The Pomp Letter - Not Your Keys, Not Your Coins

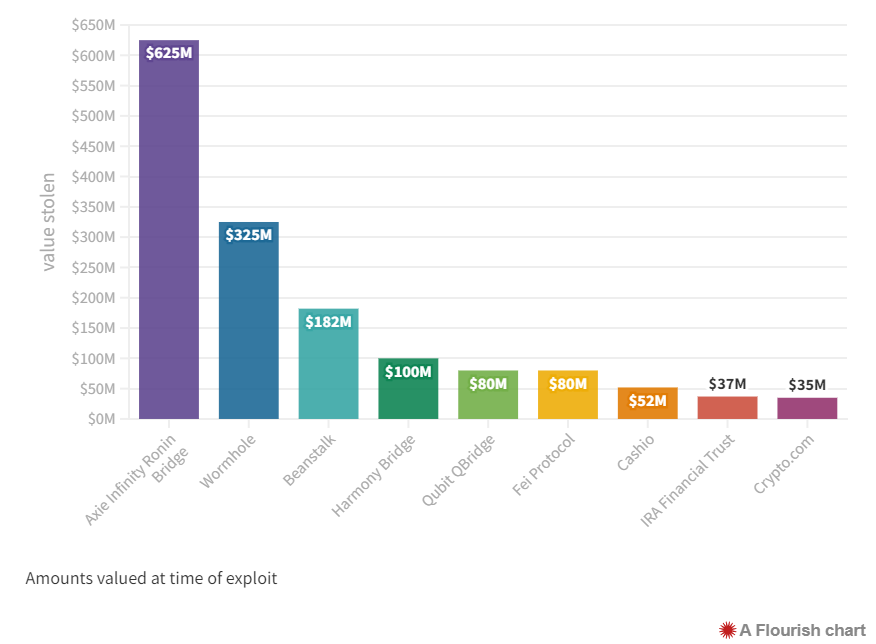

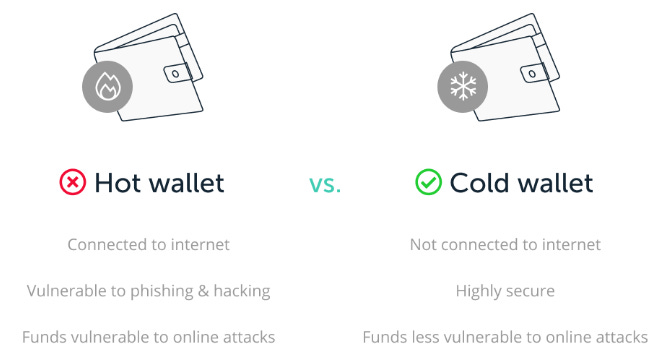

To investors, In addition to entering a crypto winter in 2022, we have experienced a multitude of exchanges closing withdrawals, filing for bankruptcy, blockchain exploits, and hackers manipulating smart contracts to drain wallets. I’ve asked my friends at Ledger to help explain the need for wallet security in today’s climate. Below is a guest post from their team: This year, crypto holders have been left (at least temporarily) without access to their digital assets with some of the largest exchanges closing withdrawals and even filing for bankruptcy. On top of holders being locked out of their assets, an estimated ~1.5 billion dollars has been lost to hackers this year across the largest exploits - including the most recent ~$8 million dollar Solana wallet drain. When it comes to keeping your digital assets safe, we need to talk about Web3 wallet security. It’s important to understand that there are different kinds of crypto wallets on the market, with different strengths and weaknesses. They can take several forms: physical device, software program or digital platform, but all of them can be stratified by two different vectors: who controls the private keys generated by the wallet, and whether the wallet is connected to the internet, both of which are key questions when it comes to assessing the protection the wallet offers. Let’s explore both of these vectors below. Custodial v Non-Custodial Wallets The first thing to consider is whether a wallet is custodial or noncustodial – in layman's terms, who has the keys for the blockchain address? “Not your keys, not your coins” is the mantra of crypto, but surprisingly, some wallets (exchange wallets, for example) don’t give you control of the private keys for the blockchain address where your assets are; instead, they control the keys themselves, giving you a “login” for their platform instead. The risk? You’re entrusting your assets to their security infrastructure. If the exchange is hacked, faced liquidity pressures, throttled or shut down, your coins and tokens go with it; with only a login and no private keys, you’re relying on the platform for your access, and can’t simply retrieve your assets yourself. This is not true ownership, something that needs to be taken into account when you’re considering how to secure your coins. With that said, let’s look now at the other main vector for wallet security: its exposure to the internet. Hot wallets vs. Cold wallets A digital “hot” wallet is a wallet that is connected to the internet. This could mean software wallets that exist on a mobile device, laptop or desktop computer, or even wallets on exchange platforms which, again, are always online. There are good reasons why you might use a hot wallet: user-friendly interfaces mean you can easily transfer and manage your crypto assets, and since you’re always online, the process is instant, which makes them very attractive for beginners. But there are also drawbacks, which we’ll discuss below. A “cold” wallet, on the other hand, refers to physical (usually small) objects, such as a hardware device, in which you can store your private key. Contrary to hot wallets, they operate in an offline environment while guaranteeing access to your funds at any time. Cold wallets provide a greater level of security as the vast majority of threats to your crypto exist online. This can range from hackers sending spyware to your computer to find your private data, to a malicious wallet app being set up to look real to gain access to your data. So although hot wallets are the most convenient means of securing your private keys, they are subject to some critical vulnerabilities that could leave your crypto at risk. Let’s look at that now. Focus: the pros and cons Beyond