| In JC’s Newsletter, I share the articles, documentaries, and books that I enjoyed the most in the last week, with some comments on how we relate to them at Alan. I do not endorse all the articles I share, they are up for debate. I’m doing it because a) I love reading, it is the way that I get most of my ideas, b) I’m already sharing those ideas with my team, and c) I would love to get your perspective on those. If you are not subscribed yet, it's right here! If you like it, please share about it on social networks! Share 💡JC's Newsletter

Once every several newsletters, I’m going to do a deep dive on health because I think there is a lot to learn, obviously for Alan but also in different industries. 👉 Invisalign: Patents, Patients, Profits (Join Colossus) ❓ Why am I sharing this article? The scale of the business they built is very interesting. Dental is an important part of our cost structure and it is key to understand this market well. I felt that understanding the scale of their business, the competitive environment can help us define our strategy on orthodontics and see if there are ways to be innovative down the line. Knowing their margin can also help us better negotiate.

Business numbers: Invisalign generates over $2 billion of revenue and accounts for roughly 20% of the orthodontic market. Pretty consistently 25 to 30% EBITDA business. Extremely strong gross margin profile ranging from 73% to 77% on an annual basis.

Their product insight: The key insight was computer-aided design to move teeth would allow one company to 3D print and then adjust people's teeth with computers. You combine that with the power of custom manufacturing through 3D printing. And the idea was, how do you take these clear aligners, these pieces of plastic and predict within 0.1 millimeters, exactly how somebody's teeth are going to move and print a tray that's just a little bit ahead. The cost of goods is much higher in the dental practice when you buy a product like Invisalign, but you can see way more patients and do way fewer office visits. And so you can drive a much more profitable practice.

➡️ Interesting to think about those incentives for the orthodontist, and for us for those kind of products. ➡️ That is why there is more and more competition. Orthodontics market: The dirty secret about orthodontics is that it's a really good margin. It's an incredible margin business if you look at the actual cost for everyone in the entire value chain. You look at a $200 or $300 product that's sold to the end consumer for $5,000 or $6,000 and it makes sense why your town orthodontist is working four days a week and driving around in a Porsche and playing golf.

➡️ Orthodontics market is very profitable. Distribution: And the idea was, we're going to sell it through a dental practice. Align went and they went really aggressively at onboarding hundreds and hundreds and eventually thousands of dentists to sell the product. Historically in dental distribution, you'd rely on a distributor. There are 2 or 3 really large distributors in dental, Henry Schein and Patterson. Invisalign built their own salesforce. So Invisalign took it on the chin and said, "We're going to build our salesforce from the ground up."

➡️ On the importance of building your own distribution. Being smart on where to outsource:

➡️ Could it inspire us for some parts of the clinics? While keeping the quality very high.

👉 Fount and the Body’s Magical Future (Not Boring) ❓Why am I sharing this article? Their vision: Example of tests: In August, we scheduled a full blood test to get a baseline. They’ll send a phlebotomist to your house. I didn’t have to pay; it was part of the program, once you sign up with Fount, everything is included. They took 14 vials of blood and a urine sample. To kick off, we went through the results of my blood tests. Hearing Andrew explain the results, and how they tied into the fatigue and stress I was experiencing, “After looking at all of the data we have collected, it’s clear that we’re going to be able to make great progress towards your goals.” “Your tests support this, with strong signs of stress hormone levels being above optimal. Combined with some important nutrient deficiencies, these really help to explain what you’re feeling. Thankfully, these are all things we can work with you to solve and get you feeling great!”

A comprehensive, personalized program across six categories: Sleep: They threw everything at sleep: light filtering glasses, Hue color changing lights, nighttime shower and meditation, nasal rinse, recommendations on when to stop eating and drinking, and sleep supplements. Exercise & Recovery: The Fount program comes with WRKOUT training sessions included. They’re live video sessions with a top-notch trainer – shout out to Marc! – as many times a week as you’d like.

