eCoinonomics Crypto Report and 2022 Theses.

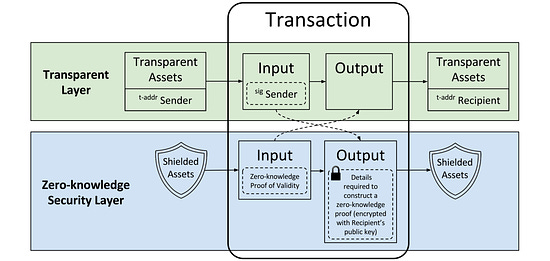

eCoinonomics Crypto Report and 2022 Theses.Trends, narratives, sectors and tokens we think will dominate 2022.IntroductionThis is not investment advice, this is an opinion piece. You can tell by how little research went into it. Just a couple of guys giving their plebian opinions on what they think is about to happen next in the crypto market. So definitely do not listen to us. Read for entertainment purposes only. 2021 by every metric has been a remarkable year for crypto. Other use cases of crypto asides from Bitcoin being a store of value were validated. L1s and L2s- the block space sector- saw a meteoric rise and the NFTs market took on a life of its own. We also saw growth in Bitcoin development, DEXs, meme tokens exploded, and stable coins helped the market gain some independence from Bitcoin dominance. China banned Bitcoin for the 1000th time and we saw a major push towards regulations in the USA. This document gives a brief overview of the crypto market in 2021 and espouses our theses for what we think will be the key themes and narratives of 2022. What we find the most interesting, in what sectors we think mass adoption will take place and where we think the real value will be created. We should see more institutional adoption of crypto. Especially into sectors that the institutional investors think will push the frontier of the new internet- Web 3 and decentralised social networks. So far, dedicated crypto investment funds have had no trouble raking in the cash as they are amongst some of the best performing investment firms of ALL TIME. According to crypto fund research, 72 Crypto funds were launched this year alone bringing the total to 851. This capital and new capital we expect will help crypto avoid the catastrophic crashes of the past as the market reaches new levels of maturity. Looking at how project development, macro narratives, and project funding are playing out, we theorise that Bitcoin, Zero-Knowledge tech stacks (privacy), Layer 0/Layer 1 and Layer 2, Web 3.0 (web infrastructure, social token, computation), cross-chain interoperability, decentralized derivative exchanges, Blockchain gaming/NFT/Metaverse and will witness more growth in 2022. BitcoinIn 2021, we saw tremendous and widespread progress in the adoption of Bitcoin by individuals, institutions and ElSalvador. Bitcoin’s market cap eclipsed $1.3T for the first time ever before receding back to $875B at the end of the year. That’s still an incredible figure once you realise that on Jan 1 2021, Bitcoin had a market cap of $546B. (Data: coinmarketcap.com) This trend is expected to continue in 2022 with more institutions, previously sidelined capital and maybe nation-states stepping into the revolutionary future of digital gold adoption. Bitcoin is maturing, growing and becoming more efficient price-wise unlike in the past. The inefficiencies in the market are getting thinner and that is a good sign of an asset maturing. If we go into a crypto winter again, Bitcoin is best positioned to fare better than everything else because of its longevity, decentralisation, market history and distribution network. “Short term and long term, Bitcoin is bullish. It is the medium-term that is the problem.” - Messari 2022 Report. Whatever happens this year, The US Fed sucking liquidity back out of the system to counter high inflation or simply maintaining it at current levels, we think Bitcoin will hold its own and it’s hard to make a case for sellers below $38000 per Oloye’s analysis. Subject to a change in bias and bull market continuation. On multiple occasions, we have witnessed how a single digit Bitcoin downtrend leads to double-digit crashes across alts tokens. In a bear market, Bitcoin will still be the ideal asset to hold if one wants to continue to have crypto exposure. A subsequent bull market will also be led by Bitcoin if previous cycles are anything to go by, so it just makes sense to position in Bitcoin. No matter what happens in 2022, Bitcoin will still be the safest crypto asset to hold- uptrend or downtrend. And to answer the question of how far can Bitcoin go? Our main reference point is Gold. If Bitcoin were to flip Gold’s market cap (as the asset class preferred by Millenials and GenZ,) at current prices, that’ll put Bitcoin at $500000. So, high. ZERO-KNOWLEDGE TECHNOLOGY (PRIVACY)One of the most dominant themes or narratives in crypto in recent weeks has been ZK rollups (Zero-Knowledge). We will explain the basic and non-technical aspects of Zero-Knowledge technology and why it is important in a later part of this writing. Just as the name implies- zero knowledge. It means adopting privacy and encrypting data and stopping unauthorised entities from having any knowledge of what has been encrypted, transmitted or transacted while also ensuring that the data meets certain validity criteria set for completeness. Zero-knowledge blockchain technology hands control of user data and privacy back to the user in a manner where transactions are settled anonymously with high security. The blockchain in its design is pseudonymous but an individual can go the extra mile to unravel the identity behind the public key which is where zero-knowledge proof protocols as an area of cryptography play a role in enhancing the privacy of a user and open network. Zero-knowledge gives people the power to fight oppressive regimes. It helps people preserve their wealth from untrustworthy state actors. It offers people the ability to do things privately whether it be financial transactions or confidential communications between a journalist and a source, human rights activists or perceived political dissidents thereby providing private and secure communication channels and tools against highly coordinated