DeFi Rate - This Week In DeFi – September 16

This Week In DeFi – September 16This week in DeFi The Ethereum Merge goes live, Compound Finance opens lending to institutions and Maker doubles its stETH ceiling for minting DAI.

To the DeFi community, This week, The Merge finally went live on Ethereum, marking one of the most important upgrades in blockchain history. The network completed a successful shift to the planned Proof-of-Stake consensus mechanism, removing the need for mining and reducing Ethereum’s energy consumption by over 99%. While The Merge itself was several years in the making, the upgrade also represents the beginning of a new journey for Ethereum, as it seeks to improve both scalability and privacy to handle mass adoption.

Shortly after The Merge, Ethereum Proof-of-Work fork “ETHPoW” was launched – albeit with some underwhelming price action. The chain, which seeks to continue Ethereum without the Proof-of-Stake model, fell from pre-merge predicted prices to as low as $8.75 per token as it hit the market – around just 0.5% of the main chain’s token value.

Compound Finance has expanded to institutional lending, as its institutional yield platform Compound Treasury announces that it will offer over-collateralized loans backed with crypto. Institutional clients can now borrow USDC or USD against their BTC, ETH and supported ERC-20 assets for as little as 6% APR, with no repayment schedule.

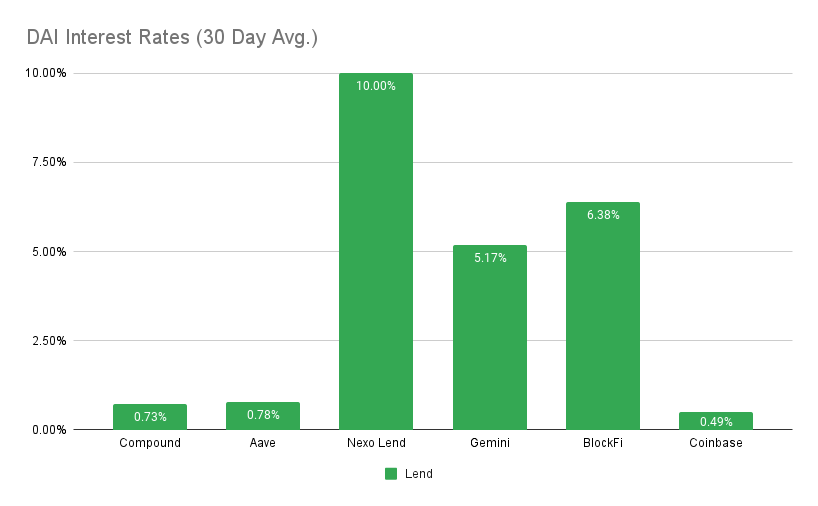

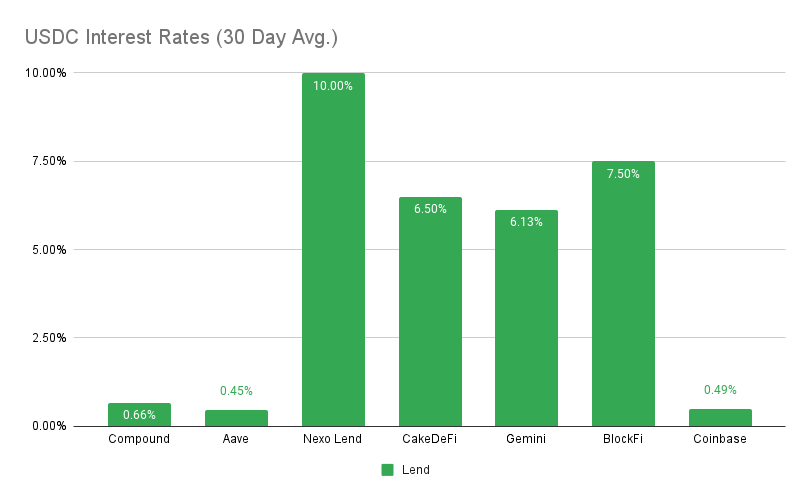

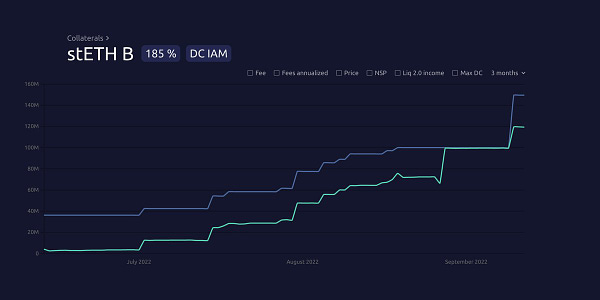

Maker has decided to double its ceiling for staked Ether (stETH) for minting its Dai stablecoin, in an effort to decrease its reliance on USD Coin (USDC). USDC currently makes up over a third of all collateral in the protocol, attracting a growing amount of criticism. Part of the criticism comes from the recent freezing of USDC tokens by Circle following Tornado Cash sanctions by the US Treasury – demonstrating that Dai collateral is not censorship-proof.   With the Ethereum Merge finally complete, the crypto community can breathe a sigh of joy and relief as the major upgrade appears to have been implemented without a hitch. DeFi project updates and releases waiting on the upgrade – such as Curve Finance’s new stablecoin – are now free to be implemented, without any Merge dangers or overshadowing. Fears over the potential ideological ETHPoW warfare have also been quelled, as the fork launch looks like it was a dud – gaining little steam or support despite some nervousness. Focus can now rest on the progression of the new-and-improved Proof-of-Stake chain, including further development and efforts to decentralize the validator ecosystem. The high concentration of staking power within the hands of a few delegated entities (including three centralized exchanges) isn’t all that reassuring, however a similar phenomenon can be argued as being present in Bitcoin via mining pools – still touted as