One month after launch, how is the ETHW ecosystem doing?

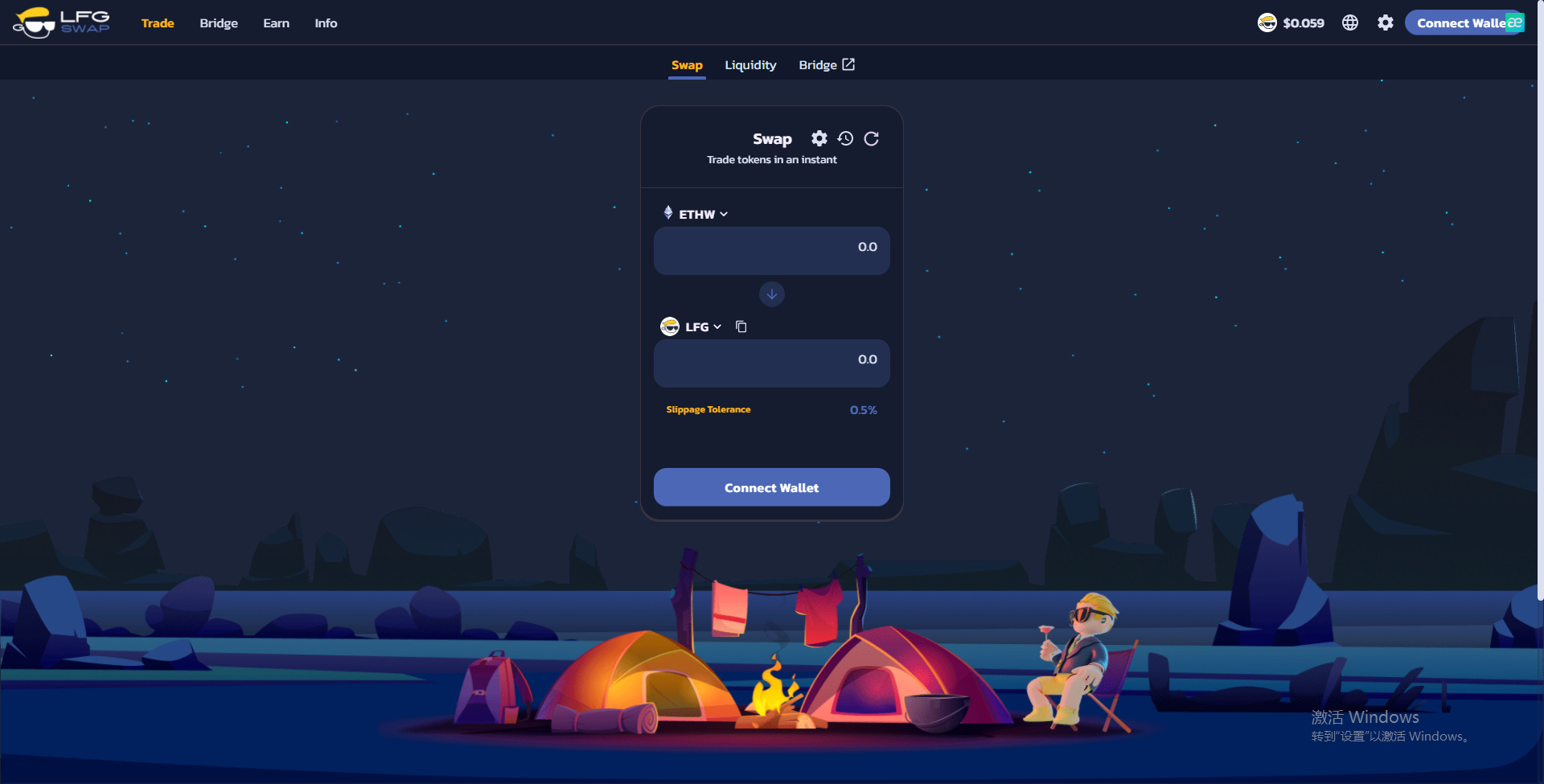

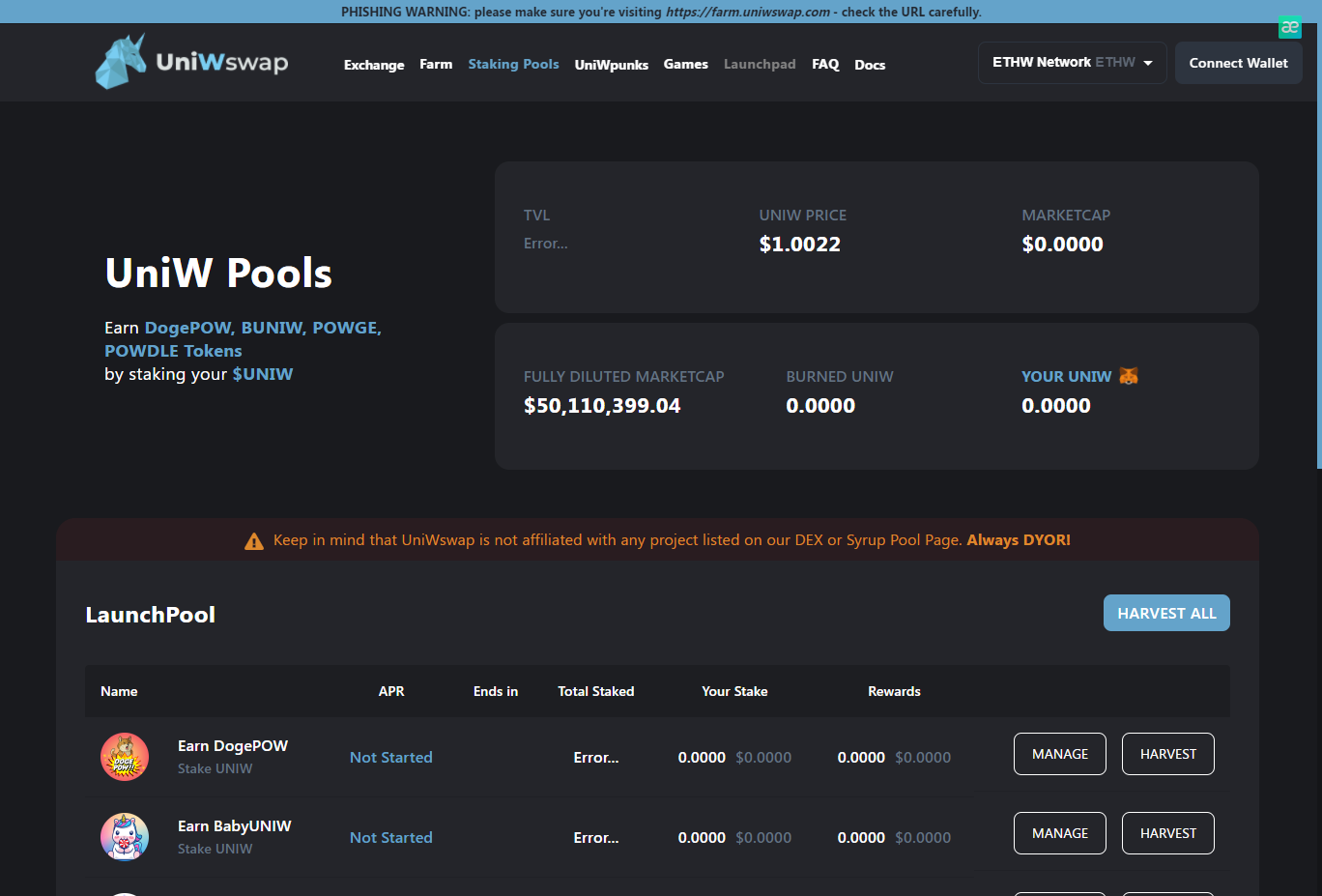

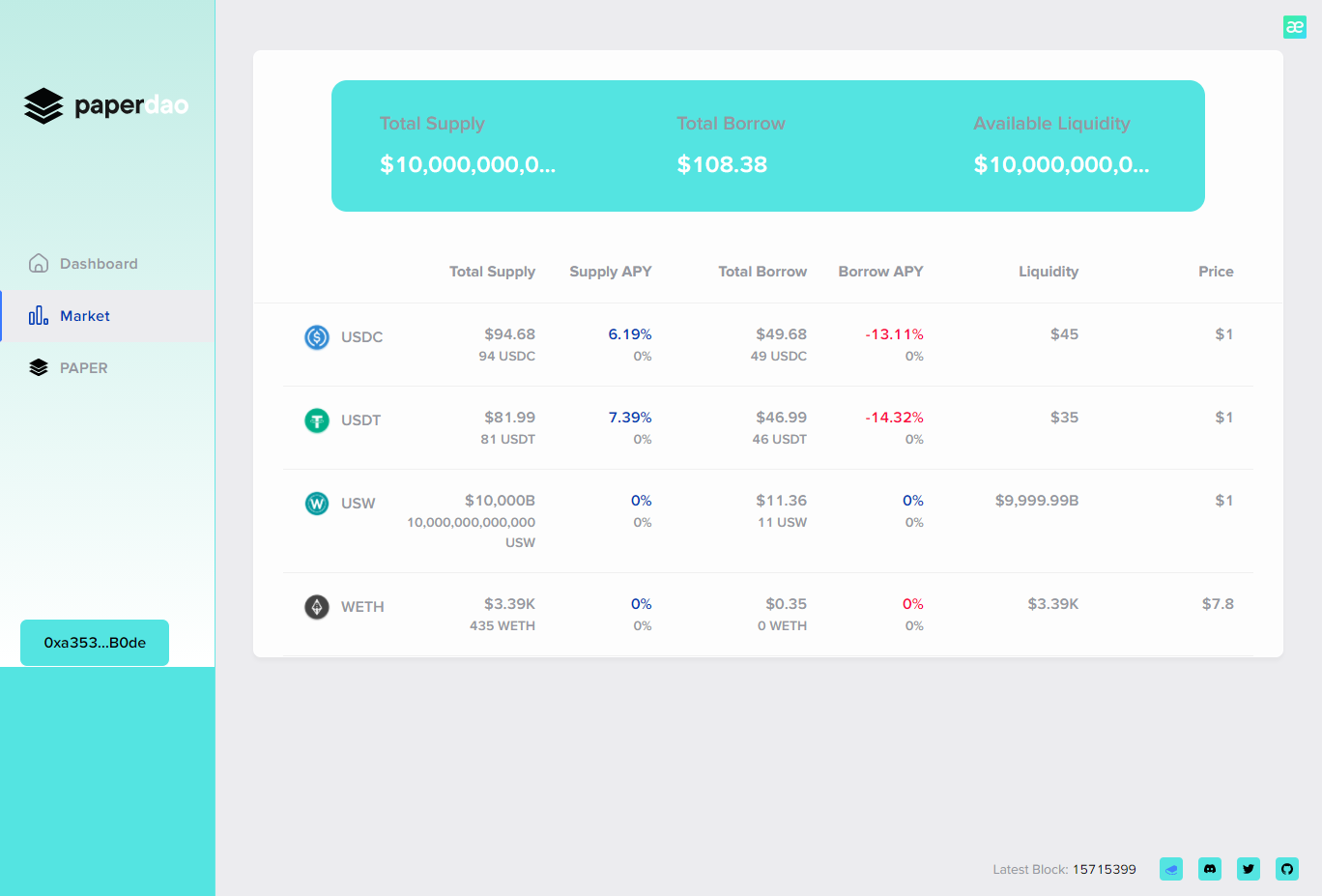

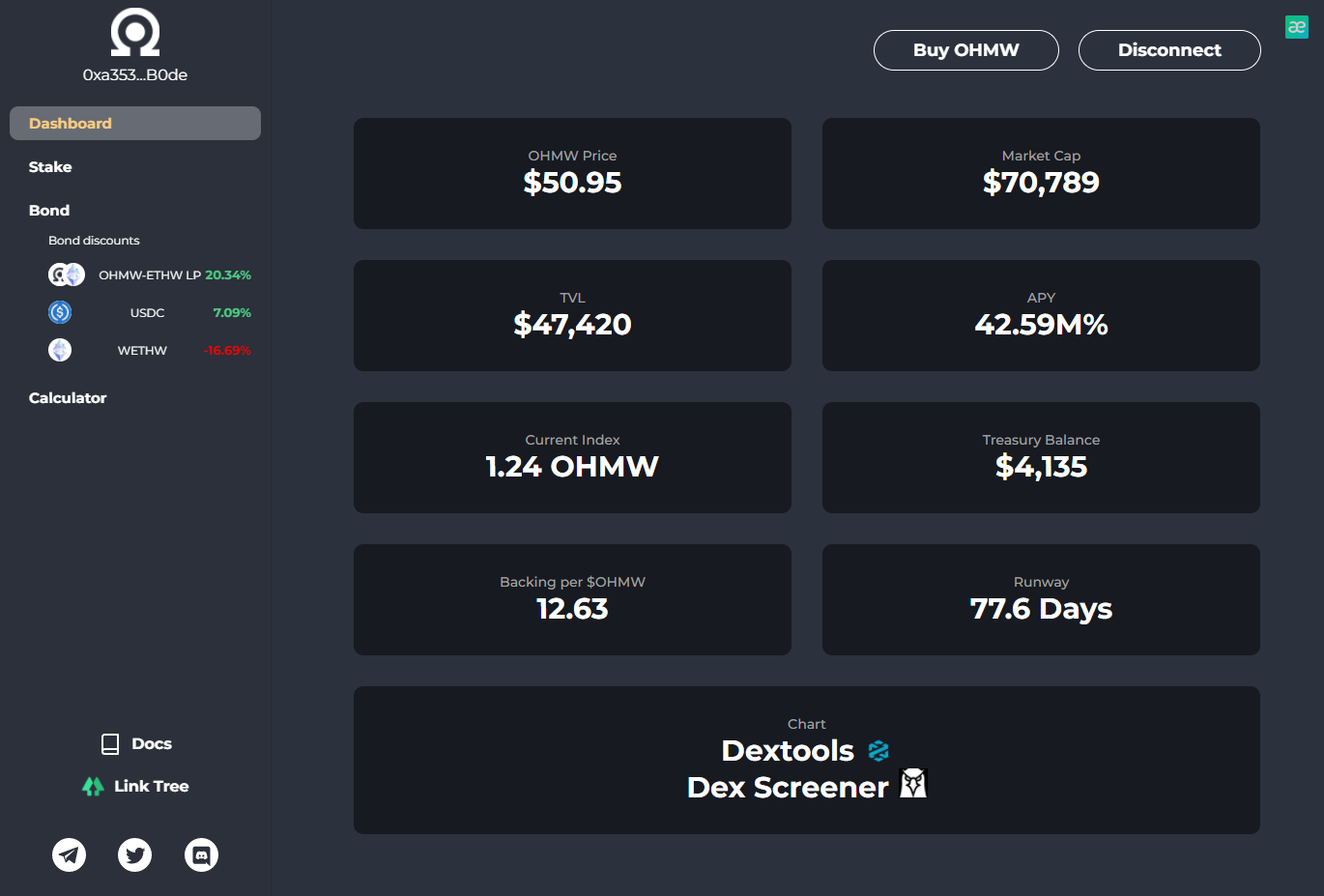

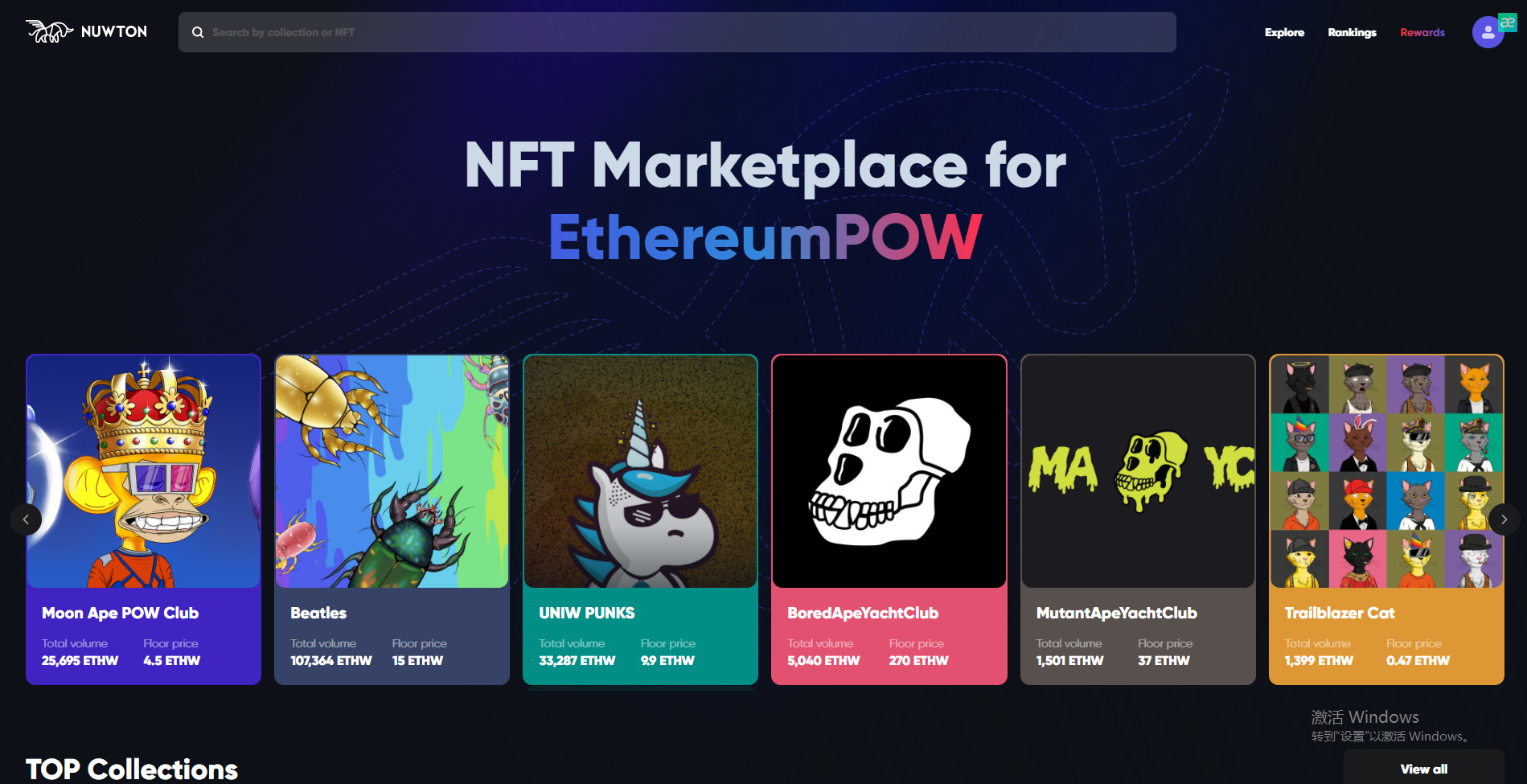

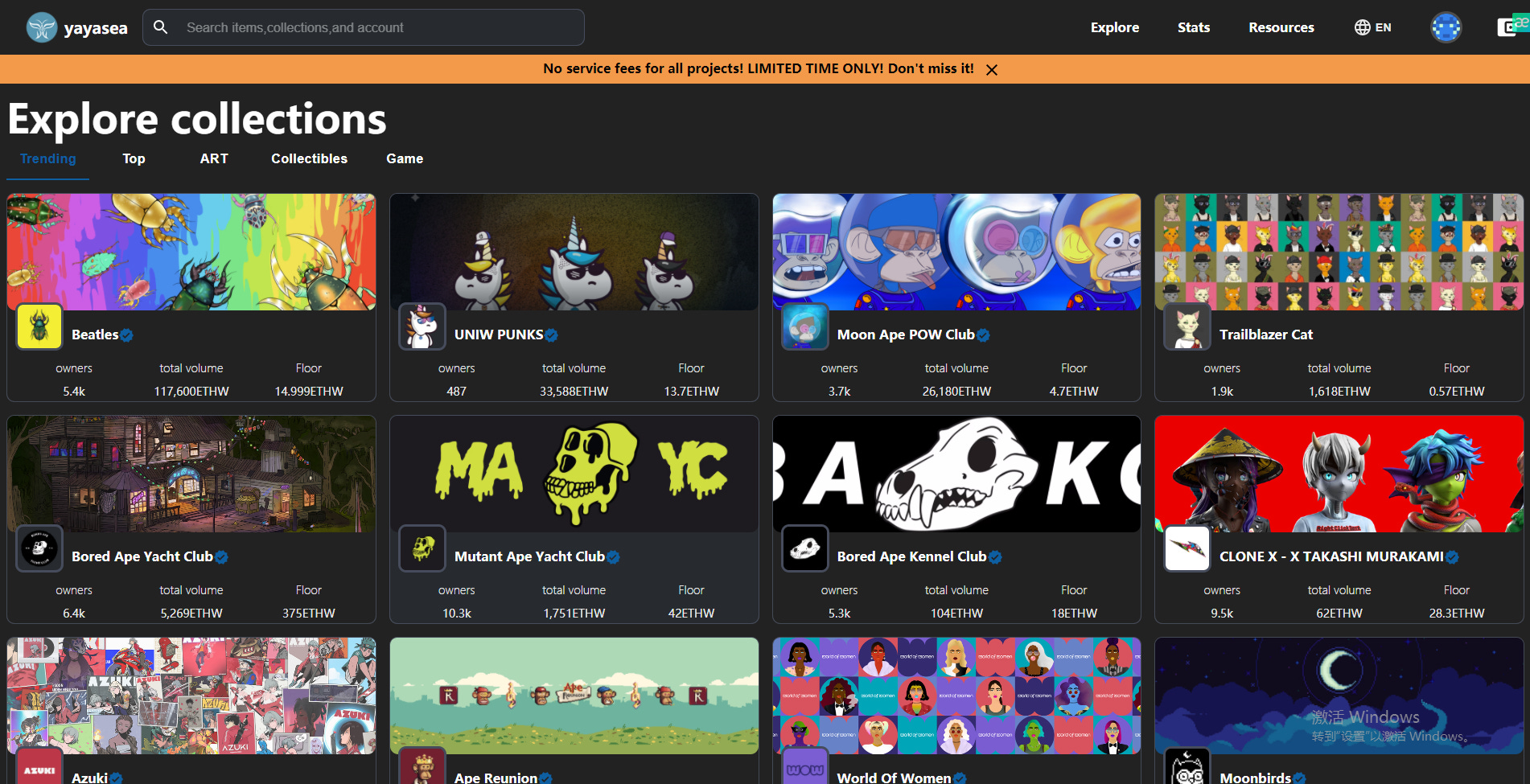

Author: @0xMavWisdom (Note: This article is for information sharing only and has no interest in any of the projects listed, does not endorse any of the projects and does not make any investment recommendations) Nearly a month has passed since the Ether Merge upgrade, and the migration of PoW miners has gradually come to an end. The hash rate of major PoW public chains has stabilized from soaring after the Merge, and the new fork chain has gradually moved away from the "candy chain" and focused on building the on-chain ecology. As the largest PoW fork of ETH, ETHW attracted a wave of traffic and supporters by virtue of the frequent social activities of its initiator Chandler Guo on social media before the Merge; after the Merge, it not only successfully completed the fork of the ETH chain, but also achieved the fork of high-quality dAPPs and NFTs on ETH, and achieved the fork by virtue of the native NFT: Beatles and Meme Token: YZZ and others have attracted a lot of players with the wealth effect they bring. According to the Wagmi33 Foundation's list, ETHW already has at least 80 eco-dapps or services on it, including DeFi, GameFi, DEX, NFT and others. Although there are some inaccuracies in the list, as a public chain less than a