DeFi Rate - This Week In DeFi – October 14

This Week In DeFi – October 14This week, Aptos goes live and airdrops 20M APT, Frax Finance announces liquid staking, Edge Capital Management raises $67M for DeFi funds and Ripple plans an EVM sidechain.To the DeFi community, This week, Aptos announced the launch of its mainnet this week, along with an airdrop of 20 million of its native APT tokens to early testers – equivalent to 2% of token supply. APT also saw rapid listings on several major exchanges, including perpetual futures contracts via Binance and FTX. The Aptos blockchain comes from the developers of Facebook’s abandoned cryptocurrency project, Libra, which was rebranded to “Diem” before eventually being shut down. Aptos already has a fully diluted market cap of almost $8 billion. Frax Finance is joining in on the liquid staking fun, as it reveals it will be launching an Ethereum liquid staking protocol “within two weeks”. The protocol will enable users to stake their Ether and mint Frax Ether (frxETH), an ETH derivative token. As with other liquid staking tokens such as Lido’s stETH, frxETH will mirror the price of ETH and be freely usable within the DeFi ecosystem.  $frxETH is LIVE at app.frax.finance/frxeth/mint

step 1: mint your $ETH into $frxETH 1:1

step 2: stake your $frxETH for $sfrxETH to earn yield estimated at 6.13% APR currently

(¤, ¤)

@fraxfinance @samkazemian

nfa Edge Capital Management, an obscure crypto hedge fund, has raised $66.78 million across two DeFi funds, according to recent SEC filings. One fund is based in the US with $28 million in funding, while the other is based in the Cayman Islands with almost $39 million. According to the limited amount of information available on the funds, the company is seeking digital asset opportunities, with a focus on macro factors.  SCOOP: Edge Capital Management, a newer crypto hedge fund, has raised $66.78 million across two of its DeFi-focused funds.

@BrandyBetz reports

Ripple has taken a fascinating step into DeFi territory, kicking off a project which plans to introduce an Ethereum Virtual Machine (EVM) compatible sidechain into the XRP ledger ecosystem. The project has been organized into three-phases, beginning with a recently-launched version of the chain on the company’s devnet. To follow, a permissionless version will launch early next year, while a full deployment of the chain is scheduled for Q2 2023.  🥁Introducing the first phase of bringing an Ethereum Virtual Machine (EVM) sidechain to the #XRPLedger.

