The Founder's Letter: Trevor Dryer & Miles Halady, Carbon Title

The Founder's Letter: Trevor Dryer & Miles Halady, Carbon TitleHelping Builders Build More, Cleanly

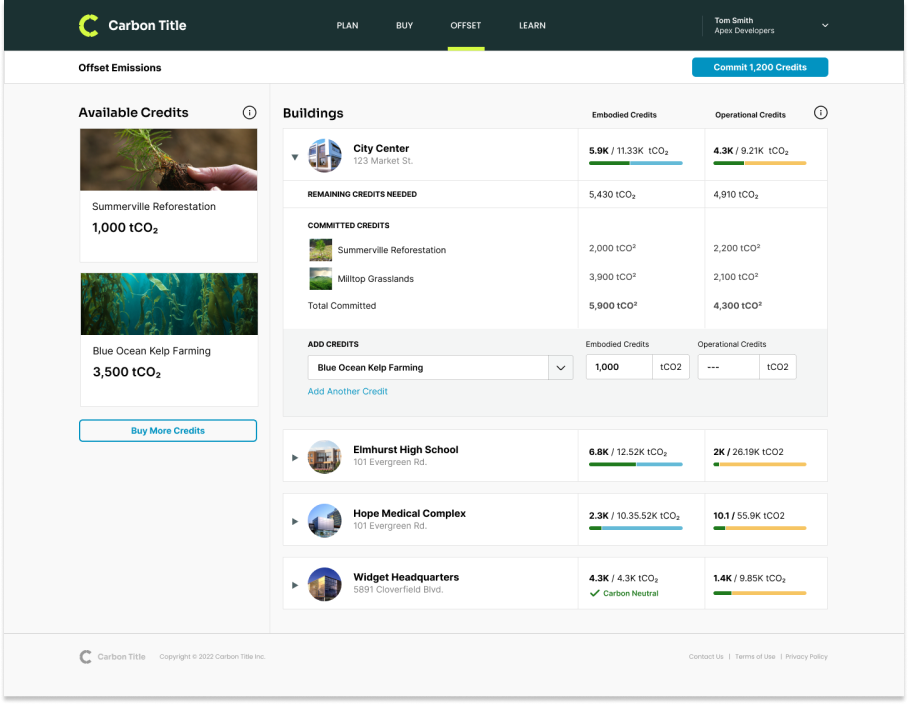

Welcome to the 600 newly Not Boring people who have joined us since Monday! If you haven’t subscribed, join 152,817 smart, curious folks by subscribing here: The Founder’s Letter Series is brought to you by… Compound If you work at a high-growth tech startup, you may have been expecting an IPO in 2022. But because of the market downturn, your company is likely still private. Your personal financial situation faces new questions: Should I sell my shares in my company’s secondary sale? How much in taxes do I owe when I exercise or sell? How do I minimize my taxes? Once I get some cash, how should I invest it? All ETFs or a balance with something else? While you could spend the time to figure this out on your own (or not address the questions at all), you could also hire an expert to optimize your personal finances for you. This is where Compound steps in. Compound is an all-in-one solution for tech founders and employees to manage their personal finances. Compound has served 1,000s of clients from companies like Stripe, Figma, and Airtable and their advisors can help you optimize company equity, diversify concentrated stock positions, plan asset allocation, and more. Request access here and they’ll be in touch. For more information, please check out further disclosures here.¹ Hi friends , Happy Thursday! On Monday, I wrote about working harder (more energy) and smarter (better technology) to create an Abundance Renaissance. Carbon Title fits the bill. One of the tensions in the climate fight is that we need to build more housing and other new buildings, but the construction and operation of buildings emits a lot of carbon. The real estate industry is responsible for 38% of greenhouse gas emissions globally, but degrowth isn’t the answer. People need places to live and work and gather. Avoiding the disastrous effects of climate change but ending up in a world in which half the population can’t afford a home isn’t a good result. Somehow, we need to build more while emitting less. Carbon Title’s mission is to resolve that tension by helping building owners, and their tenants, better understand each building’s carbon footprint and facilitating the purchase of high-quality carbon credits to offset their impact. They’re launching today — check them out — so I asked the company’s co-founders Trevor and Miles to tell us about what they’re building, and why. IT’S TIME TO BUILD cleanly. Let’s get to it. The Founder’s Letter: Trevor Dryer & Miles Haladay, Carbon TitleOne of the most complex industries on Earth needs radical changeLet’s start with an enormous, and seemingly intractable, problem. We need to build 3.8 million more housing units in the United States just to keep up with the rate of household formation—we’re currently building at a rate of 1.5 million per year. Add in the need for additional essential infrastructure, and construction output will likely double by the end of the decade. To keep up with the Paris agreements—and to stave off the worst-case climate scenario—the construction industry, like every other industry, needs to reduce its total carbon emissions by about 45% by 2030. It doesn’t take a math genius to calculate that in order to both double construction output and cut emissions almost in half, all within the next 8 years, we need to slash per-project emissions by at least 70%. 2030 is coming fast in construction time. Construction isn’t software and can’t be iterated multiple times a day. Many in the industry work on one project at a time. And given that new buildings take, from idea to occupancy, about 2 to 4 years to complete, we need to make radical changes right now—leaving us the next three to four iterative cycles to hit the 2030 targets. Oh—and building shit is hard. You’re putting millions of dollars on the line for a single digit profit margin, and, at the same time, dealing with all of the challenges of a people business: mistakes are made, employees argue, and construction materials—well, we can only hope they show up sometime. Let’s just say adding brand-new, untested products to the mix isn’t something contractors hope for when they wake up. If you aren’t concerned enough yet…real estate accounts for 38% of global greenhouse gas emissions. Construction is a necessary industry and its impact on society is real and lasting. Without construction, we don’t have hospitals, schools, housing or power. No stadiums, retail spaces, theaters, conference centers. Without construction we live in tents. Bottom line: construction is a high carbon, low margin, essential industry. We can’t just cross our fingers and hope it will decarbonize. We have to do the work. As two dads with kids whose lives will be shaped by the trajectory of the climate crisis, we feel we have a personal stake in doing this work—and, as successful founders with experience in the construction and fintech industries, we believe we have a unique angle on the solution to construction’s seemingly intractable carbon problem. We need to radically rethink how we approach construction. In order to make that happen, we need to give everyone – from the bankers who finance construction projects, to the corporations that rent office space, to the ordinary people who rent apartments – the information they need to easily identify carbon-neutral buildings, and vote with their feet for lower-carbon options. We need to align the financial incentives of this industry with the urgent human need to address the climate crisis. Two key things need to happen to get the construction industry to go carbon-neutral within the next 8 years. First, it needs to be easier for builders to find, evaluate, and implement lower-carbon materials, and purchase high-quality carbon removal credits to offset the remaining emissions and get to carbon neutral. High-quality carbon credits serve two purposes. First, they finance projects that actually remove and sequester carbon. Second, they capture the cost of the negative externality (carbon emissions) in the cost of the building. This not only helps us achieve our climate goals, but also makes greener alternatives more cost