Main Street Insiders - China Risk Is Investment Risk

Power corrupts. And when some people taste it, they will do anything to accrue even more. They’ll always give a convenient rationale for their power grab, and it doesn’t matter when their rationale turns out to be a lie. The damage has already been done.  .@BlackRock CEO Larry Fink reiterates his new ESG talking point, claiming "climate risk is investment risk." We’ve been fed a lie about the “climate emergency.” Wall Street and global elites have used that lie to accrue massive amounts of power and wealth. One of the ways they push their emergency is by forcing companies to report the alleged business risks of climate change. By causing so much hysteria, they’ve created a real emergency. One that will actually increase pollution and human misery. This thread explains it all.  How a fake climate emergency created a real energy emergency

The false idea that fossil fuels' climate impacts are an "emergency" that requires us to rapidly eliminate fossil fuels has caused an energy emergency.

The "climate emergency" movement must be held accountable.

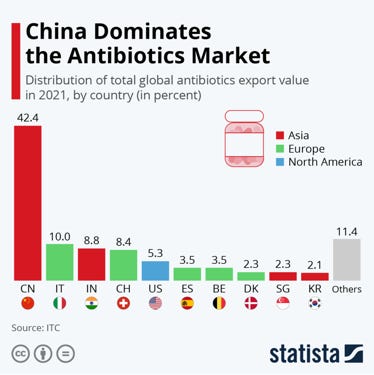

🧵👇 The elites love to push net zero mandates and dreams of a green future, but ignore the harsh realities of their childish fantasies.  People like the idea of solar farms in the abstract, but hundreds of communities around the world are currently fighting them because they require 300-600x more land than other energy sources, produce 300x more toxic waste, and devastate critical wildlife habitats. We’re starting to think these people might be slightly out of touch.  They don't know how they sound, because everything they read and everyone they know just echo their ideology back at them - except turned up in volume, higher in pitch, and with applause.  RNC Research @RNCResearch Climate risk is not investment risk. Changes to our climate – which have existed since the beginning of time – can usually be mitigated at a reasonable cost based on facts and observation. While the elites keep us occupied with a fake climate emergency, they’re making billions a year doing business with the worst polluter in the world: China. And they’re making America vulnerable by doing so. That’s the real risk. Unsurprisingly, the elites are oddly silent about that one. They thought we wouldn’t notice. But we did. And we don’t need convoluted projections or complicated computer models to see the risk of doing business in China. We just look at the facts. The Risks of Doing Business With ChinaThe Chinese Communist Party (CCP) is an oppressive regime that’s hostile to freedom and democracy. The only topic they’re truly transparent about is their desire to be a world super power and dominate the US. And they’re increasingly aggressive about pursuing this power through everything from massive military spending to rounding up dissenters by the millions. Yet, we continue to feed this regime with our money, talent, and technology. The peril of doing so increases with each passing day. It All Started With A Ruthless Quest For Cheap LaborWe’ve written before about the ways elites exploit the Producing Class to increase profits. As a result, we’ve outsourced manufacturing to China for many everyday goods. Those manufacturing jobs should have remained in the US to help prosper US communities. Especially forgotten communities like impoverished inner cities and rural towns. Yes, it does make a difference in your everyday life when your work boots are made in North Carolina instead of North China (Huabei). But it’s deeper than the location of a particular factory. It’s the sheer, reckless extent of this outsourcing that makes us vulnerable and strengthens the CCP. Here are just a few examples: Control of our medicines: China dominates the supply of pharmaceuticals, including antibiotics. US officials worry about how that power could be used in the event of a global conflict. Imagine millions of Americans with treatable conditions dying because we’ve run out of simple medications that cost pennies per dose. From an NBC news article on the topic:

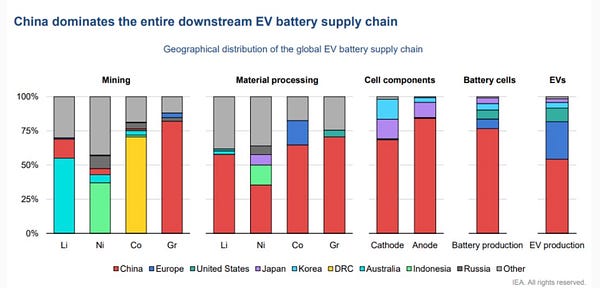

If that seems far-fetched, remember that China was the country that cut their Wuhan province off from the rest of China when it became the epicenter of the COVID pandemic. Yet, they let travel continue to the rest of the world. They were determined to stop COVID in their country, but they were okay if the rest of us got it. Control of our energy: China dominates the supply chain for rare earth minerals used for electric car batteries and other renewable energy sources. This means that every new Tesla and every new windmill installation makes the CCP richer and more powerful. As 3 Aces mentioned on our podcast, the elitist push for net zero and a Green New Deal is a resounding vote for China’s oppressive regime.  China dominates the electric vehicle battery supply chain.

