DeFi Rate - This Week In DeFi – October 28

This Week In DeFi – October 28This week, MakerDAO approves up to $1.6 billion in USDC deposits into Coinbase Custody, FTX looks to launch its own stablecoin and zkSync drops zkSync 2.0 with smart contracts.To the DeFi community, This week, MakerDAO has passed a proposal which could see the protocol move up to $1.6 billion in USDC to Coinbase Custody, for a 1.5% return. Maker has already joined Coinbase’s institutional rewards pilot program for the move. A second proposal has also approved a $500 million USDC loan to Coinbase, collateralized with ETH and BTC. The loan will generate a variable interest rate of 4.5% to 6%, with monthly payments.  MakerDAO community approves our proposal to custody up to $1.6B in USDC with Coinbase.

We are excited for what this means for USDC,

@MakerDAO, and the stablecoin ecosystem as a whole.

coinbase.com/blog/coinbase-…

FTX CEO Sam Bankman-Fried revealed in an interview that the exchange is very likely to create a stablecoin – and is currently exploring a suitable partner for the move. He also hinted that an announcement is coming soon. Currently, FTX offers margin trading against a basket of five stablecoins, including competitor Binance’s BUSD.  SBF, the founder of FTX and alameda, said "we're working on our stablecoin". According to @TheBigWhale_ He said Binance converts USDC --> BUSD and begins the Second Great Stablecoin War before.

Layer-2 scaling network zkSync is set to launch version 2.0 of its platform today, opening the floodgates for developers to create and deploy smart contracts. A governance token may also be on the way. zkSync is a ZK-Rollup platform which reduces transaction fees and increases throughput, while allowing code to be written in Ethereum’s Solidity programming language. The previous version of the network, zkSync 1.0, only allowed the simple transfer of tokens between wallets.  1/ zkSync 2.0.

The talk of the town.

Ethereum's recent scalability developments are going to change our industry as we have never seen before👇

Lending protocol Compound has paused markets for four assets on its platform, following a governance proposal aiming to protect user funds. The move – which will halt deposits and loans on the affected assets – is designed to prevent price manipulation attacks in current low-liquidity conditions. The four affected markets are 0x (ZRX), Basic Attention Token (BAT), Maker (MKR) and Yearn Finance (YFI).  Proposal 131 has passed with quorum. ✅

Proposal 131 pauses supply for cZRX, cBAT, cMKR, and cYFI on Compound v2.