month old, its on-chain ecosystem is already as well built as its next-door competitor, ETC, which has been around for several years. The projects listed in this article are based on the Wagmi33 Foundation list, the official list, social media attention, platform data, community discussions and prospects. (Many of the projects on the ETHW chain are driven by the Wagmi33 Foundation, which is part of the AWSB DAO, an influential group in the Chinese-speaking community) It should be noted that new chain projects will often take control of the market and pull the market in the early stage to artificially raise the Token price to attract investors to enter the market; in addition, most of the players in ETHW must be trading on the "candy" they receive or the income they earn from the "candy", so they have less psychological burden; do not be greedy for investment returns and easily enter with large capital. There is also a basic valuation method for new chain projects, that is, the market value of the on-chain application will not exceed the market value of the public chain, the current market value of ETHW is about $960 million. DEX LFGSwap Twitter followers: 175k, Telegarm subscribers: 330k LFGSwap is currently the largest DEX on ETHW, with an overall interface style quite similar to Pancakeswap, with built-in features such as trading, cross-chain, liquity and IDO, complete with Armors Labs auditing. Each transaction is charged a 0.25% fee, 0.17% is allocated to LP, 0.0225% is allocated to treasury, and 0.0575% is used for LFG repurchase and destruction. DeFi Llama data shows that LFGSwap has $1.86 million TVL, representing 52.47% of the TVL on the over ETHW chain. The official website interface shows that LFGSwap has seen 8,000 users complete 900,000 transactions in the last 30 days. LFGSwap ran its IDO Token launch between 30 September and 2 October, when LFG was priced at $0.03 for $100-2000 per address, and eventually oversold its fundraising by over $1.3 million in 3 days. However, on 6 October, the LFGSwap team issued an urgent announcement that it would return the full amount raised to investors, citing the macro environment and the fact that early private placement investors had temporarily changed the vesting terms of the Token and the team was unwilling to compromise on this. The team did however retain the rights of those who participated in the IDO and gave them an airdrop of 777 LFG. LFG eventually went live on 7 October at an opening price of around $0.025 and is currently trading at around $0.058 with a market cap of $5.88 million. UniWswap Twitter Followers: 37k, Telegram subscribers: 2.9k A DEX that mimics Uniswap with trading, cross-chain, and liquity/stake features, in addition to NFT: UniWpunks and a chain tour based on UniWpunks, with a launchpad coming in the future. UniWswap is one of the two dapps on the ETHW chain with over $1 million in locked positions, growing over 30% in the last 7 days, second only to LFGSwap. In addition, all the UNIW raised at the UniWpunks launch will be destroyed and half of the ETHW will be added to the liquidity. UniWswap