The Daily StockTips Newsletter 07.29.2022

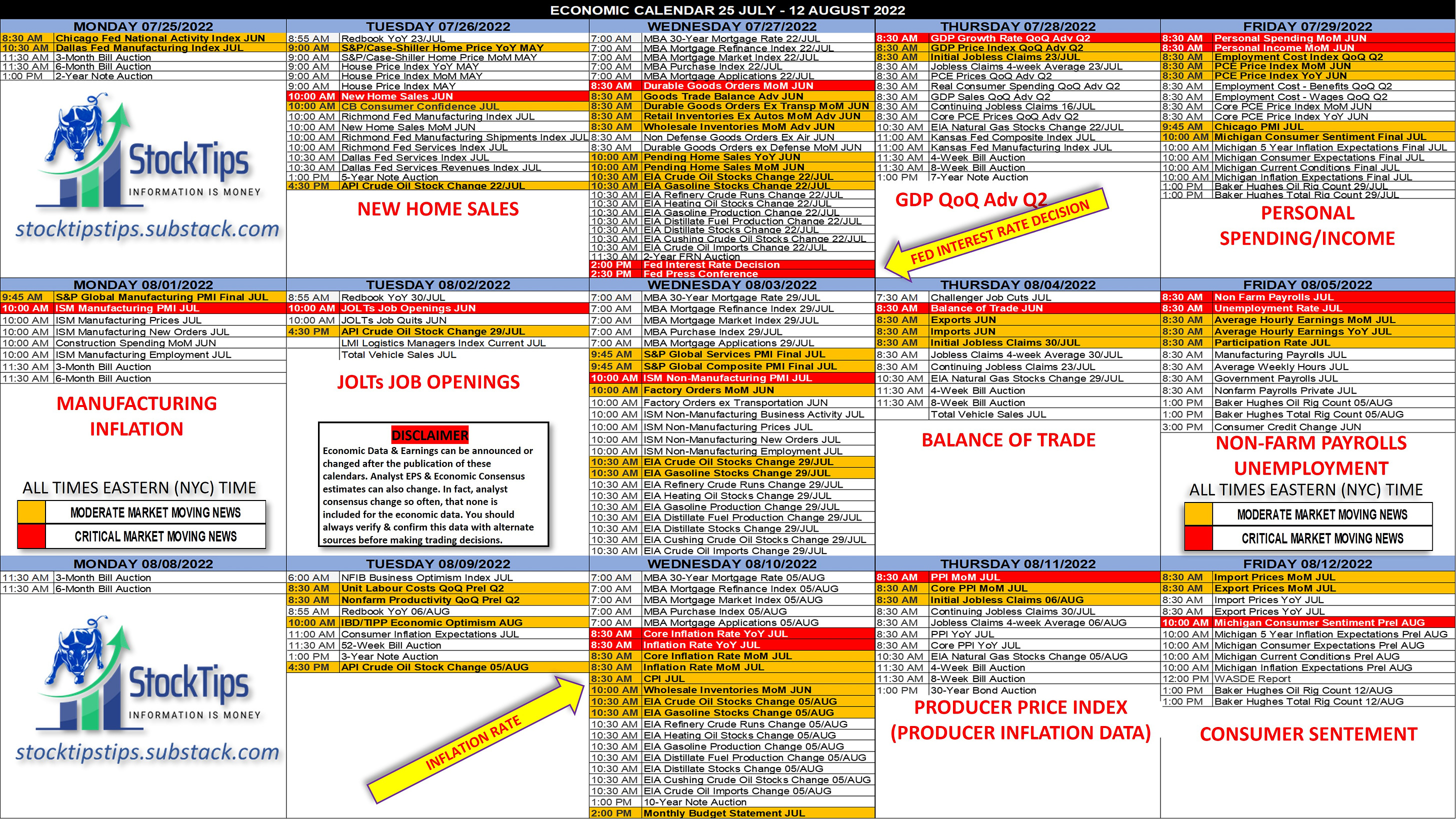

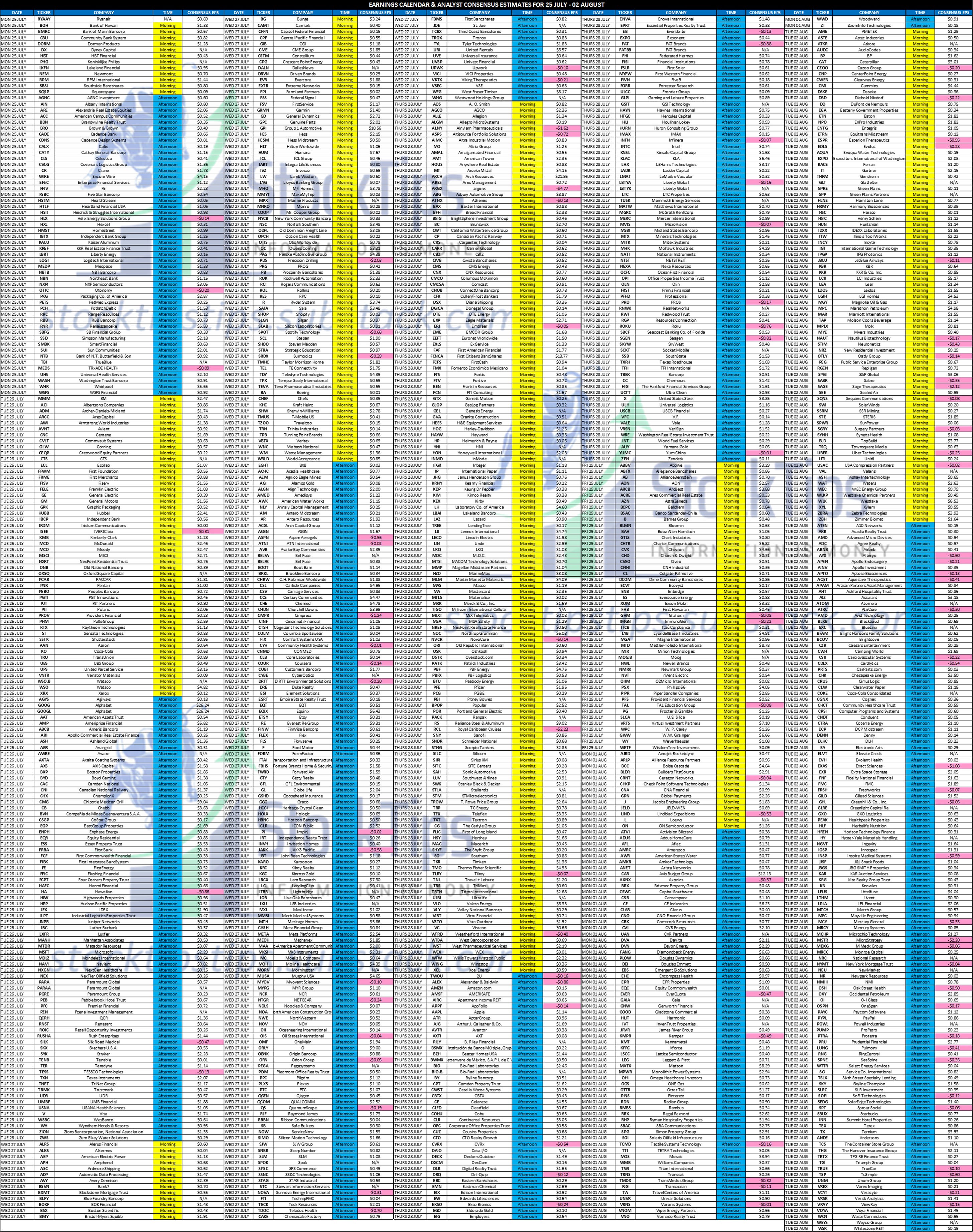

The Daily StockTips Newsletter 07.29.2022I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)WE’RE ON YOUTUBE NOW! See HERE & HERE (Yeah … I’m REALLY excited about this). Before you Trade Today: Know the Economic Calendar! Also See This Weeks Most Anticipated Earnings. NEVER BE SURPRISED BY EASILY ANTICIPATED MARKET BREAKING NEWS. That’s our goal here. PAID SUBSCRIBERS: My short play is red by 7.93%. Ouch huh? & that’s after averaging up. They reported earnings Wednesday (AH). NON-GAAP EPS was $0.11 when -$0.02 was expected (Matching the same quarter last year). Bad news for my short? All up until we consider the GAAP EPS. Their GAAP loss was -$0.45 per share. My position is small enough to increase in size significantly. So I will wait & see where she goes before allocating more capital. I haven’t lost on a short play yet in this newsletter, & I’m hoping this one turns around. But damn this market certainly turned bullish despite a mountain of bad economic data. ECONOMIC NEWS & COMMENTARY: GDP growth came in at -0.9% after -1.6% the previous quarter. Markets rallied for one or all of three reasons. 1) The bad news is largely behind us until the inflation numbers Wednesday after next. 2) A slowing is what investors want to see to get inflation in check. 3) Short covering taking profit prior to AAPL/AMZN earnings. Institutions are really pumping this market, but they have a vested interest in blowing smoke up our asses. Listen, consumer spending is overwhelmingly propped up by the service industry. Discretionary spending is shockingly low, the inventories reflect this. Sure, Amazon announced higher than expected sales, but I’ve been ordering from Amazon just so I don’t have to drive to the store (gas prices) to pick up my essentials ... well, that … & I can buy Redbull in bulk on the cheap. Yeah yeah, I know its bad for me … don’t preach. What do you think fuels these newsletters? HOW HIGH EMPLOYMENT IS DRIVING INFLAITON: As of June 2022 the Civilian Labor Force Participation Rate was 62.2%. Before the pandemic hit it was 63.4%. We have yet to fully recover on civilian labor force participation. And if you think 1.2% is small potatoes, understand that a 1.2% increase in labor participation would add nearly 2% more workers to the existing labor force. Now