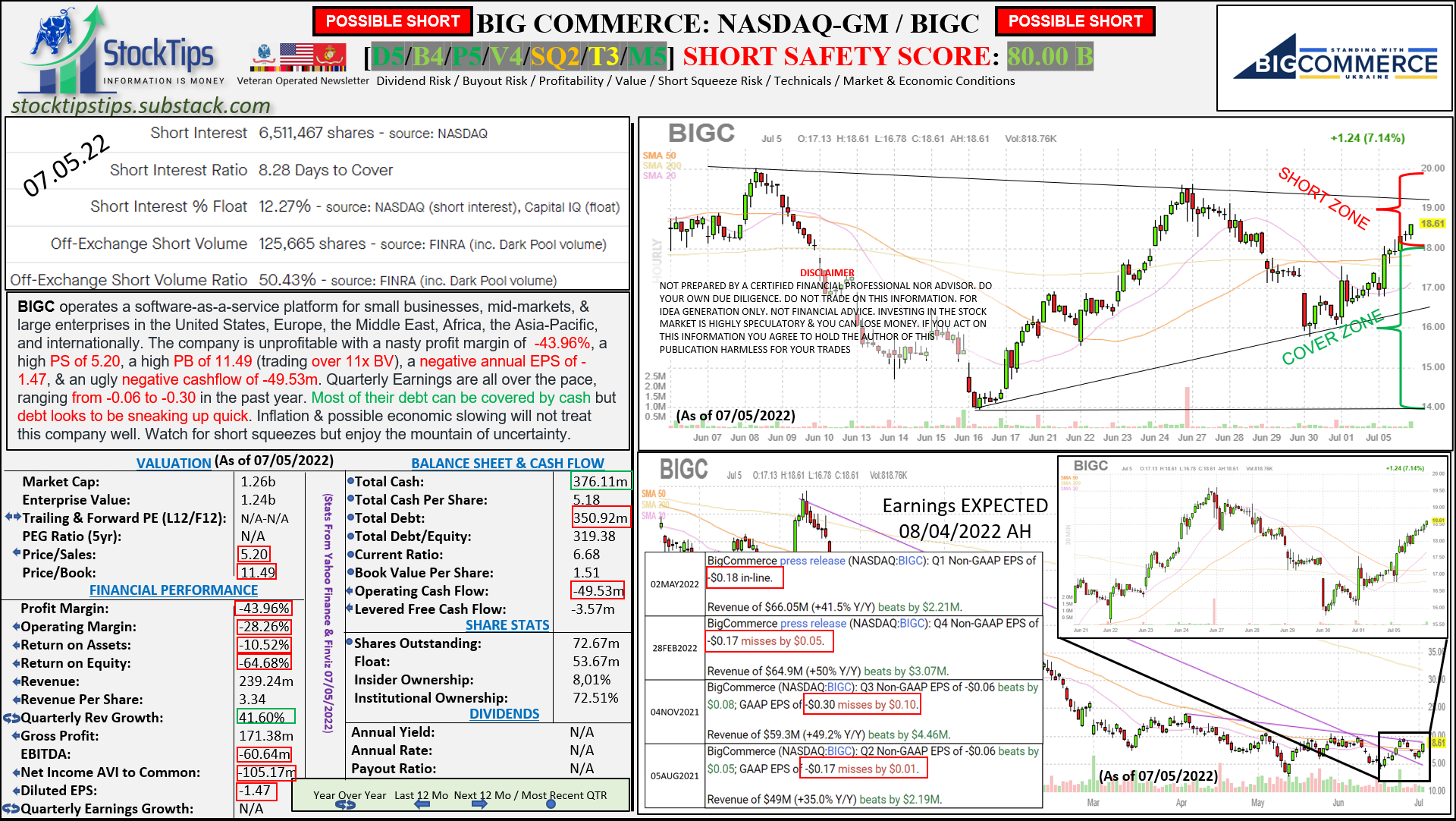

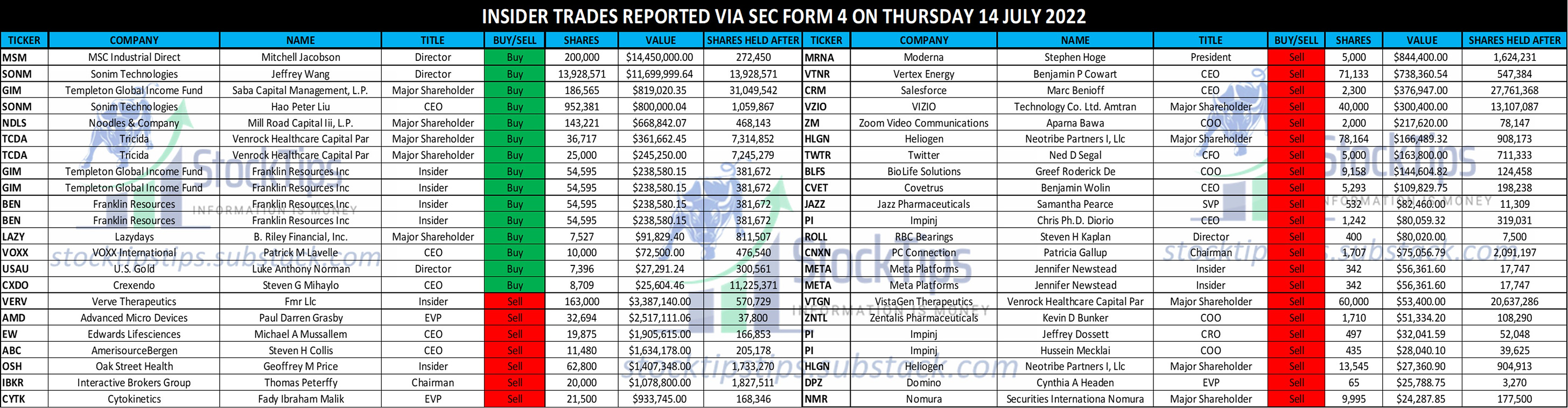

PAID SUBSCRIBER SECTION — PAID CONTENT BEGINS HERE (FREE TODAY)ONGOING POSSIBLE SHORT PLAY’S: The short plays were really the bottom of the barrel stocks that were sure to get slammed by inflation. Yes the overall markets were back & forth, but these plays were nothing but red red red giving us green green green. Note I had the days screwed up yesterday. If you haven’t already done so, its time to cover. each of these plays likely netted you over 10%-14! ALKT dumped an additional 6.21% yesterday, after dropping 0.62% Wednesday, after dropping 3.9% Tuesday, & 4% on Monday. BASE dumped an additional 4.11% after dropping 2.33% Wednesday, after dropping 3.34% Tuesday, & 4.92% Monday. BIGC dumped an additional 5.75% yesterday, after dropping 1.30% Wednesday, after increasing 1% Thursday, after dropping 1.67% Monday. After hours last night it dropped a further 4.65%! YESTERDAYS EARNINGS & INSIDER TRADES ARE REPORTED BELOW POSSIBLE SHORT PLAYS: Make a Killing on a StockTips Play? Consider a Tip YESTERDAY’S EARNINGS RESULTS: INSIDER TRADES FROM THE PREVIOUS TRADING DAY: IMPORTANT DISCLAIMER: I am NOT a registered investment adviser, broker dealer, or member of any other association for research providers in any jurisdiction whatsoever & I am NOT qualified to give financial advice. Investing/Trading in securities, particularly microcap securities, is highly speculative & carries an extremely high degree of risk. The information, analysis, & opinions listed above are my own & may not properly reflect the underlying conditions of a company or security. You should do your own Due Diligence. Past performance does not guarantee future results. If you trade based on anything I have written YOU ACCEPT FULL RESPONSIBILITY AND LIABILITY for your own trades & actions & hold the author of this publication harmless. If that isn’t clear enough DO NOT TRADE, ACT, OR INVEST, BASED UPON ANYTHING I WRITE OR RECOMMEND. There, we should be solid now.You’re a free subscriber to StockTips Newsletter. For the full experience, become a paid subscriber. |

Older messages

The Daily StockTips Newsletter 07.14.2022

Thursday, July 14, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 07.13.2022

Thursday, July 14, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 07.12.2022

