The eCoinomics Team - December 2021, #2

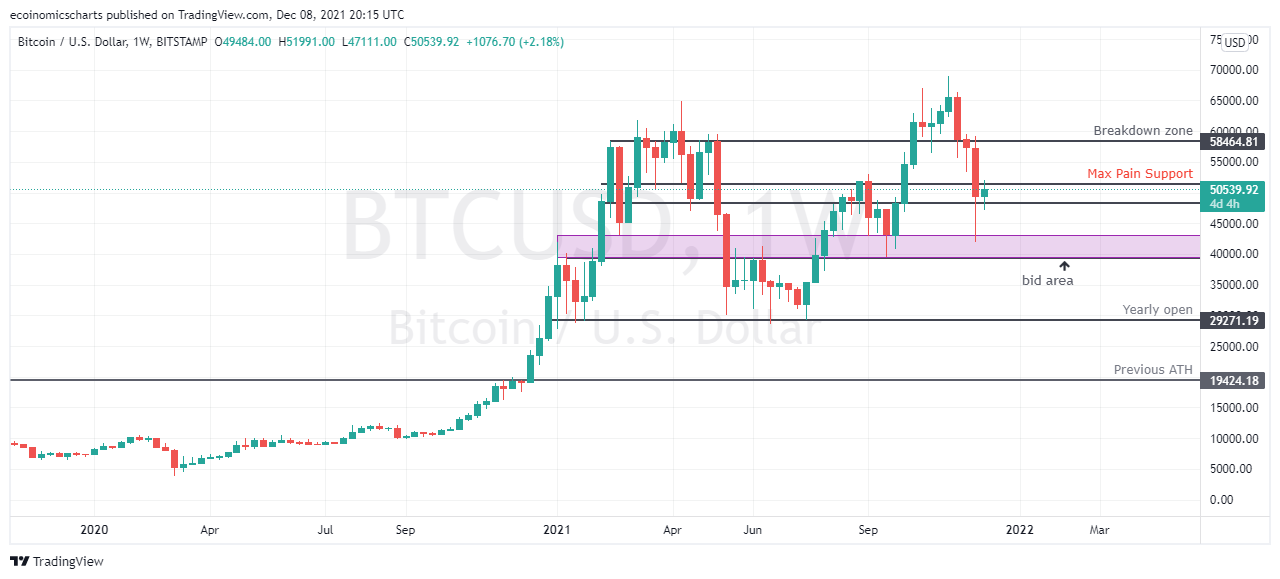

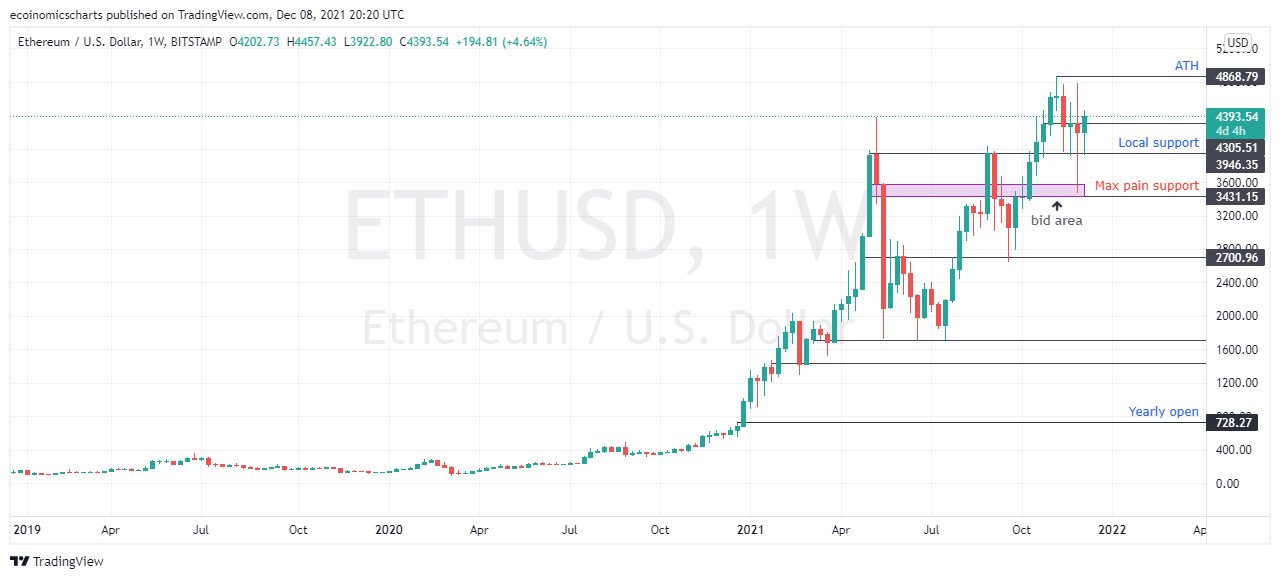

December 2021, #2We discuss last week's liquidation cascade, Ethereum reclaims support post pullback, introducing Bitpowr, a blockchain solutions company and Zoom-In on Polygon (MATIC) and Bit Torrent Token (BTT)This Week. 1. Bitcoin drives liquidation cascades. 2. Ethereum retest $4000, ETH/BTC at multi-month high. 3. Introducing BitPowr. Building projects on the blockchain in a cost-effective way. 4. Zoom-In: Bit Torrent Token (BTT) and Polygon (MATIC). Dear reader, Thank you for subscribing to eCoinomics. We appreciate your readership and hope you are here with us for many more issues. When we thought about writing a weekly newsletter, we weren’t thinking about an audience. It was more about reminding ourselves to stay the course and not act against our sober minds once money was on the line. It’s a reminder not to FOMO or be afraid to take a trade because we fear price might dump past what would have been a good entry. So in a way, that’s exactly what you get by reading eCoinomics. We discuss macro technical and fundamental analysis away from low time frame noise that helps build a long-term trading mentality. You also get news and we discuss the projects we are looking at for the week in the Zoom-In section. These are essentially letters to ourselves and we hope you can gain some useful insights every time you read them. You may contact us for any reason at ecoinomicsweekly@gmail.com. We host a twitter spaces session called #CryptoRoundUpAfrica with some of our best buds on Twitter every Thursday at 10 PM WAT. Follow us @craspaces, @avogroovy and @oloye__ If you missed any of the Twitter live sessions, check out the podcast at https://linktr.ee/cryptoroundupafrica The eCoinomics team. 1. Bitcoin drives liquidation cascades.Bitcoin revisited $42000 to devastating effect last week. The event seemed to have been driven by a mixture of narratives. One being news of the Fed tapering that’s expected in the US anytime now. The SARS-COV 2 omicron variant that is being reported in many countries around the world. As far as specifics go for what actually caused the dump, the most logical reason would be that the crypto market is correlated to the traditional markets. And when tradfi traders start taking a risk-off approach due to uncertainty caused by news, it’s only a matter of time before the crypto market reacts. Since the Saturday low, Bitcoin has reclaimed and traded above our current local support of $48000. The liquidation cascade causing dump was hard to predict from a technical perspective because the market was already trading in backwardation (spot price of most assets was lower than perp price.) -You can read an institution trader’s perspective of what happened by clicking on this link. (It won’t make you feel better.)