Coin Metrics' State of the Network: Issue 165

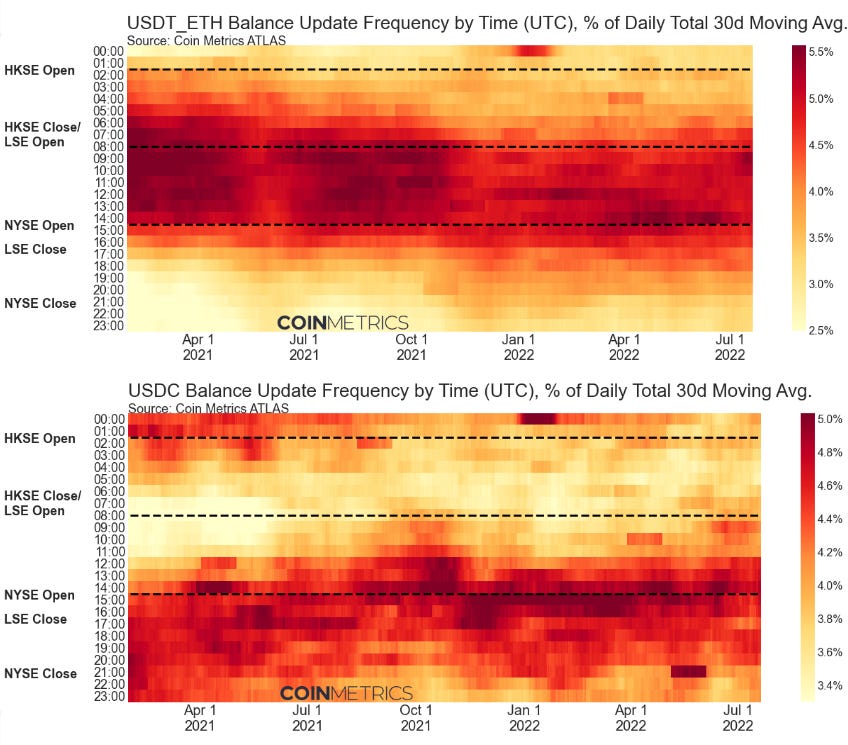

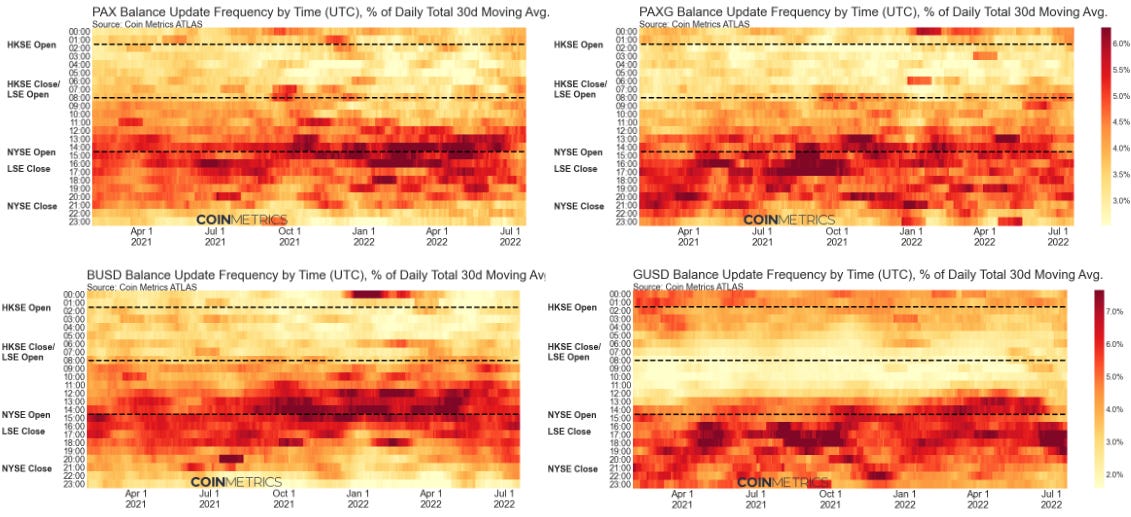

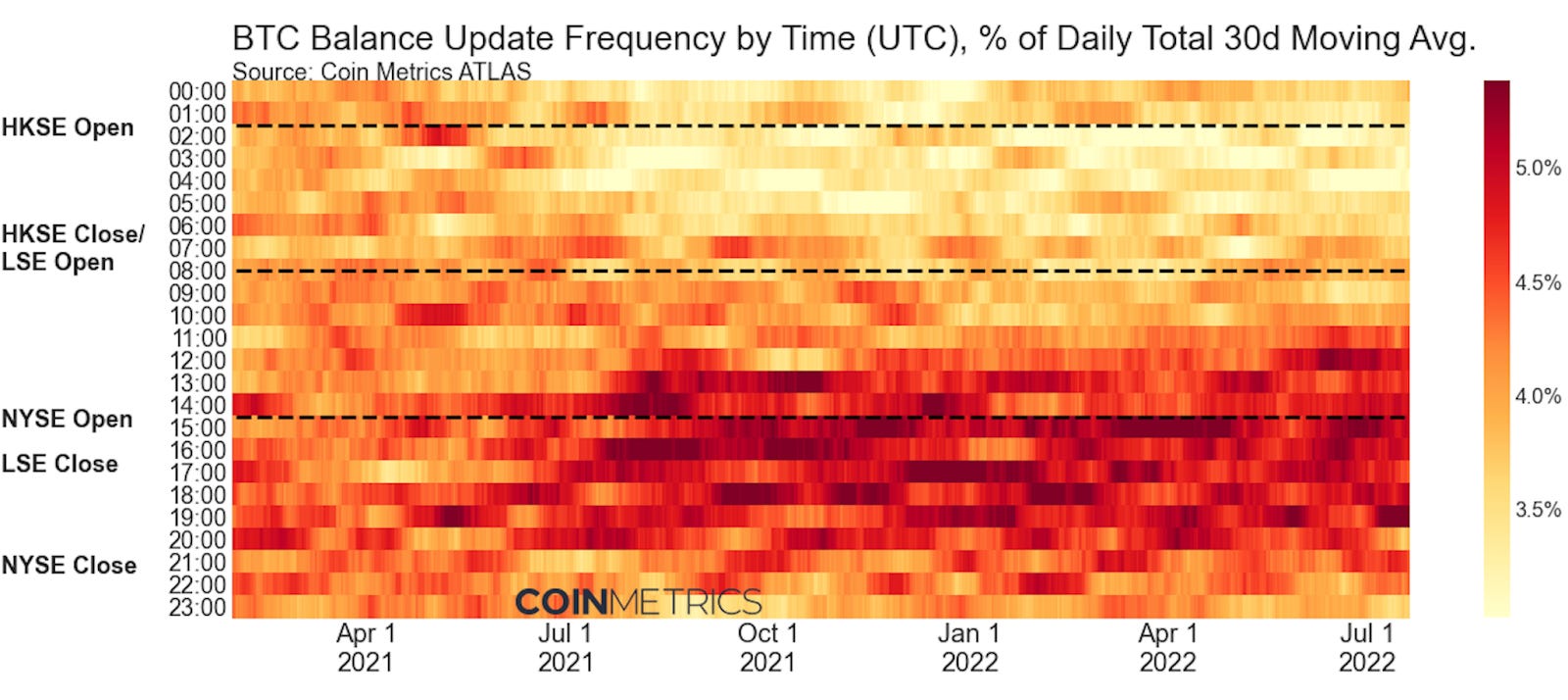

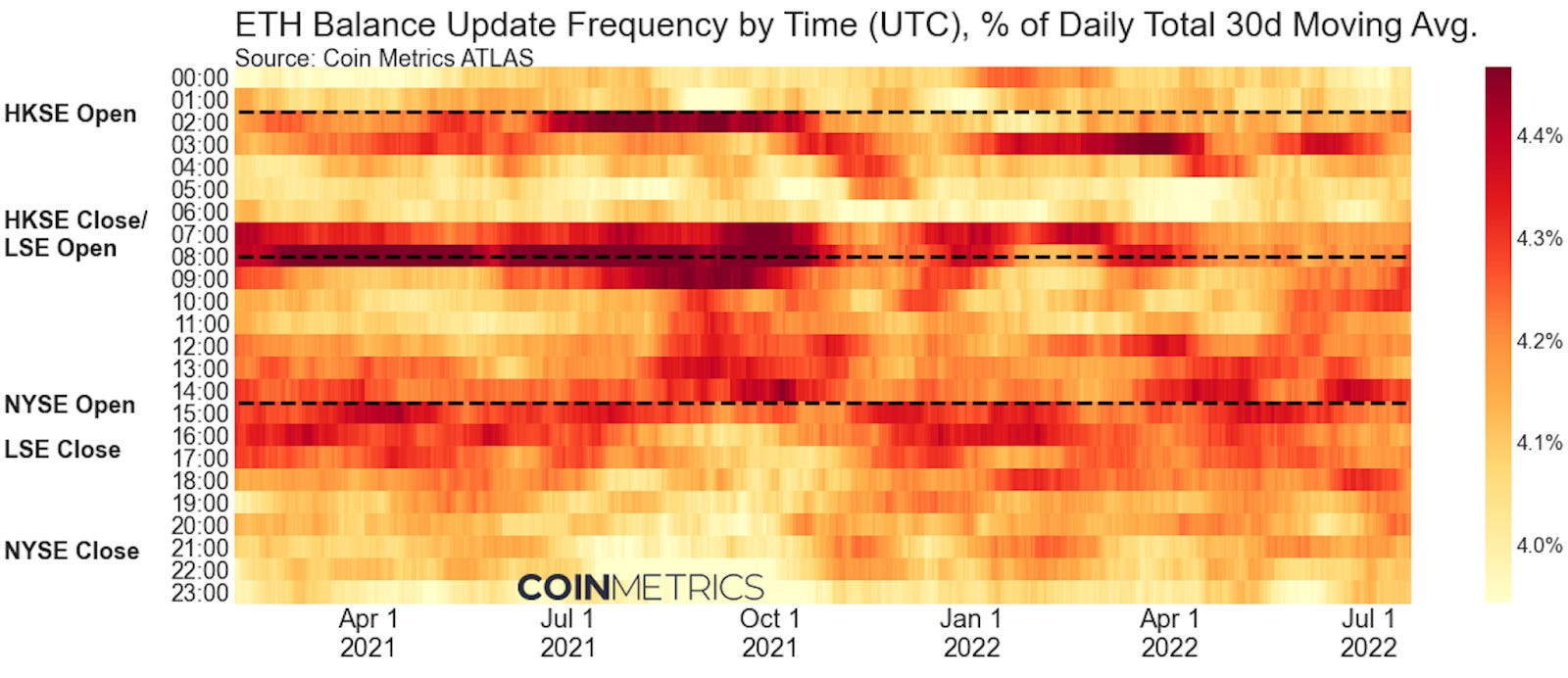

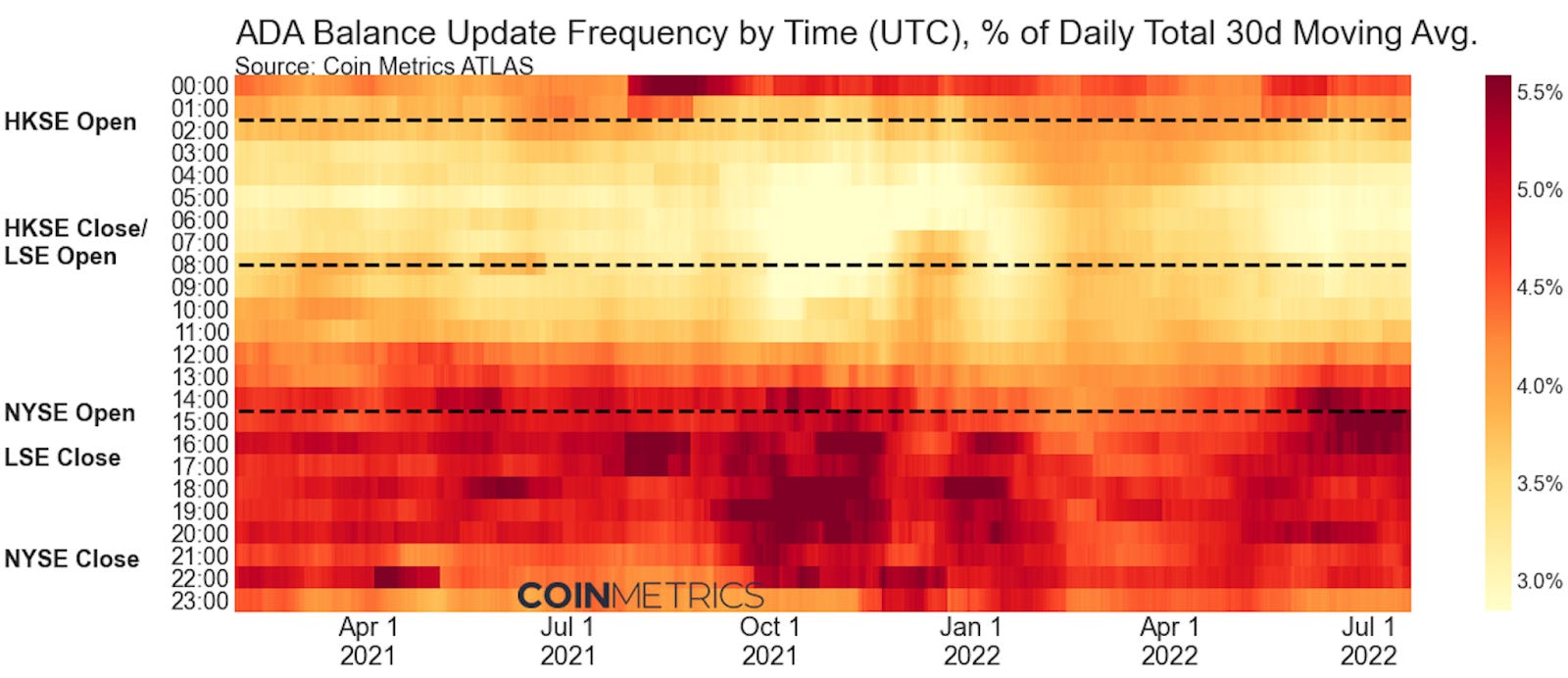

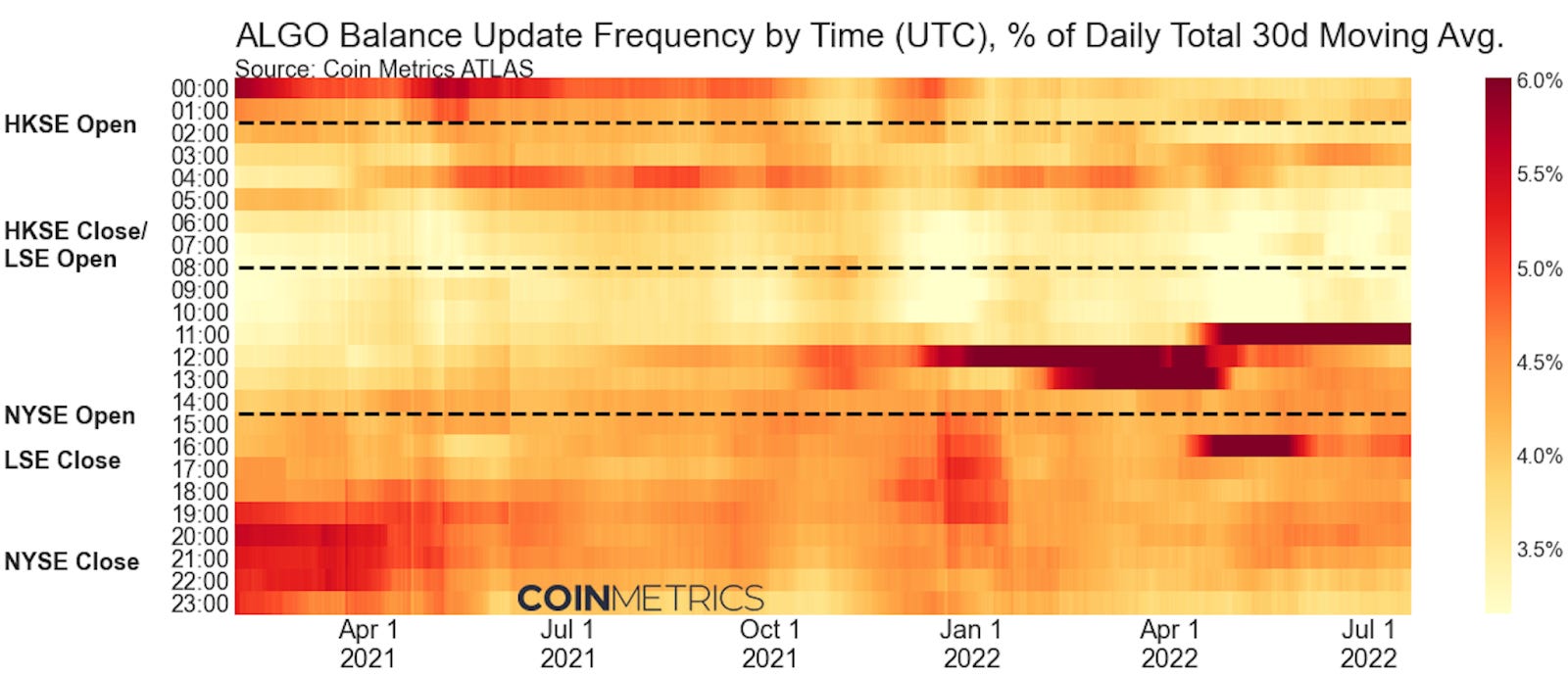

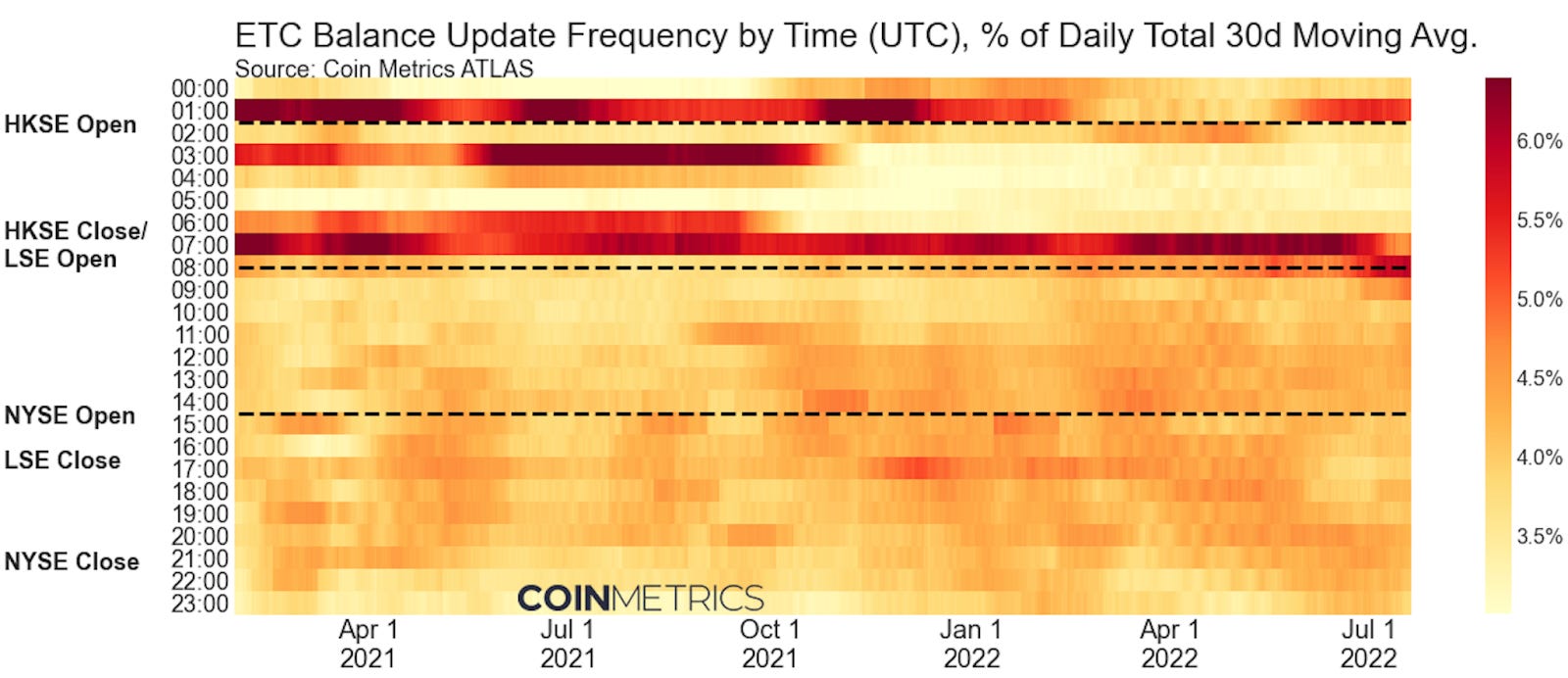

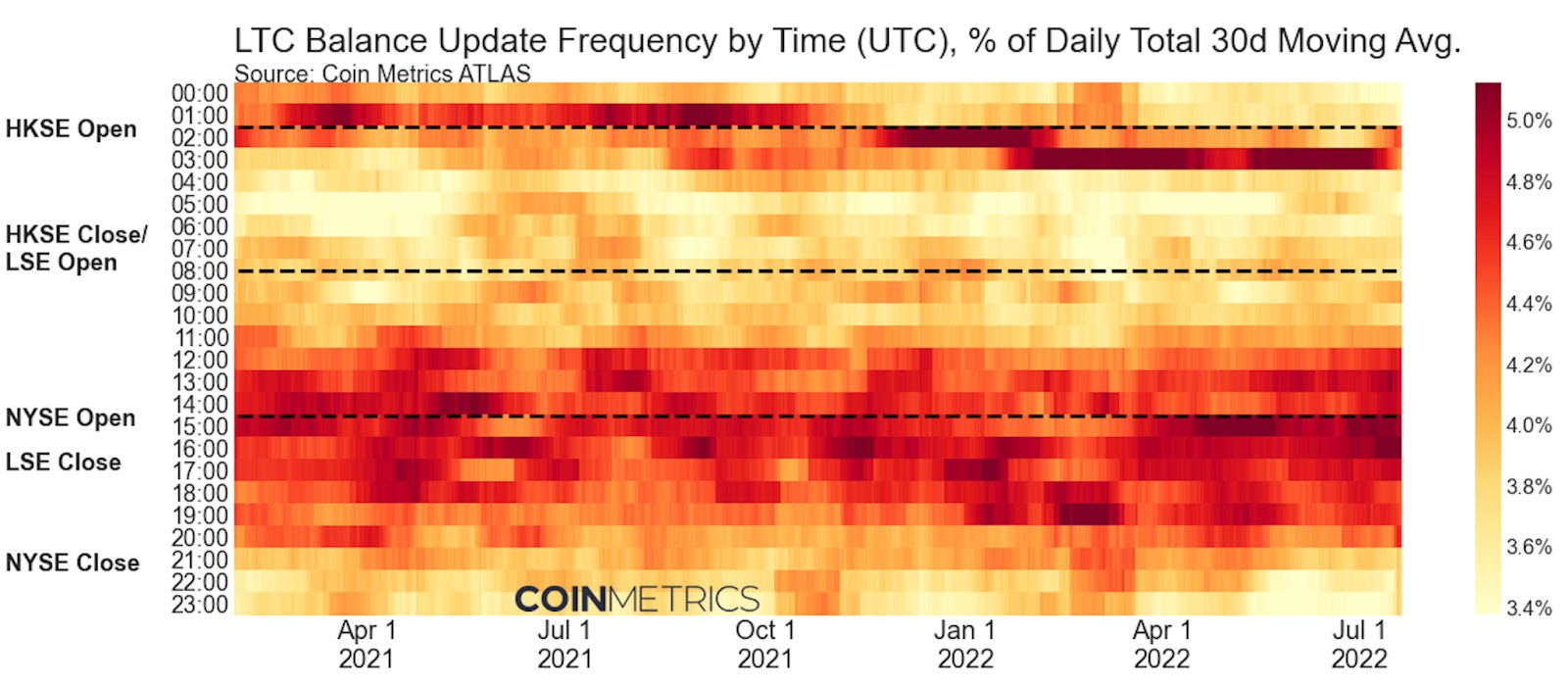

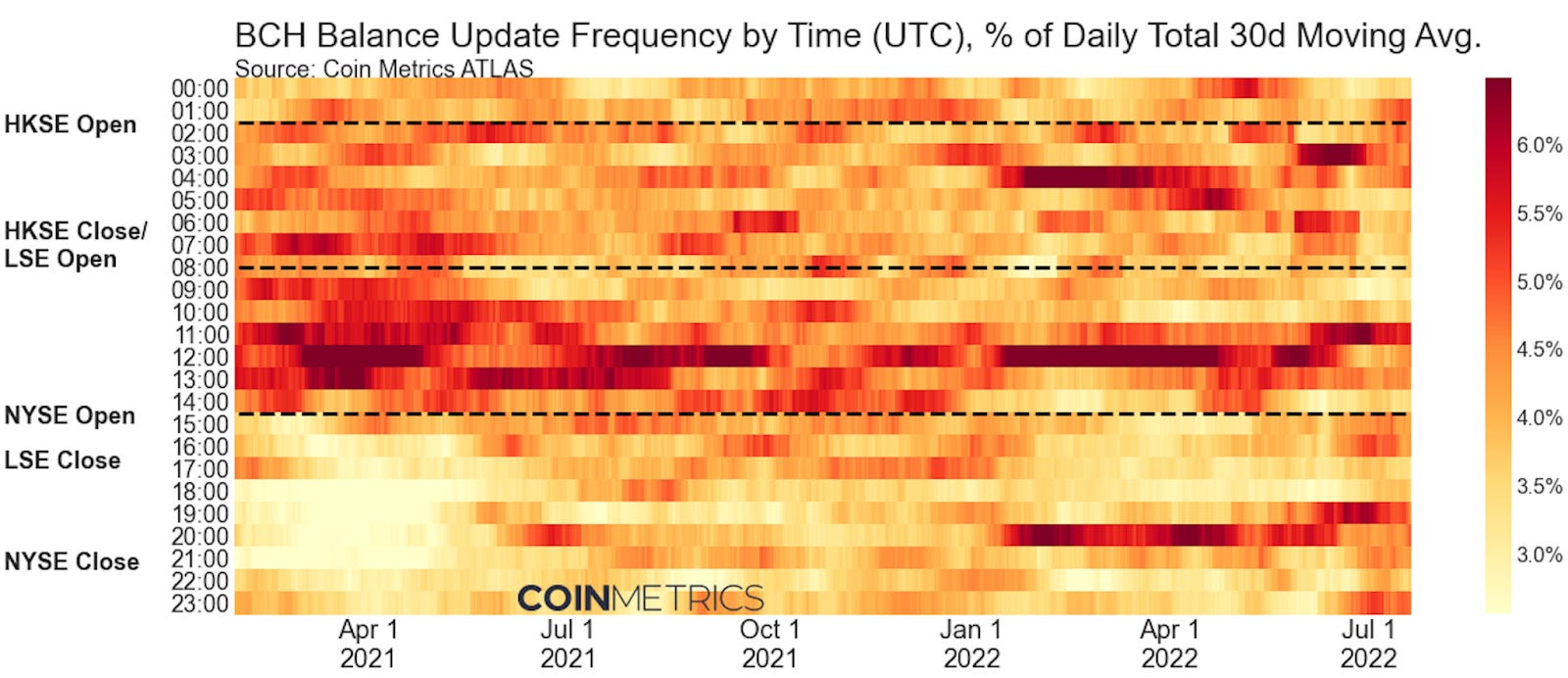

Get the best data-driven crypto insights and analysis every week: Exploring the Time-Based Patterns of Blockchain ActivityBy Kyle Waters, Nate Maddrey, and Matías Andrade Blockchains are well known for offering a degree of pseudo-anonymity to transactors. But even though individual transactions might not be all that revealing, the collective behavior of blockchain users can be informative in understanding broader usage patterns. One