Coin Metrics' State of the Network: Issue 175

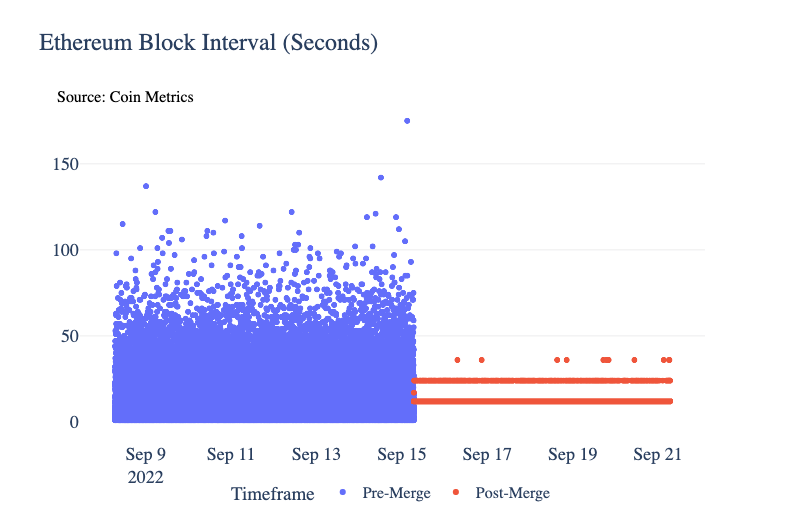

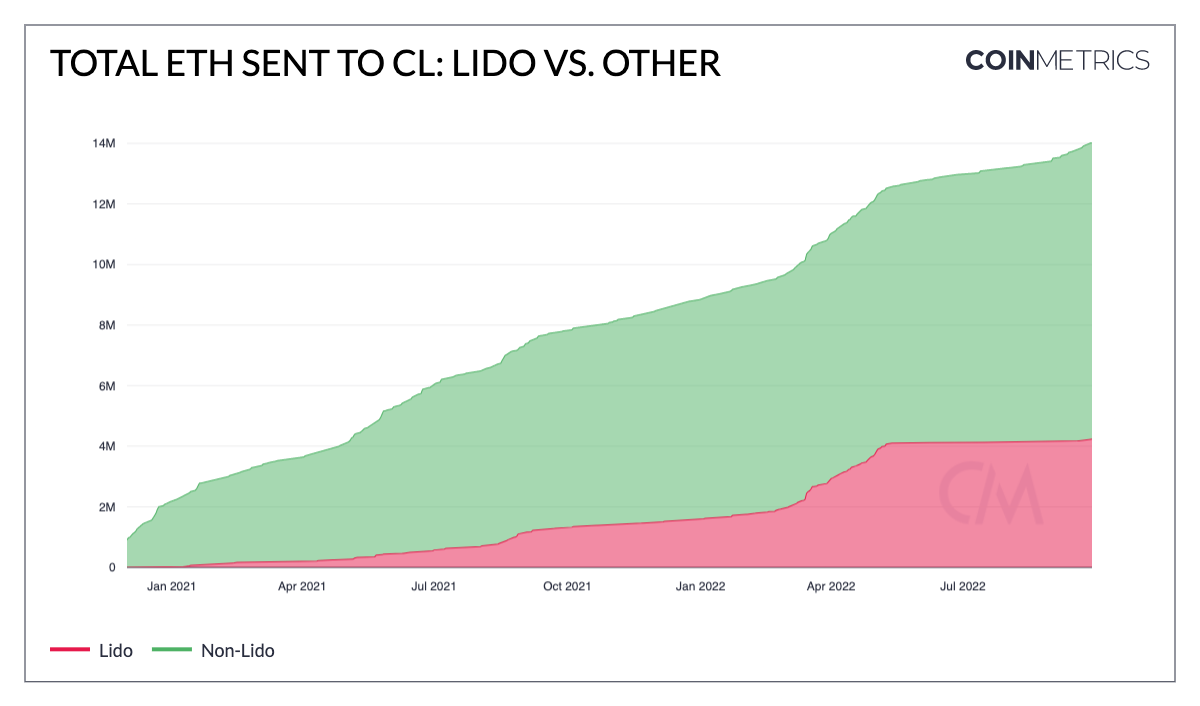

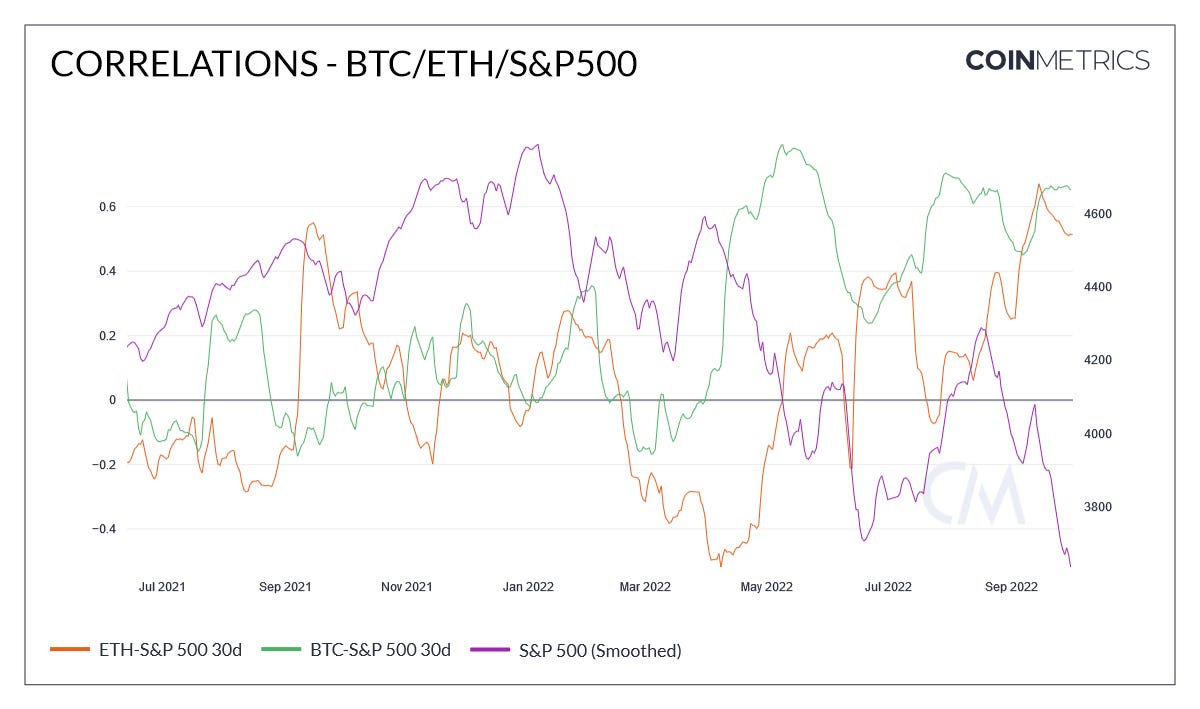

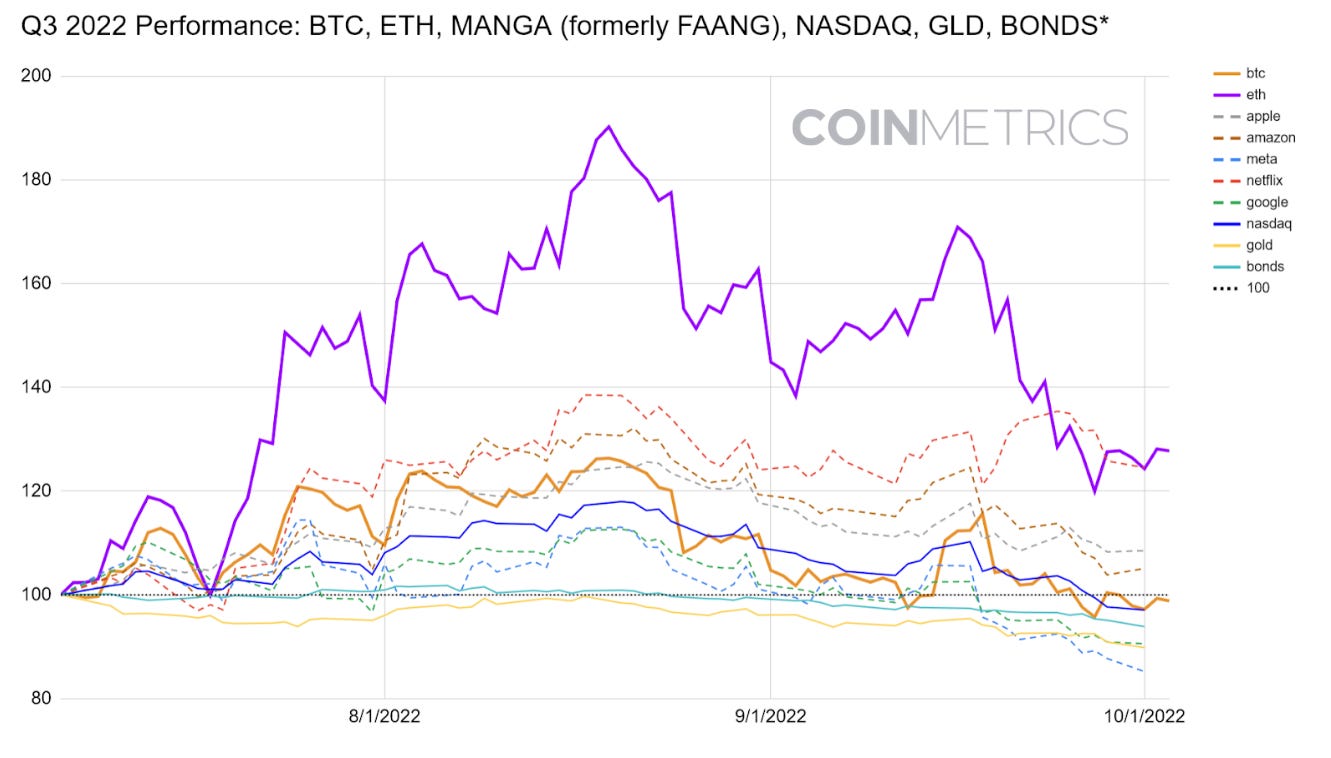

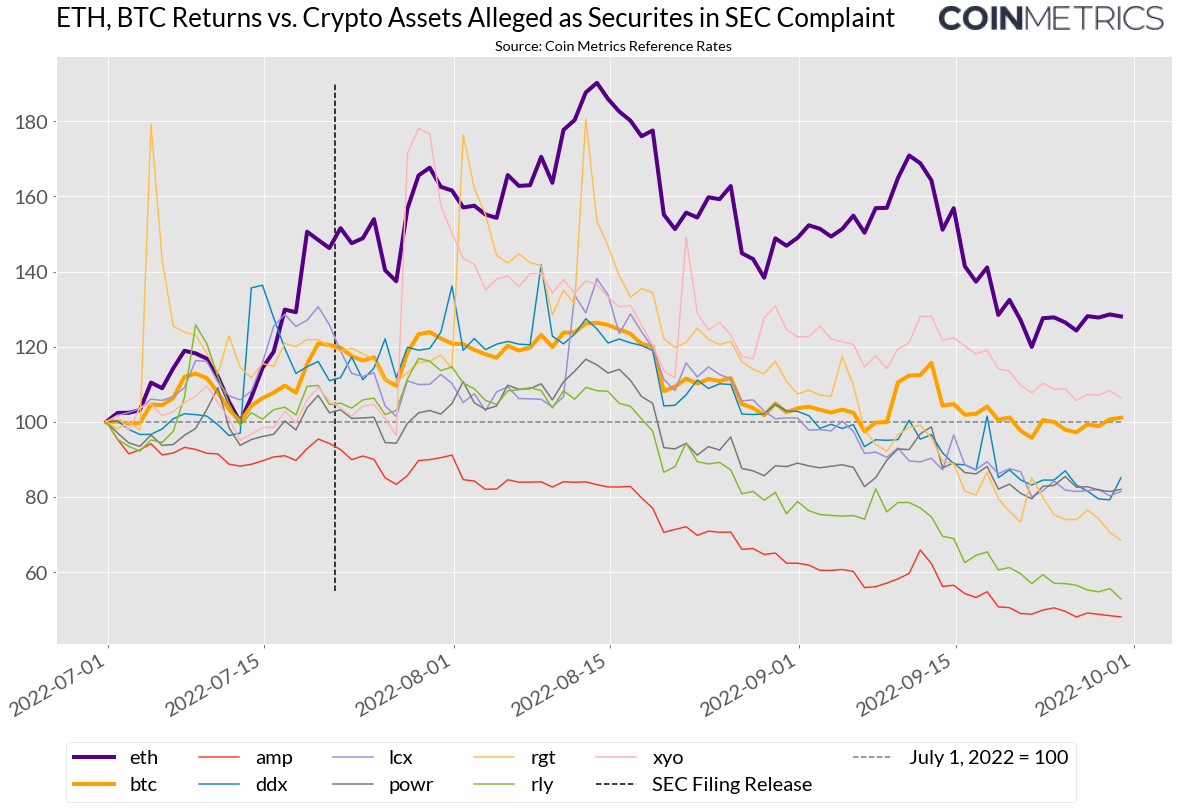

Get the best data-driven crypto insights and analysis every week: The State of the Network Q3 2022 Wrap-UpBy Kyle Waters, Matías Andrade, and Nate Maddrey In this special edition of State of the Network we take a data-driven look at the most important stories from the crypto ecosystem in Q3, 2022. Before we jump to a review of Q3, we’re excited to share a new research report on DeFi’s biggest – yet seldom understood – risk: admin keys. In this new report, the Coin Metrics Labs team walks through the rise of admin key use in DeFi development and showcases past instances where these keys have been compromised, shedding light on historical exploits. You can download the full report for free below. Merged: Ethereum completes its transition to Proof-of-StakeAt the start of 2022, it was clear that Ethereum was finally inching closer to what would likely be one of the biggest storylines of the year in crypto: The Merge – the name given to Ethereum’s ambitious change from a system of miners securing the network under Proof-of-Work to a set of validators under an alternative mechanism called Proof-of-Stake. After years of research, testing, and anticipation Ethereum successfully completed The Merge on September 15th. Over the last few weeks we’ve covered The Merge extensively, including leading up to and after the event. For a full collection of our research, be sure to check out this