- Nonetheless, it happened and more than $2billion in leveraged longs was wiped. Where do we go from here? Last week, we said we expected a “pullback to $50000, maybe a wick below.” We got more than we bargained for, so this week we are going to tender a cheaper bargain. The risk: return on Bitcoin doesn’t make sense unless we buy another retest of last week’s low at $42000. We are trading with a margin of error by bidding the $40000-$43000 zone (highlighted in the chart). A daily close below $40000 will signal weakness so this is a high probability trade with so much more upside than downside. If Bitcoin breaks upwards, we’ll be happy to buy a retest of $50000 as the case may be. 2. Ethereum retest $4000. ETH/BTC at multi-month high.Ethereum broke below $4000 on Saturday making a low of $3740. Congratulations if you bought the dip because ETH looks like a moneymaker right now. It recovered in lightning fast time and has continued to show strength v its USD and BTC pairs. It quickly reclaimed $4000 after the forced sell-offs and has continued to consolidate above its support. Last week, we mentioned that there was a clear bullish case to be made for ETH and that continues to be the case (again, assuming Bitcoin doesn’t shit the bed.) But as far as fresh longs go, we cannot make a case for that. We are closer to resistance than support. Scalping trades between $4000 and $4400 makes more sense. ETH/BTC looks even better as it’s currently retesting the multi-month high at 0.0087BTC which is the final boss before open skies all the way to 0.01BTC. If you look at the evolution of our ETH/BTC charts over time, you’ll see why we are betting on a continuation as the path of least resistance. In summary, if Bitcoin continues to range, we are expecting a ripple in ETH price. ATH is at $4800. Eth is currently (at time of writing) closer to ATH than support at $4000. 3. Introducing BitPowr. Building projects on the blockchain in the most cost-effective way.Bitmart exchange lost over $196 million to hackers over the weekend. Bitmart in its report to users said it identified a large scale breach of two of its hot wallets and currently investigating the incident. The two hot wallets containing Ethereum and Binance Smart Chain network tokens were affected in the hack. Trading is currently suspended on the exchange and the founder announced that users will be compensated from the exchange´s fund and payment will start this week. In a related development, the CEO of Bitpowr, a blockchain and wallet infrastructure project Oyetoke Toby will be joining CryptoRoundUpAfrica this Thursday to discuss their institutional-grade secured wallet solutions for safeguarding digital assets and avoiding loss of funds through hacks. Join us on #CryptoRoundUpAfrica tomorrow at 8 PM WAT by following @avogroovy and @oloye__ 4. Zoom-In: Bit Torrent Token (BTT) and Polygon (MATIC).The fear and greed index shows peak fear in the market amongst market participants after the big nuke on Saturday. With an expectation of relief bounces across the board, we are bringing you tokens that have caught our attention this week and have the ability for potential gains even under current market conditions.

