| Jerome Powell spoke and the market listened as the Nasdaq dropped almost 4% on Friday. We still have a ways to go to get inflation under control which according to Powell means “pain” ahead. Restoring price stability will require a “sustained” period of below-trend growth and a weaker labor market, Powell said. “While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses,” he said.

While I’m a realist, I also try to bring my glass half-full mentality to situations. There will be pain but one of the areas least affected will be continued growth in cybersecurity spending. If you want to understand what’s 🔥 and selling, there is no better place to look than Crowdstrike and Palo Alto Networks. This past week PANW crushed its earnings forecast with analysts suggesting it’s on a path to doubling its market cap to a 🤯 $100B in 2 years. So investigated deeper and pulled out a few 💎 from the earnings transcript: Tons of security vendors in market and as a 🦍 should do, it’s flexing its 💪🏼 and selling the one platform and vendor consolidation sale It confirms and validates our view that customers will consolidate if we give them constant best-of-breed products and ensure that they are integrated to deliver better security outcomes.

What recession? Security spending will remain strong especially as “majority” of customers continue to modernize their infrastructure. …in transformational projects, the vast majority of our customers continue on their investments here despite the expected short-term macro impacts. Security spending is tied into our customers' desires to move to the cloud, drive more direct relationship with their customers, modernize their IT infrastructure, as well as drive efficiencies while adapting to a new way of working.

Startups are F&$%ing hard and large tech vendors are striking back to get their best employees to return - 😲 PANW aggressively rehiring top performers who left with 50% returning from startups! Another trend I would like to highlight is the return to Palo Alto Networks by employees who had left for seemingly greener pastures. Over a six-month period, as part of our Welcome Home program, we have engaged with many former employees. To date, dozens of top performers have been rehired with many more in the funnel. Over 70% of people reached out to have expressed a desire to come back to us and a significant number already have. 50% are returning from start-ups, the next largest percentage coming from peer companies. We're happy to welcome these employees back to Palo Alto Networks.

Multi-product sales and platform opportunity works - look at those attach rates 🤯 - 50% of Global 2000 have purchased products in all 3 of its platforms. The number of customers that spend over $1 million annually with us continues to grow, with the millionaire count now in excess of 1,200 and the number of Global 2000 customers that have purchased products in all three of our platforms is now 50%.

Hello Wiz - the TAM for cloud security is early and massive. You may soon see a day where there will be $1 trillion in public cloud consumed. Our observation thus far in this early market is that companies allocate 2% to 5% of the cloud budgeted security, creating a significant Prisma Cloud opportunity.

Developer first security is just getting started! In 6 months Bridgecrew Cloud IAC product has signed over 200 customers. The Developer opportunity for cloud security is real and huge. Our approach with Prisma Cloud delivers a comprehensive platform with a growing set of capabilities to stay ahead of our customers' needs. Increasingly, cloud security needs to start at the moment, developers write their first lines of code through to deploying and running this code in public cloud. The acquisition of Bridgecrew brought us infrastructure as code, a way of detecting and fixing security issues during development. IAC became our ninth integrated module of Prisma Cloud at the end of January. And in the first six months of availability, we already have over 200 customers, making it our fastest-growing new module

More on the size and opportunity in ☁️ security 🤯 Rob Owens -- Piper Sandler -- Analyst Great. Thanks for taking my question. I'd love to drill down into the success you guys are seeing in Prisma Cloud. And what are the biggest factors and/or technical differentiation that's driving your success right now? Nikesh Arora -- Chairman and Chief Executive Officer Let me give you sort of an overarching picture, and Lee has been kind enough to elicit our product capabilities. But like -- very quickly, we're noticing that if you go out look that there's hundreds of billions of dollars of cloud being sold by our cloud service providers, the top five around the world. And what is becoming clear is most of the top end or large customers are in multiple clouds. They're not just in one. We ourselves are in GCP and AWS instances and in the [Inaudible] of Azure. So we're seeing ourselves in multi-cloud scenario. So, one, that multi-cloud development is causing customers to look for a multi-cloud solution, and that's normally not driven by one cloud service provider typically somebody like us. That's one part of it. The other part is if the customer is looking for a point solution, it's harder for us, but most customers are migrating away from point solutions, looking for a more platform approach. As Lee highlighted, which -- Bridgecrew, which we acquired operates on the left side of the development life cycle, the build life cycle. Prisma Cloud used to traditionally operate in the run cycle where you put things into production. By connecting build and run, we've created the sort of even the extension to the development life cycle. So we are seeing people who are taking a serious view toward cybersecurity in the cloud come to Palo Alto Networks and not chase some point solutions. If you look at the industry, there are no platform solutions available. Most industry groups have already validated that as the SC awards we heard about this morning. So Lee, do you want to add something? Technical differentiation?