the hot/cold dichotomy, there are subcategories of wallets. Each of them having pros and cons. In order to guide you in your crypto security journey, let’s quickly review them all. Hot Wallets Exchange and online wallets These wallets are hot wallets accessible through websites. Both are easy for beginners as they offer convenience. However, they do not allow you to own your private keys, i.e. your crypto assets. And they are prone to hacks, online threats and virus attacks. Therefore, they have a lower level of security and limit your freedom. Software wallets Hot wallets accessible through a dedicated desktop or mobile app. While being safer than web wallets, they are under the threat of malwares and hacks, like the Slope wallet that was impacted by the recent Solana exploit. . Hot wallets are highly popular for mobile users and conveniently transfer small amounts of cryptocurrencies. However, users should never store vast sums in hot wallets. Treat hot wallets as you would treat a physical wallet, where you only keep small sums of cash at a time. Cold Wallets Hardware wallets Cold wallets and the most secure way to keep your digital assets safe. Hardware wallets are physical devices used for storing your private key in an encrypted, offline environment. Put simply, hardware wallets allow you to perform all your operations when connected to your computer or phone, without ever letting your private key “out”, on the Internet or on your device. Therefore, your private keys remain safe from online hacks or virus threats while managing or transferring your crypto assets. That’s why hardware wallets are not vulnerable to such cyberattacks, unlike exchanges and other hot wallets. Conclusion There is no certainty on when the next blockchain exploit will hit or if an exchange will close its doors (either temporarily or permanently). Using a hardware wallet is the safest way to mitigate risk of losing your crypto - ensuring full ownership and control over your digital assets as you are the only one in charge of your money and own your private keys. There is no third party involved. Hardware wallets, like the Ledger Nano X and Ledger Nano S Plus, are the flagship standard for security. Users, exchanges, and projects all favor hardware wallets as their long-term storage solutions for cryptocurrency assets. Pomp’s Thoughts: The last few months have shown us how important security can be. Market participants will continue to use a variety of solutions, especially if they are able to generate yield or leverage various applications, but a core understanding of hardware wallets is important. The saying “not your keys, not your coins” is catchy and holds quite a bit of truth too. A big part of the value proposition from bitcoin and cryptocurrencies is self-custody. Be your own bank. Don’t rely on any third party. You can only do this if you hold your private keys. The journey to learning this information can be intimidating, but I promise it isn’t nearly as hard as it looks. Take an afternoon and dig in. Move $5 worth of bitcoin back-and-forth between hot and cold wallets. Learn how these things work. Your future self will thank you. Hope everyone has a great weekend and I’ll talk to you all on Monday. -Pomp 🚨 SPONSOR: The most anticipated crypto event of the year is back. Don’t miss Mainnet 2022, September 21-23rd in New York City. Connect with 4000+ crypto builders and thought leaders for 3-days of can't-be-missed keynotes, fireside chats, demos, networking, and more. Mainnet brings together a stellar cast of crypto pioneers to speak about the industry's current state and provide projections on the future of web3. Don't miss programming like the fireside chat between Messari’s Ryan Selkis and Ripple's Brad Garlinghouse and keynotes from speakers like crypto entrepreneur Balaji Srinivasan and OpenSea's Devin Finzer. Click here to see our 150+ speaker lineup and purchase your pass. Plus, get $300 off of your pass today by visiting and entering promo code "POMPLETTER" at check out. 