DeFi Rate - This Week In DeFi – September 9

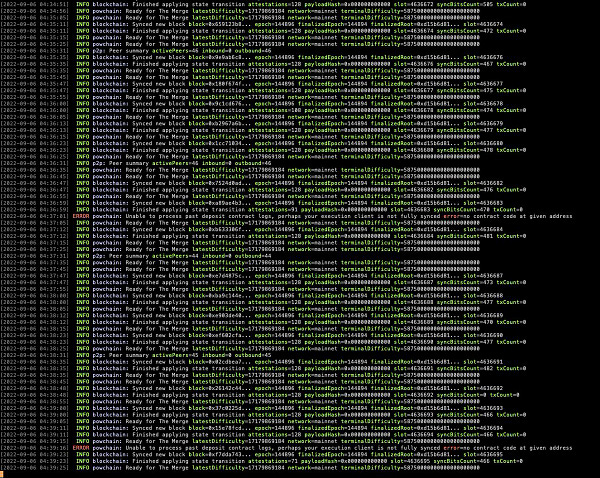

This Week In DeFi – September 9This week, Ethereum activates its Bellatrix upgrade, Binance removes USDC markets and Coinbase goes against the US Treasury over Tornado Cash sanctions.This week, Ethereum’s Bellatrix upgrade has been successfully activated – the final preparatory step before the Merge next week. Bellatrix was an important step on the Beacon Chain, adding a vital “execution payload” parameter for nodes to be able to process transactions post-Merge. The Merge will be activated via the “Paris” upgrade at a Terminal Total Difficulty (TTD) of 58750000000000000000000, estimated to occur September 14-15.

Binance has removed USDC as an independent tradable asset – converting USDC, USDP and TUSD deposits into BUSD, its own Binance USD stablecoin. The exchange says the move is designed to improve liquidity and capital efficiency. Users will still be able to make withdrawals in USDC, USDP and TUSD at a 1:1 ratio to their BUSD account balance.

Multiple employees from crypto exchange Coinbase are filing a suit to challenge the US Treasury’s sanctions on Tornado Cash. The suit challenges the authority of the Treasury to sanction smart contract code, rather than a person or entity. The distinction between smart contract and individual crypto address is a highly important one, with potentially profound implications for the future of blockchain apps.