completed its Coinsult audit on 23 September. The current UniWswap Token UNIW is approximately $0.1 and has a market value of approximately $1.2 million. Lending and stablecoins PaperDAO Twitter followers: 415, Telegram subscribers: 140, Discord community members: 139 PaperDAO (beta version), currently the first and only DeFi lending dapp on the ETHW chain, offers USDC, USDT, wETHW and the native stablecoin USW. According to the whitepaper, PaperDAO will launch USW, an over-collateralised stablecoin, backed by ETHW as a guarantee, using the stablecoin DAI as the economic model. Users will be able to mint USW by staking ETHW. PaperDAO will then launch an AMM similar to the Uniswap V2 style and add ETHW-USW LP liquidity. These two tools will be used to launch the ETHW ecosystem and allow various other dapps to be built on it, and PaperDAO will launch stablecoin trading with USW if other stablecoins are launched on the ETHW chain in the future. (WETH in the above diagram should be wETHW, Error in interface) As designed in the whitepaper, USW is modelled on DAI, but the underlying code is forked from Compound V2 (2022.4) and contains only two assets, wETHW and USW. USW has a fixed cap of 10 trillion coins, with an initial USW collateralisation rate set at 50% and a reserve ratio of 10%, and can only be borrowed through the collateralisation of ETHW and staking. But the biggest challenge PaperDAO faces now is the lack of prophecy machine support. Back in August, before the Merge, Chainlink announced that it was aligning itself