Tuesday, July 12, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 07.11.2022

Monday, July 11, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 07.08.2022

Friday, July 8, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

You Might Also Like

💀 RIP, world's biggest dividend

Tuesday, March 4, 2025

Aramco slashed its billion-dollar handouts, the US faced retaliation, and bitcoin went up against organs | Finimize Hi Reader, here's what you need to know for March 5th in 3:14 minutes. Aramco –

RIP to the 4% Rule

Tuesday, March 4, 2025

How to ignore the retirement strategy ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

President Trump is asserting extraordinary power over independent agencies. Is the Fed next?

Tuesday, March 4, 2025

The rise and potential fall of independent agencies. View this email online Planet Money Not-so-independent agencies anymore? by Greg Rosalsky President Trump vs. the independent agencies. It's a

No Sales, No Survival - Issue #514

Tuesday, March 4, 2025

What smart businesses are doing to win in the long run. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🇺🇸 The president's crypto fund

Monday, March 3, 2025

Crypto's back in favor and European defense stocks got an, uh, arm up | Finimize Hi Reader, here's what you need to know for March 4th in 3:15 minutes. The US president announced plans for a

CDs supercharge your savings

Monday, March 3, 2025

You could earn up to 4.10% for a 1 year term ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI's Impact on the Written Word is Vastly Overstated

Monday, March 3, 2025

Plus! VC IPOs; Sovereign Wealth Funds; The Return of Structured Products; LLM Moderation; Risk Management; Diff Jobs AI's Impact on the Written Word is Vastly Overstated By Byrne Hobart • 3 Mar

Know you’re earning the most interest

Sunday, March 2, 2025

Switch to a high-yield savings account ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Longreads + Open Thread

Saturday, March 1, 2025

Hackers, Safety, EBITDA, More Hackers, Feudalism, Randomness, CEOs Longreads + Open Thread By Byrne Hobart • 1 Mar 2025 View in browser View in browser Longreads A classic: Clifford Stoll on how he and

🚨 This could be a super bubble

Friday, February 28, 2025

An expert said we're in the third-biggest bubble ever, the US poked China one more time, and OpenAI's biggest model | Finimize TOGETHER WITH Hi Reader, here's what you need to know for