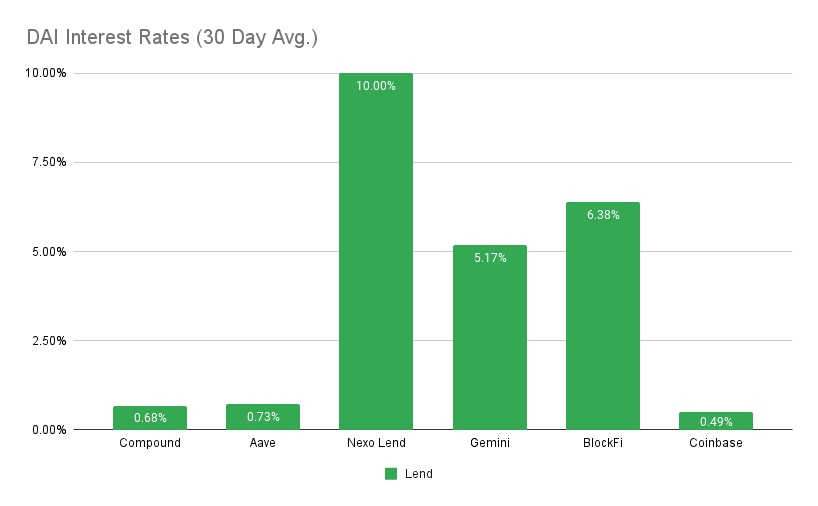

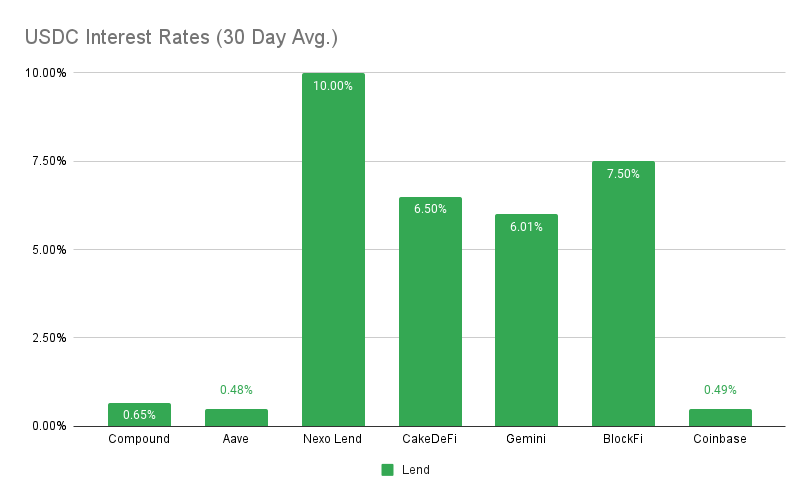

Curve Finance has released front-end code on GitHub for its upcoming crvUSD stablecoin, giving away some clues to features on the new token. So far, it appears that crvUSD may be an over-collateralized stablecoin, backed by ETH or one or more of Curve protocol’s largest liquidity pools.   Ethereum’s Merge looks as though it will be happening right on time, as US regulators decide to crack down on crypto mining and its energy consumption. The shift to Proof-of-Stake (PoS) will place Ethereum out of the way of any mining-based regulation, meanwhile Proof-of-Work (PoW) miners on Bitcoin or Ethereum forks may have to go green, or even worse – shut down altogether. Implications of the research and the subsequent outcomes could be substantial for the future of Bitcoin within the country and elsewhere, as the EU seems to be heading down the same path. Ethereum staking may also get a boost from large players, as SEBA bank pushes to provide staking services to institutions. The threat of regulation also looms over stablecoins, as Fed Chair Jerome Powell calls for legislation to tame the ever-growing stablecoin market. Centralized stablecoins will be the first to feel the heat, adding to the pressure of the inter-stablecoin wars already in motion. USDC has been effectively scrubbed from Binance, as the exchange giant consolidates USDC balances into Binance USD (BUSD), in an effort to improve liquidity and BUSD dominance. On the horizon, we also have Curve’s stablecoin, expected to launch shortly after the Merge. The finer details of the token are still yet to be disclosed, however one thing is for certain – the sheer size of the protocol and its influence in DeFi will ensure that crvUSD captures a significant market share. Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, BlockFi at 6.38% APY MakerDAO Updates DAI Savings Rate: 0.01% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 1.00% WBTC Stability Fee: 0.75 USDCHighest Yields: Nexo Lend at 10% APY, BlockFi at 7.50% APY Top StoriesSEBA Bank to provide Ethereum staking services to institutionsPowell: ‘We need legislation’ on stablecoinsFirst Mover Americas: Bitcoin Back Over $19K as ECB Goes for Record Interest-Rate HikeWhite House report proposes possible restrictions on proof-of-work crypto miningStat BoxTotal Value Locked: $58.35B (down 2.2% since last week) DeFi Market Cap: $49.60B (up 13%) DEX Weekly Volume: $11B (down 15%) Bonus Reads[Kristin Majcher – TheBlock] – DeFi investing platform Credix raises $11 million in Series A round [Oliver Knight – CoinDesk] – Crypto Lender Nexo Introduces Spot and Margin Trading Platform [Samuel Haig – The Defiant] – Arbitrum Transactions Quadruple After Upgrade If you liked this post from This Week in DeFi , why not share it? |

Older messages

This Week In DeFi – August 26

Friday, September 2, 2022

This week, 1inch airdrops $OP to wallet users on Optimism, Curve hints a Sept. stablecoin launch and Arbitrum completes its Nitro upgrade.

This Week In DeFi – August 26

Friday, August 26, 2022

This week, the Ethereum foundation confirms dates for the Merge, Coinbase announces liquid ETH staking, and Symbolic Capital raises $50M for "pioneering" Web3 apps.

This Week In DeFi – August 19

Monday, August 22, 2022

This week, CoinFund raises $300M for a new Web3 fund, Tether takes back the spotlight and Unstoppable domains launches as app for managing yourWeb3 identity.

This Week In DeFi – August 12

Friday, August 12, 2022

This week, the US Treasury sanctions Tornado Cash, Ethereum PoW futures go live on BitMEX and the Curve Finance front-end gets exploited.

This Week In DeFi – August 5

Friday, August 5, 2022

This week, Solana and Nomad see major exploits, Aave goes ahead with its GHO stablecoin and Ethereum PoW supporters rise ahead of the Merge.

You Might Also Like

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