Billions from Joe Biden's Inflation Acceleration Act will go into the bank accounts of communists. Theft of our secrets: China steals our trade secrets and technology. We’re not just talking about fake Nike shoes and Titleist golf clubs. We’re talking about high tech trade secrets that can be used for commercial and military purposes. From the National Review:

Chasing Profit Has ConsequencesImagine a future conflict with China where we have to fight the CCP’s military - one we essentially built for them by outsourcing our industrial base and running huge trade deficits. Where they’ll use our technology – including AI developed here – against us. Where they could cut off our supply of life-saving medicines and cut off supply of minerals needed to run our newly “green” economy (after we foolishly phased out fossil fuels). And that’s just the beginning. The extent of China risk goes further than the outsourcing of our supply chains. In a future article, we’ll explore how:

It’s a mess. They Always Have A “Reason” But The Reason Is Ultimately Just Money and PowerSo why would Blackrock and other global elites promote imaginary climate risk and ignore obvious China risks? Because they make lots of profit by promoting climate risk. And they make even more by ignoring China risks. Examples: ESG Funds: ESG funds rack up higher fees even though they deliver lower returns. Green Investing: Investing in green energy startups can be lucrative when you can count on government allies to shovel money your way. Subsidies and tax credits - that’s where the money is at.  When asked by Bill Clinton about where the money is going to come from to facilitate a global ESG transition, one of the UN's ESG Czars said:

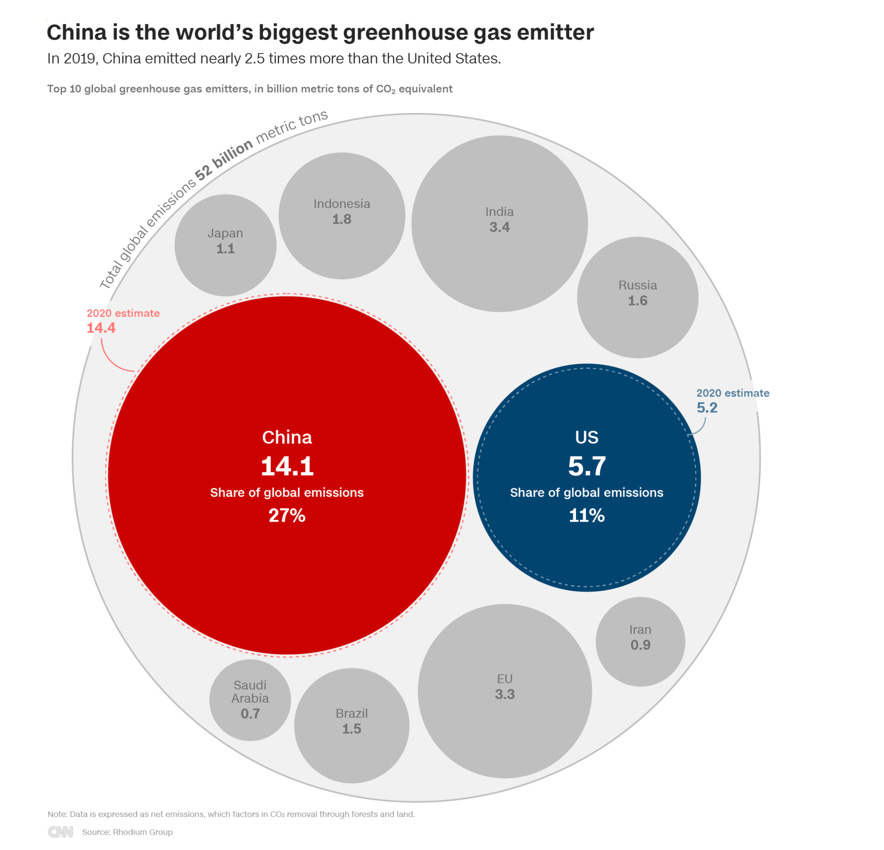

"Just like how we found $17 trillion for COVID, the money must be there somewhere..." Outsourcing to China: Large American companies who manufacture in China know they are cutting costs and increasing profits. Bringing those supply chains back to America might threaten the bottom line. They don’t include access to medicine and national security in that bottom line, sorry. Investing in China: While Blackrock pushes ESG mania in the US, they are aggressively building their asset management business in China – the world’s largest emitter of carbon emissions by far. The potential management fees generated by China’s $3.5 trillion financial services industry is too lucrative to pass up. Ignoring China’s Environmental Record: And while Blackrock uses their power to turn America’s energy companies green, they have no such illusions for their large investment in PetroChina, China’s largest fossil fuel company. Elites Only Listen When We Speak Their LanguageHowever, as noted earlier, pointing out their hypocrisy isn’t going to change them. Only the loss of money or the loss of power gets their attention. That’s where we’re seeing some progress. We need to pull assets from Wall Street firms that take your money and bet on China. Some states are getting that party started already. We hope many more will follow.  .@LATreasury tells me what happened when he met with BlackRock after Louisiana divested nearly $800 MILLION from the company: "They wanted to assure me they weren't against the fossil fuel industry...But what I read, see, and hear is something totally different out of their CEO." We can do our part as consumers by buying more goods that are made in America and other democracies. Companies should be pressured to account for the economic and moral risks of doing business with China. This pressure can be brought by conservative institutional investors and regular old retail investors like you. Our leaders in government can do their part by prohibiting technology transfers, increasing import tariffs, promoting domestic energy production, and streamlining regulations to speed up the re-shoring of our manufacturing base. As Kevin Freeman of Economic War Room said on our podcast, we’ll have to eventually decouple from China one way or another. We can wait until the situation gets dire and do it the hard way. Or, we can get started now and do it the easier way. We need to face up and start decoupling from the CCP now. This is the way. -Jeff and Luke Perlot |

Older messages

Why We Need A Parallel Economy

Thursday, October 13, 2022

Before It's Too Late

The Creative Destruction Smokescreen

Thursday, October 6, 2022

If It Walks Like A Robber Baron . . .

The Story Behind Uyghur Genocide

Thursday, September 29, 2022

Why The CCP Is Destroying An Entire Nation

China Wants To Rule The World

Thursday, September 22, 2022

And The Uyghurs Are In Their Way

The Attention Economy Is Part Of The Greatest Wealth Transfer Ever

Thursday, September 15, 2022

How About Creating An "Intention Economy"?

You Might Also Like

From 0 to $5B (local non-US market)

Tuesday, March 4, 2025

I love that you're part of my network. Let's make 2025 epic!! I appreciate you :) Today's hack From 0 to $5B (local non-US market) Nadiem Makarim is a guy who managed to create

Quiet quitting is out. Revenge quitting is in? 😜

Tuesday, March 4, 2025

Do it loud. Do it proud, I guess.

Building complete rank and rent sites in just minutes

Monday, March 3, 2025

This tool is incredible

🌁#90: Why AI’s Reasoning Tests Keep Failing Us

Monday, March 3, 2025

we discuss benchmark problems, such as benchmark saturation, and explore potential solutions. And as always, we offer a curated list of relevant news and important papers to keep you informed

I interviewed THE largest Amazon Seller [Roundup]

Monday, March 3, 2025

Need funding for your Canadian Amazon business? Not sure if you should use a Canadian corporation or US LLC to form your company? We'll cover these questions and more in our Start and Grow Your FBA

The state of data-driven decision-making for CPG brands

Monday, March 3, 2025

How marketers use purchase insights to maximize campaign performance

Facebook updates, TikTok ROI, Instagram format matches, and more

Monday, March 3, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... presented by social-media-marketing-world-logo New week, fresh insights, Reader! Stay sharp with the latest updates on AI, social

Are you losing revenue to rivals?

Monday, March 3, 2025

This is a challenge that costs businesses millions every year: Their customers are switching to competitors for various reasons... even though most of them could easily be fixed. On Tuesday, March 4,

DeepSeek’s 545% Profit Claim

Monday, March 3, 2025

PLUS: Siri 2027?!

Insurtech VC resets, readies for growth

Monday, March 3, 2025

Europe's share of regional IPOs sinks; the agtech revolution is now; hope flares for natural gas deals Read online | Don't want to receive these emails? Manage your subscription. Log in The