“When we looked at your labs, your wearable data, and your interview data, it looked like you had both high inflammation and sensitivity to stress hormones, so we experimented... We tested what happened when we supported you via supplements to keep your inflammatory levels in the optimal range and then added breakfast to support your brain, and voila, much more energy and focus when you wanted it!”. Where I could check in each day to see what I needed to do – when to meditate, what to eat, what supplements to take when, etc... They built their own custom supplement packaging facility. They know that no one is going to take supplements from 7 different bottles every day, so they send personalized pre-packed supplements by time of day. Throughout the program, I’ve had video check-ins every 1-2 weeks. I also had monthly blood tests to understand what was happening in my body and adjust the program accordingly. Now that I’m through the three-month Core program, I’m staying on the Support program: I still have supplements coming, less regular blood tests, monthly check-ins, and the ability to message Guy and Andrew whenever something comes up.

Business model: $5,000 per month for the three-month Core program and $1,000 per month for the ongoing Support program, a long waitlist, growing corporate sales, and software-level margins, high-end health and performance advisory is a very good business. While Fount says that it’s building an operating system for the human body, what it’s really building in the short-term is a set of health & performance APIs that allow you to access the collective knowledge of the Fount team and toolkit they’re building on top of their unique data set.

👉 Avi Medical raises €50m to bring back the family doctor experience (Sifted) ❓Why am I sharing this article? I think it is worth looking at the AI tools of Avi, and what it really does. ML in health is accelerating fast. Knowing the economics of clinics will be useful in the future. Good contrarian angle on how to approach the German market.

Berlin’s Patient21 — which has been buying and injecting technology into dental clinics and is looking to expand into primary care — emerged from stealth in January with a healthy $142m raise. Avi combines online forms, video consultations and in-person appointments with predictive technology to make its healthcare more bespoke to the patient, Lata says. The answer, says Lata, is an AI-based “decision support tool” that makes recommendations to the doctor, based on a patient’s medical history.

➡️ I would be interested to know what their “predictive technology” is and if it really exists. ➡️ Interesting angle for the German market. That’s not cheap, and it costs between €100k-150k to licence one and a further €200k-250k to remodel and design it. “Everything to do with expanding the clinics is financed with bank loans.”

➡️ Interesting datapoint on the cost of creating a clinic and how it can be financed by loans. 👉 The Crossover Health Report (Exits & Outcomes) ❓Why am I sharing this article? The way they answered the Apple RFP is very inspiring, and should apply to us. Their pitch and the value they deliver, especially in company where there is an internal “médecine du travail” The importance of asynchronous care, which is close to our approach for the Clinic.

Apple RFP: A few months later Yee and the Crossover team were invited to formally respond to Apple’s RFP for the Apple Wellness Center. They were the clear underdogs. The competition was: Stanford, Palo Alto Medical Foundation, and CHS, which was the biggest on-site clinics company at that time. Apple asked the team to respond to some 200 questions that included requests for 10 years of financials and 10 customer references. Crossover only had a few months of financials to share and zero references. Shreeve told me in a recent interview: “So, we responded to this RFP even though we couldn’t answer about half the questions. We just told them: ‘Hey Apple, you have disrupted seven industries. This should be your eighth. And we are your right partner to do this.’ And we went through all this stuff in the process of bidding on this project. We designed the centers. We really put our hearts and souls into this thing. Apple recognized that. And they ended up picking us to run their health center. Their advisors told them not to do it, but they took a bet on us.

