The Daily StockTips Newsletter 07.18.2022

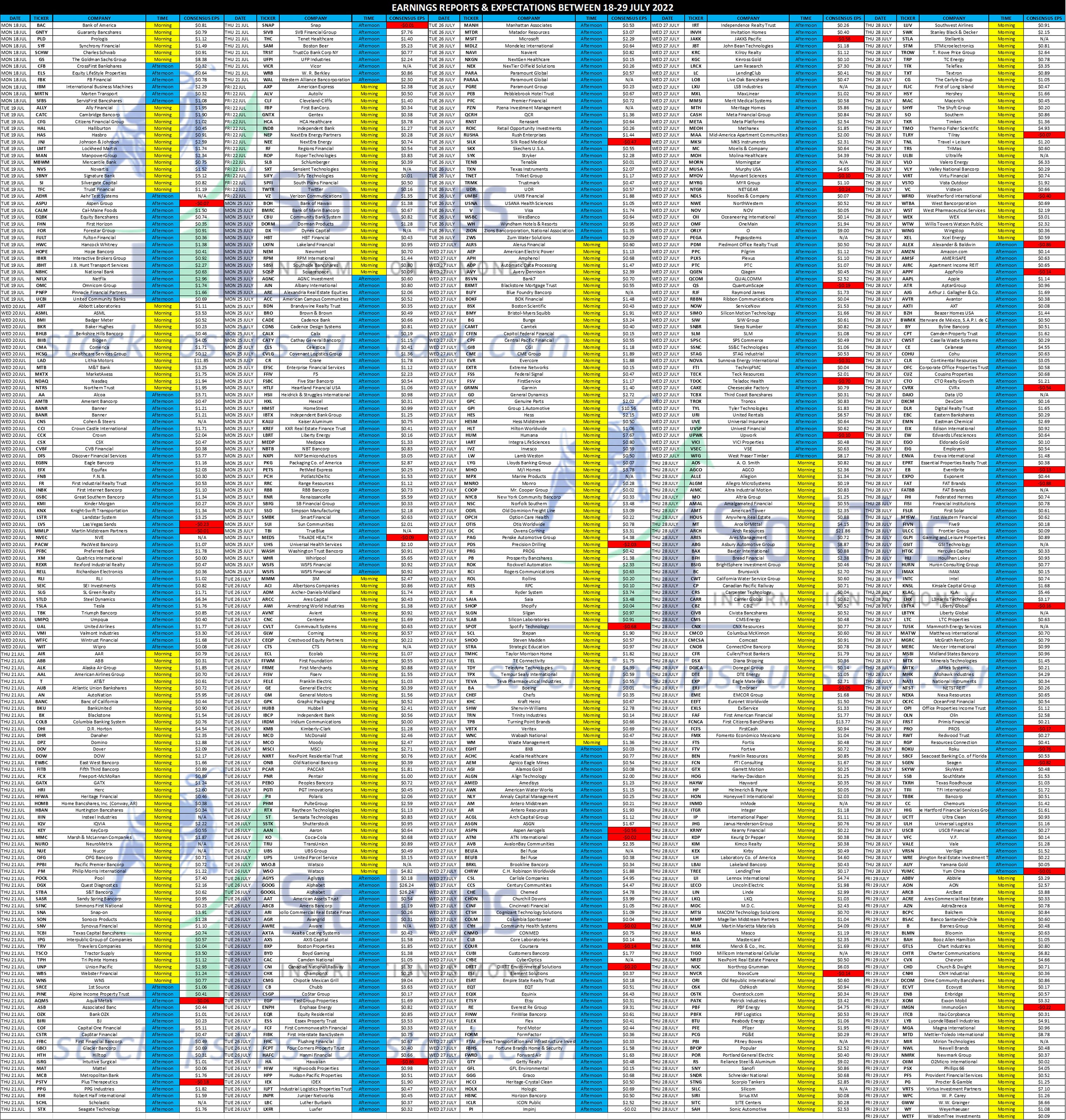

The Daily StockTips Newsletter 07.18.2022I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)WE’RE ON YOUTUBE NOW! See HERE & HERE (Yeah … I’m REALLY excited about this). Before you Trade Today: Know the Economic Calendar! Also See This Weeks Most Anticipated Earnings. NEVER BE SURPRISED BY EASILY ANTICIPATED MARKET BREAKING NEWS. That’s our goal here. UPCOMING ECONOMIC NEWS: June Housing Starts (Tuesday) are expected to come in at 1.585m. That’s lower than where we were at the beginning of the pandemic. June Building Permits (expected to come in at 1.65m) are still expected to be higher than pre-pandemic permits. June Existing Home Sales will be reported on Wednesday & are expected to come in at 5.38m. Also lower than we were prior to the pandemic. That’s about all the major market moving news we have for the week. And markets usually rally when bad news, such as what we experienced last week, is behind us. But what about the Fed interest rate decision & press conference next week? Well, the street expects 75bps but will be just as satisfied in my opinion with a 100bps hike. Firms want to see a Fed that’s serious about tackling inflation. Sure, Powell could say something silly, but given the economic numbers over the past weeks I expect him to paint a rosy picture. He will likely say the job market is strong, wages continue to increase, the labor market remains tight, consumer spending is trucking along (although negative when adjusted for inflation), housing is pulling back, & inflation is still unacceptably high … though perhaps expected to come down a little month to month as a result of slightly deflating energy costs. He will be describing textbook stagflation, but he won’t admit it. There is no reason to suspect a major shift in the Fed’s game plan at this time (My assessment). So that’s even more reason to expect markets to rally. No real economic surprises, in my view, are before us for a bit ... unless they’re some serious economic surprises! EARNINGS SEASON IS HERE: It seems the only thing that can rain on the recent market