example of this is time-based patterns and seasonality. The activity levels of some crypto assets have been known to show high amounts of clustering during certain times of the day. For example, in the past we’ve analyzed the activity patterns of USDC and Tether to show that USDC is moved around most during New York/US trading hours while Tether is used primarily during Asia/Pacific and European business hours. In this week’s State of the Network, we broaden this study to many different assets, examining the daily variation in on-chain activity to elucidate when these crypto assets are typically most active. In each of the following charts we break down the percentage of daily balance updates (credits and debits to wallets) for each asset by hour of day using data from ATLAS, Coin Metrics’ blockchain search tool designed to standardize and simplify raw blockchain data. Using this powerful universal blockchain data model, the heatmaps below summarize the time patterns emerging from hundreds of millions of balance updates since 2021. We visually segment activity into three main categories based on the trading hours of the Hong Kong Stock Exchange (HKSE, 1:30 - 8:00 UTC), the London Stock Exchange (LSE, 8:00 - 16:30 UTC), and the New York Stock Exchange (NYSE, 14:30 - 21:00 UTC). Note that the data is smoothed with a 30-day moving average. StablecoinsSource: Coin Metrics’ ATLAS As mentioned above, one of the strongest observable patterns is the distribution of USDC and Tether (USDT) balance updates. USDC activity is highly concentrated during US market hours while USDT activity is centered around Asian and European market hours (note this is true for Tether across the Omni layer and Tron as