with the community and that its protocol and services would not support forks of the ethereum network, including PoW forks. Without a prophecy machine there would be no meaningful on-chain liquidity to create TWAP-based price feeds, so in the early stages PaperDAO fears it will have to update prices manually. Also, it is worth noting that PaperDAO Token PPR will launch on UniWswap in 2 days. OHMPOW Twitter Followers: 20k, Telegram subscribers: 687 Fork of OlympusDAO on ETHW. The current OHMW price is around $50, with TVL of $47k and an APY of 44.82million%. There are also bond discounts available to purchase OHMW including OHMW-ETHW LP, USDC and wETHW. The treasury balance is $4,120. NFT Marketplace Nuwton Twitter followers: 10.7k, Discord community members: 5,165 Supported by the Wagmi33 Foundation, the first NFT marketplace on the ETHW. In the last 24 hours, Nuwton traded around 6,360 ETHW, or about $50,000, with the largest volume being Beatles at 3,951 ETHW, or 62%. In addition to some native projects such as Beatles, there are also forks of Ethereum blue chips such as BAYC and MAYC. yayasea Twitter Followers: 510 The interface has a much rougher feel than Nuwton, and the links to the documentation and Discord are not working. In the last 24 hours, yayasea has traded around 6,055 ETHW, or about $48,000, with Beatles also having the highest volume at 4,053 ETHW, or 66.9%. When comparing the two marketplaces, the floor price of the same series of NFTs can vary considerably from market to market. OpenW Twitter Followers: 49.2k The ETHW