Polygon (MATIC) has been showing strength and maintaining bullish momentum even in the face of uncertainty in the market. A leading narrative in the crypto market right now is Zero-Knowledge rollups and MATIC is one of the leading builders of rollup technology and an Ethereum scaling solution. The price is currently at $2.30, sitting just under resistance. A break of resistance at $2.44 and a successful retest will see price challenge all-time high and go into price discovery. If the price is rejected, $2 is a level that bulls must defend for further bullish momentum. BitTorrent Token (BTT) price sits a $0.00384 an area that was flipped back to resistance during the last marketwide pull-back. Usually, we wouldn't advise buying a token at resistance but some news may serve as a catalyst for upward price movement in a significant manner. BTT mainnet launch and redenomination of circulating tokens are a few days away and this could be the reason for the quick recovery from the bottom and a trigger for price rally which we expect will break the resistance. If price can make its way past the current hurdle, $0.0050 is the next area up where many traders will look to take profit and scale out of their long position. If the price is rejected at resistance, $0.0030 is a good buy zone if bulls are to stay in control. It is important to note that the altcoin market is still mostly dependent on what bitcoin does and the overall state of the market. If bitcoin remains relatively stable then we expect the spotlighted coins to perform well. The contents herein are for educational, informational and entertainment purposes only. It should not be considered financial or investment advice. We are not financial advisers and have no experience in the field. Please talk to trained finance professional before making any investment decisions. If you liked this post from eCoinomics Newsletter, why not share it? |

Older messages

December 2021, #1

Thursday, December 2, 2021

This week we discuss ranging Bitcoin price action, Ethereum strength, introduce Wicrypt a blockchain based smart internet provider and Zoom-In on Dusk Network (DUSK) and Solana (SOL).

November 2021, #3

Wednesday, November 24, 2021

This week we discuss Bitcoin/USD close breakdown, Ethereum show relative strength, introduction to Diagon.io, a super casual p2e platform, and Zoom-In on the sectors we think will outperform in 2022.

November 2021, #2

Wednesday, November 17, 2021

We discuss BTC and ETH PA, we complete our crash course on trading R/S, how to DYOR and briefly discuss market sectors we think will outperform others in 2022.

November 2021, #1

Thursday, November 4, 2021

This week we discuss Bitcoin PA, ETH/BTC, a crash course on trading support and resistance and attempt the question of what is the Metaverse?

October 2021, #4

Thursday, October 28, 2021

This week we discuss BTC/USD and ETH/BTC price action, Bitcoin ETF explained, and Zoom-In on The Graph (GRT) and Akropolis (AKRO)

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