well). Looking across other stablecoins, transfers of Gemini’s GUSD, as well as Paxos’ USDP (aka PAX) and Paxos Gold (PAXG) are concentrated during US business hours – a reasonable outcome for US-based issuers. Binance’s BUSD, which is issued in partnership with Paxos, is also active during early US business hours and European market hours. Source: Coin Metrics’ ATLAS BitcoinSource: Coin Metrics’ ATLAS Most activity for Bitcoin is now concentrated during European/US business hours with a noticeable downward change in the percentage of activity during Asia/Pacific hours around July 2021. While it is not entirely certain, this does correspond to the crackdown on Bitcoin mining in China that took place last spring and summer. EthereumSource: Coin Metrics’ ATLAS Unlike Bitcoin, Ethereum (ETH balance updates) does not show as strong of a daily pattern. Balance updates are somewhat dispersed. However, when looking at fees, there is a tendency for gas fees to be higher during US market hours, historically. CardanoSource: Coin Metrics’ ATLAS Most balance updates for Cardano are concentrated during the hours of 14:00 to 23:00 UTC, overlapping with US/Americas business hours. AlgorandSource: Coin Metrics’ ATLAS Algorand activity is higher during NYSE hours but exhibits distinct bands of activity. In the last few months, the 11:00 UTC hour has been especially active. Ethereum ClassicSource: Coin Metrics’ ATLAS Ethereum Classic exhibits curious concentrations of activity consistently within certain hours mostly taking place during the Asia/Pacific session, and we observe clusters with more than 6% excess balance updates relative to the rolling mean consistently around 1:00, 6:00 and 7:00 UTC. Looking deeper into