attacks. Our thesis on Zero-Knowledge proofs gaining adoption and bullish narrative in 2022 is hinged on the premises below: Zero-Knowledge will be a technological solution to defend against the invasion of privacy hence data encryption are sovereign tools that are humanitarian in nature. Zero-Knowledge technology solves the problems for anyone whose lives depends on privacy (journalists, whistleblowers and victims of crime) because of how incredibly difficult it is to de-anonymise. In recent times, you may have heard ZK rollups a gazillion times. It is the dominant narrative for zero-knowledge technology use cases and you should pay attention to developments in this sector. The Ethereum blockchain network is currently broken and bedevilled by the same old problems - network congestion, high gas fees and slow transaction speed because of low throughput numbers per second. Different scaling solutions are being proposed to solve this problem and zero-knowledge has been proffered as a remedy for the problem without compromising the security and decentralisation Ethereum is known for. Here is a basic explanation of how ZK rollups will work: ZK rollups are smart contracts that can take transactions off the main chain to a side chain or off-chain for data and computational processing, then gathers the data into a single batch or block with a cryptographic proof and settle the transactions on the main blockchain or settlement layer. However, the main blockchain has to confirm that the transactions being received from the layer 2 network are valid and have been correctly processed and validated. ZK rollups are able to perform this function through encryption of data and only allowing necessary data to be exposed in order to validate proof. The purpose of this is to reduce the load on the main blockchain resulting in high throughput and instant finality (super fast transaction and cheap fees) while maintaining the security and decentralisation of the main blockchain. These ZK rollup solutions are Layer 2s and some already have tokens $MATIC, $LRC, $ZKsync and $IMX for example, or made plans for it. It’s advisable to bet on the growth of these projects as most retail investors/users that want to interact with smart contracts on the Ethereum network will most likely use these scaling solutions thereby fees and value accrual goes to bag holders. It is instructive to note that roll-ups will bring value to the Ethereum network also as it is the settlement layer and ensures the economic security and decentralisation of the network. Gas fees will be paid in Ethereum hence, Layer 2 scaling solutions do not signal the death of Ethereum Layer 1, rather they strengthen the “Ethereum as a decentralised tech” narrative. The Ethereum blockchain is notable for a lot of the experiments and innovations built on the blockchain. Roll-ups help scale and maintain its dominance as the ground zero for innovation which makes the ecosystem stronger and allows it to thrive as crypto gains mainstream adoption. Finally, there are other L1 blockchain protocols building Zero-Knowledge native networks that allow for open-source programmable smart contracts and decentralised applications to be securely built and deployed directly on the main network. They enjoy the security and decentralisation of the main chain which settles and performs the transaction without any intermediary or off-chain processes e.g $MINA, $DUSK, $SYS, $FRA, $CELO, $PIVX. These networks ensure the privacy of data, fast transactions and cheaper fees. Application Layers (L1. L2)Application layer protocols are important to the development of blockchain technology. They are the building blocks or foundations upon which primitives or decentralised applications are built. The entire application stacks such as DeFi, NFTs, social tokens, exchanges and dApps run on these protocols for all their settlement and computational needs. Layer 2 protocols help to scale certain base-layer protocols such as Ethereum by taking a huge amount of transactions off the main chain load and completing/settling them on the main layer at a later time to reduce the load on the base layer and ensure cheaper fees and faster speed. Blockchain networks can take different forms or shapes in the way they are designed; such as substrates, modular or monolithic design, proof-of-history, proof of humanity, Directed Acyclic Graph architecture etc. the architectures are developed in certain ways to tackle the blockchain trilemma- cheap, fast and decentralised. Ethereum is the dominant application layer for deploying decentralised applications but it is facing a tough fight for its position as the most used Layer 1 to “ETH killers” like Binance Smart Chain, Solana and Avalanche. We foresee a future where the market is saturated with supposed ETH killers that are Ethereum Virtual Machine (EVM) compatible in order to bridge with the Ethereum network which will put them in positions to likely continue to eat into the Eth’s market and we expect to see the rise of many of such little known networks pop up in 2022 as long as they are able to convince developers to deploy on their networks, onboard new users and maintain considerable network effect. Our job as traders/investors is to pick the winner/winners of the L1 fight as they all scramble for devs and users with their considerable war chest which they all seem to have due to the influx of capital into the crypto market. It’s a sector we’ll pay attention to this year. Ethereum network moving to Proof of Stake in 2022 will lead to a reduction in gas fees of the network, and make Eth a deflationary asset. If the Ethereum Foundation is able to ship ETH 2.0 in 2022 then the real battle will be that of the dominant narrative. In the failure to ship then the floodgates are opened for competitors. Get your popcorn!

