Hot in Enterprise IT/VC - What's 🔥 in Enterprise IT/VC #308

What's 🔥 in Enterprise IT/VC #308Seed market on 🔥 as round sizes & valuations adjusted faster than ever, 🪃 effect in venture

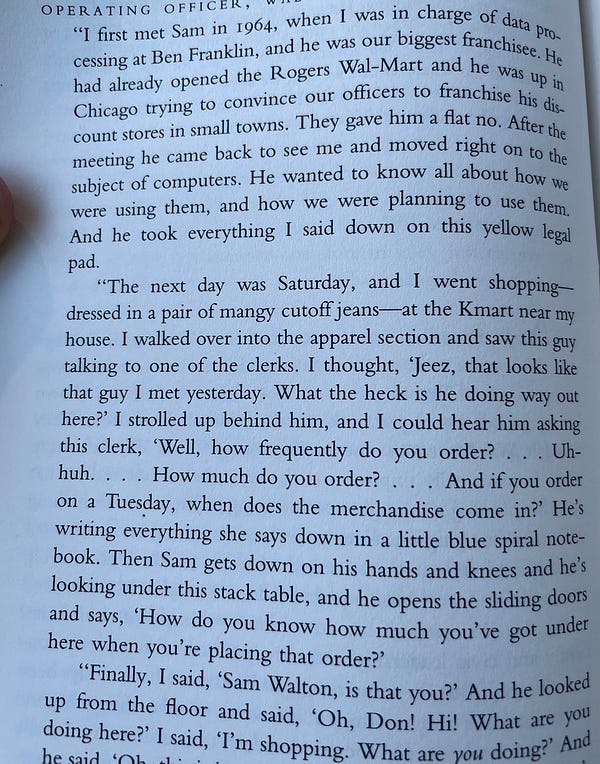

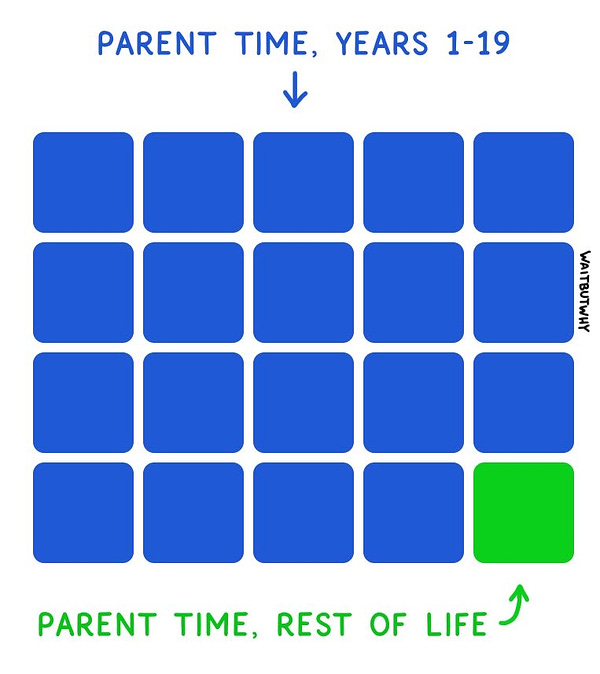

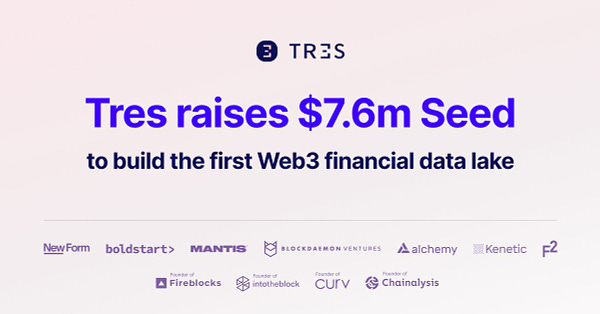

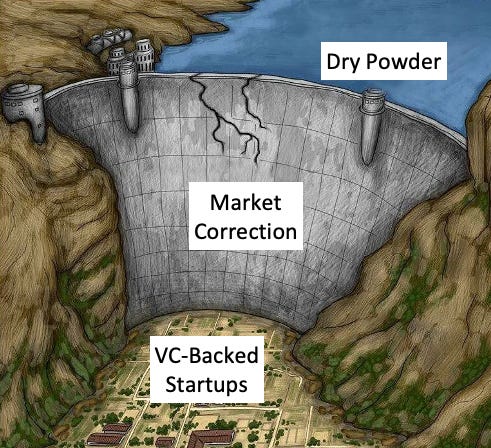

Delian captures what’s happening well…I would add that this is the busiest fundraising season I’ve seen in 26 years of investing, yes 26 years!  While we (boldstart) took a number of pitch meetings this summer and have our largest fund ever at $192,168,111 to lead rounds at company formation, to date we have only written two checks, one $400k and the other $600k! That has all changed the past couple of weeks as we are more 🔥 up than ever with 3 term sheets in action in new categories of dev tooling, crypto infra & SaaS. I can’t wait to share these with all of you! So what has changed? IMO while valuations still have more to fall in the public markets, the long lag factor effect between public market pricing and early stage pricing has finally adjusted and taken hold. When public markets get 🔨, late stage valuations are the first to go. That adjusted almost instantaneously as there is very little growth investing these days. What usually takes much longer is for this to trickle down to seed and A rounds. Well guess what? It’s happened faster than ever as the smart founders understand the that raising too much capital at too high a price can impact their future. $5M-8M seed rounds used to be the norm pre-crash and in the last few weeks, most of what we saw was in the to $2-4M range which makes sense as downward pressure on round sizes and valuations have trickled down from the publics to A rounds and now seed. As founders at the earliest stages have now internalized what a great round today can look like, we are all busier than ever. While no one knows where the bottom is when it comes to valuations and many believe that there is more pain to come, I do believe we are at the bottom for seed round sizing and pricing. Also, if you believe what Jon Sakoda from Decibel has to say, this is going to be an interesting finish to 2022 as a wall of 💰 is waiting to be unleashed over the next couple of years.   One other reflection I had this past week was around the importance of thinking LT versus ST when it comes to partnering with founders. Read 🧵 and comments.  2 of the 3 term sheets we currently have in play are all heavily influenced by relationships we established in Fund II dating back to 2012! Both are cofounders of new companies, both had some early struggles where we had to step up and lead internal bridge rounds, and now we have had the privilege and honor to get the first look at their next startups. When it comes to both Snyk and Superhuman, both of those relationships were also started in Fund II and in those situations, each founder sold early before raising an A round (to Akamai and LinkedIn respectively). While we did make a nice return, it certainly wasn’t the 20x outcome we were hoping for. That being said, this is something the founders wanted, and we did all that we could to help them realize their initial exits. Fast forward, and I am truly 🙏🏼 that we had the opportunity to not only brainstorm on the initial ideas for Snyk and Superhuman, but