remember that the unemployed count as labor participants. So the amount of people truly working is roughly 58.6% once we deduct the 3.6% unemployment rate. (Note: The Labor Force Participation rate are those who are either working or looking for work [Employed + Unemployed]=Labor Force). Why is all of this important? Because labor is the number one expense of most firms. And when there is a labor shortage, businesses need to increase wages to compete for workers. Here’s what I’m getting at, so as long as labor force participation remains low, so as long as unemployment remains low, INFLATION WILL DRIVE ON, despite whatever happens to supply chains, energy, or other factors. And as people are having less and less children as time goes on, that means the labor force grows at a slower & slower rate as time goes on, despite businesses growing at a faster rate over the same time frame. By now, it should suddenly dawn on you how inflation can drive higher & higher over time. The only way’s to cool this off is to either import more workers, force people back into the labor force, automate more jobs, or for the Fed to drive the economy into a recession. And what is the dual mandate of the Fed? Price stability & high employment! THEY ARE OFTEN MUTUALLY EXCLUSIVE! While it is possible to do both at the same time, amid periods of high inflation it can result in runaway inflation & an eventual economic collapse. Why isn’t anyone telling you this? Because no politician, economist, or member of the Federal Reserve Board of Governors, wants to admit that they need higher unemployment, businesses to fail, or pay cuts to get prices to come down. It’s why, IN PART, Congress ceded their constitutional authority to a central bank in the first place & preached the “independence of the Fed.” They can avoid the political fallout of tough decisions amid hard times. Food for thought! WORLD MARKETS:

RECOMMENDED:

Subscribe to StockTips Newsletter to read the rest.Become a paying subscriber of StockTips Newsletter to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

The Daily StockTips Newsletter 07.28.2022

Thursday, July 28, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

I Accidently Published the Newsletter Early This Morning

Wednesday, July 27, 2022

All, I was setting the newsletter up to go out at 0730 as I do every day & I accidently hit the “publish now” button. I tell you this just in case you're looking for it but can't find it at