➡️ Great advice for RFPs. Business model: Apple and their outside consultants on the project insisted on a Cost+ model, which saw Apple paying for all the costs of setting up and staffing the clinic plus a management fee on top of that to Crossover. “Since we didn’t care about the management fee as we were making no money anyway, we just focused on the fact that Apple would pay for our entire build-out, our staff, and would enable us to effectively launch our whole business.” Worksite clinics have trended at various times throughout recent history, but for much of their existence they have largely offered occupational health-related services. (Most people summing up the legacy model for worksite clinics mention something about patching workers up after a worksite injury so they can get back to work.) By the time Crossover entered the market in 2010, worksite health clinics had already begun to look more like urgent care practices. Crossover was among the first to lean into both tech-enabled services and a more holistic approach to care that included primary care but also physical medicine, behavioral health, health coaching, and fitness programs.

➡️ Should it be our strategy for large companies? Show how holistic we are? Virtual first: “Everyone talks about virtual care as having a lot of leverage and a lot of efficiencies. But, to be honest, if virtual care to you means a synchronous video visit, then there is no efficiency. It’s still one-to-one, there’s no leverage, and I still need to match schedules with people because they need to physically be talking to each other at the same time. We don’t think those are very effective, and it turns out people only want that two to five percent of the time — max. What they really want is connectivity. People want to message. They want to quickly hit their care team up about an issue that came up overnight. They are OK with asynchronous. And there is a ton of leverage in asynchronous care.”

“We basically say that we’re 100% digital-first. So folks, whenever they need care, they go log into Crossover and click get ‘Care Now’, and that really creates what we call the episode of care. It’s kind of the equivalent of a Slack channel. A member tells us what’s going on in that episode, and we immediately start asking them questions. It’s the same dedicated care team every time they reach out.

What’s interesting about that is our physical centers are really being transitioned into smaller footprints, more targeted services. It’s about transitioning those centers away from being exploratory. Meaning, you walk into the door and we don’t have any idea why you’re here. We need to figure that out. To: we know exactly why you’re here. You’re in and out and it’s hyper-efficient.”

👉 ‘Betting against the NHS’: £1bn private hospital to open in central London (The Guardian) A new 184-bed private hospital is about to open in London, the second-largest in the capital, where patients will enjoy views of Buckingham Palace and will be treated by doctors understood to be paid up to £350,000 a year.

It provides a stark contrast with the NHS, which is buckling under the strain of record waiting lists, backlogs for cancer care and routine operations and a resurgence of Covid cases that is putting pressure on wards and staffing. The opening of the Ohio-based Cleveland Clinic’s first London hospital at the end of this month comes at a time when the private health sector is booming. About 270 consultants will be working at the new site, the vast majority of whom also work for the NHS, and will typically spend one to two days a week at the clinic. The company has reportedly offered most of them fixed salaries of up to £350,000 a year, rather than the fee-per-service basis common in the private sector, triggering a recruitment war. “The worry is the two-tier health system. London has always been the centre of the private hospital market. An estimated £1bn investment in a single hospital is a sign of how strongly foreign investors are betting against the NHS being able to meet the future health needs of the population. And the government seems entirely relaxed about this shift.”

👉 Season Health raises $34 million in Series A funding (Fast Company) ❓Why am I sharing this article? As nutrition seems to be an important part of the prevention screening, I found that the questions they asked are interesting for us if we want to go deeper and automate more Is it easy to build a database of recipes and match it with the needs?

Season, which launched earlier this year, works with health systems to connect patients with foods that will improve their condition. Right now, it facilitates meal delivery for people with diabetes and chronic kidney disease. The company has dietitians on staff, but can also work with doctors and nutritionists inside of hospitals to fulfill meal plans for patients.

If a patient comes through the season platform, they receive a clinical and diagnosis nutrition prescription. This prescription is based on: 1. Clinical guidelines 2. Personal preferences

The clinical guidelines that apply are based on the (chronic) condition(s) of the patient. If a patient has chronic kidney disease, for instance, there are clinical guidelines governing what they should or shouldn't eat, how much and at what rate. That differs dramatically from someone with gestational diabetes when they’re pregnant or someone who is on a Mediterranean diet to lose weight. Patient preferences are more about the reality of the patients' life and are based on a set of questions they are asked when they are onboarded: What budget do you have to allocate to food? What resources do you have in your house? Do you have cooking skills? How much time do you have? Do you hate blue cheese?