The market for cloud security is still early, and it will be interesting to see top down CISO driven vendors like Palo Alto Networks and private cos like Wiz and Orca compete while Snyk attacks from a different entry point with the world’s first developer-centric cloud security platform. As always, 🙏🏼 for reading and please share with your friends and colleagues.

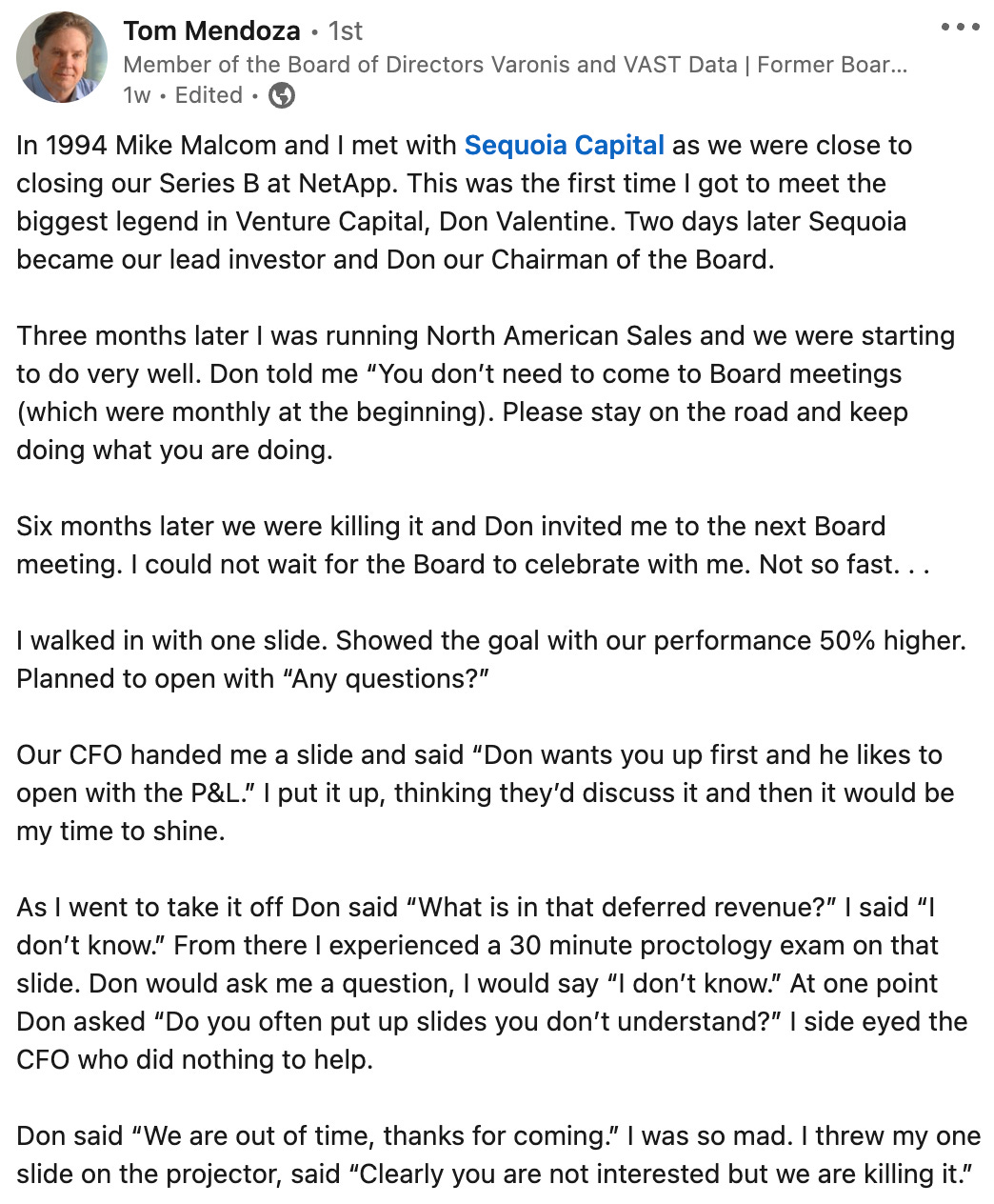

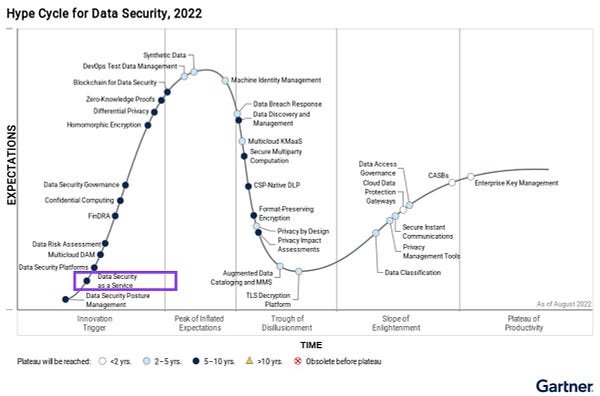

Lessons on leadership from Tom Mendoza, founding head of sales and then President of NetApp. I was fortunate enough to spend time with him in board meetings for Security Scorecard Read the rest here This reminds me of my 3 Cs for working with founders… 💯 as I’ve mentioned many times - the challenge for founders is how to maintain scrappiness while still scaling team over time May you one day be in position to think about this - getting a real CFO onboard for public earnings - that being said, they are many baby steps to be take as your startup grows and raises more capital What is root cause reasoning and how it can help you deeply understand a problem before building a solution…

GitLab 2022 Global DevSecOps Survey is out Secure software development is now an imperative for DevOps teams around the world. It’s the number one reason for – and benefit of – DevOps platform usage.

