Coin Metrics' State of the Network: Issue 177

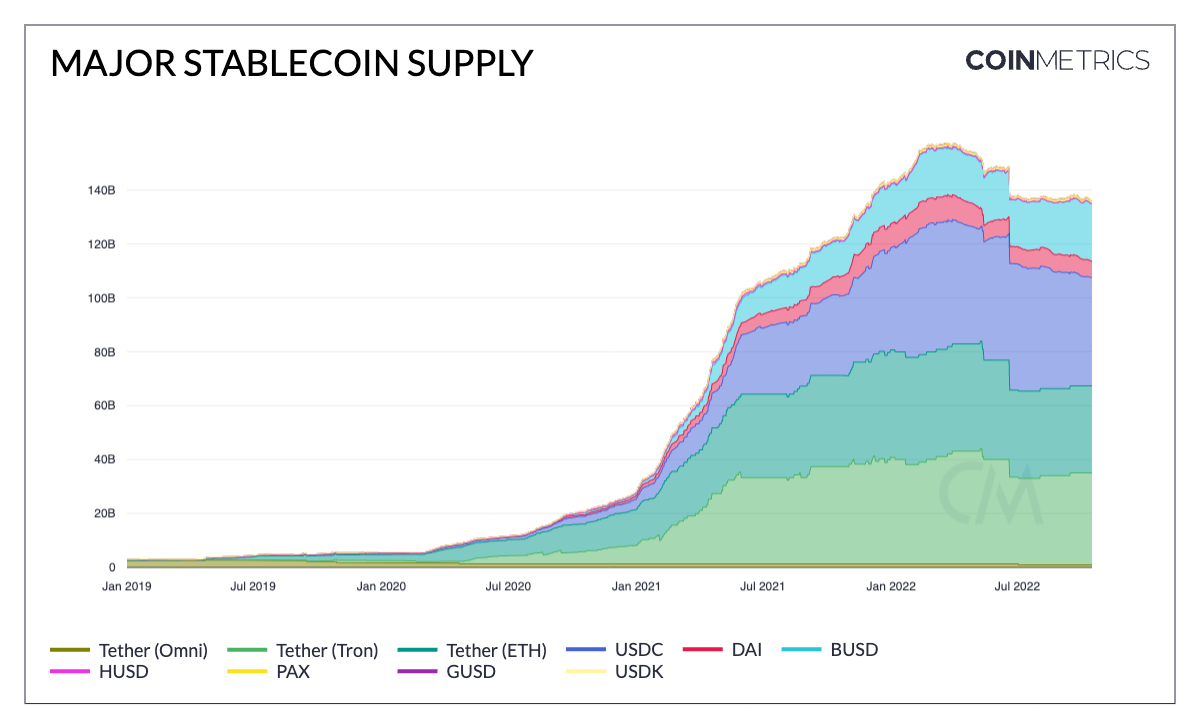

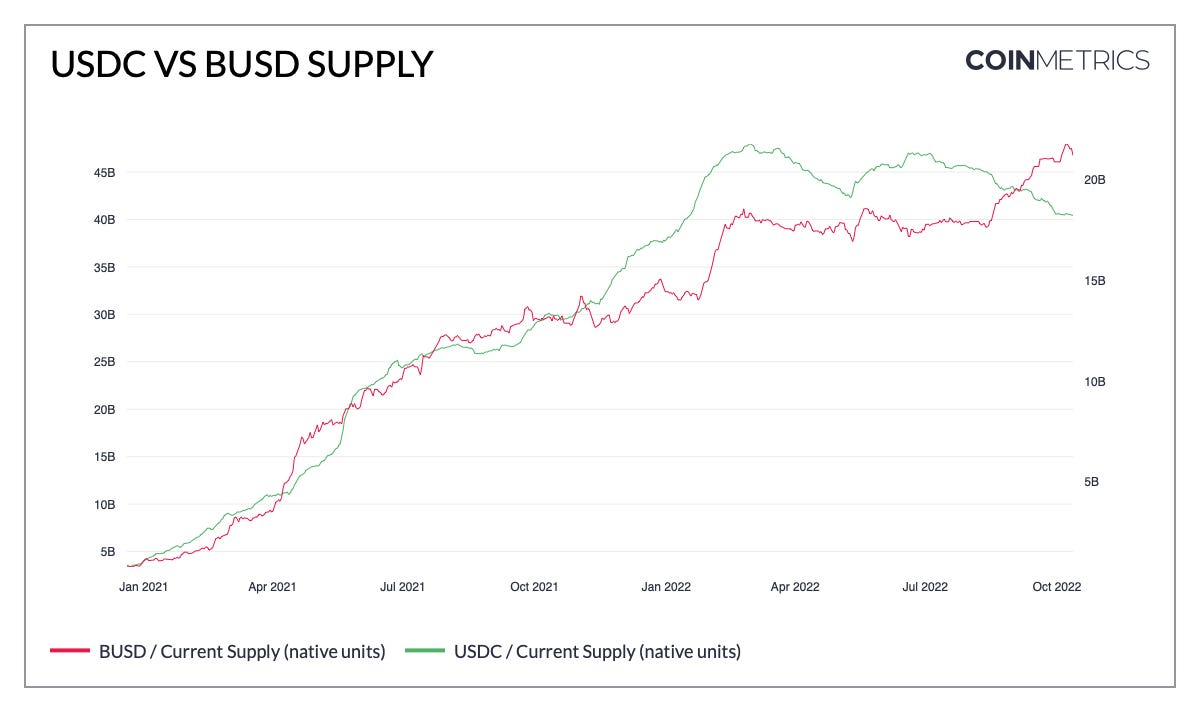

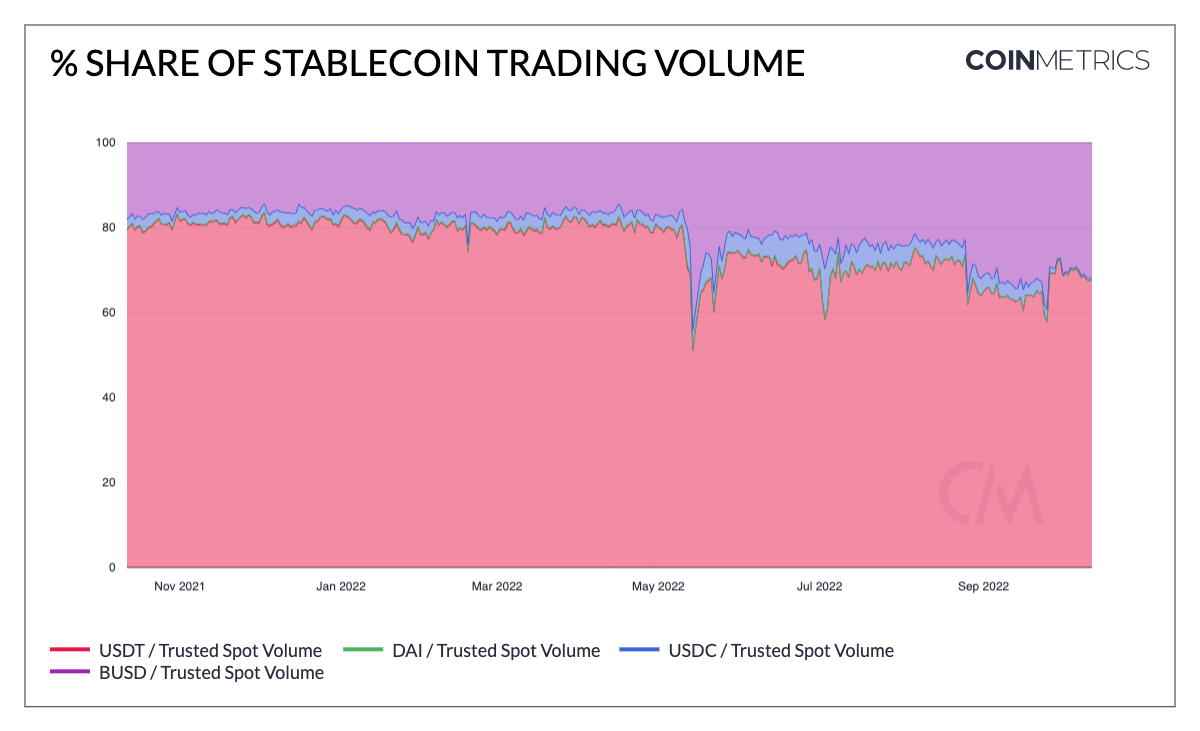

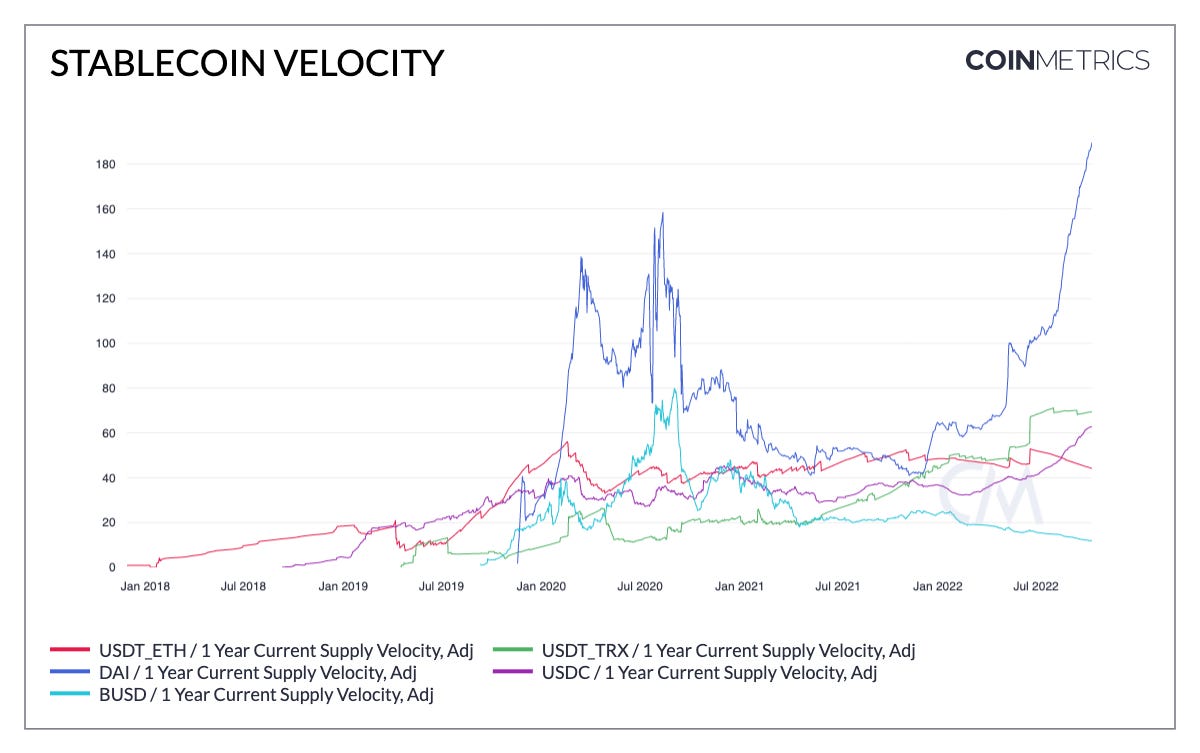

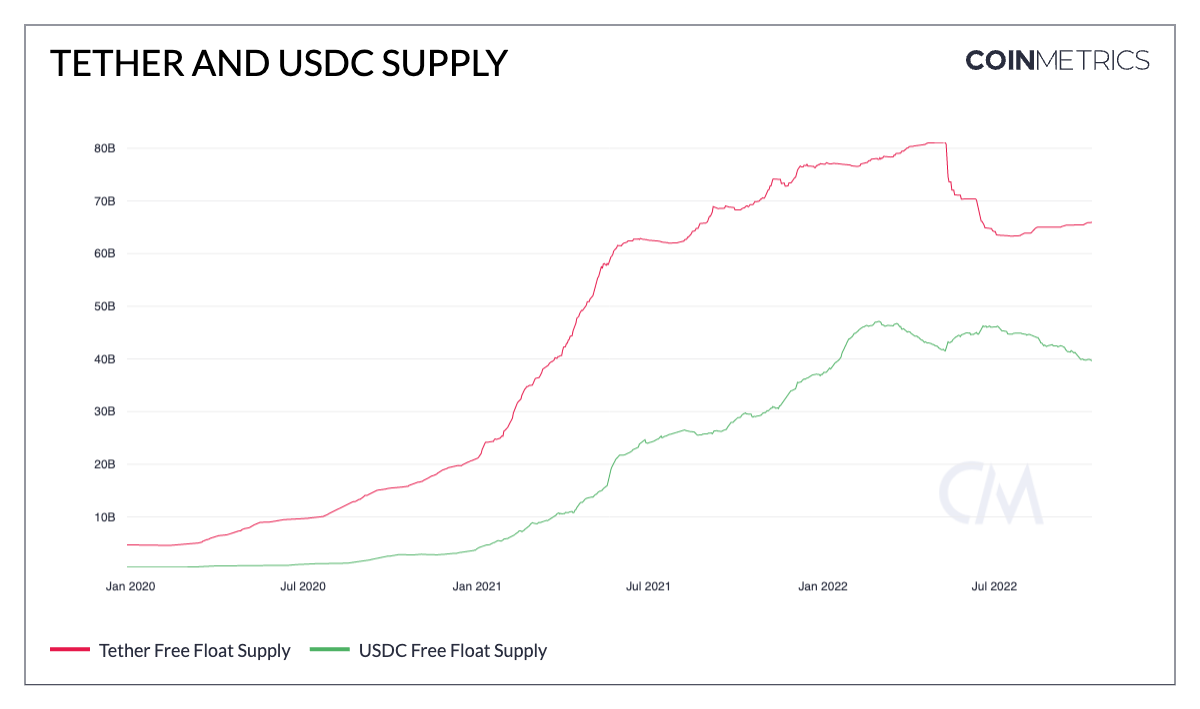

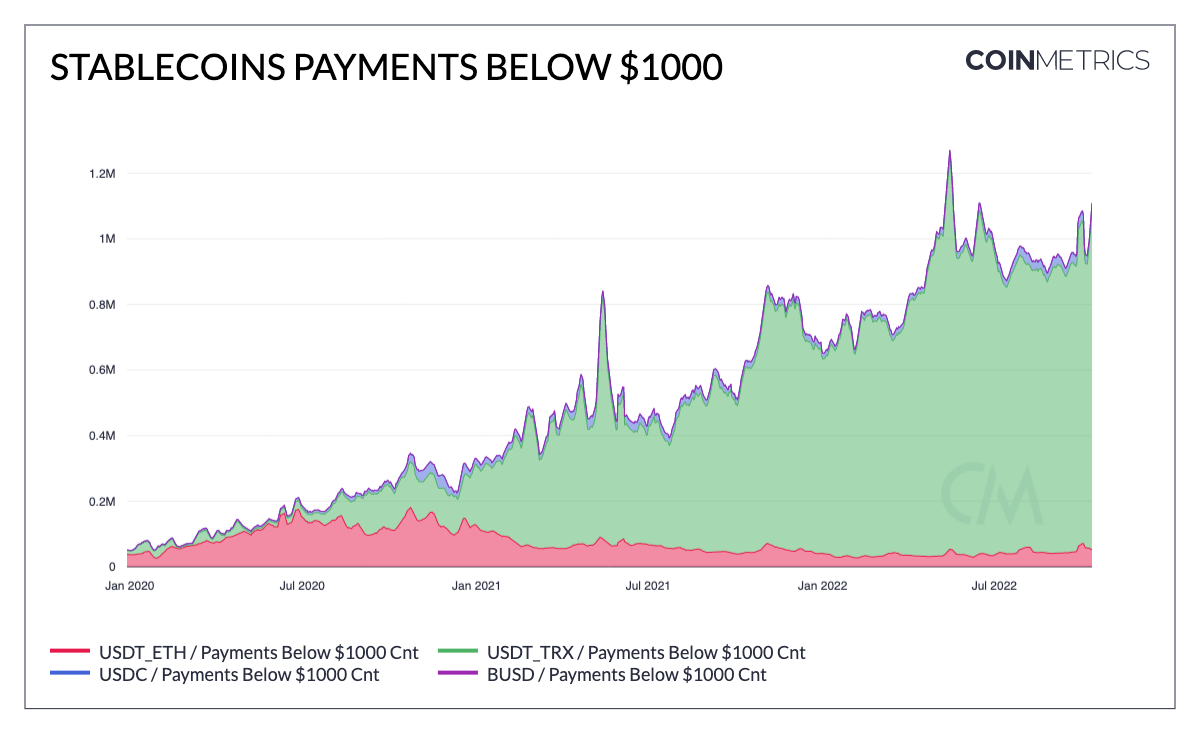

Get the best data-driven crypto insights and analysis every week: Stablecoins Come Into Focus in EU’s MiCa LegislationBy Matías Andrade, Kyle Waters, and Nate Maddrey Stablecoins are one of the most fascinating products in the cryptocurrency ecosystem in spite of their, well, stability. But in the stablecoin ecosystem there are many things worth keeping in mind, and recent changes have brought fresh developments in what is sometimes called crypto’s leading killer app. The total market cap of stablecoins has fallen in 2022, but is at least $135B today. Source: Coin Metrics Network Data Regulatory guidance and oversight are topics that regularly intrude in the stablecoin market and are sure to shape the future of the ecosystem. Last week, the European Council voted in favor of the EU’s Markets in Crypto Assets (MiCA) legislation, set to come into force in 2024, to provide greater transparency and accountability to individuals and businesses operating in the crypto industry with stablecoins given special treatment. In particular, the new rules forbid the collection