parade is poor earnings. Particularly on a major sector leading company. So pay close attention! A major miss on a market leading firm will have repercussions on like companies throughout. Indeed, bad banking sector earnings (banks are reporting right now) will have reverberations market wide. Just as big retailers will when they’re reported, or big tech when their day is up. For you short term traders there are ways to play a volatile earnings season. If, for example, you want to play WMT earnings, who usually reports prior to target, you can POSSIBLY play the assumptions inherent in WMT earnings through TGT (Just an example). And even do it slightly after WMT reports. Same with semiconductor companies, like tech companies (“like” meaning “similar”), etc. Earnings on Walmart will have implications on Target, though Target will be slower to move, as they report after. Of course, you know I always post the upcoming earnings under the economic calendar. The sooner you realize shifting market trends the quicker you can develop profitable ideas. So write down what interests you, the dates they report, the implications they have on the sector (or other companies), & how you expect the market to react. The effort will likely pay off. Finally, & I know you’re tired of hearing this, this earnings season will fully reflect the China lockdowns, the sanctions from the war in Ukraine, & skyrocketing gas prices. Last earnings season partially reflected these items. This earnings season gets the whole shebang! Whatever business you’re invested in, or shorting, is paying more for labor, more for energy, & more for finished goods, than they likely ever had before. Sure, they might be able to pass some of the cost off to the consumer, which will increase their revenue. But do not think that will necessarily translate into a bumper EPS. Revenue may be up when everything is more expensive, but as we saw last earnings season … margins were still down. WORLD MARKETS:

RECOMMENDED:

Subscribe to StockTips Newsletter to read the rest.Become a paying subscriber of StockTips Newsletter to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

