The eCoinomics Team - October 2022, #1

This week.

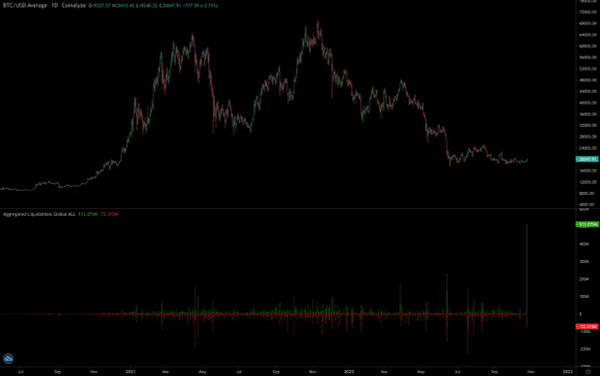

The last time we wrote about Bitcoin, the price had just broken below $45,000 causing a liquidation cascade event. That feels like decades ago now. Since then, Groovy has gone back to his job at McDonalds and I have been jobless and living on welfare. Which explains our absence. It’s almost anti-climatic that more than $1.1bn leveraged positions were liquidated a few days ago triggered by Bitcoin’s move from a low of $19,169 to a weekly high of $21,012. And naturally, Groovy and I hope this represents a reverse in our fortunes. For now, Bitcoin continues to hang around $20,000. Closest resistance is at $21,800 and we can depend on $19,000 to act as support if the reel is rewound. These are the levels we are watching for the week. In other news. A record 55,000 Bitcoin, or over $1.1 billion was withdrawn from Binance a few days ago. While on-chain data doesn’t support that the Bitcoin bottom is in, withdrawal from exchanges can mean Bitcoin hodlers are accumulating and not willing to sell. A decrease in sell pressure equals bullish sentiment. 🤞 We’ll see. Ether/USD.Ether- The token is called Ether or Eth. The company is called Ethereum. You’re welcome🤝- rallied 14% this week after doing its best impression of a stablecoin for weeks. Ether’s price currently hangs around $1,500. The closest weekly resistance is between $1,800-$2,000 while support is at $1,200. These are the levels we are watching for Ether. The macro environment doesn’t present many positives with inflation figures still coming in at a higher than expected level. The US Fed meets next on the 2nd of November 2022 and we expect price volatility to reflect the decision taken. Another 75bp raise in interest rate is expected as quantitative tightening remains the anthem as the US continues to battle historic inflation levels. Next week, we will take a look at how we expect the crunch in oil supply from Russia and China to affect the global financial markets especially risk-on assets like Bitcoin and Ether. 2. Elon Musk acquires Twitter.(3 mins read)Elon Musk has bought Twitter. He offered to buy the company in for $44 billion in April but seemed to change his mind after alleging that Twitter lied about the amount of bots on it. Twitter then sued him to force the sale. The lawsuit was in progress when the deal happened after Elon asked for a stay of trial to allow time to complete the deal. The deal was announced to be complete today, Friday 28th of October. Read more on the topic by clicking underlined title above. Oloye is doing a victory lap as we speak. Anyone who knows me knows why 😂 3. FTX records largest short liquidation event in its history. (1 min read)FTX saw $936.24 million in short trades liquidated over the last 24 hours, the largest such event ever recorded on the exchange. Liquidation happens when the trade engines forcefully close trades due to insufficient margin to keep the positions open. Traders involved in a liquidation lose all their money. In total, the entire crypto market posted about $1.1 billion in liquidation with FTX in first place. Thank you lord SBF. 🙏  Today was the single largest liquidation event on FTX in its history and the runner up isn't even close.

~$600m

Someone get carried out on a stretcher?

Seems excessive given the move. But then again there's like 12 people who understand how their liq engine works. Click on the underlined link above to get the full rundown. 4. Nigerian P2P exchange Scalex gets funding from Adaverse. (2 mins read)Nigerian peer to peer crypto and web3 platform Scalex has announced the successful raise of strategic investment from Adaverse, a Cardano ecosystem accelerator. Scalex CEO, Nnaemeka Nwosu said the undisclosed seed funding will be used to continue building web3 solutions that bridge the gap between traditional finance and decentralised finance by providing on-ramp and off-ramp services for Africans. 👏 5. zkSync ready for mainnet.Ethereum L2 scaling solution zkSync is set to launch on Mainnet on October 28th. ZkSync made the announcement on its official Twitter account recently. What you need to know about zkSync:

To be eligible for the airdrop, it’s advisable that you interact with the zkSync ecosystem by opening a wallet and carrying out transactions here. Follow them on twitter by clicking on the topic. 🔌 6. Aptos. Solana NFT killer? (4 mins read)For Solana which advertised itself as an “Eth killer,” things look to have come full circle. Because Aptos is calling itself the “Sol killer.” We all know how patient, understanding and loyal NFT traders are. We all know they don’t listen to hype and they are only in it for the art. This hasn’t stopped some other “nameless” NFT devs and artistes from taking advantage of the hype that comes with the novelty of a new platform 😂. Remember Near NFTs? Solana can only hope Aptos is as effective at it has been in killing OpenSea. For the full story, nah! I am not repeating myself. 😒 7. Reddit and Polygon’s partnership lead to surge in Reddit avatar NFTs volume. (5 mins read)The Reddit NFT avatar has become one of the most traded NFTs recently, due to the partnership between Reddit and Polygon that was signed one year ago. Reddit users are flocking to Polygon to mint the collectible avatar, which is built on Polygon's scaling infrastructure which provides minimal gas fees and high speed. As a result, the trading volume of Reddit NFT avatar has increased, as well as its floor price on secondary NFT marketplaces. The Polygon token (MATIC) is also up 11% this week. Thanks for reading. For comments and feedback, please write to us at ecoinomicsweekly@gmail.com. Groovy and Oloye.

