DeFi Rate - This Week In DeFi – October 14

This Week In DeFi – October 14This week, Uniswap raises $165M in Series B funding, Solana's Mango Markets is exploited for $100M and ETH becomes deflationary.To the DeFi community, This week, decentralized exchange Uniswap raised $165 million in Series B funding, led by Polychain Capital. Uniswap intends to use the capital for a range of uses, including improving its web app and developer tools, supporting its NFT platform launch and improving user experience on mobile. The platform’s governance also completed a vote last night to launch Uniswap on privacy-focused Layer-2 scaling solution, zkSync, with almost 100% in favor.  1/ We’re proud to announce that we’ve raised $165 million in Series B funding to bring the powerful simplicity of Uniswap to even more people across the world 🦄🍾

uniswap.org/blog/bringing-…

Solana decentralized derivatives exchange, Mango Markets, was exploited for well over $100 million – the second 9-figure hack in less than a week (following Binance Smart Chain). The attacker opened a large trade on perpetual swaps of Mango’s native $MNGO token, then proceeded to manipulate the price to drastically inflate their position. They then borrowed and withdrew almost all of the protocol’s available liquidity against the inflated figure. Following the exploit, the attacker made a proposal via Mango’s governance to return around $51 million worth of tokens – in exchange for immunity.  1/ this is how I think the mango attack played out, please let me know if I got anything wrong:

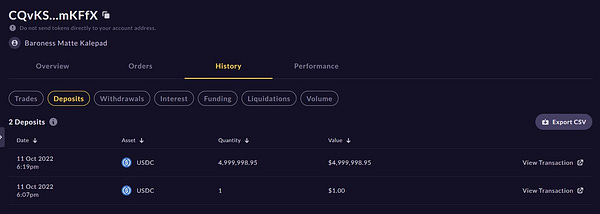

at 6:19 PM ET, attacker funded acct A (CQvKS...) with 5mm USDC collateral

trade.mango.markets/account?pubkey…  OtterSec @osec_io

Ether has become deflationary over the past week, for the first time following the proof-of-stake Merge. The supply has reduced around 0.13% during the last seven days – around 4,000 ETH. The shift has come as gas prices increase on the network, mostly driven by a minting-frenzy for experimental project “XEN Crypto”. XEN currently accounts for over 40% of the total gas fees used on Ethereum over the last 24 hours.  A single (pointless) token mint has burned ~6% of all net ETH issued post-merge in the past few hours.

Showcasing that any sustained activity coming back would immediately lead to ETH supply quickly becoming deflationary. Stablecoin giant Tether claims that it has eliminated ALL commercial paper holdings from its USDT reserves, along with an increase in exposure to US Treasurys. The move got rid of over $30 billion of commercial paper without any losses in the process, according to Tether. It follows the promises of Tether to improve the quality of its USDT backing, which had been heavily criticized.  BREAKING: Tether is proud to announce that we have completely eliminated commercial paper from our reserves. This is evidence of our commitment to back our tokens with the most secure, liquid reserves in the market. (1/3)