page. The Merge was successfully completed without any network downtime, and the moments right after The Merge were captured in on-chain data. One immediate change was noticeable in the time between blocks, which went from a probabilistic process under PoW to more predictable 12-second slots under PoS (occasionally 24 or 36 seconds when there are missed slots). The chart below shows the time between blocks for all Ethereum blocks one week before and one week after The Merge. Each dot in the chart represents an individual block. Source: Coin Metrics Network Data Pro Ethereum continues to hum along with blocks being produced and attested to by validators. With the execution risk of The Merge behind us, attention has now turned to Ethereum’s next steps in its roadmap. Core developers are starting to scope out Ethereum’s next upgrade, dubbed Shanghai, that will likely allow partial and full withdrawals of ETH from the consensus layer (aka the Beacon Chain). In the meantime, liquid staking derivatives continue to be a popular mechanism for staking ETH as they effectively allow users to benefit from rewards locked on the CL today. After flatlining for a few months, ETH staked through the Lido protocol has started to pick up a bit, helping push the total amount of staked ETH over 14M. Source: Coin Metrics Network Data Pro The Shanghai upgrade may also include improvements to boost layer-2 (L2) scaling technologies. It’s clear that Ethereum is still an ever-changing protocol, and the concentration of staked ETH as well as maximal extractable value (MEV) are areas of intense discussion post-Merge. But despite the success of The Merge, ETH price