Season marries the clinical guidelines and the patient preferences and creates a unique patient profile. Afterwards, their system matches the patient to specific recipes (they have over 22,000 recipes in total) that match his profile. Finally, the patient can select the meals that look good and put those into his cart, hit order and then Season distributes all the ingredients to the patient's doorstep.

👉 Devoted Heath turned a profit in the first half of this year, as other insurance upstarts bled money. Now it’s plotting an expansion into 8 new states. (Business Insider) ❓Why am I sharing this article? Devoted, in Waltham, Massachusetts, combines a health insurer and a medical group under one roof. It was founded in 2017.

The startup has raised almost $2 billion in funding. The October round valued Devoted at $12.7 billion. Devoted had 78,305 Medicare Advantage members as of June 30, up from 39,268 at the same time in 2021. Its regulatory filings show that it was profitable in the first six months of the year, even as it doubled its membership and paid more medical costs as a result. Thanks to the influx of new members, Devoted's revenue swelled to $537.8 million in the first six months — more than it collected for all of 2021. The insurer spent about 92% of its revenue on members' medical expenses, Insider's analysis found. That's down from about 101% a year ago. Devoted's net income was $7.7 million in the first half of the year, compared with a loss of $27.2 million over the same period a year ago. For all of 2021, it reported a loss of $116.3 million. Meanwhile, Devoted's in-house medical group is bulking up to support the new members. The company confirmed to Insider that the medical group plans to employ about 1,000 clinicians and other staff next year, up from 400 people now.

👉 HTN | Weekly Health Tech Reads | 3/27 (Health Tech Nerds) 👉 Weekly Health Tech Reads 8/14 (Health Tech Nerds) ➡️ Bright might go bankrupt if they don’t manage to raise money. ➡️ +Oscar failed. It should not impact our AaaS strategy, and I think we already made it evolve in a way that is a lot more interesting to us. 👉 New Health Plans Need New Operating Systems with Flume Health (Out-of-Pocket) ❓Why am I sharing this article? I was wondering if there is some inspiration for our claim engine on building tools that make it really easy to configure it and create new workflows, in a no-code environment. Flume Health has built a tech-enabled back-office solution for anyone that wants to launch their own health plan - claims, payments, eligibility, etc. all powered by APIs, webhooks, and data sharing.

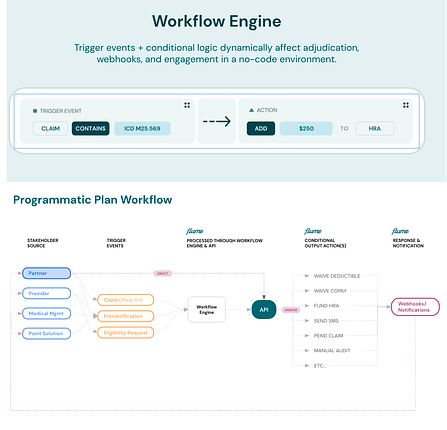

However, most self-insured employers don’t want to deal with the admin and the network contracting themselves so they still outsource those functions. In one version they’ll outsource it to health insurance carriers that already have a contracted network and admin function and you just use their rails. This is called an Administrative Services Only (ASO) contract. Another version is working with a third-party administrator (TPA) that has a bit more flexibility vs. the ASO, which is largely pre-packaged. Flume Workflow Engine: Trigger events and conditional logic dynamically affect adjudication, webhooks, and engagement in a no-code environment You can think of it kind of like Zapier for any insurance-like function. Want to waive the amount a patient pays if they go to certain providers? Want to send them a text if there are plan updates specific to them based on their medication history or nudge them to a mail order pharmacy? Need to pay a provider using some reference-based pricing scheme and send bills to a patient for the remainder? Need to set triggers for manual review of a claim if the amount is super high? Conditional logic + having a claims processing engine built on a modern tech stack lets you create these more complex payment arrangements and rules.