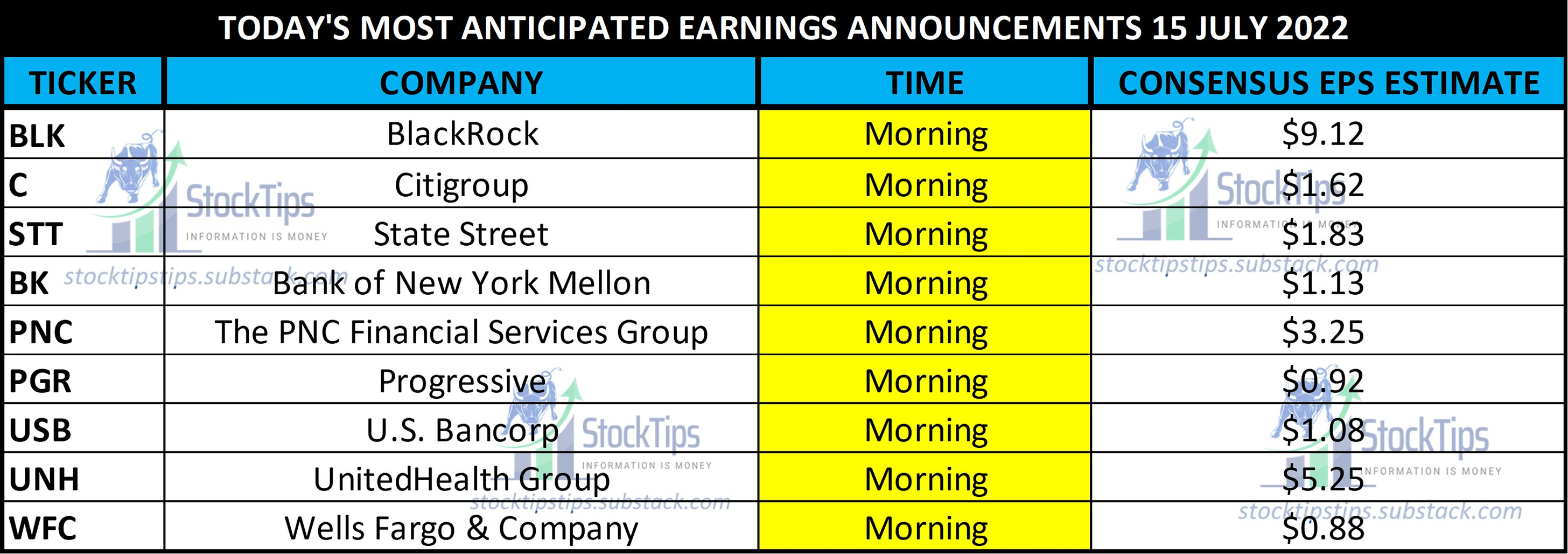

The Daily StockTips Newsletter 07.15.2022

Friday, July 15, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 07.14.2022

Thursday, July 14, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 07.13.2022

Thursday, July 14, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 07.12.2022

Tuesday, July 12, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 07.11.2022

Monday, July 11, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

You Might Also Like

RIP to the 4% Rule

Tuesday, March 4, 2025

How to ignore the retirement strategy ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

President Trump is asserting extraordinary power over independent agencies. Is the Fed next?

Tuesday, March 4, 2025

The rise and potential fall of independent agencies. View this email online Planet Money Not-so-independent agencies anymore? by Greg Rosalsky President Trump vs. the independent agencies. It's a

No Sales, No Survival - Issue #514

Tuesday, March 4, 2025

What smart businesses are doing to win in the long run. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🇺🇸 The president's crypto fund

Monday, March 3, 2025

Crypto's back in favor and European defense stocks got an, uh, arm up | Finimize Hi Reader, here's what you need to know for March 4th in 3:15 minutes. The US president announced plans for a

CDs supercharge your savings

Monday, March 3, 2025

You could earn up to 4.10% for a 1 year term ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI's Impact on the Written Word is Vastly Overstated

Monday, March 3, 2025

Plus! VC IPOs; Sovereign Wealth Funds; The Return of Structured Products; LLM Moderation; Risk Management; Diff Jobs AI's Impact on the Written Word is Vastly Overstated By Byrne Hobart • 3 Mar

Know you’re earning the most interest

Sunday, March 2, 2025

Switch to a high-yield savings account ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Longreads + Open Thread

Saturday, March 1, 2025

Hackers, Safety, EBITDA, More Hackers, Feudalism, Randomness, CEOs Longreads + Open Thread By Byrne Hobart • 1 Mar 2025 View in browser View in browser Longreads A classic: Clifford Stoll on how he and

🚨 This could be a super bubble

Friday, February 28, 2025

An expert said we're in the third-biggest bubble ever, the US poked China one more time, and OpenAI's biggest model | Finimize TOGETHER WITH Hi Reader, here's what you need to know for

Boring, but important

Friday, February 28, 2025

For those life moments you might need . . . ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