has fallen about 10% since September 15th as the macroeconomic environment continues to anchor crypto-asset returns, including ETH and other tokens. Macro Remains Dominant FactorA wide sell-off of risky assets has ensued as the market reprices their expectations in accordance with interest rates and economic conditions around the world. The US Federal Reserve has hiked the Federal Funds Rate by 75 bps on three separate occasions since June 16, 2022, with a target rate of 3.25%. The ECB is turning hawkish and has raised rates by a total of 1.25%, with expectations of further hikes to tame high inflation rates in Europe. Meanwhile, Japan’s Ministry of Finance has spent around $20 billion to prop up a rapidly devaluing yen, which recently reached a 24-year low. The Bank of England’s hand was similarly forced to intervene as price rapidly fell in the gilt market (the name given to the UK’s sovereign debt) that threatened local pension funds, willing to commit up to £65 billion. Source: Coin Metrics Network Data Pro Fear of protracted worldwide central bank action to control inflation, rising interest rates and deteriorating economic conditions are suppressing economic expectations in the near future, and this has impacted many financial assets and cryptocurrencies alike. This corresponds to the third consecutive quarterly loss in the S&P 500. Correlations among BTC, ETH and with the S&P 500 have increased recently as the benchmark index fell in price to 3600, which had not been breached since December of 2020. Sources: Coin Metrics Reference Rates & Google Finance The Evolving Regulatory BackdropThe quarter was also impactful from a