also lead their initial rounds at company formation. This is just a reminder for investors that the first check you write with a new founder relationship is hopefully the beginning of a much longer journey. Make decisions with that framework and the 🪃 will come back many times over. Founders, please also choose your initial investors carefully as if done right, it will hopefully be the beginning of a many company partnership and friendship. As always, 🙏🏼 for reading and please share with your friends and colleagues. Scaling Startups

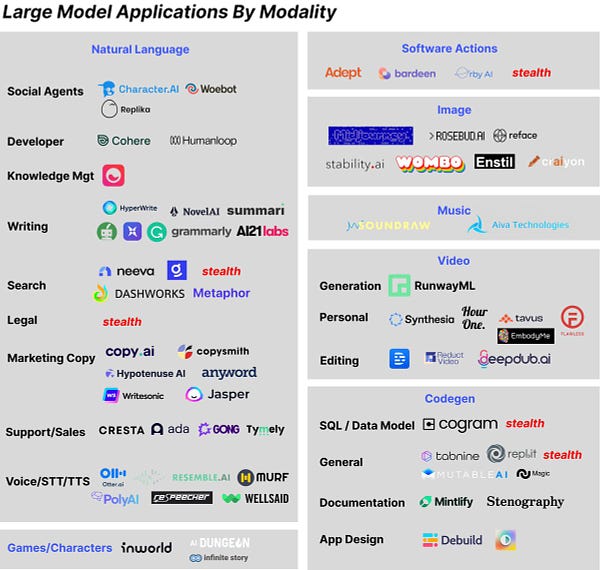

Enterprise Tech

Markets

If you liked this post from What's Hot in Enterprise IT/VC, why not share it? |

Older messages

What's 🔥 in Enterprise IT/VC #307

Saturday, September 17, 2022

🙏🏼 Hope springs eternal in SaaS land...but only a rare, few like Figma

What's 🔥 in Enterprise IT/VC #306

Saturday, September 10, 2022

What's the sandwich 🥪 model + how enterprise design partners can help accelerate PLG

What's 🔥 in Enterprise IT/VC #305

Saturday, September 3, 2022

Forget everything you learned the last 2 years, what's ahead for venture + startups in the fall

What's 🔥 in Enterprise IT/VC #304

Saturday, August 27, 2022

State of cybersecurity market through 👀 of Palo Alto Networks - ☁️ huge + developers 🔑

What's 🔥 in Enterprise IT/VC #303

Monday, August 22, 2022

Sustaining momentum once you launch and "hello world"

You Might Also Like

🚀 Ready to scale? Apply now for the TinySeed SaaS Accelerator

Friday, February 14, 2025

What could $120K+ in funding do for your business?

📂 How to find a technical cofounder

Friday, February 14, 2025

If you're a marketer looking to become a founder, this newsletter is for you. Starting a startup alone is hard. Very hard. Even as someone who learned to code, I still believe that the

AI Impact Curves

Friday, February 14, 2025

Tomasz Tunguz Venture Capitalist If you were forwarded this newsletter, and you'd like to receive it in the future, subscribe here. AI Impact Curves What is the impact of AI across different

15 Silicon Valley Startups Raised $302 Million - Week of February 10, 2025

Friday, February 14, 2025

💕 AI's Power Couple 💰 How Stablecoins Could Drive the Dollar 🚚 USPS Halts China Inbound Packages for 12 Hours 💲 No One Knows How to Price AI Tools 💰 Blackrock & G42 on Financing AI

The Rewrite and Hybrid Favoritism 🤫

Friday, February 14, 2025

Dogs, Yay. Humans, Nay͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦄 AI product creation marketplace

Friday, February 14, 2025

Arcade is an AI-powered platform and marketplace that lets you design and create custom products, like jewelry.

Crazy week

Friday, February 14, 2025

Crazy week. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

join me: 6 trends shaping the AI landscape in 2025

Friday, February 14, 2025

this is tomorrow Hi there, Isabelle here, Senior Editor & Analyst at CB Insights. Tomorrow, I'll be breaking down the biggest shifts in AI – from the M&A surge to the deals fueling the

Six Startups to Watch

Friday, February 14, 2025

AI wrappers, DNA sequencing, fintech super-apps, and more. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

How Will AI-Native Games Work? Well, Now We Know.

Friday, February 14, 2025

A Deep Dive Into Simcluster ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