The Daily StockTips Newsletter 07.27.2022

Wednesday, July 27, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 07.26.2022

Tuesday, July 26, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 07.25.2022

Monday, July 25, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

You Might Also Like

President Trump is asserting extraordinary power over independent agencies. Is the Fed next?

Tuesday, March 4, 2025

The rise and potential fall of independent agencies. View this email online Planet Money Not-so-independent agencies anymore? by Greg Rosalsky President Trump vs. the independent agencies. It's a

No Sales, No Survival - Issue #514

Tuesday, March 4, 2025

What smart businesses are doing to win in the long run. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🇺🇸 The president's crypto fund

Monday, March 3, 2025

Crypto's back in favor and European defense stocks got an, uh, arm up | Finimize Hi Reader, here's what you need to know for March 4th in 3:15 minutes. The US president announced plans for a

CDs supercharge your savings

Monday, March 3, 2025

You could earn up to 4.10% for a 1 year term ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI's Impact on the Written Word is Vastly Overstated

Monday, March 3, 2025

Plus! VC IPOs; Sovereign Wealth Funds; The Return of Structured Products; LLM Moderation; Risk Management; Diff Jobs AI's Impact on the Written Word is Vastly Overstated By Byrne Hobart • 3 Mar

Know you’re earning the most interest

Sunday, March 2, 2025

Switch to a high-yield savings account ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Longreads + Open Thread

Saturday, March 1, 2025

Hackers, Safety, EBITDA, More Hackers, Feudalism, Randomness, CEOs Longreads + Open Thread By Byrne Hobart • 1 Mar 2025 View in browser View in browser Longreads A classic: Clifford Stoll on how he and

🚨 This could be a super bubble

Friday, February 28, 2025

An expert said we're in the third-biggest bubble ever, the US poked China one more time, and OpenAI's biggest model | Finimize TOGETHER WITH Hi Reader, here's what you need to know for

Boring, but important

Friday, February 28, 2025

For those life moments you might need . . . ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Last Trader Standing

Friday, February 28, 2025

The Evolution of FX Markets ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