regulatory and enforcement perspective. In July, the US Securities and Exchange Commission filed a complaint against a former Coinbase employee alleging he traded on insider information regarding which crypto assets were soon to be listed on the exchange. The SEC also alleged that some of the tokens involved were crypto asset securities under US securities laws. As shown in the chart below, the release of the allegations did not appear to have an immediate impact on the prices of the tokens alleged as securities, however, most did underperform in the quarter vs. ETH and BTC. Source: Coin Metrics Reference Rates Then in August, the US Treasury took an unprecedented step in sanctioning the open source smart contracts behind Tornado Cash, a privacy-enabling decentralized application running on Ethereum. Some block producers (miners in PoW pre-Merge, validators in PoS post-Merge) have been filtering for Tornado Cash transactions as a result of the sanctions. The actions quickly led to a renewed conversation surrounding blockchain censorship resistance, open source software, and the limits to sanctioning code that is not controlled by a central entity or individual. Coinbase announced in early September that it would be funding a lawsuit challenging the US Treasury’s sanctions, arguing that “Sanctioning open source software is like permanently shutting down a highway because robbers used it to flee a crime scene.” Later in September, some aspects of the ban were rescinded, with the Tornado Cash GitHub repository coming back online. Looking to Q4, the conversation around crypto regulation is set to be an important ongoing area of