Layer 2s are designed to eliminate some of the inherent flaws of Layer 1 networks through off-chain/side chain scaling solutions. Layer 2s in their first principle take away the computational load from the main chain and run them through their independent validators and return to settle the transactions later on the main layer by proving that the computations were correctly done and verified and secure. Loopring, Polygon, Skale were some of the first Layer 2s, but now we have Starkware, Arbitrum, Zksync, Optimism and other solutions. Speed and cheap fees are some of the advantages of layer 2 networks and these have proven to meet the expectations of the average crypto user. We think these factors will be a strong propellant for the success of scaling solutions in 2022. Layer 2s will be impactful in scaling blockchain gaming because of the heavy computational data and speed gaming applications require. Polygon is currently the leading L2 for blockchain-based gaming applications. In 2021, we witnessed the immense run and growth of different layer 1 blockchain networks such as Solana, Binance Smart Chain, Avalanche, Polkadot, Harmony and Terra Luna ecosystem which has reflected in the in price action and also the number of decentralised applications deployed, devs building in these ecosystems, and the amount of total value locked (TVL) in them. We hypothesise that in 2022 we will see this trend continue. WEB3.0 (Decentralized Internet)Web 3.0 is the buzz of crypto at the moment because blockchain technology offers the opportunity to combine the functionalities of both web 1 and web 2 to create a better and advanced iteration of the internet. However, it is still largely an emerging trend that we hope will change the way we interact, align incentives, form communities online, own data, use media and access financial solutions. . Web 1.0 - Read-only . Web 2.0 - Read and write . Web 3.0 - Read, write, own Web 2 was mostly driven by social media, mobile phones and cloud computing. With those mainstay retained, these features can be technologically advanced with edge computing, decentralised data networks and artificial intelligence which will all be powered by blockchain technology (web3). Why do we think Web 3.0 will be one of the leading themes for 2022?