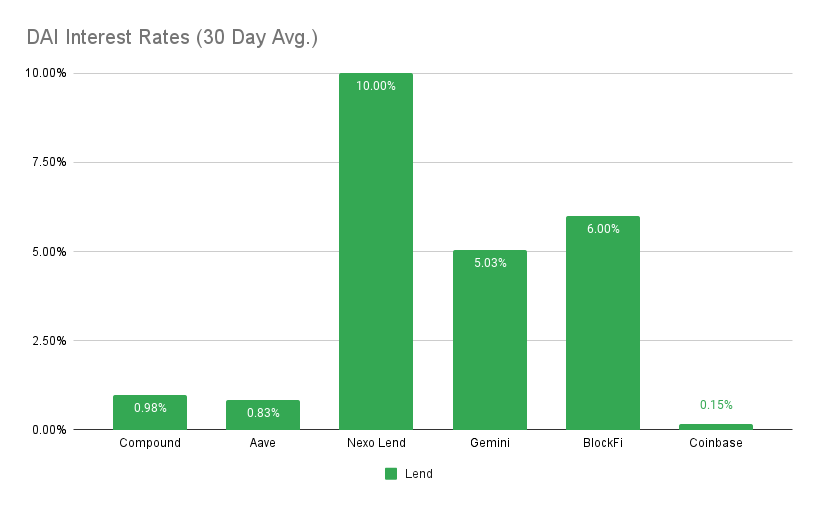

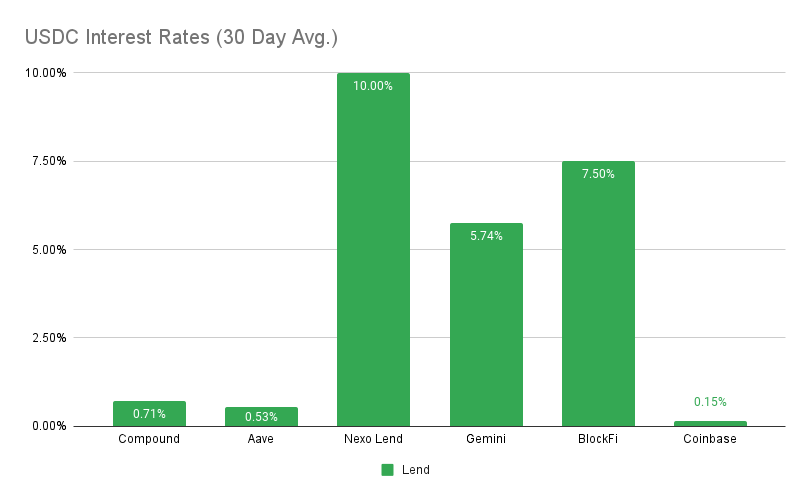

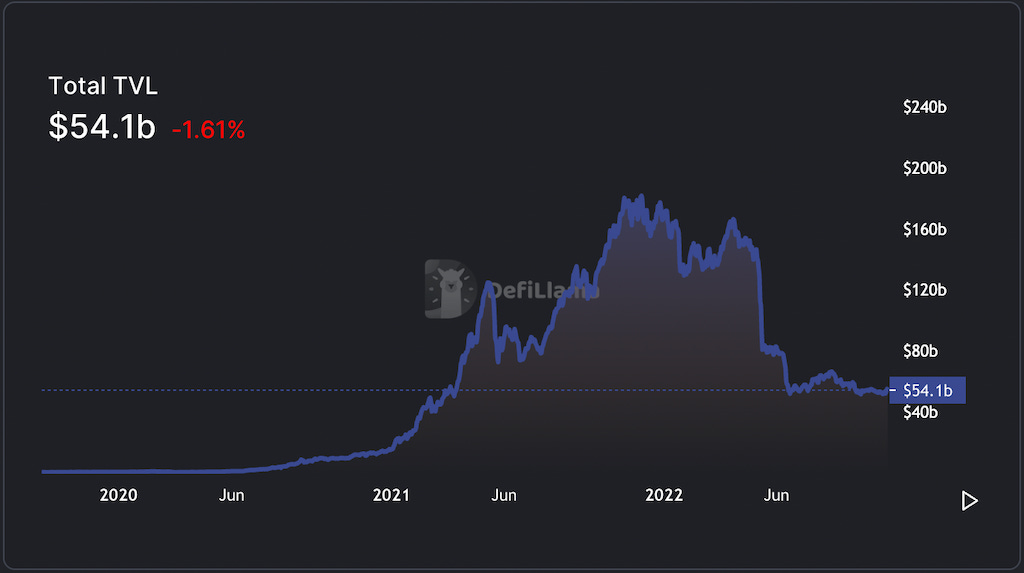

The proposal will be applied in two days. FTX may be the latest major party to jump into the stablecoin warzone, as CEO Sam Bankman-Fried alludes to the exchange launching its own stablecoin. The move would place the new token as the closest competition for Binance’s BUSD, which has steadily gained market share after “basketing” other stablecoins on the Binance exchange. On the other side of the stablecoin market, Maker ventures further into the “Ce-Fi” world, passing proposals to use Coinbase custody and loan services to earn a return on USDC collateral backing DAI – a controversial move in the eyes of some. Zooming out, the wider DeFi market appears to still be in a slight slump, as users and traders await long-anticipated airdrops and development updates on major projects, such as the expected Arbitrum governance token release. Low liquidity leading to halted Compound markets isn’t the best sign, however market volatility has picked up ever so slightly. Whichever upcoming project decides to make a push for trading activity and wider adoption may just be able to take the attention of the whole ecosystem during this quiet time – but who will make the first move? Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, BlockFi at 6% APY MakerDAO Updates DAI Savings Rate: 0.01% Base Fee: 0.00% ETH Stability Fee: 0.50% USDC Stability Fee: 0.00% WBTC Stability Fee: 0.75 USDCHighest Yields: Nexo Lend at 10% APY, BlockFi at 7.50% APY Top StoriesUK May Soon Recognize Cryptoassets As Financial InstrumentsApple's New NFT Policy Sparks ControversyGoogle Introduces Cloud-Based Blockchain Node Service for EthereumInflation-pegged ‘flatcoin’ launches testnet to track the cost of livingStat BoxTotal Value Locked: $54.1B (up 4.4% since last week) DeFi Market Cap: $45.75B (up 7.3%) DEX Weekly Volume: $7B (up 17%) Bonus Reads[Vishal Chawla – The Block] – Near Foundation spends $40 million to replace USN stablecoin's 'collateral gap' [Osato Avan-Nomayo – The Block] – Ribbon Finance mulls new DeFi lending pools for institutional borrowers [Andrew Hayward – Decrypt] – Teleport Creators Raise $9M to Build Decentralized Uber Rival on Solana [Mike Dalton – Crypto Briefing] – Twitter Introduces Tweet Tiles for NFTs If you liked this post from This Week in DeFi , why not share it? |

Older messages

This Week In DeFi – October 14

Friday, October 21, 2022

This week, Aptos goes live and airdrops 20M APT, Frax Finance announces liquid staking, Edge Capital Management raises $67M for DeFi funds and Ripple plans an EVM sidechain.

This Week In DeFi – October 14

Friday, October 14, 2022

This week, Uniswap raises $165M in Series B funding, Solana's Mango Markets is exploited for $100M and ETH becomes deflationary.

This Week In DeFi – October 7

Friday, October 7, 2022

This week in DeFi, Bitwise launches a Web3 ETF, Binance Smart Chain is halted after a hack and Ribbon Finance launches unsecured lending for institutions.

This Week In DeFi – September 30

Friday, September 30, 2022

This week, USDC plans expansion to 5 more networks, Chainlink partners with SWIFT and launches a growth program, and Robinhood launches its own Web3 wallet.

This Week In DeFi – September 23

Friday, September 23, 2022

This week, US Congress looks to ban certain algo stablecoins, Nomura launches a crypto VC unit and FV Bank accepts direct deposits in USDC.

You Might Also Like

Crypto traders lose nearly $1 billion as US-China trade war overshadows Trump’s crypto reserve initiative

Tuesday, March 4, 2025

US trade tensions with China and allies spark $500 billion crypto market plunge despite Trump's crypto reserve plan. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Analyst Spotlight Solana Overview

Tuesday, March 4, 2025

An in-depth look at Solana (SOL) and this week's market developments ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ETH Denver Conference Impressions: VC Indifference, Lackluster Narratives, and the Disillusionment of Idealism

Tuesday, March 4, 2025

Compared to last year — and even more so than the recently concluded Consensus — the overall atmosphere was much more subdued, with panel speakers noticeably outnumbering the audience. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