competitive. Second, it needs to be easier for tenants and stakeholders to evaluate a building or project’s carbon footprint. Much of this information is not well understood or is locked up in proprietary databases, hidden from mass consumption. Do you know how many metric tons of greenhouse gasses your apartment building emits each year? As one industry person put it, without public data, it is easy for tenants, bankers, investors and developers “to stay blissfully ignorant of the mess they are making.” Banks, investment firms, and companies with large real estate portfolios need to stop the hot potato game of who owns a building’s carbon emissions. Building owners profit from their buildings, and we believe they are ultimately responsible for the carbon emitted. Tenants and other stakeholders should and are starting to demand better—reports already show that green-certified office buildings command rental premiums of as much as 21%. Many of our early customers tell us that their buildings are more valuable-upon sale and in the form of higher rents–if they are carbon neutral. So, do it for the earth, or do it for your bottom line. In the end, it doesn’t matter. Our company Carbon Title offers a simple, transparent, cost-effective way to neutralize buildings’ climate impact. Our platform empowers building owners, developers, and contractors to easily understand a building’s CO2 emissions over time, purchase high-quality carbon credits, and apply carbon credits to achieve verifiable carbon neutrality. We do this with radical transparency, using Web3 tools (blockchain, NFTs etc.) to verify carbon neutrality claims and enforce traceability. No hidden greenwashing. What are two non-crypto native founders doing talking Web3?At our last companies, Mirador, a fintech company Trevor founded, and Viewpoint, a construction software company owned and operated by Miles’s family, we learned that technology needs to solve a problem, not just sound cool. In this case, the problem—a lack of transparency and trust in the carbon credit market—is tailor-made for new Web3 tools. We didn’t set out to start a web3 company and, in fact, when we raised our pre-seed at the top of the market in December of 2021, we didn’t mention web3. However, as we learned more about public blockchains and NFTs–even as the market crashed–we realized Web3 could help us fulfill our mission. To start, Carbon Title aims to build a decentralized database of carbon emissions. This data has to be public, so that all stakeholders can apply pressure on builders to use lower-carbon materials and finance high-quality carbon removal projects. Transparency is also essential for the large (and growing) number of corporations, money managers, hedge funds, banks, and endowments that have made climate neutrality pledges. This data also has to be trustworthy. The stakes are too high to allow for greenwashing. Construction won’t be able to go completely carbon-neutral without adding some carbon removal into the mix—that’s simply the reality of building in the physical world and the limitations of today’s technology. So stakeholders need to be able to trust that the carbon removal credits getting a building to net zero are actually removing carbon from the atmosphere. Creating NFTs for carbon removal credits ensures that each carbon credit purchased is unique. Public opinion is on the side of change. Rapid change. But right now, high-quality data on carbon emissions simply isn’t available to the public. As a result, builders and developers haven’t felt much pressure yet to change. Putting carbon data on the blockchain will enable us to make it accessible, verifiable, and trustworthy. Because blockchain data can’t be edited and is public, stakeholders will be able to see the whole history of a building’s efforts to go carbon neutral, even when the building is sold to new management. This will give people and institutions the tools they need to force the industry to change—and give the construction industry the tools it needs to make changes faster and more effectively. Building a better worldThe climate crisis is a generation-defining problem, and construction is a big part of that problem. We need to keep building more homes and more infrastructure, but we need to quickly start building greener. With Carbon Title, we will give both builders and their customers the tools they need to demand and enact rapid change. We’ll make the financial benefit of greener construction crystal-clear, and we’ll help builders buy high-quality, verifiable carbon removal credits to close the gap and get their projects to carbon-neutral. We believe that humanity has the potential to alter its course, even at this point. We also believe that we can solve this problem while continuing to build the economy. We want more building, and cleaner building. Most importantly, we all owe it to our children to figure this out – they need both a planet to live on and buildings to live in. We each have two kids who are the same ages—8 and 11—which is how we met. We can no longer say that some generation in the future will deal with our problems; our children will see the ocean rise at least a foot in their lifetime. They will experience more wildfires, countless losses of natural wonders like the Great Barrier Reef, and potentially untold problems such as food scarcity and mass migration that we can’t fully anticipate today. Carbon Title is our effort to drive radical climate change. What’s yours? Trevor & Miles Thanks to Trevor & Miles for sharing their story! We’ll be back here first thing tomorrow morning with the Weekly Dose of Optimism. Thanks for reading, Packy 1 Investment advisory services are provided by Compound Advisers, Inc. (“Compound Advisers”), an SEC-registered investment adviser (CRD# 306341/SEC#: 801-122303). The information contained in this communication is provided by Compound for general informational purposes and should not be considered as financial or tax advice. This communication is not an offer to sell securities. All investing involves risk, including the possible loss of any or all of the money invested, and past performance never guarantees future results. Please see Compound Advisers' Form CRS here, and ADV Part 2A Brochure here. If you liked this post from Not Boring by Packy McCormick, why not share it? |