on-chain NFT marketplace powered by the Wagmi33 Foundation. On October 11, it was reported that because the user experience of the trading platform was not accepted by the quality evaluation department, the release of the OpenW website was expected to be delayed for more than 24 hours. Open Tigers NFT holders will become members of OpenW. Domain Name Services ETHW ID- .ethw Twitter followers: 37k, Telegram subscribers: 40.5k, Discord community members: 17.9k The ETHW domain name service, which offers domain names with the .ethw suffix, has partnered with LFGSwap, OHMPOW and others. According to the website FAQ, the ETHW ID DAO will soon go live and each address of a successfully registered domain will receive an airdrop of 500 Tokens. The pre-registration period for .ethw domain names is from 12 October 2022 to 22 October 2022, during which if a domain name is registered by more than one person, it will go into auction mode to the highest bidder. The domain name will be claimed from 26 October 2022 to 26 October 2023 and can be used as NFT or traded in. WENS Twitter followers: 15.8k, Discord community members: 2.9k ETHW on-chain domain name service powered by the Wagmi33 Foundation, website not yet live. WENS is currently running a marketing partnership campaign with Chinese KOLs and has partnered with OpenW, a trading platform built under Open Tiger. Native NFT Beatles Twitter followers: 11k, Discord community members: 7.3k The first NFT on the ETHW, and currently the most actively traded NFT on the chain. The current Beatles floor