the activity of specific accounts, we find one (likely) mining pool account LitecoinSource: Coin Metrics’ ATLAS Litecoin exhibits some interesting behavior clustering roughly between 1:00-3:00 UTC, which aligns with the Asia/Pacific market open, clustering tightly around a single hour bin. There is also an increase in activity during the LSE and NYSE sessions. Bitcoin CashSource: Coin Metrics’ ATLAS Bitcoin Cash has three clusters at 3:00, 12:00 and 20:00 UTC. Activity is most concentrated in Asia/Pacific and London sessions, but their share of activity has decreased relative to last year’s data. Bitcoin Cash has in the past exhibited a skewed activity profile due to applications and give aways. ConclusionThe transparency of public blockchain data allows for incredibly rich insights to be made into the nature of activity conducted on-chain. While balance updates are a useful primitive to study activity levels, other metrics could be used such as the number of active addresses by hour, total amount transferred, and fees paid by users. To keep up to date on on-chain data across the entire crypto ecosystem check out our free charting tools, formula builder, and correlation tool. Network Data InsightsSummary MetricsSource: Coin Metrics Network Data Pro Bitcoin daily active addresses held steady at around 870K week-over-week, a 1% rise. Ethereum active addresses fell by 1%, to an average of 538K/day. Other on-chain metrics picked up over the week as crypto assets rose broadly. BTC adjusted transfer value ($) rose 30% week-over-week to a daily average of $12B. Coin Metrics UpdatesThis week’s updates from the Coin Metrics team:

As always, if you have any feedback or requests please let us know here. Subscribe and Past IssuesCoin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. To learn more, acquire our data, or contact Coin Metrics reach out here. © 2022 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. If you liked this post from Coin Metrics' State of the Network, why not share it? |

Older messages

Coin Metrics' State of the Network: Issue 164

Tuesday, July 19, 2022

Tuesday, July 19th, 2022

Coin Metrics' State of the Network: Issue 163

Tuesday, July 12, 2022

Tuesday, July 12th, 2022

Coin Metrics' State of the Network: Issue 162

Wednesday, July 6, 2022

Wednesday, July 6th, 2022

Coin Metrics' State of the Network: Issue 161

Tuesday, June 28, 2022

Tuesday, June 28th, 2022

Coin Metrics' State of the Network: Issue 160

Wednesday, June 22, 2022

Wednesday, June 22nd, 2022

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