development. ConclusionThis quarter was beset by the same trends that we witnessed in the previous quarter: a broad decrease in asset value in crypto and in many other markets. Although many of the events we mention concern everyone equally, this quarter has also given us reason to be optimistic, such as Ethereum’s successful transition to Proof-of-Stake. Many great financial institutions, such as Blackrock, labor in the background to offer crypto assets to their clients and to build important infrastructure to push the ecosystem forward. Q3 Summary MetricsBITCOIN IN Q3 2022

ETHEREUM IN Q3 2022

Coin Metrics’ Q3 UpdatesThis quarter’s updates from the Coin Metrics team:

As always, if you have any feedback or requests please let us know here. Subscribe and Past IssuesCoin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. Check out the Coin Metrics Blog for more in depth research and analysis. © 2022 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. If you liked this post from Coin Metrics' State of the Network, why not share it? |

Older messages

Coin Metrics' State of the Network: Issue 174

Tuesday, September 27, 2022

Tuesday, September 27th, 2022

Coin Metrics' State of the Network: Issue 173

Tuesday, September 20, 2022

Tuesday, September 20th, 2022

Coin Metrics' State of the Network: Special Merge Update

Thursday, September 15, 2022

Thursday, September 15th, 2022

Coin Metrics' State of the Network: Issue 172

Tuesday, September 13, 2022

Tuesday, September 13th, 2022

Coin Metrics' State of the Network: Issue 171

Thursday, September 8, 2022

Thursday, September 8th, 2022

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