We live in an increasingly polarised world with different political opinions and ideologies. Both sides of this divide have complained about their opinions getting censored on social media at different times. It seems the only opinions that are allowed to thrive are those with which the creators/devs/employees of the platform agree. Obviously, people being able to superimpose their politics on others by the mere virtue of being able to de-platform those who don’t toe the line doesn’t bode well for freedom of speech and other people’s rights. “Who fact checks the fact-checkers?” Governments have also shown they can censor the internet very easily and we see it frequently with the rise of authoritarianism especially in the developing world. It hit closer to home in Nigeria with the censorship of Twitter. Web 2.0 is easy to censor and countries can turn off the internet on the telecom packet layer side and bullying of ISPs. We have also seen internet blackouts in a handful of countries most especially during general elections. This makes for a great example of the relevance and importance of a permission-less, trust-less, open, private and decentralised community devoid of state-level censorship and attack.

There has been a great amount of attention from developers and the brightest builders. A lot of developers are currently leaving web 2 companies to build web 3 projects and we expect Web 3 to be a hyper scaling industry with the ability to poach more developers and entice more users to migrate from web 2 to experience this new shiny iteration of the internet that promises innovation, decentralisation, community ownership, privacy and return of power to the people from the big tech oligarchs and giants.

Talking about giving power to the people, Web 3 solves the scourge of surveillance capitalism with the tracking of users data by big tech companies through cookies which they end up monetising. In Web 3 you are the custodian of your data and will have to be compensated for it if anyone wants your browsing history or search data. Blockchain solutions that help users monetise their unique data while preserving privacy already exist and more are being built. Additionally, Web 3 also empowers creators on the internet to be the owners of cultural artefacts that live on the internet. With Web 3, we will witness the advancement of the Metaverse, p2E gaming, artificial reality, virtual reality, music and video streaming. All of these require different blockchain infrastructures to perform as a unit for better scalability, accessibility, functionality and user experience. Web 3 will have to be decentralised and powered by thousands of computer that serves as nodes that are not under the control of any centralised body. Below are web 3 specific sectors we think will experience hyper-growth in 2022.