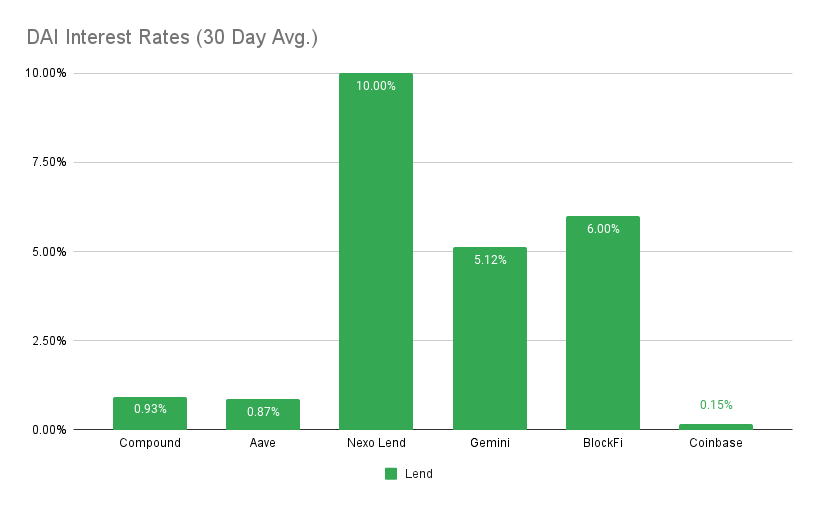

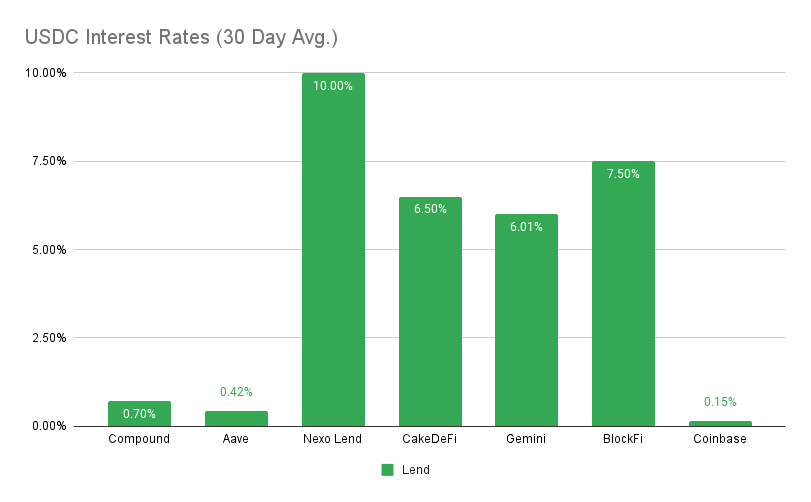

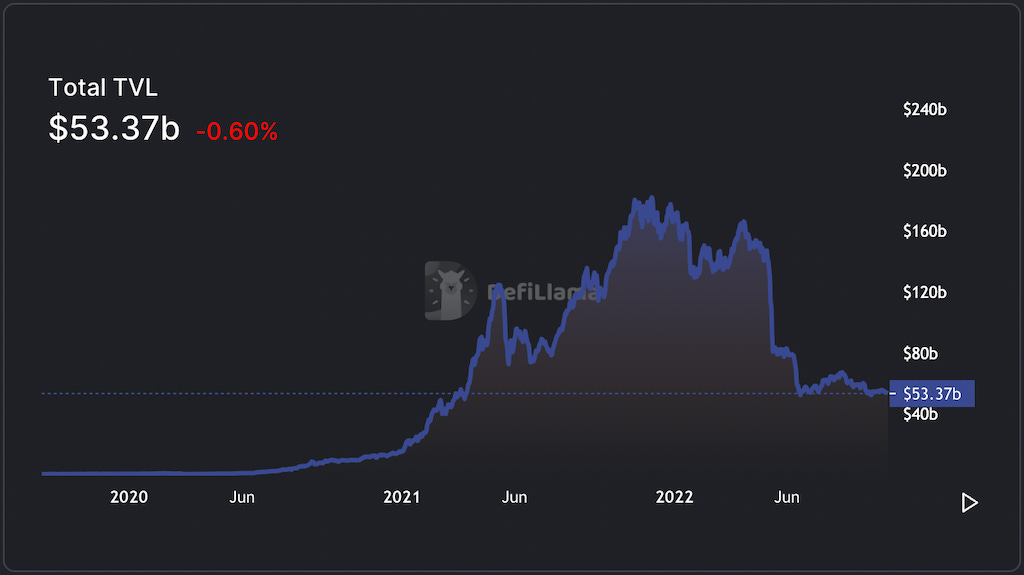

The time appears to be ripe for smart contract hacks and exploits, while the ecosystem has its guard down and liquidity is low. Four hacks happened in a single day on October 11, adding to the Binance Smart Chain hack of last week. October 2022 is already the “biggest month ever for hacking activity,” despite us not even being halfway through the month. The most notable exploit of the week was the Mango Markets hacker, who managed to easily manipulate the price of the $MNGO token and make away with over 9 figures of protocol funds. Aside from exploits, news has been mixed regulation and institution-wise, as we see greater levels of both adoption and regulation. On the adoption side we have the US’ largest bank, BNY Mellon, announcing custody services for cryptocurrencies – an enormous nod to crypto from the legacy banking system. On the regulation side, the EU Commission is seeking full-blown blockchain monitoring, with a very dystopian “embedded supervision” pilot program on the way. Coin Center is fighting back against the US Treasury over Tornado Cash sanctions, trying to nip the department’s overreach and precedent in the bud – before its too late. Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, BlockFi at 6% APY MakerDAO Updates DAI Savings Rate: 0.01% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 0.00% WBTC Stability Fee: 0.75 USDCHighest Yields: Nexo Lend at 10% APY, BlockFi at 7.50% APY Top StoriesEU Commission seeks automated Ethereum DeFi monitoringTreasury Sued by Coin Center Over Tornado Cash BanBNY Mellon Will Hold Bitcoin and Ethereum for Clients. Here's Why It MattersU.S. inflation comes in hot, up 0.4% month-on-month and 8.2% year-on-yearStat BoxTotal Value Locked: $53.37B (down 3.9% since last week) DeFi Market Cap: $44.09B (down 3.5%) DEX Weekly Volume: $6B (down 25%) Bonus Reads[Brayden Lindrea – Cointelegraph] – Decentralized exchange Uniswap v3 gets ‘Warp’ed’ onto StarkNet [Krisztian Sandor – CoinDesk] – Crypto Investment Firm Blockwater Technologies Defaults on DeFi Loan [Owen Fernau – The Defiant] – Curve DAO Votes To Enable Permissionless Rewards [Zhiyuan Sun – Cointelegraph] – Cosmos co-founder says a major security vulnerability has been uncovered on IBC If you liked this post from This Week in DeFi , why not share it? |

Older messages

This Week In DeFi – October 7

Friday, October 7, 2022

This week in DeFi, Bitwise launches a Web3 ETF, Binance Smart Chain is halted after a hack and Ribbon Finance launches unsecured lending for institutions.

This Week In DeFi – September 30

Friday, September 30, 2022

This week, USDC plans expansion to 5 more networks, Chainlink partners with SWIFT and launches a growth program, and Robinhood launches its own Web3 wallet.

This Week In DeFi – September 23

Friday, September 23, 2022

This week, US Congress looks to ban certain algo stablecoins, Nomura launches a crypto VC unit and FV Bank accepts direct deposits in USDC.

This Week In DeFi – September 16

Friday, September 16, 2022

This week in DeFi The Ethereum Merge goes live, Compound Finance opens lending to institutions and Maker doubles its stETH ceiling for minting DAI.

This Week In DeFi – September 9

Friday, September 9, 2022

This week, Ethereum activates its Bellatrix upgrade, Binance removes USDC markets and Coinbase goes against the US Treasury over Tornado Cash sanctions.

You Might Also Like

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