Great stories on Figma’s early days and how it grew inside of pockets of Microsoft despite a strategic relationship with Adobe - this is what a great early enterprise design partner or customer can do for you (CNBC) Figma had to start small. Like many organizations, Microsoft began using it for free. Today, a customer can pay Figma each month based on the number of people who make changes to files, while a more limited version of the service is available at no cost. In 2017, a year after the Xamarin acquisition, Field hosted Friedman at his company’s San Francisco headquarters. Field says he remembers asking Friedman why Microsoft didn’t want to keep using the free version of Figma. ″’Look, we’re all worried you’re going to die as a company,” Field recalled Friedman telling him. “We can’t spread it inside Microsoft as a company even though we like it, because you’re not charging.” It wasn’t just about keeping Figma alive. As a big-spending customer, Microsoft was in position to start asking for more features. Field said Microsoft’s feedback led to several improvements. For example, Figma engineers worked to make it easier to move from screen to screen in a single Figma file. The company also added support for input from Xbox game controllers and made prototype previews work faster on mobile devices. Ultimately, Microsoft’s requests helped Figma develop its top-tier enterprise plan, Field said, adding to the free version and paid monthly premium packages that range from $12 to $45 per editor per month. The enterprise package runs at $75 per editor and includes dedicated account managers and advanced password management.