price is nearly 15 ETHW, an increase of thousands of times from the original mint price. Open Tigers Twitter Followers: 66.5k A project that has received a lot of attention from the community and could be the next Beatles. However, the minting of Open Tigers has also been delayed due to the failure of the OpenW delivery. Meme ShibaW Twitter followers: 1.7k, Telegram subscribers: 1.1k The SHIB copycat on the ETHW chain, which has risen more than a hundredfold since its launch on 23 September, has also been launched with the ShibaW NFT pass: SHIBAWINU. YZZ Token Twitter followers: 8k, Telegram subscribers: 4.7k Ten thousand times more. Investors were lured to ETHW by YZZ's gains in search of the next high return. Overall, ETHW's DeFi applications are mainly focused on Swap, with nearly a dozen swaps, large and small, in addition to those listed in this article, and this is because the trading feature is the simplest and most urgently needed feature on the chain. After the token and NFT trading features were perfected, and then through the Meme narrative and the powerful wealth effect, many speculators were attracted to the chain in search of high returns. After the foundations were built, unlike ETC which was stagnant, ETHW was more innovative and dynamic, not only forking some applications of Ether, but also opening up the exploration of native stablecoins and on-chain lending. Follow us Twitter: https://twitter.com/WuBlockchain Telegram: https://t.me/wublockchainenglish If you liked this post from Wu Blockchain, why not share it? |