Older messages

Working Harder and Smarter

Monday, September 12, 2022

Or why more energy + software = progress

Weekly Dose of Optimism #11

Friday, September 9, 2022

Abolish NEPA, Diablo Days, Interracial Marriages, GUTS, and Abundant Robots

Weekly Dose of Optimism #10

Friday, September 2, 2022

Artemis I pt. II, EVs & Batteries, Seabed Mining, Intelligent Tools, Passion & Pain, and Dude Where's My Flying Car?

Weekly Dose of Optimism #9

Friday, August 26, 2022

Fermi's Responsibility, Chinese Research, Forever Chemicals, Heated Hydrogen, and the Golden Age of AI

Techbio Taxonomy

Monday, August 22, 2022

A guest post by Elliot Hershberg on the four forces reshaping biotech startups

You Might Also Like

OpenAI’s underestimated us!

Friday, February 28, 2025

Altman admits they ran out of GPUs—what now?

Influence Weekly #378 - YouTube Star MrBeast Is Raising Money at a $5 Billion Valuation

Friday, February 28, 2025

GTA Developer Explores Partnerships With Metaverse Creators To Transform Popular Game Into UGC Creative Hub

Weekly Dose of Optimism #133

Friday, February 28, 2025

Pancreatic Cancer Vaccine, Restoring Hearing, Loyal, Atlas, Apple, Coinbase, Lunar Landers ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

VC valuations feel the pressure

Friday, February 28, 2025

AI prompts record VC funding; Kindred Ventures' Steve Jang on AI wearables; Stripe hits $91.5B valuation Read online | Don't want to receive these emails? Manage your subscription. Log in The

Standing on the other side of goodbye

Friday, February 28, 2025

Little moments that make me question: have I moved away or come home? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

A New EBITDA Adjustment to Drive Business Selling Price (a short video)

Friday, February 28, 2025

THE EXIT STRATEGIST A New EBITDA Adjustment to Drive Business Selling Price (a short video) Click Here to Watch Our Short Video The Key to driving strategic value in the sale of a technology company is

The Daily Carnage Show 🎙️

Friday, February 28, 2025

Podcast inside.

"Notes" of An Elder ― To Dispense Love (A Special Gift Just for You Inside)

Friday, February 28, 2025

Love is the most powerful force we possess.

What it takes to get paid by YouTube, TikTok and other social platforms

Friday, February 28, 2025

Digiday has the lowdown on which platforms are offering what revenue share models and creator funds. February 28, 2025 PRESENTED BY What it takes to get paid by YouTube, TikTok and other social

🔔Opening Bell Daily: Testing US exceptionalism

Friday, February 28, 2025

US equities are under-performing the rest of the world to start 2025.