the most decentralized network on the planet. On the other hand, the significant drop in the issuance of new ETH may give price a long-term boost, a supply shock that should be on everyone’s radar. Zooming out to the broader picture, more institutional money may be ready to hit the crypto market as Charles Schwab, Citadel and Fidelity team up to provide liquid institutional exposure. On the other hand, inflation also hasn’t eased up all that much, potentially leading to a larger hike in interest rates later this month. All of the above provides a very clouded picture for crypto market direction (and in turn, attention and investment) – which forces will prevail in the near-run could be anyone’s guess. Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, BlockFi at 6.38% APY MakerDAO Updates DAI Savings Rate: 0.01% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 0.00% WBTC Stability Fee: 0.75 USDCHighest Yields: Nexo Lend at 10% APY, BlockFi at 7.50% APY Top StoriesCharles Schwab, Citadel, Fidelity Digital launch digital asset exchangeCPI Inflation Low, But Offers Little Encouragement For Fed Or Markets64% of staked ETH controlled by five entities — NansenBinance Labs Doubles Down on Aptos Bet Ahead of Blockchain LaunchStat BoxTotal Value Locked: $54.61B (down 6.4% since last week) DeFi Market Cap: $45.80B (down 7.7%) DEX Weekly Volume: $12B (up 9.1%) Bonus Reads[Mike Dalton – Crypto Briefing] – Google Cloud Now Available to BNB Chain's 1,300 Apps [Krisztian Sandor – CoinDesk] – Lido’s Staked Ether Surges Closest to Ether Since Terra Crash [Samuel Haig – The Defiant] – U.S. Permits Tornado Cash Users to Access Crypto Deposits [Shaurya Malwa – CoinDesk] – Crypto Network Tron Set to Capitalize on DeFi Boom With Wintermute as Market Maker If you liked this post from This Week in DeFi , why not share it? |

Older messages

This Week In DeFi – September 9

Friday, September 9, 2022

This week, Ethereum activates its Bellatrix upgrade, Binance removes USDC markets and Coinbase goes against the US Treasury over Tornado Cash sanctions.

This Week In DeFi – August 26

Friday, September 2, 2022

This week, 1inch airdrops $OP to wallet users on Optimism, Curve hints a Sept. stablecoin launch and Arbitrum completes its Nitro upgrade.

This Week In DeFi – August 26

Friday, August 26, 2022

This week, the Ethereum foundation confirms dates for the Merge, Coinbase announces liquid ETH staking, and Symbolic Capital raises $50M for "pioneering" Web3 apps.

This Week In DeFi – August 19

Monday, August 22, 2022

This week, CoinFund raises $300M for a new Web3 fund, Tether takes back the spotlight and Unstoppable domains launches as app for managing yourWeb3 identity.

This Week In DeFi – August 12

Friday, August 12, 2022

This week, the US Treasury sanctions Tornado Cash, Ethereum PoW futures go live on BitMEX and the Curve Finance front-end gets exploited.

You Might Also Like

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