DeFi Rate - This Week In DeFi – September 23

This Week In DeFi – September 23This week, US Congress looks to ban certain algo stablecoins, Nomura launches a crypto VC unit and FV Bank accepts direct deposits in USDC.

To the DeFi community, This week, members of US Congress are working on legislation that may ban “endogenously collateralized stablecoins” for two years, according to a report by Bloomberg news. Infringement could be punishable by up to five years in prison and a $1 million fine. The representatives are seeking to stop the creation of stablecoins that are backed solely by the value of another asset also issued by the same entity – motivated by the collapse of Terra and TerraUSD earlier this year. The US Treasury department will be conducting a study to examine such stablecoins, while the proposed ban is in effect.

Nomura, one of Japan’s largest investment banks, has launched a venture capital unit to invest in crypto, with a focus on DeFi, CeFi, Web3 and blockchain infrastructure. The VC unit will be called Laser Venture Capital, operating under Nomura’s new digital asset business Laser Digital. The bank also seeks to launch secondary trading and investor products.

Digital Bank FV Bank has enabled direct deposits of USDC for account holders. Deposits of the stablecoin will be converted automatically into US dollars, providing a frictionless banking experience bridging the DeFi and traditional financial world. The solution will make it easy for FV Bank users to invoice global clients in USDC, for rapid international settlements.

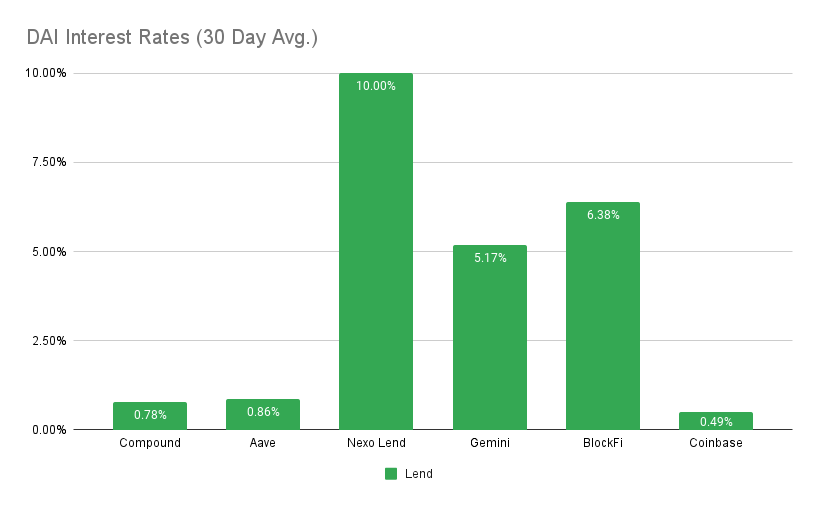

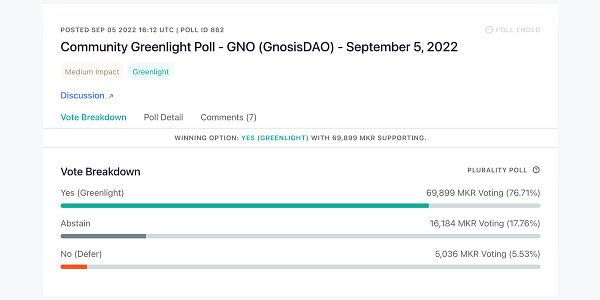

MakerDAO governance has voted in favor of adding GnosisDAO (GNO) as a collateral token for DAI, with 77% of voting power in favor of the addition. Risk, technical and oracle assessments are still yet to be carried out, which will be followed by a final vote to actually add GNO as a collateral type. GnosisDAO has expressed plans to mint 30 million DAI using GNO from its treasury as collateral, if it is added.   Stablecoins have taken the majority of this week’s spotlight, with a mixture of both good and bad news for the asset category. USDC has seen some tremendous adoption and acceptance over the last week, being added as a supported asset on trading app giant, Robinhood – the first stablecoin on the platform. Digital Bank, FV Bank, has also created a significant bridge for its customers between the crypto and traditional financial worlds, with USDC taking center stage and being accepted for direct deposits. Algorithmic stablecoins, on the other hand, are being dealt another blow. This time, US Congress is taking action to ban stablecoins backed solely by an asset from the same issuer – a move that has the potential to take out a few major decentralized stables. This may also may push back launch dates for pending stablecoin releases from Aave (GHO) and Curve (crvUSD), as the more clarity is sought for the details and likelihood of the legislation. On the other hand, institutions have embraced DeFi and crypto across the world this week, as Japanese investment banking giant Nomura begins to invest in the space, also accompanied by SoftBank, Deutsche Telekom and Nasdaq. Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, BlockFi at 6.38% APY MakerDAO Updates DAI Savings Rate: 0.01% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 0.00% WBTC Stability Fee: 0.75 USDCHighest Yields: Nexo Lend at 10% APY, BlockFi at 7.50% APY Top StoriesNasdaq reportedly preparing crypto custody services for institutionsRobinhood Adds USDC to Crypto ListingsFed Hikes Rates by Another 75 Basis PointsSoftBank, Deutsche Telekom Back $300M Fund With Web3 ComponentStat BoxTotal Value Locked: $55.53B (up 1.7% since last week) DeFi Market Cap: $45.04B (down 1.7%) DEX Weekly Volume: $9B (down 25%) Bonus Reads[Michael McSweeney – The Block] – CFTC files lawsuit against decentralized autonomous organization [Brandy Betz – CoinDesk] – A16z Leads $51.5M Round for Web3 Fraud Protection Startup Sardine [Owen Fernau – The Defiant] – Newly-Formed Uniswap Foundation Awards First Grants [James Hunt – The Block] – Cardano’s Vasil upgrade triggers after a 3-month delay If you liked this post from This Week in DeFi , why not share it? |

Older messages

This Week In DeFi – September 16

Friday, September 16, 2022

This week in DeFi The Ethereum Merge goes live, Compound Finance opens lending to institutions and Maker doubles its stETH ceiling for minting DAI.

This Week In DeFi – September 9

Friday, September 9, 2022

This week, Ethereum activates its Bellatrix upgrade, Binance removes USDC markets and Coinbase goes against the US Treasury over Tornado Cash sanctions.

This Week In DeFi – August 26

Friday, September 2, 2022

This week, 1inch airdrops $OP to wallet users on Optimism, Curve hints a Sept. stablecoin launch and Arbitrum completes its Nitro upgrade.

This Week In DeFi – August 26

Friday, August 26, 2022

This week, the Ethereum foundation confirms dates for the Merge, Coinbase announces liquid ETH staking, and Symbolic Capital raises $50M for "pioneering" Web3 apps.

This Week In DeFi – August 19

Monday, August 22, 2022

This week, CoinFund raises $300M for a new Web3 fund, Tether takes back the spotlight and Unstoppable domains launches as app for managing yourWeb3 identity.

You Might Also Like

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