🚨 THE RUNDOWN:US Federal Reserve Minutes Show More Rate Hikes Coming, Concern About Stablecoin Risks: U.S. Federal Reserve governors anticipate announcing more interest rate increases in the coming months, but the pace of the hikes will likely slow if the inflation rate starts to come down, according to meeting minutes released Wednesday. The minutes are from last month’s meeting of the Federal Open Market Committee, which is the Fed’s monetary-policy panel, led by Chair Jerome Powell. But more than interest rates came up during the meeting. The financial stability of digital assets, particularly stablecoins, was also discussed, according to the minutes. Read more. Why Bitcoin Traders Should Care About Double-Digit Inflation in UK: The cost of living in the U.K. surged to 10.1% in July, a government report showed Wednesday, providing the first instance of double-digit inflation in a major economy post-COVID-19 and presenting a fresh sign of price pressures spreading around the world. The report could bring more urgency to economic discussions among crypto analysts, because inflation has underpinned a key bitcoin market narrative for the past couple years. Read more. Penn to Buy Rest of Online Gaming Partner Barstool Sports: Penn Entertainment Inc. is acquiring the remaining shares of Barstool Sports that it doesn’t already own, giving the casino operator full control of the controversial sports and pop-culture company. In a filing Wednesday, Penn said it exercised call rights and would complete the purchase of the remaining Barstool shares by February 2023. Read more. Football Fanatic Builds $1 Billion Bet Against Game’s Mega Rich: John Textor has taken just 12 months to go from fanatical football fan, watching hundreds of games a year, to one of the sport’s biggest investors. He’s acquired stakes in teams from London to Rio de Janeiro, building a football empire like a business to cast himself against the game’s mega rich elite. It’s a second act for Textor, who forged his reputation and wealth over decades as an investor in disruptive digital technologies. Read more. Sergej Kotliar is the CEO of Bitrefill. In this conversation, we discuss the Circular Economy, Bitcoin the tool vs. Bitcoin the monetary movement, if the lightning network is overrated, and all of the hypocrisies that exist in the Bitcoin maximalism space. Listen on iTunes: Click here Listen on Spotify: Click here Bitcoin Is Not Close To Global Adoption — A Rational Conversation With Bitrefill CEO Sergej Kotliar Podcast SponsorsThese companies make the podcast possible, so go check them out and thank them for their support!

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You’re a free subscriber to The Pomp Letter. For the full experience, become a paid subscriber. |

Older messages

Is A Soft Landing Possible Anymore?

Friday, August 12, 2022

To investors, Below is a guest post from Alfonso Peccatiello (@MacroAlf), author of The Macro Compass, providing analysis on the latest CPI and labor market reports, and showing how they do not

Podcast app setup

Sunday, August 7, 2022

Open this on your phone and click the button below: Add to podcast app

Institutions Aren't Running From The Bear Market

Thursday, August 4, 2022

Listen now (4 min) | To investors, There has been anticipation of Wall Street institutions joining the bitcoin and crypto industry for years. Fidelity started mining bitcoin back in 2014, which was

Podcast app setup

Thursday, July 21, 2022

Open this on your phone and click the button below: Add to podcast app

Podcast app setup

Sunday, July 17, 2022

Open this on your phone and click the button below: Add to podcast app

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these