Older messages

Opinion: XEN doomed to failure and why benefits to Ethereum

Tuesday, October 11, 2022

Author: @0xMavWisdom In recent days, XEN Crypto, a project that claims to be founded by Jack Levin, Google's No. 21 employee, has caused FOMO in communities both at home and abroad. With its unique

CEX data report for August: Bybit Phemex Soar, Crypto.com plunge

Monday, October 10, 2022

Wublockchain's statistics showed that: In September, the main CEX spot trading volume, up 15% month on month. The top three increases were Bybit (Spot) +250%, Bitfinex +72% and KuCoin +42%. The top

Global Crypto Mining News (Oct 3 to Oct 9)

Monday, October 10, 2022

1. Core Scientific produced 1213 bitcoins in September. The Company sold 1576 bitcoins at an average price of $20460 per bitcoin. As of September 30, 2022, the Company held 1051 bitcoins and

Exclusive: The real buyer of Huobi is Justin Sun, possibly with the help of SBF

Monday, October 10, 2022

In the early morning of October 8th, Huobi announced that the controlling shareholder company has transferred all the shares of HuobiGlobal held by the fund of About Capital Management. But

Weekly Project Update:The Otherside community launches its first mini-game "Flappy Koda" and Top 10 Projects

Saturday, October 8, 2022

Author:Mingyao Editor:Colin Wu 1. Binance's weekly summary 1.1 BNB Chain hacked, over $500 million in funds involved (updating) link 1.2 Binance will start the LUNC burning process link Binance

You Might Also Like

What is DeFAI? The AI-enabled DeFi narrative looking to take 2025 by storm

Wednesday, January 15, 2025

AI-driven DeFi projects aim to simplify finance with real-time insights, trading, and personalized strategies, but face hurdles in transparency and security. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈Solana’s daily DEX trading volume beat Ethereum’s by 84%; Sony launched its L2 blockchain, …

Wednesday, January 15, 2025

Solana's daily DEX trading volume beat Ethereum's by 84%. Sony launched its L2 blockchain, Soneium. Compound integrated Ethena's stablecoin and Mantle's liquid staking token. ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈Solana’s daily DEX trading volume beat Ethereum’s by 84%; Sony launched its L2 blockchain, …

Wednesday, January 15, 2025

Solana's daily DEX trading volume beat Ethereum's by 84%. Sony launched its L2 blockchain, Soneium. Compound integrated Ethena's stablecoin and Mantle's liquid staking token. ͏ ͏ ͏ ͏ ͏

OKX Founder's Full Speech: "Always Hold Bitcoin"

Wednesday, January 15, 2025

January 14, 2025, OKX CEO Star delivered a speech via video link. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

JPMorgan believes Solana, XRP ETPs could attract $15 billion in net inflows

Tuesday, January 14, 2025

Both assets register $2.5 billion in assets under management currently, with a little over $500 million in inflows registered last year. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Coin Metrics’ 2025 Crypto Outlook

Tuesday, January 14, 2025

Key Trends & Outlooks Shaping Digital Assets in the Year Ahead ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin’s sharp rise and fall starts week with $418 million in liquidations

Monday, January 13, 2025

Crypto positions unwind with $245M in longs liquidated across major exchanges. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

₿ US-based entities hold 65% more BTC reserves than non-US entities; Crypto.com launched stocks and ETFs trading i…

Monday, January 13, 2025

US-based entities hold 65% more BTC than non-US entities; Crypto.com launched stocks and ETFs trading in the US; South Korea is reportedly planning to gradually allow institutional crypto trading ͏ ͏ ͏

Crypto Crash Imminent As US DOJ Sells Over 69K BTC

Monday, January 13, 2025

Monday Jan 13, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR Crypto Crash Imminent As US DOJ Sells Over 69K BTC Senator Lummis To Head New Crypto Subcommittee Dogecoin Fails To Break

2024 Cex Annual Report: Binance's lead narrowed, while Bybit spot and Bitget contracts grew significantly

Monday, January 13, 2025

In December, major exchanges recorded a 14% increase in spot trading volume, with Bitget leading at 102% growth, and a 6% rise in derivatives trading volume, where Gate saw the largest increase at 111%