Building Web 3 solutions will be capital intensive from both the engineering, infrastructural, architectural and user experience perspective. Based on this assumption we can posit that funds will be deployed and talents will see value in building in this sector than elsewhere in the general technology sector. Good news if you’re a blockchain dev asking yourself the question of what’s next? InteroperabilityYou want to move your ERC20 token to the Solana blockchain in a fast, securely, easy and cheap without using Wormhole and wrapping your native tokens to another network. You can’t do that right now without going through several steps. Ideally, you should be able to move from one blockchain to the other from your wallet or interface without knowing what happens in the background - that is what interoperability is. Interoperability is one of the main areas of crypto that has taken longer to execute. Since 2017 there has been constant chatter about the possibility of bridging across different chains. We are confident in 2022 we will witness actual bridges that are fast, secure and cheap to move between chains. The lack of good interoperable networks is one of the factors that has held back crypto adoption. It has been a hassle that has cost users a great deal of pain, opportunity and transaction costs; the inability to move from one blockchain to the other. Interoperability will help different blockchains to be able to communicate and transact with each other faster and securely which eases the burden of manually moving between different blockchain networks for the user. It is expected that different chains being able to interact and operate will lead to a boost in development and adoption as it makes the user experience easier for non-crypto natives who may want to dip a foot in the crypto waters. This value is expected to trickle down to all blockchain networks that participate in connectivity and interactions. Teams like Wanchain and Kardiachain have been working on solving this particular problem for a while. The Cosmos team has so far made tremendous progress and seems closer to solving this with “the Internet of Blockchain” being developed and it is believed we will start to see this fully deployed in 2022. Interoperability is a necessity and it will be interesting to see how it is accepted and the value accrual to teams building this new tech stack. Keep an eye out. Decentralised Derivative ProtocolsThese are decentralised exchanges that offer trading crypto assets where the traders are in full control of their assets/tokens at all times. These protocols offer leveraged trading in form of margin and perpetual contracts e.g $DYDX, $PERP, $DDX, $MNGO, and $HXRO. Not your keys, not your coin. You may have heard this a lot within blockchain discourse and it goes back to the fundamental argument that people should have the freedom to be the custodian of their tokens. On the flip side, if people think they can not safely guard their assets then they can delegate it to another third party like centralised exchanges for safekeeping. But that comes with a risk of hacks, exchange account being frozen or deleted or the exchange rug pulling and going out of business e.g Mt Gox, Cryptopia. A major argument for decentralised trading platforms is the security function that comes with ownership of your keys and being the custodian of your tokens (property rights). Of course, this means the users have to be responsible for their own security. But that’s what decentralisation is about. It’s the ethos of blockchain technology itself. We think 2022 is the year we see a shift from centralised exchanges to decentralised exchanges by most whales at least, especially with the government crackdown on centralised exchanges and “over-regulation.” The rise of $DYDX, a decentralised trading protocol recently was precipitated by China’s crackdown on centralised exchanges which made many users migrate to decentralised leverage trading platforms. If whales and market makers start moving liquidity away from centralised exchanges it’s only a matter of time before retail investors “copy-move” whales. A big catalyst for the shift to decentralised leveraged trading exchanges rise in 2022 will be privacy and their censorship-resistant nature. These exchanges are permission-less and do not require Know Your Customer (KYC) information to onboard users as users only have to connect their non-custodial wallet and trade. Even though transactions are open and public on the blockchain, however, minimal transactions details are published on-chain, therefore, being privacy-preserving and hiding the identity of the trader. Decentralised trading platforms can offer various financial products such as synthetics which centralised exchanges may not be able to offer due to regulatory risks e.g Binance running into regulatory problems in Europe for listing publicly traded shares on its platform. Decentralised leverage trading platforms have better governance systems because of their decentralised nature and being run through a Decentralised Autonomous Organisation (DAO) which is comprised of community members and token holders rather than a centralised entity that makes all the decisions. Decentralised leverage trading protocols built on other networks may witness more growth than those built on the Ethereum network except layer 2 scaling protocols solve the congestion, high fees and slow speed trilemma. Even with that, there is still cause for concerns with Miners Extracted Value (MEV) which makes traders susceptible to being front-run by validators. Such networks built on Solana too are at risk of downtime if the network goes down as we’ve seen on multiple occasions with the Solana network experiencing downtime or low throughput leading to orders not being fulfilled on-chain. It is also fair to state some of the cons or disadvantages of these platforms includes, low number of trading pairs unlike centralised exchanges, low leverage size, and that transactions are only settled in USDC. These factors may inhibit the growth and adoption as predicted here as these protocols are fairly new and have not been battle-tested to withstand high volatility. But we believed that eventually, these protocols will witness acceptance especially if regulators take a hard stance against centralised exchanges. Gaming/NFT/Metaverse