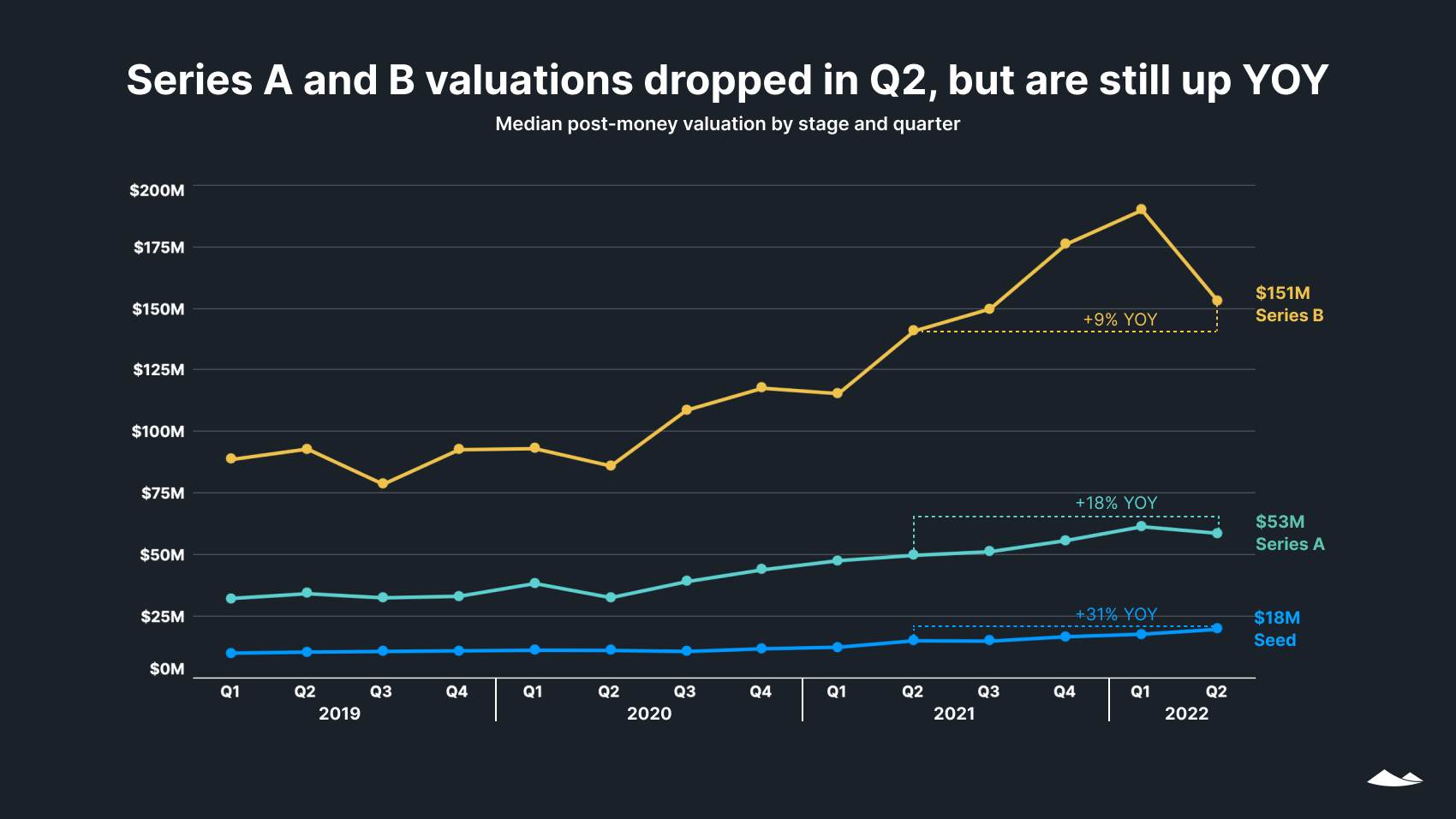

NFTinfrastructure landscape Gartner Hype Cycle for Data Security Primer on developer productivity…IMO still a huge opportunity for better tools to allow devs to do more with less Seed market still on 🔥 according to Carta - while the overall number of seed investments are down from last quarter, the rounds that are getting down are 21% higher at $3.3M with valuations up 31% YOY with a median post-money of $18M - makes a ton of sense as it is a great time to be heads down building now Many companies are “topping off” and adding to last rounds of financing previously raised. This week you have two AI-related startups with Anyscale adding $99M to its $100M Series C round announced in December and Celonis adding $400M of equity to its last round along with $600M of debt The $400 million investment was led by the Qatar Investment Authority and included the participation of more than a half dozen other backers including Accel and T. Rowe Price Associates. According to Celonis, the funding extends a Series D round that it closed last year. The $600 million revolving credit facility, in turn, was raised from a group of banks led by KeyBanc Capital Markets.

Great podcast 🎧 from Changelog on eBPF (Extended Berkeley Packet Filter) and why Facebook, Cloudflare, Netflix and others are using the low level kernel tech for observability, security, and more - many of leading cloud security vendors are leveraging eBPF for security Must read, especially for non-technical founders Huge decision from Plaid - how to go from being a commodity + invisible API to extending the interface to the consumer front end - took 18+ mos to convince bank partners, etc. to get comfortable with not controlling the front-end but over time consumers grew to love the consistency - not obvious at time 😲 Incredible numbers from FTX crypto - from Kate Rooney with CNBC - “Revenue jumped 1,000%, topped $1B - Profitable, with 27% operating margins - Most biz coming from derivatives, outside U.S. - Global footprint growing through M&A” Read more on data poisoning and adversarial ML attacks - still early days but there will surely be some massive attacks in the future - more here 👇🏼

Sign of times - how do you raise capital and keep your current valuation - convertible debt - Arctic Wolf in talks to raise $300M (The Information) The debt would convert to shares at a premium to the price in an eventual initial public offering, the people said. Such an arrangement would indicate that the investors are betting the stock will trade even higher after the IPO price. The Eden Prairie, Minn.–based startup is working with Morgan Stanley as part of the deal, which has not closed. Bankers expect more late-stage startups to take on debt as venture investors curtail equity deal-making.

👀

If you liked this post from What's Hot in Enterprise IT/VC, why not share it? | |