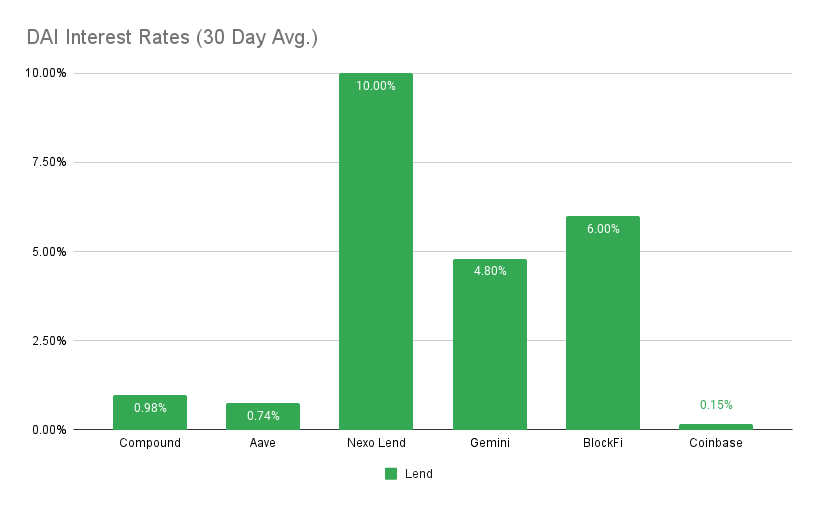

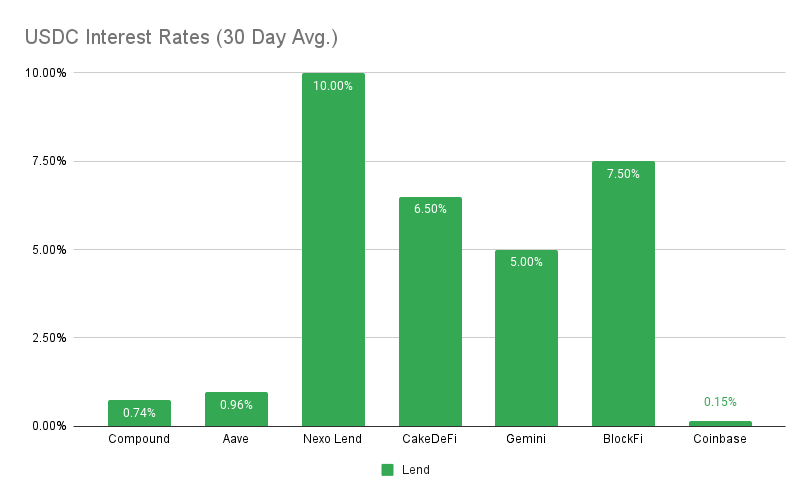

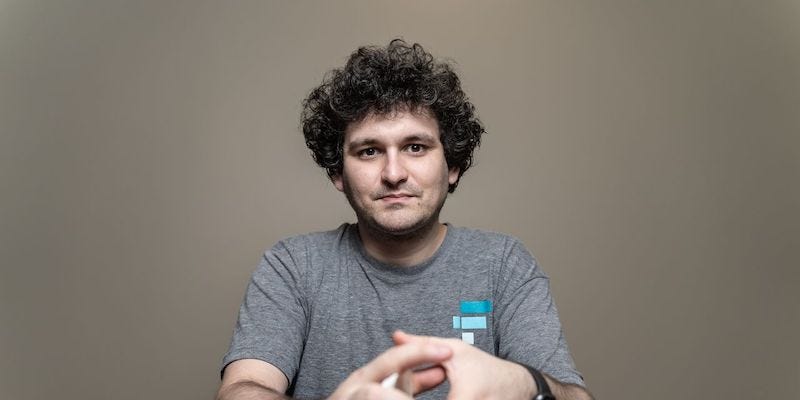

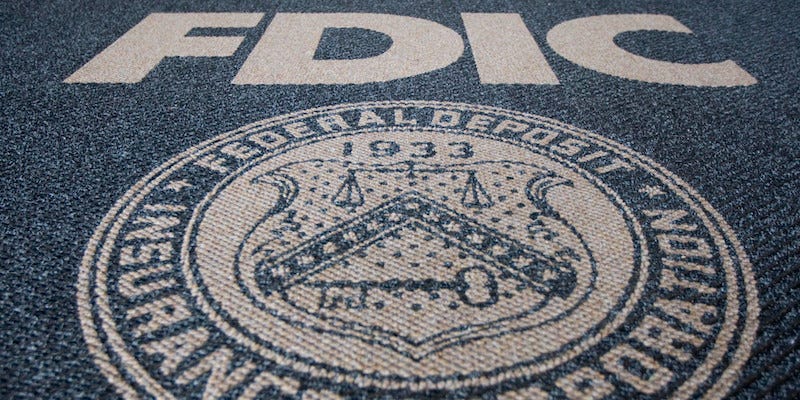

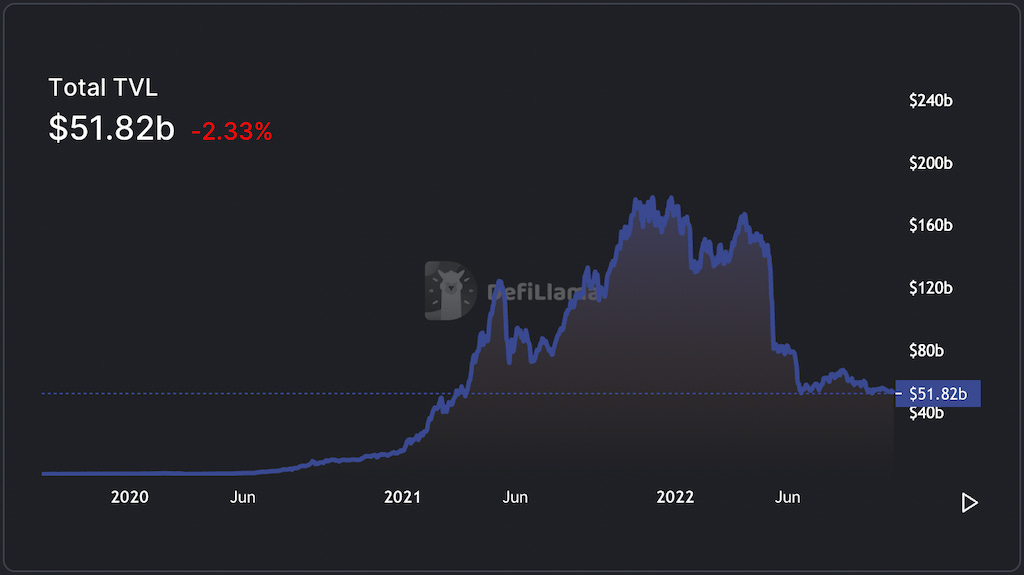

EVM developers, we invite you to experiment with the functionality on Devnet and enjoy the best of Ethereum and XRPL for your #DeFi applications. dev.to/ripplexdev/an-… The walls of regulation continue to close in on crypto and DeFi, with news coming from multiple parties this week. Perhaps the most shocking was FTX CEO Sam Bankman-Fried’s regulatory proposal seeking to standardize regulation around DeFi – including implementing know-your-customer (KYC) rules across companies and websites offering access to decentralized exchanges. Bankman-Fried’s proposal was met with a ton of backlash from the crypto community, with many perceiving his moves as protecting his own self-interests in the market. On the regulatory agency side of things, we had the Federal Deposit Insurance Corporation (FDIC) acting chair calling for more controls on stablecoins. Martin Gruenberg encourages a system where such tokens are only permitted on networks where all parties are clearly identified and verified – essentially pushing for an entirely permissioned network. Finally, over at the IRS, the most recent tax guidance has been beefed up to explicitly mention NFTs as taxable assets, as well as shifting language from “virtual currencies” to “digital assets”. The IRS was careful to use language that would also apply its reporting rules to emerging digital asset classes, which may attempt to escape the agency’s grasp. It will be highly interesting to see how the ecosystem reacts to and defends itself from these budding regulations and others. A great DeFi split into “permissioned” DeFi and the wild-west may truly be beginning – but how segregated will things get? Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, BlockFi at 6% APY MakerDAO Updates DAI Savings Rate: 0.01% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 0.00% WBTC Stability Fee: 0.75 USDCHighest Yields: Nexo Lend at 10% APY, BlockFi at 7.50% APY Top StoriesSam Bankman-Fried draws fire from DeFi proponents after regulation proposalFDIC head calls to limit stablecoins to permissioned blockchainsFidelity’s Embrace of Ethereum Augurs More Institutional AdoptionIRS Drafts New Crypto Reporting Rules for Tax Year 2022Stat BoxTotal Value Locked: $51.82B (down 2.9% since last week) DeFi Market Cap: $42.65B (down 3.3%) DEX Weekly Volume: $7B (up 17%) Bonus Reads[Tim Copeland – The Block] – Binance now second-largest entity by voting power in Uniswap DAO [Kristin Majcher – The Block] – Here’s why Silvergate is delaying its planned stablecoin launch [Samuel Haig – The Defiant] – Polygon Builds Web3 Mojo With LatAm Fintech Deal [Adam James – The Block] – Polkadot synthetic asset protocol Tapio raises $4 million from Polychain and others If you liked this post from This Week in DeFi , why not share it? |

Older messages

This Week In DeFi – October 14

Friday, October 14, 2022

This week, Uniswap raises $165M in Series B funding, Solana's Mango Markets is exploited for $100M and ETH becomes deflationary.

This Week In DeFi – October 7

Friday, October 7, 2022

This week in DeFi, Bitwise launches a Web3 ETF, Binance Smart Chain is halted after a hack and Ribbon Finance launches unsecured lending for institutions.

This Week In DeFi – September 30

Friday, September 30, 2022

This week, USDC plans expansion to 5 more networks, Chainlink partners with SWIFT and launches a growth program, and Robinhood launches its own Web3 wallet.

This Week In DeFi – September 23

Friday, September 23, 2022

This week, US Congress looks to ban certain algo stablecoins, Nomura launches a crypto VC unit and FV Bank accepts direct deposits in USDC.

This Week In DeFi – September 16

Friday, September 16, 2022

This week in DeFi The Ethereum Merge goes live, Compound Finance opens lending to institutions and Maker doubles its stETH ceiling for minting DAI.

You Might Also Like

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