of interest by investors on stablecoins, which could provide motivation for securitization of tokenized retail money-market funds or commercial bank deposits, which do not fall under MiCA and are free to pay interest. Furthermore, MiCA pursues mandatory disclosure of “adverse impacts on the climate and other environment-related impacts [driven by] consensus mechanisms.” Recent transition to Proof-of-Stake by Ethereum poses an interesting case-study—by reducing the energy consumption of consensus activities in the order of 99.5 percent, it may reduce liability and promote acceptance of Ethereum-based stablecoins. Finally, one of the more consequential changes proposed is a limit on daily traded volume of non-euro stablecoins at €200M. With the overwhelming majority of stablecoins being USD-denominated, EU officials are recognizing the proliferation of the US dollar abroad via stablecoins. Circle’s USD Coin (USDC) boasts a total supply of over $45B while its Euro stablecoin counterpart (EUROC) only had a supply of €76M in August (though EUROC is a newer offering). In another shakeout in the stablecoin ecosystem, Binance — the world’s leading cryptocurrency exchange by volume — recently announced in September that all user holdings in USDC, USDP and TUSD (alternative stablecoin offerings) would be converted automatically to BUSD (Binance’s stablecoin) when deposited onto the exchange. This decision is justified by Binance as an attempt to improve liquidity by consolidating order books into a single stablecoin pair, as well as increase demand for their own stablecoin. BUSD supply recently surpassed $21B, while USDC supply has tilted downward in recent months. The fast changing interest rate environment in the US and abroad has also contributed though, as stablecoin holders are likely seeking to capture yield elsewhere in the financial markets. Source: Coin Metrics Network Data Pro BUSD’s share of spot volume has grown as it is being used more frequently as a quote asset on Binance. USDT continues to dominate trading volumes in centralized exchange markets, and USDC receives relatively little use, especially after Binance’s decision to deprecate USDC-quoted spot pairs on the exchange. However, USDC remains a popular quote asset for trading on decentralized exchanges (DEXs) and dominates in DeFi more generally. Source: Coin Metrics Network Data Velocity is an interesting metric to gauge stablecoin activity. It measures the relative turnover in token value between accounts taking place in each tokens’ respective network. Velocity is thus proportional to transaction size and frequency. We can see that DAI has rapidly grown in popularity as a result of its considerable on-chain footprint, dominating over all other