👉 Psychedelic Therapy Is Poised To Create A Revolution In Mental Health, Can VR Accelerate It? (Forbes) ❓Why am I sharing this article? I’m wondering what is going to happen in this field and how Alan should position ourselves (leading with science obviously, but how to be at the edge). Over the next three to five years an expanding number of psychedelic treatments will produce alternatives for the many patients who find no relief from FDA-approved, first-line therapeutics like selective serotonin reuptake inhibitors (SSRIs). Health insurance giant Blue Cross Blue Shield announced eligibility of coverage for ketamine treatments, a major endorsement of such therapies. The VR product looks to cover the unmet need of assisting people unfamiliar with the use of psychedelics in clinical settings, as well as the many patients who will come to such therapies with no experience at all in psychedelic substances. “We created the Sanctuary as a clinical tool using virtual reality to prepare a patient for a transformational psychedelic treatment.”

👉 Omada integrates behavioral health into chronic condition management platform (MobiHealthNews) ❓Why am I sharing this article? The new behavioral health integration includes anxiety and depression assessment, resources to manage social determinants of health, like access to food, stress management and sleep tools, care teams supplemented mental health specialists and training, and triage and guidance in serious mental health crises.

👉 Mental health funding (Healthcare Insights)

👉 Provider Directories, Physician data, and Ribbon Health (Out-of-Pocket) ❓Why am I sharing this article? Very US-based but the problem is the same. How could we have the best data in Europe on doctors? What should we build? It is not a priority now, but it feels like an interesting problem to solve at some point.

Each health plan tries calling to get updated information from the providers (which is redundant across the health plans) while they’re also calling the providers about a million other things, too. As you can imagine, everyone gets really frustrated. The result is bad directories. The key here is using a combination of data + services + customer workflows to get a much more accurate directory. Ribbon uses 1000+ different data sources (scraping open web, data partnerships, claims data, etc.). Apparently there’s so much conflicting data out there about physicians that Ribbon gets about 50 different phone numbers per physician through the total dataset.

The result is to build a machine learning model that can spit out a confidence score that determines the likelihood a physician’s contact information is correct. Each of these data sources have some clues that help inform whether or not the provider is practicing at a particular address, which phone number the provider can be reached at, etc. There’s a lot of noise in these datasets that need to get parsed through to build the confidence score.

Ribbon does two key things to improve the accuracy. The first is having a two-way data exchange with customers. For example if a company is using Ribbon data to power a downstream referral to a specialist, then when the appointment is confirmed Ribbon also receives data that confirms the specialist is at the location. The second thing Ribbon does is use its own call center to reach out to providers to confirm their information. With the confidence score in hand, it makes it much easier to create outreach lists based on priority + missing information.

👉 As Google looks to get struggling health efforts back on track, it turns to a safe bet with search tools (Stat News) ❓Why am I sharing this article? It is quite old (a few months), but interesting to see if booking is going to become a commodity or not. Unlikely google will push this anytime soon in France, and they integrate with existing third-party scheduling tools.

As the company works to bolster its health efforts following an embarrassing reshuffle last year, which included the dismantling of the Google Health organization and the departure of its leader, David Feinberg. When it launches in coming weeks, the feature will show appointments for CVS MinuteClinics, and Google is partnering with third-party scheduling tools Kyruus and Stericycle Communications Solutions, which providers can use to pipe their availability into the search engine. The feature — which will be free for providers to take part in The company frequently cites data showing that most people turn to the internet first when searching for health information. Google’s tool will send users to a provider’s website for the actual process of booking an appointment.

It’s already over! Please share JC’s Newsletter with your friends, and subscribe 👇 Let’s talk about this together on LinkedIn or on Twitter. Have a good week! | |