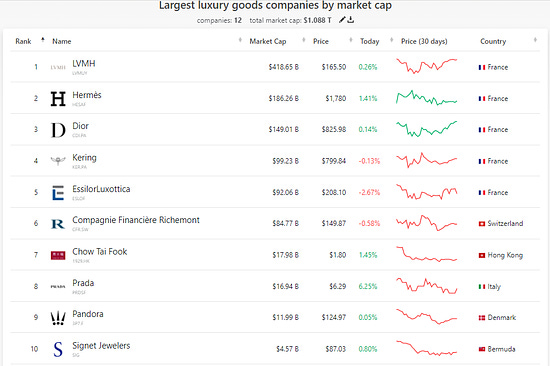

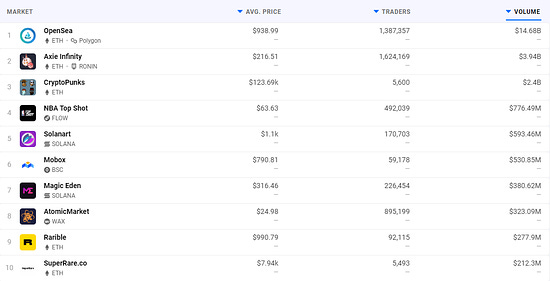

The sector witnessed tremendous growth in market size, adoption and participation. It still has the most upside amongst all crypto sectors going into 2022 as it has the best compensation or incentivisation model built into it as a way of rewarding users for participation. First came the NFT wave with blue-chip NFTs such as Crypto punks, Bored Apes, Fidenzas leading the pack, then came Axie Infinity with Play2Earn model, followed by Facebook announcing a name change and pivot into the metaverse. The entrance of Facebook into the metaverse has solidified the sector and we predict will have a network and domino effect market-wide with more capitals coming into the space to build. With Meta's announcement, we expect many VC funds are also raising funds to rival Meta in the race to build the metaverse. We are bullish on blockchain tech long term because of the immense human resources and talent making a transition to building within the space. The Metaverse is beyond peer to peer gaming, it is the digitization of everything. It will be an extension of our current digital life but more immersive and interconnected than now. Crypto projects like Decentraland (MANA) and Sandbox (SAND) are pioneering digital land ownership within the Metaverse and this has led to the surge in Metaverse token prices as the race to purchase digital land heats up. Are most NFTs overvalued? Yes. Would the floor price of most of them go to Zero? Definitely. So what’s the point? The best use case of NFTs- JPEGs/Punks/BAYC as far as we are concerned is as a digital proof of status. They represent programmable pieces of digital property. Data from DappRadar, a firm that tracks NFT sales, showed that trading in NFTs reached $22B in 2021, compared with just $100M in 2020. The skyrocketing market cap has many people questioning when the bubble will pop. But not so fast. Going by our best use case theory that NFTs are the new digital flex. The best comparison to the NFTs market will be the global luxury goods market. And the more people get rich, the more people are going to indulge in digital luxury and participate in the status symbol flex. Compare the NFTs market $22B market cap to the global luxury goods market cap of $1.088T, and you begin to understand why there’s still space for growth. LVMH alone is worth $418B. NFTs are really no different from art in their perceived value. Artificially scarce status symbols have a market cap of >$1T. And you don’t need to own a full NFT as they can be fractionalised which increases the total addressable market. NFT tokens aren’t going anywhere soon. Those who can create better games than Axie Infinity and projects that can onboard everyday non-native crypto gamers like Diagon.io will see an explosion in their valuation immediately they are able to reach a wider audience. Gamify projects can do better with their game design. Traditional gaming studios like EA Sports or RocStar Games entering the gamify space will sustain this bubble for a much longer period. Bull or bear market. So we’ll keep an eye out for that. Already existing gamify projects like Star Atlas, Splinterlands, Hashlands, Diagon, Gala Games, BLOK, DREAMS should see their value explode or at least sustained in the case of Axie Infinity. It’s hard to predict who will win the gamify race and join Axie Infinity in the blue-chip department. We’ll keep an eye out. Just got an update that this newsletter is near max length so, well end it here. TL;DR. WAGMI. Happy New Year- The eCoinomics team. If you liked this post from eCoinomics Newsletter, why not share it? |

Older messages

December 2021, #2

Wednesday, December 8, 2021

We discuss last week's liquidation cascade, Ethereum reclaims support post pullback, introducing Bitpowr, a blockchain solutions company and Zoom-In on Polygon (MATIC) and Bit Torrent Token (BTT)

December 2021, #1

Thursday, December 2, 2021

This week we discuss ranging Bitcoin price action, Ethereum strength, introduce Wicrypt a blockchain based smart internet provider and Zoom-In on Dusk Network (DUSK) and Solana (SOL).

November 2021, #3

Wednesday, November 24, 2021

This week we discuss Bitcoin/USD close breakdown, Ethereum show relative strength, introduction to Diagon.io, a super casual p2e platform, and Zoom-In on the sectors we think will outperform in 2022.

November 2021, #2

Wednesday, November 17, 2021

We discuss BTC and ETH PA, we complete our crash course on trading R/S, how to DYOR and briefly discuss market sectors we think will outperform others in 2022.

November 2021, #1

Thursday, November 4, 2021

This week we discuss Bitcoin PA, ETH/BTC, a crash course on trading support and resistance and attempt the question of what is the Metaverse?

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