tokens, thanks to popularity as collateral and quote in DeFi. Although this is in part because other tokens receive greater use off-chain on centralized exchanges, it is remarkable that USDC velocity is increasing, even if it is far below the velocity observed for DAI. Source: Coin Metrics Network Data We have seen both Tether and USDC supplies decrease this year as tokens are redeemed and removed from circulation. Tether supplies have stabilized at around $67B after almost $18B in redemptions. USDC (on Ethereum) has decreased in supply and is approaching $40B after reaching a high point of almost $48B on February of this year. Source: Coin Metrics Network Data The low-value transfer market is dominated by USDT tokens issued in the Tron network. These tokens benefit from low fees and rapid transaction processing of the Tron platform, which are especially important for cost-sensitive users. This relative dominance is clearly visible in the chart below. Source: Coin Metrics Network Data Pro In the US, regulators are also moving closer to stablecoin legislation. A recent US Treasury report laid out some considerations that could be reflected in upcoming legislation, including a two-year ban on algorithmic stablecoins. To follow the data used in this piece and explore our other on-chain metrics check out our free charting tool, formula builder, correlation tool, and mobile apps. Network HighlightsSummary MetricSource: Coin Metrics Network Data Pro Most assets show signs of stagnating on-chain activity, with decreasing numbers of active addresses. But some assets showed strong growth week-over-week with LTC daily active addresses rising 75% and ALGO daily active addresses rising 60%. Coin Metrics UpdatesThis week’s updates from the Coin Metrics team:

As always, if you have any feedback or requests please let us know here. Subscribe and Past IssuesCoin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. Check out the Coin Metrics Blog for more in depth research and analysis. © 2022 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. If you liked this post from Coin Metrics' State of the Network, why not share it? |

Older messages

Coin Metrics' State of the Network: Issue 176

Tuesday, October 11, 2022

Tuesday, October 10th, 2022

Coin Metrics' State of the Network: Issue 175

Tuesday, October 4, 2022

Tuesday, October 4th, 2022

Coin Metrics' State of the Network: Issue 174

Tuesday, September 27, 2022

Tuesday, September 27th, 2022

Coin Metrics' State of the Network: Issue 173

Tuesday, September 20, 2022

Tuesday, September 20th, 2022

Coin Metrics' State of the Network: Special Merge Update

Thursday, September 15, 2022

Thursday, September 15th, 2022

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