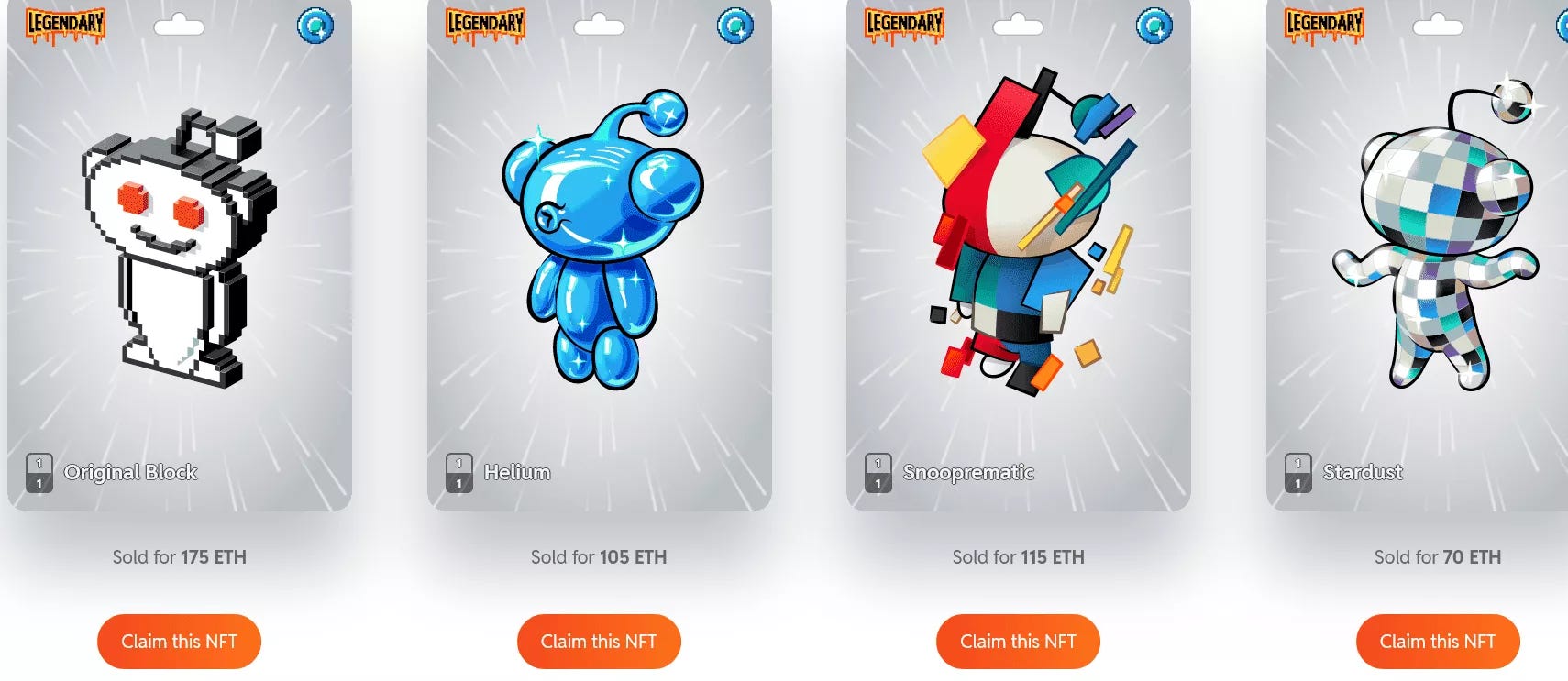

If you liked this post from ecoinomics, why not share it? |

Older messages

“Sorry for the break in transmission, we rebranded.”

Thursday, October 20, 2022

nu brand, who dis? 😋

January 2022, #1

Friday, January 14, 2022

We discuss the majors' limp into 2022 and upcoming token unlocks schedule for some crypto projects.

eCoinonomics Crypto Report and 2022 Theses.

Saturday, January 1, 2022

Trends, narratives, sectors and tokens we think will dominate 2022.

December 2021, #2

Wednesday, December 8, 2021

We discuss last week's liquidation cascade, Ethereum reclaims support post pullback, introducing Bitpowr, a blockchain solutions company and Zoom-In on Polygon (MATIC) and Bit Torrent Token (BTT)

December 2021, #1

Thursday, December 2, 2021

This week we discuss ranging Bitcoin price action, Ethereum strength, introduce Wicrypt a blockchain based smart internet provider and Zoom-In on Dusk Network (DUSK) and Solana (SOL).

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